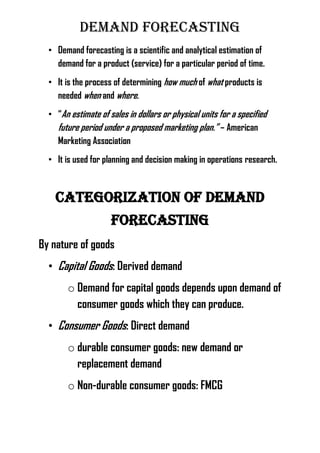

1. Demand forecasting is used to estimate future demand for products over specific time periods and is important for planning operations.

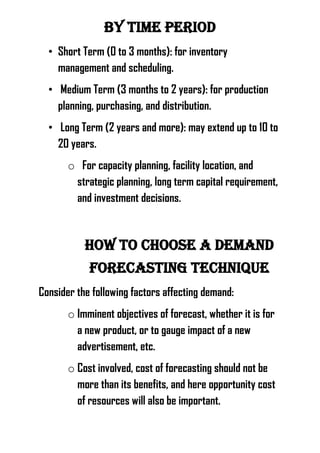

2. Demand can be categorized by the type of goods (consumer vs capital) and time period (short, medium, long term). Quantitative forecasting techniques include trend projection methods like time series analysis and regression.

3. Techniques like ARIMA combine moving averages and autoregressive methods to model trends and differences in time series data. Regression analysis uses statistical methods to model relationships between demand and influencing factors.