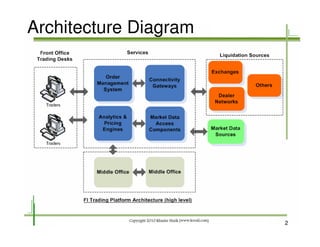

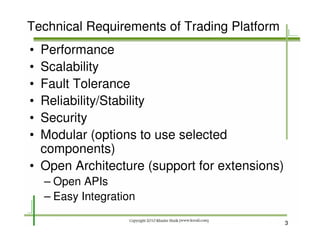

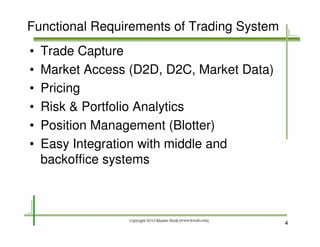

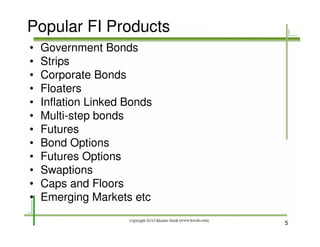

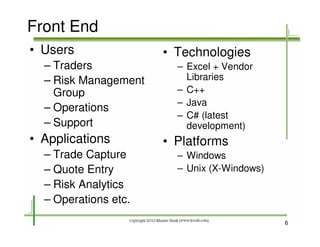

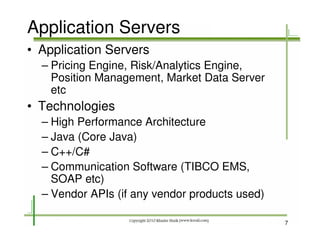

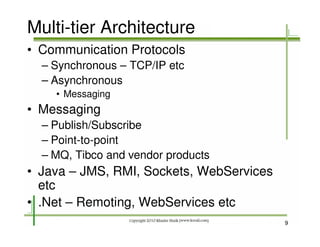

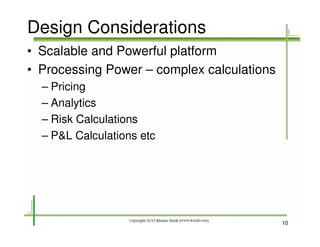

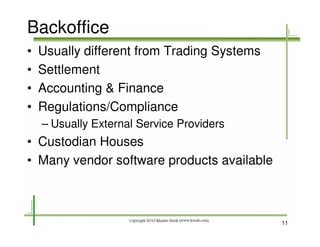

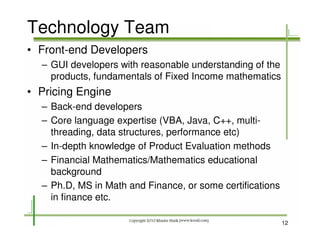

This document outlines the architecture for a fixed income trading platform. It discusses both technical requirements like performance, scalability, and security, as well functional requirements such as trade capture, pricing, and risk analytics. It describes popular components like the front-end applications, middleware application servers, database, and backoffice systems. Finally, it covers considerations for the technology team developing and supporting such a platform.