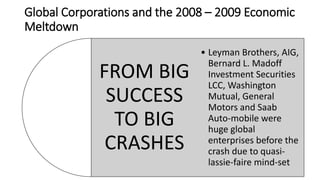

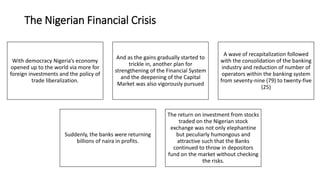

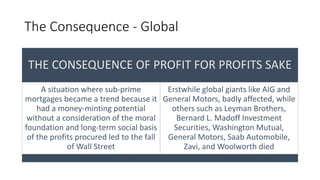

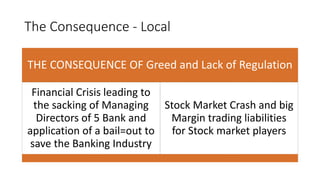

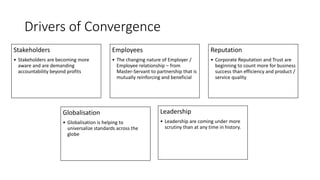

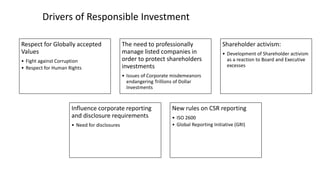

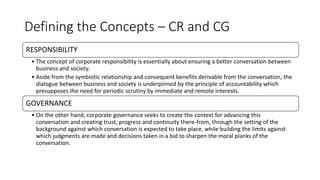

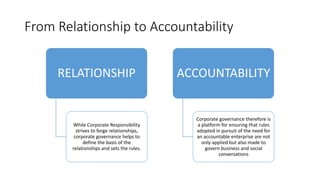

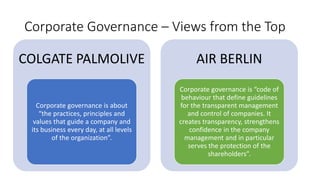

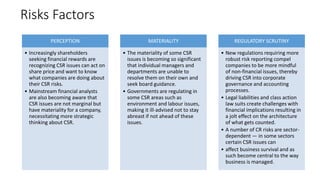

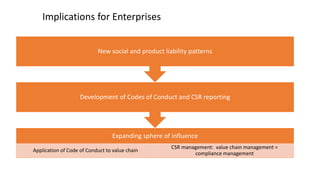

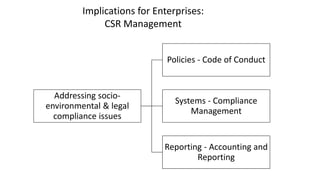

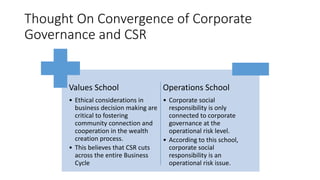

The document discusses the convergence of corporate social responsibility (CSR) and corporate governance (CG), highlighting the lessons learned from the 2008-2009 economic meltdown involving significant corporations like Lehman Brothers and AIG. It emphasizes the importance of accountability, transparency, and the evolving expectations of stakeholders regarding corporate behavior, which drive reforms and promote responsible investment practices. Ultimately, it calls for a redefined relationship between business and society, rooted in ethical considerations and sustainable practices.