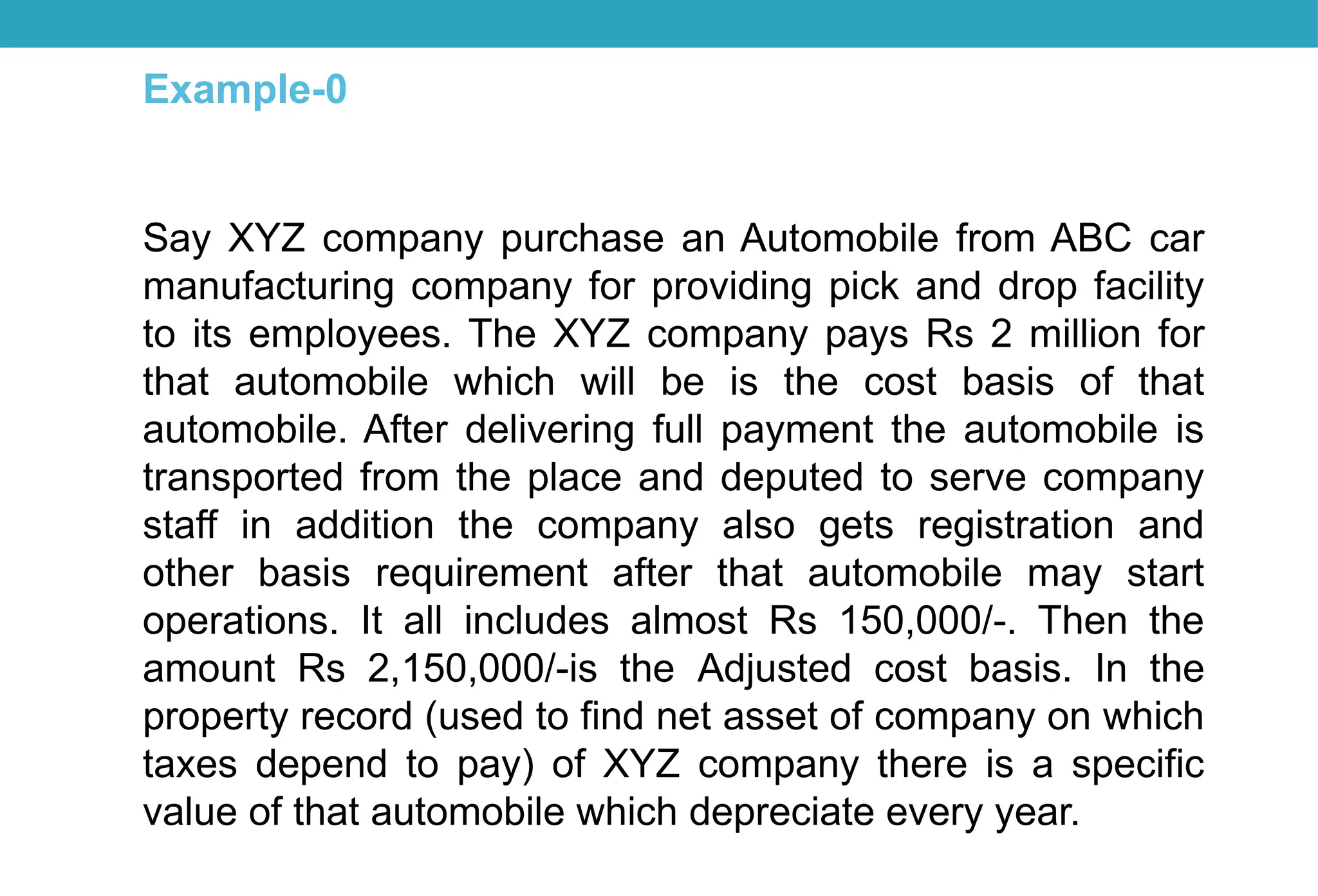

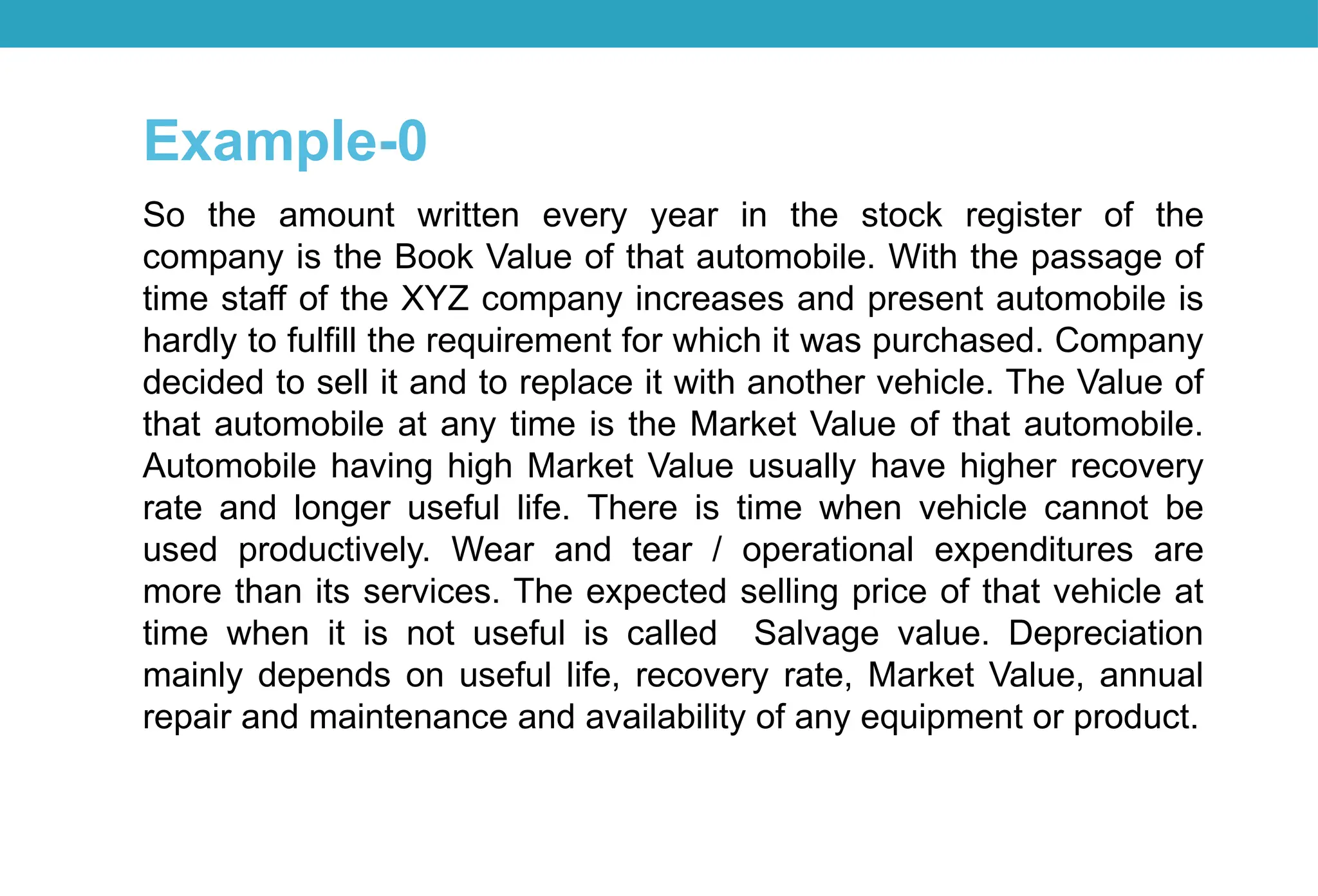

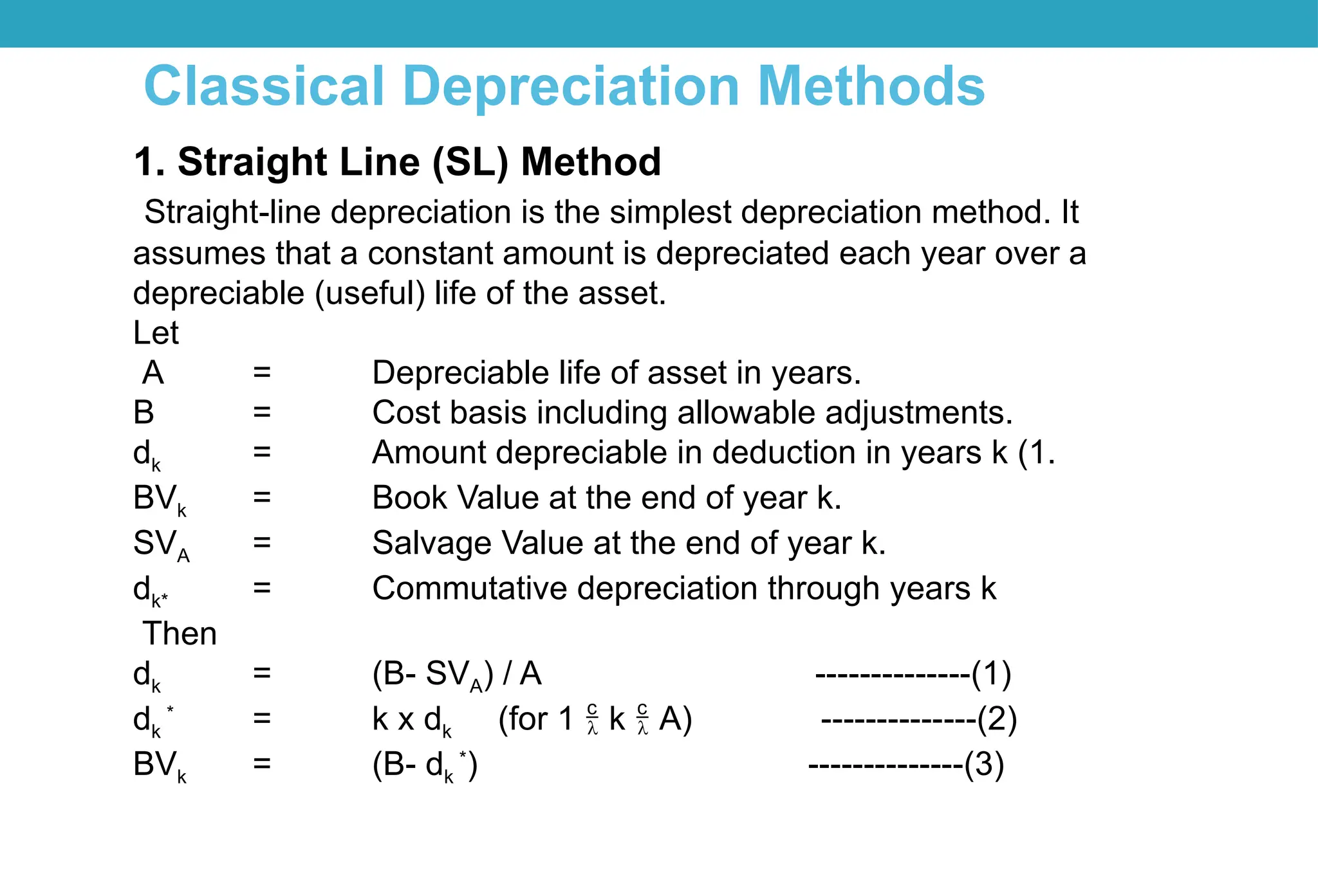

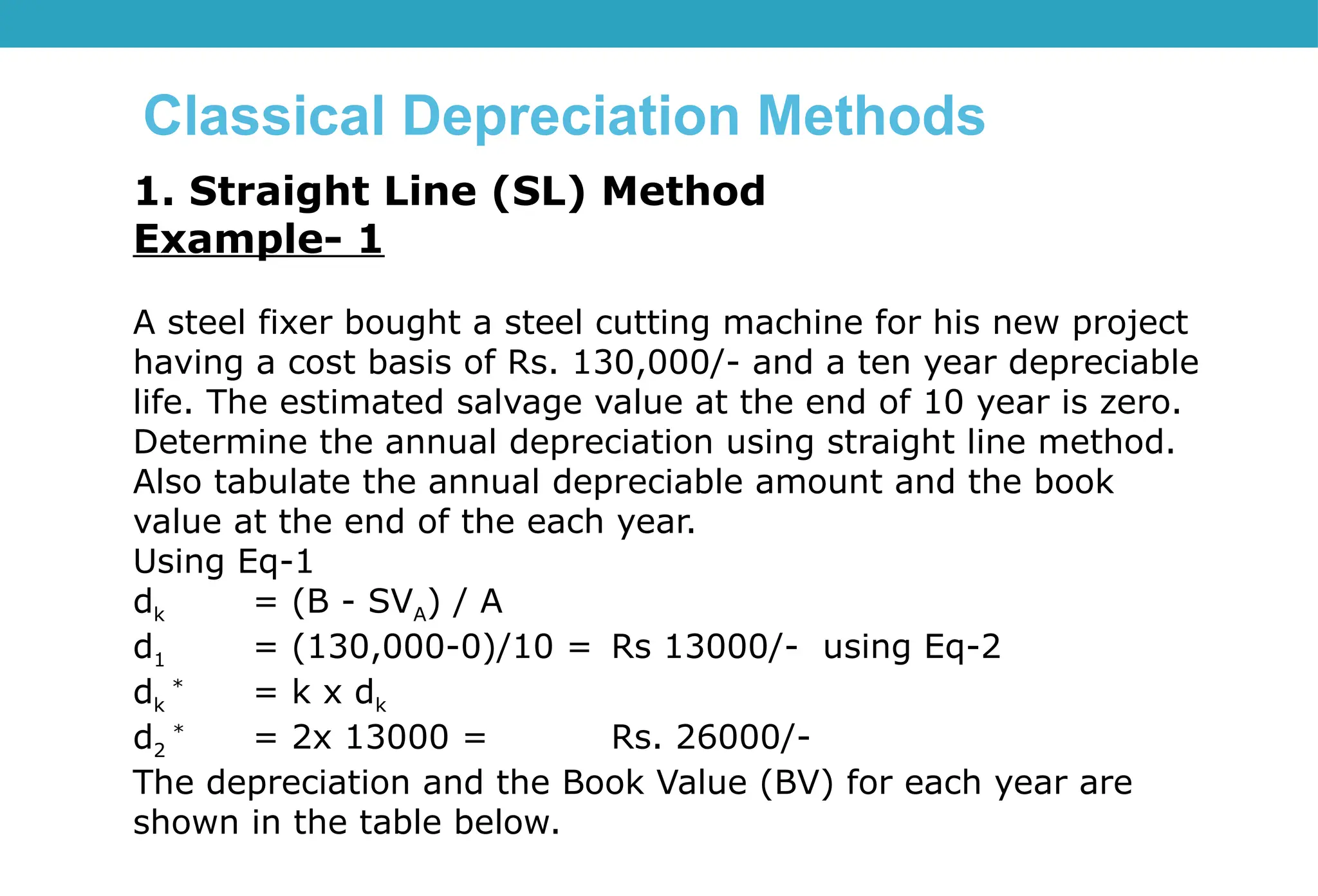

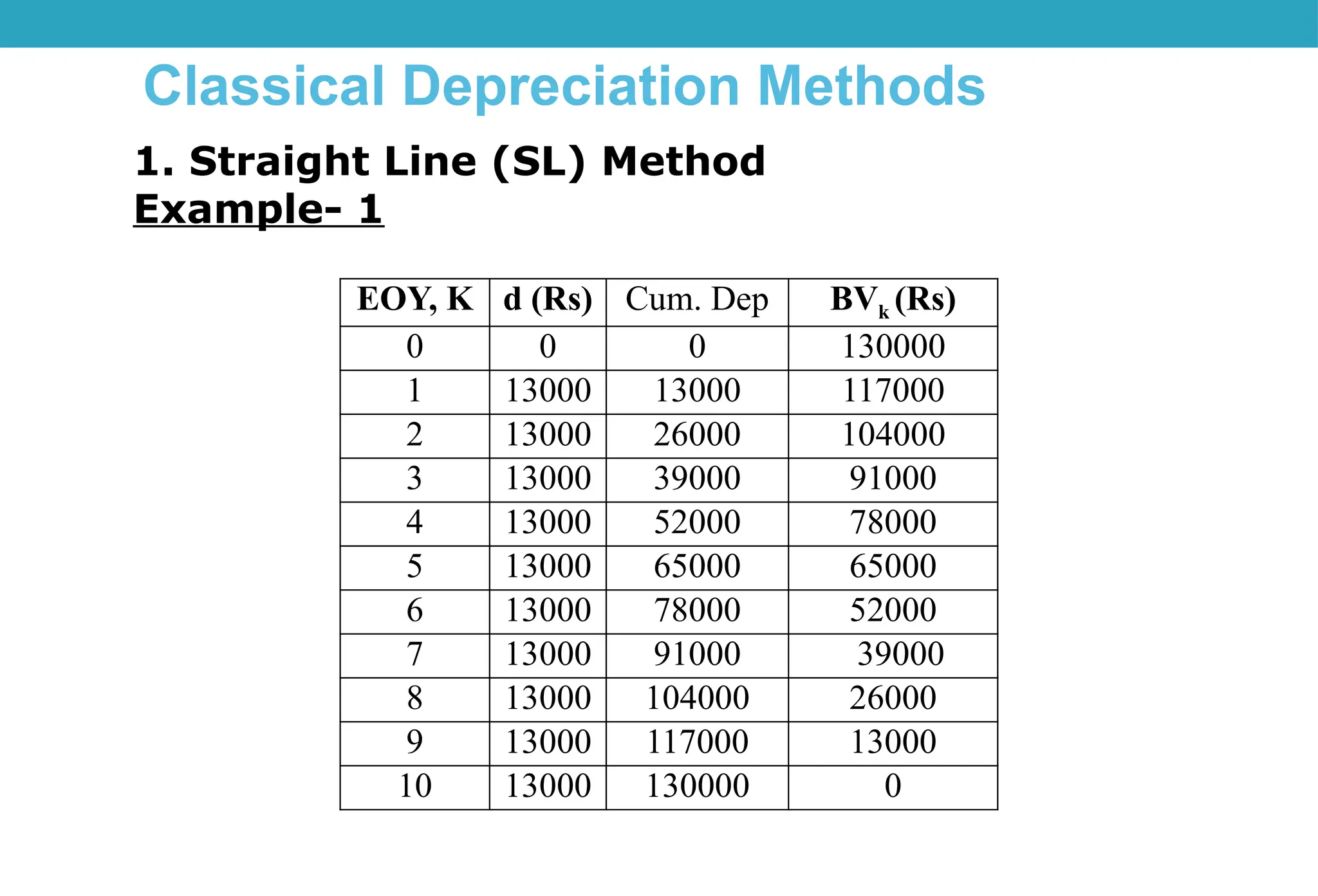

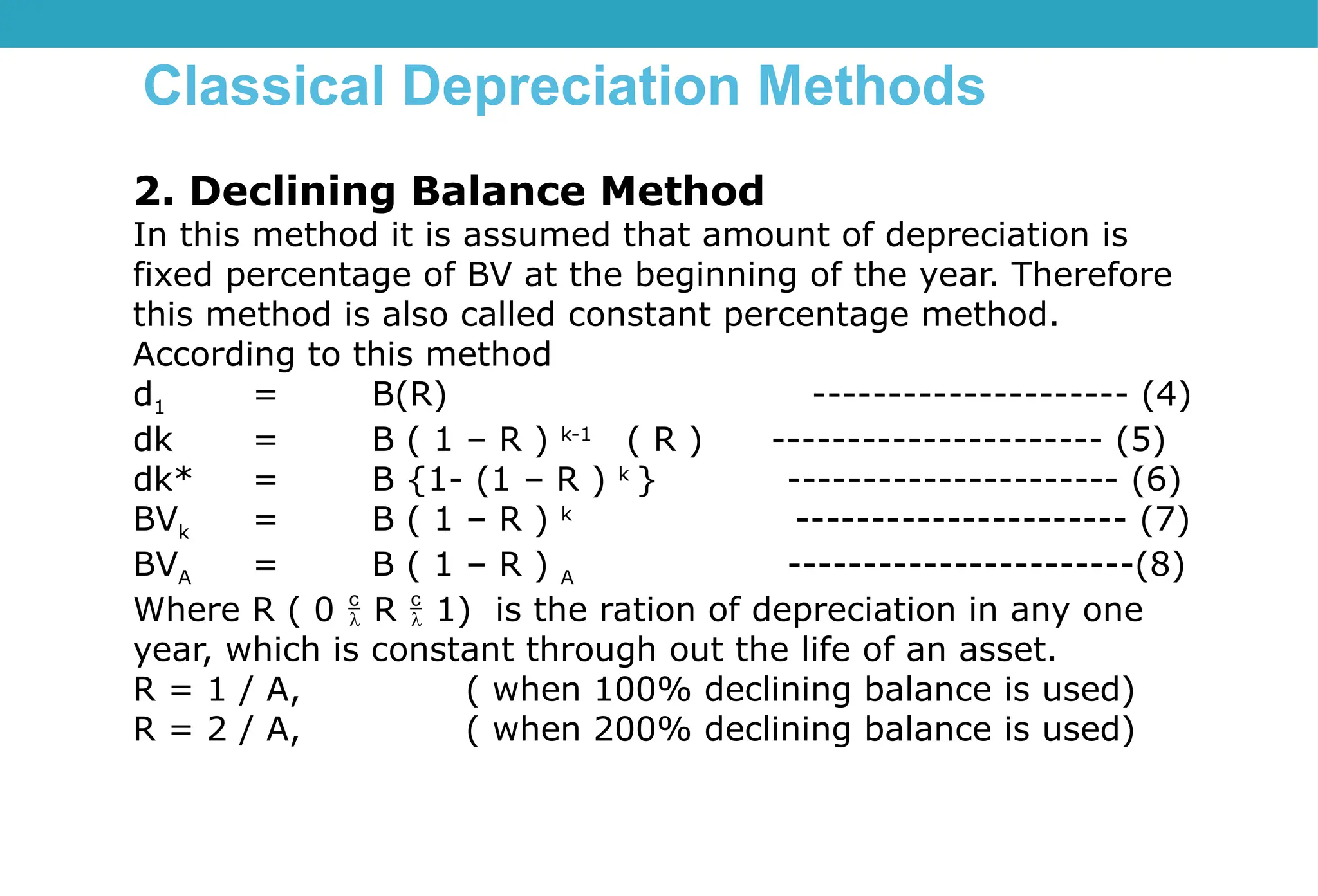

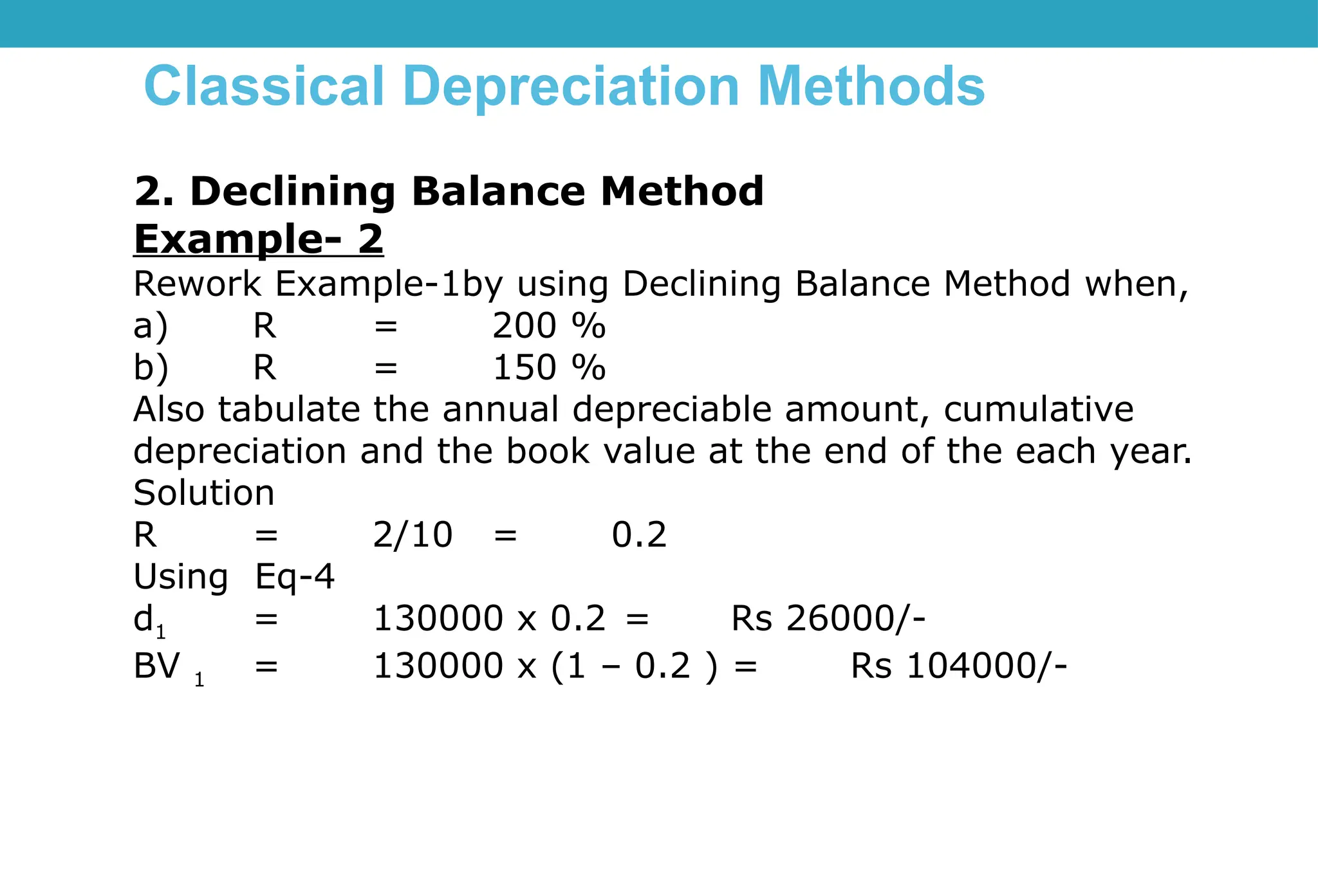

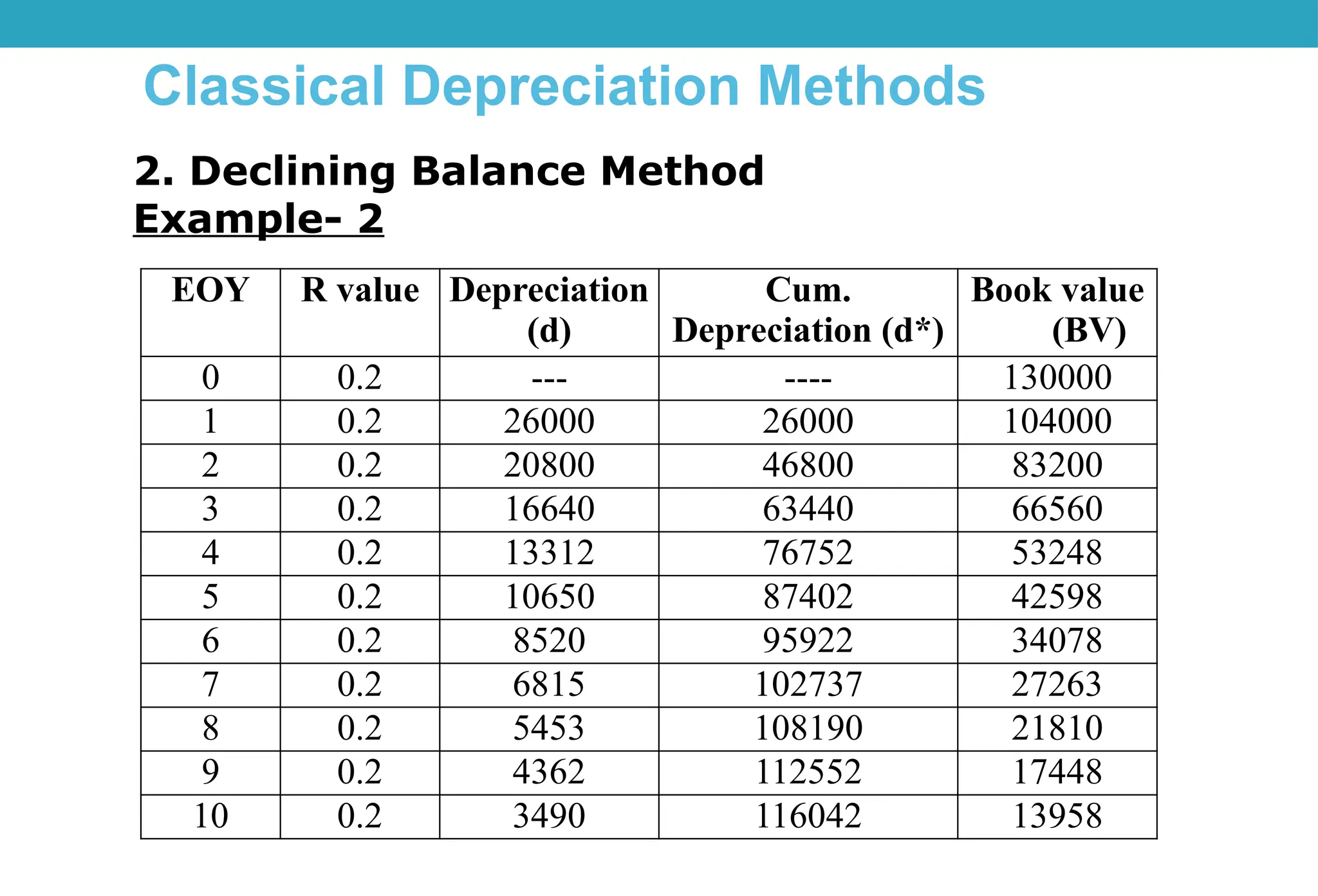

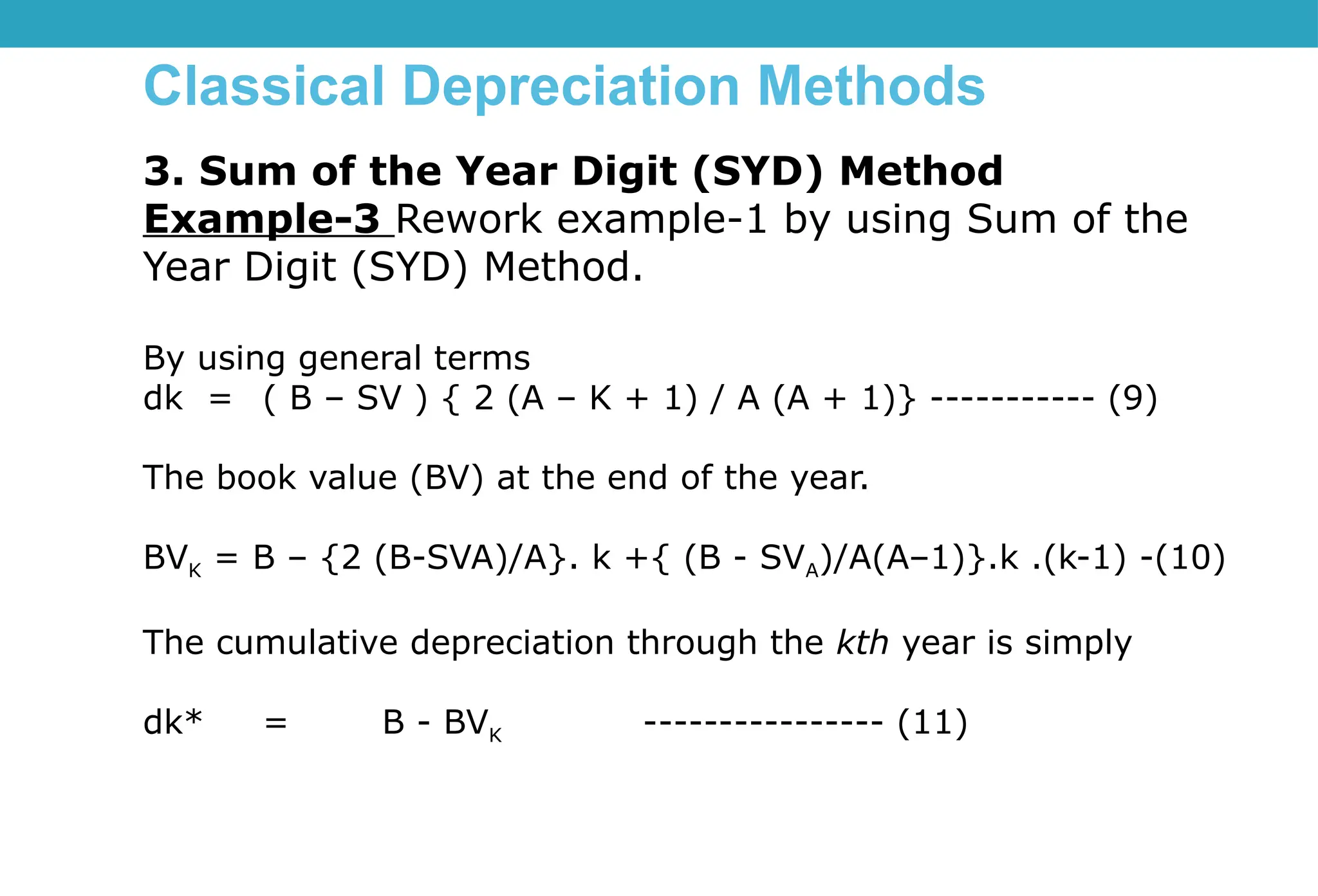

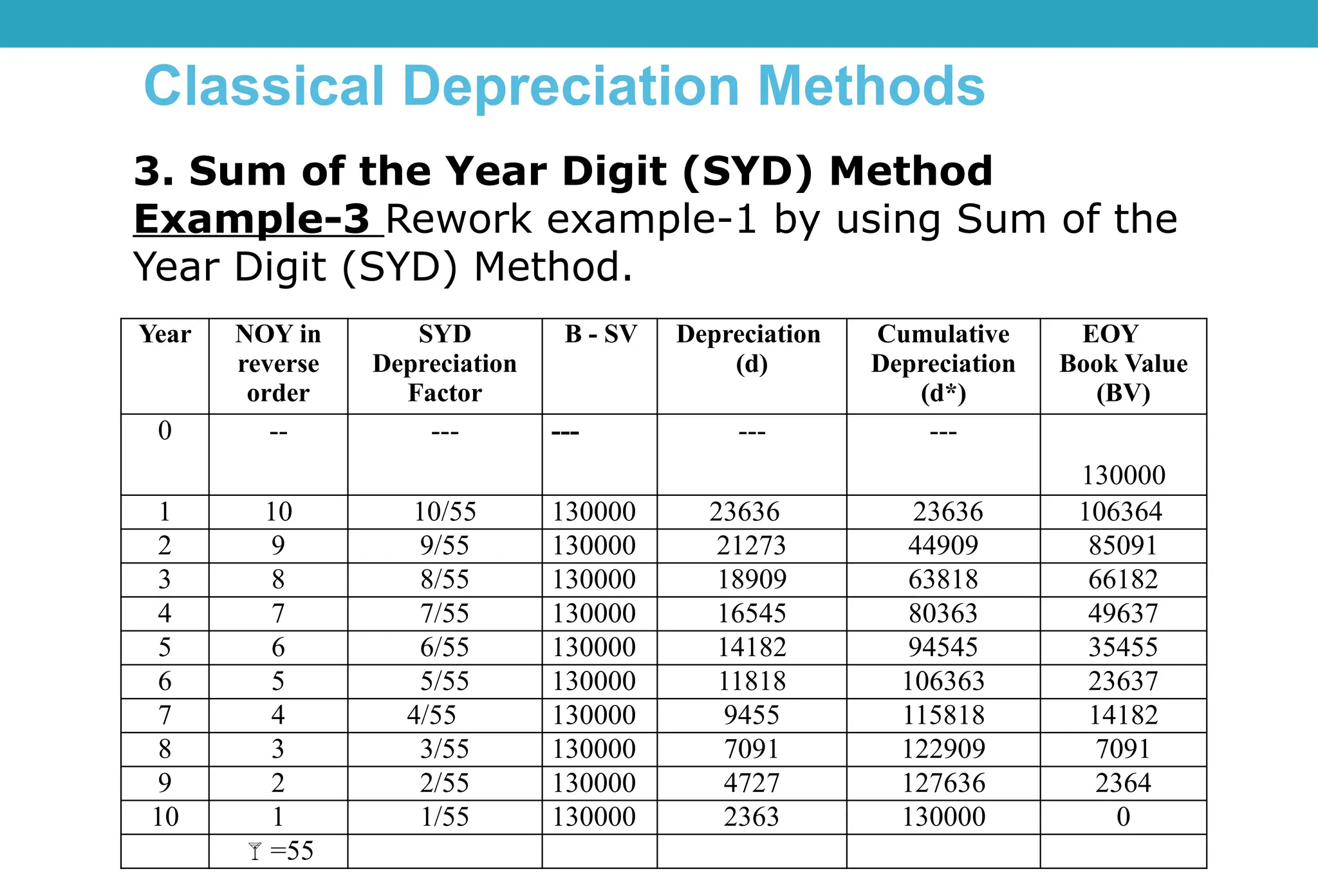

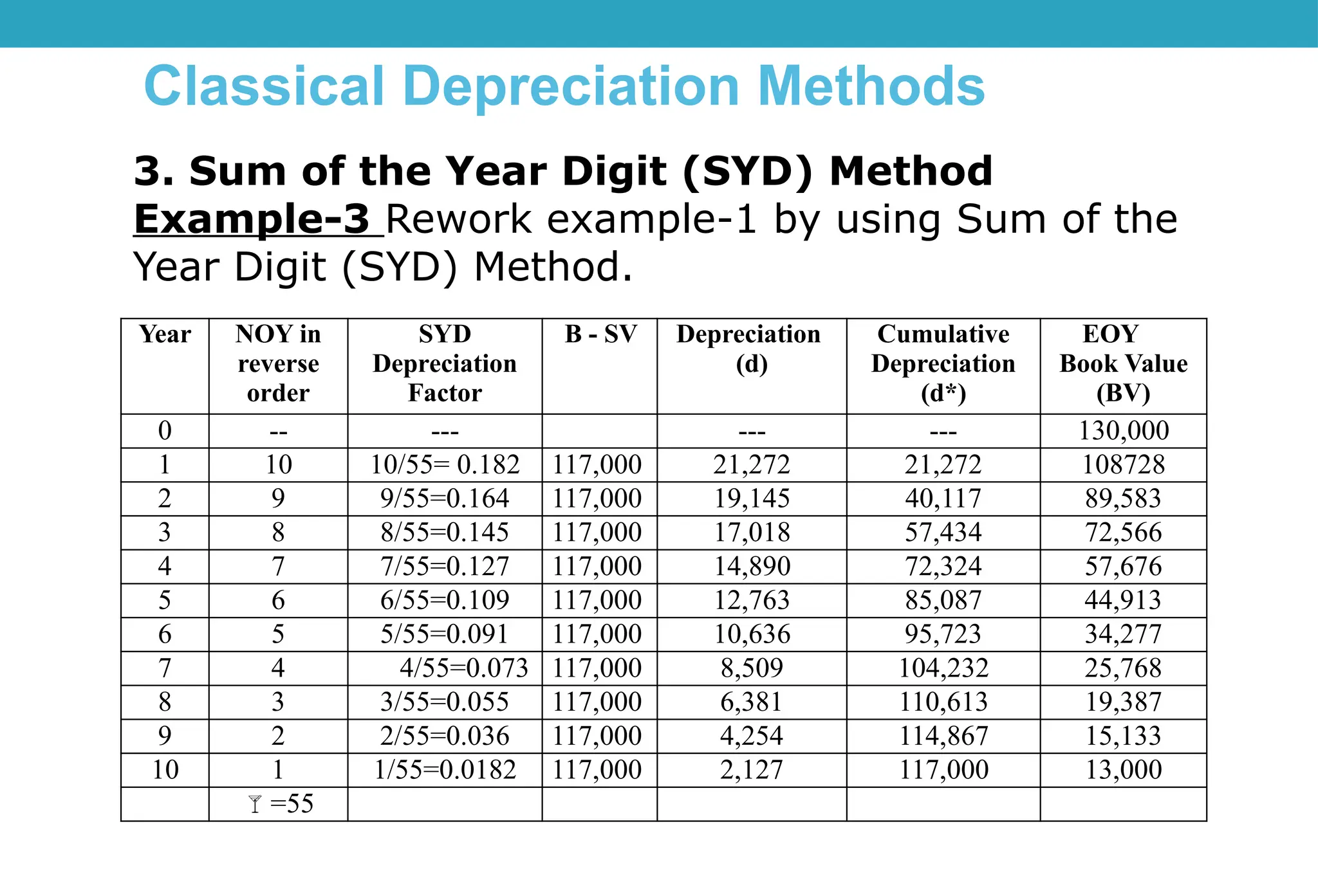

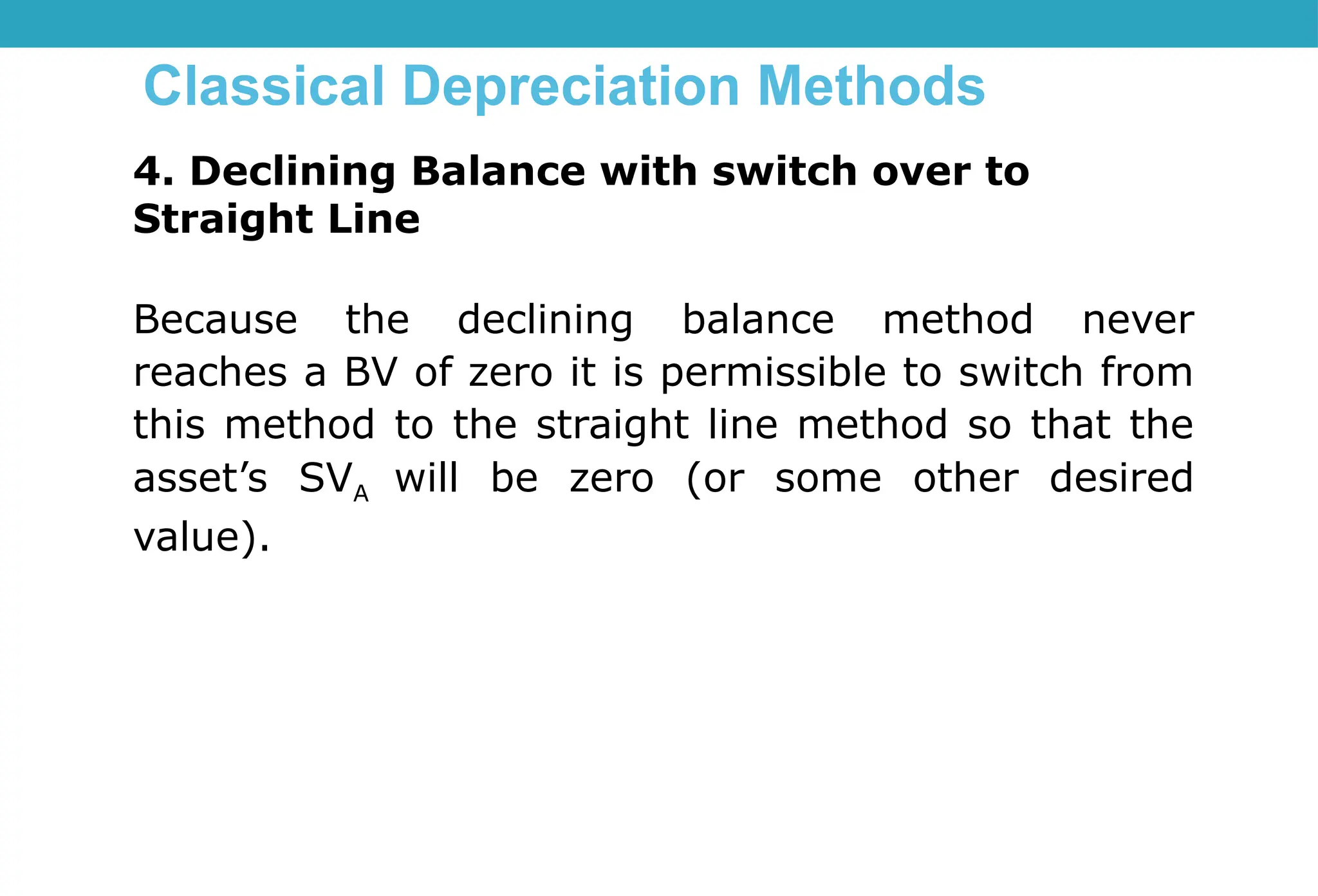

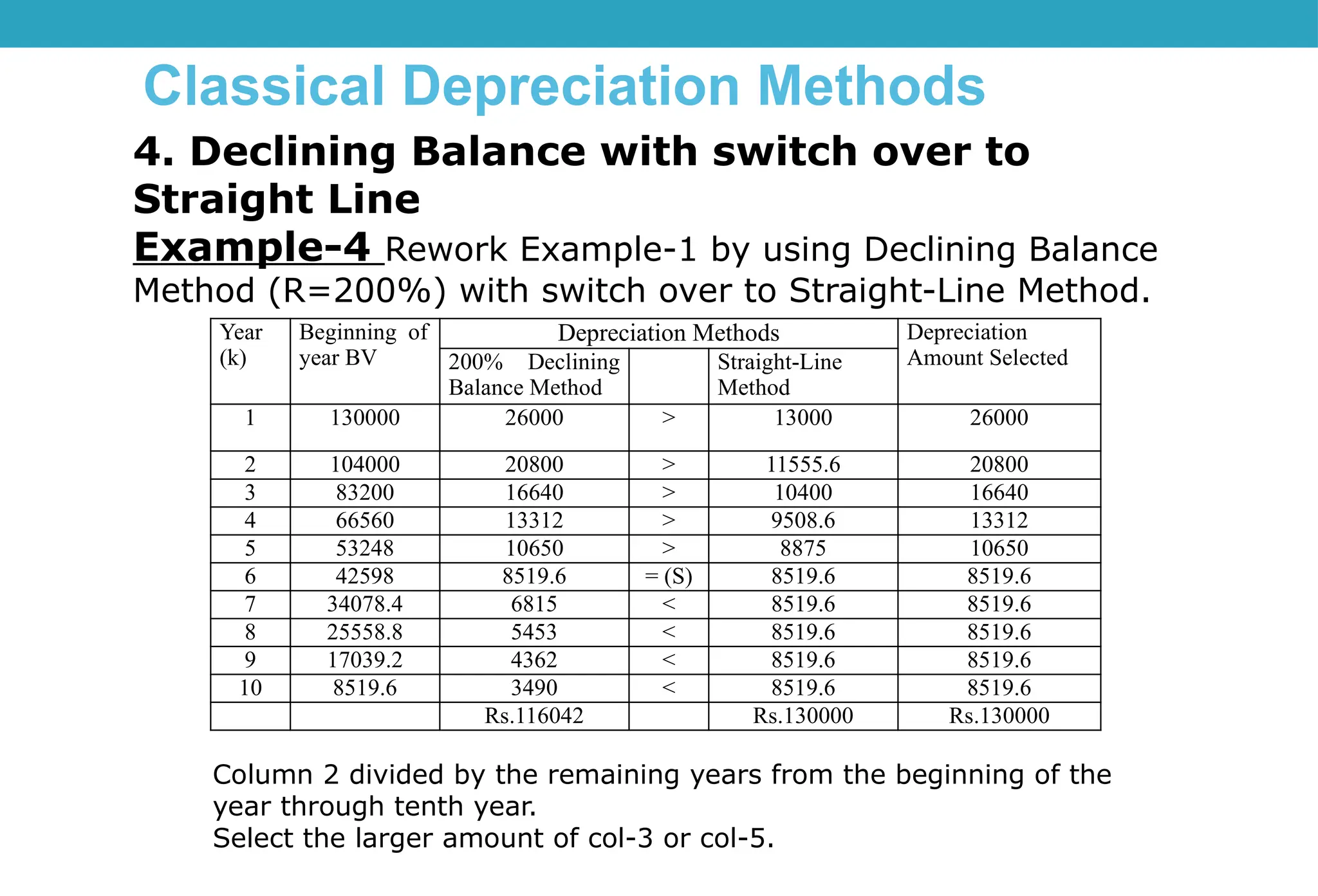

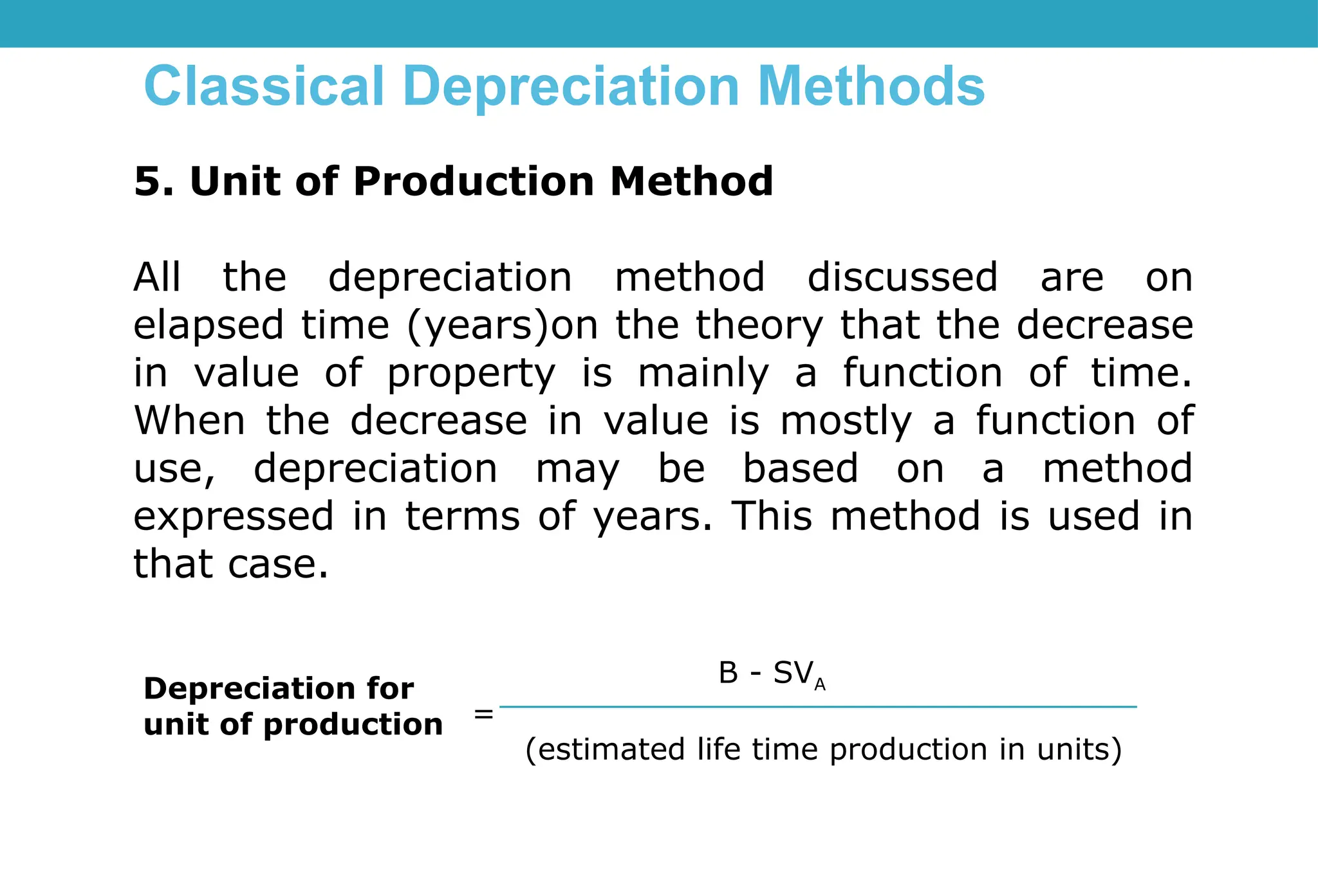

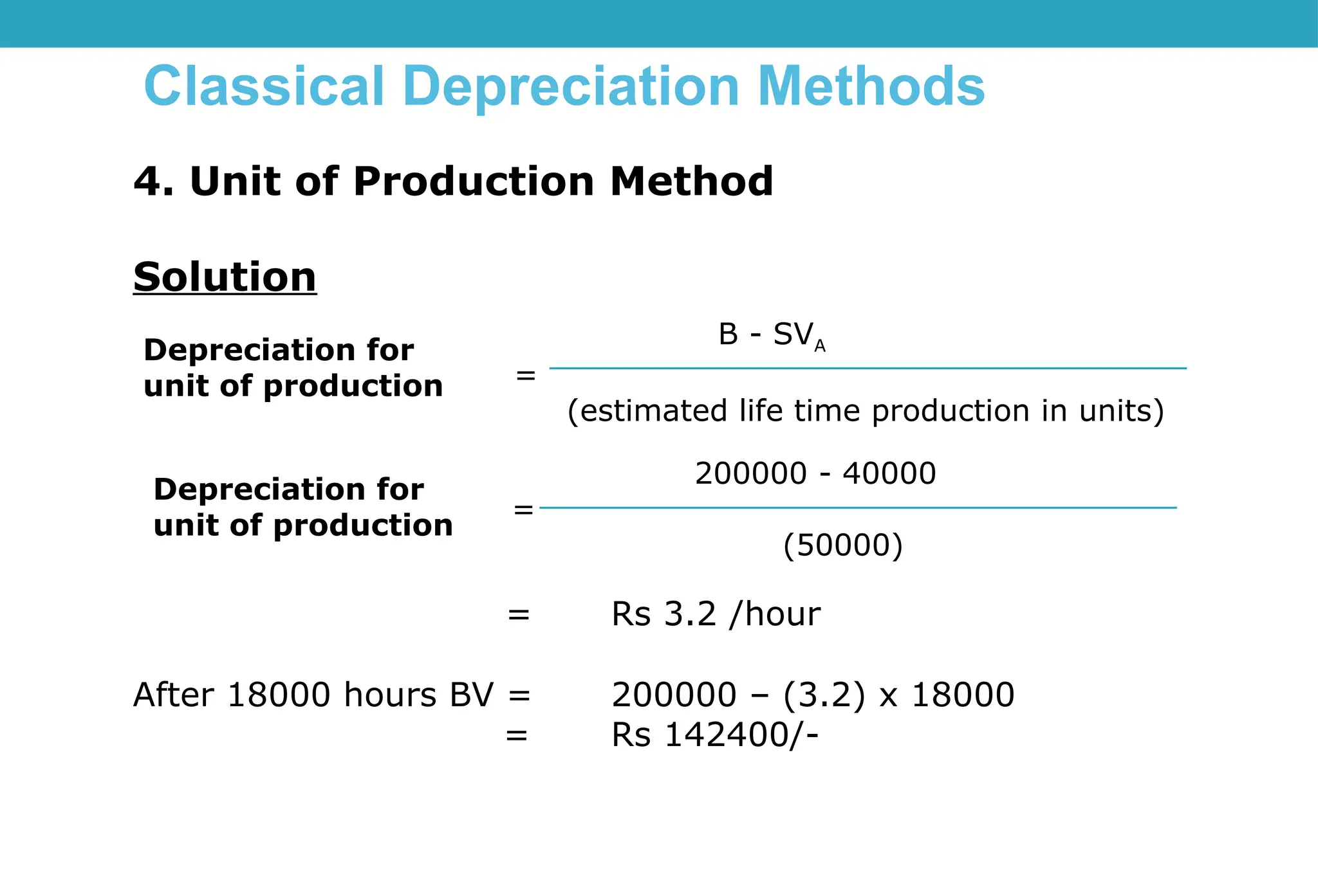

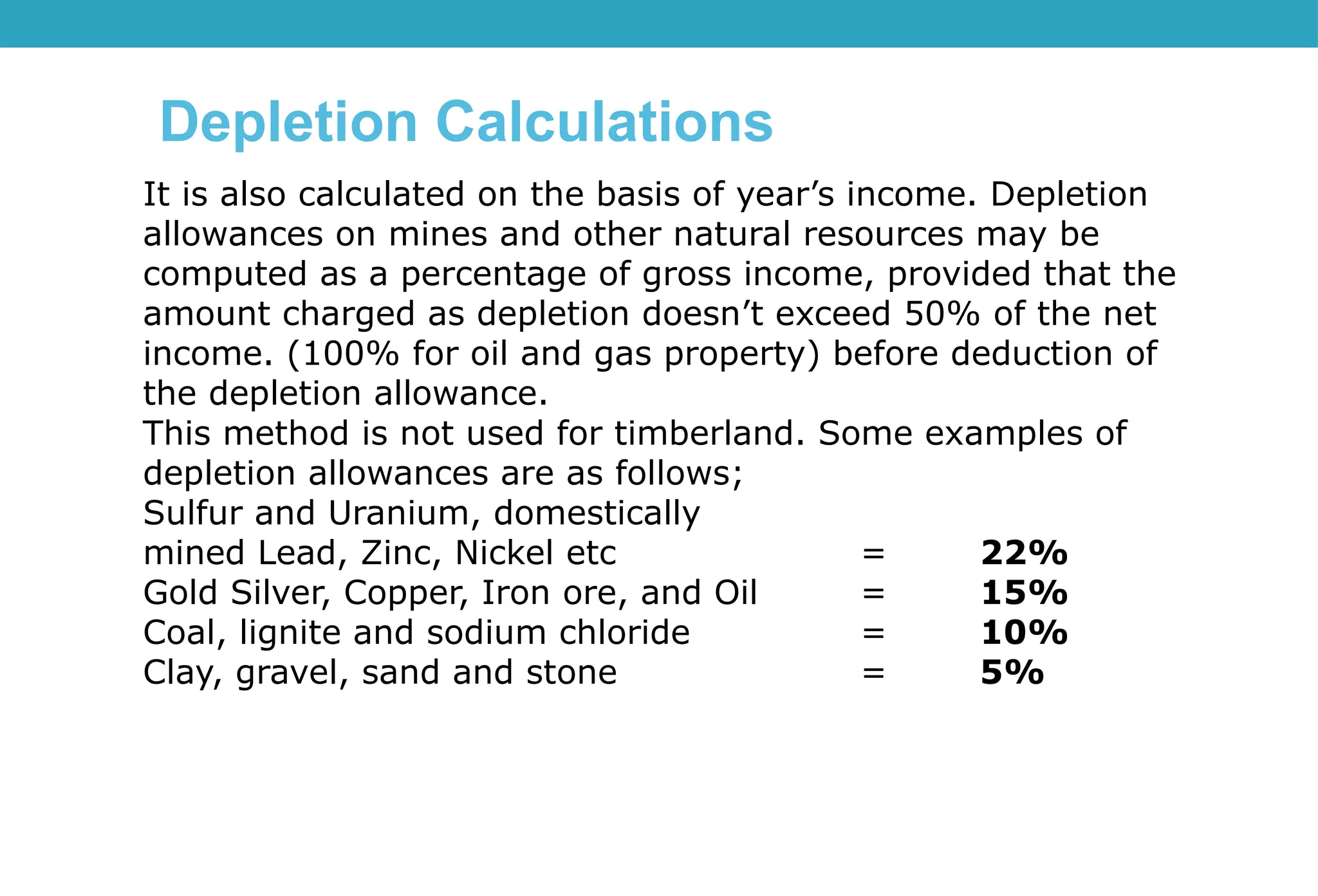

The document provides a comprehensive overview of depreciation, defining it as the decrease in value of fixed assets due to usage, wear and tear, or obsolescence. It outlines basic requirements for depreciation, different types of property, and key terms such as adjusted cost basis, book value, market value, recovery period, and salvage value. Additionally, it discusses various classical depreciation methods, including straight-line, declining balance, sum of the years digit, and unit of production methods, while also touching upon depletion in natural resource contexts.