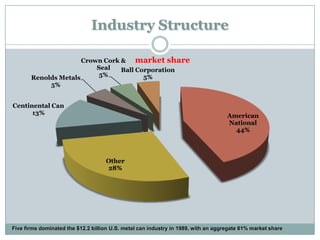

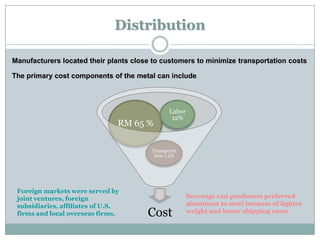

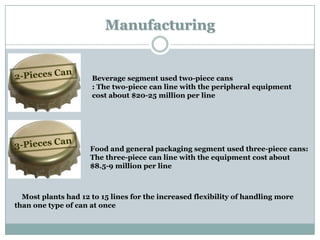

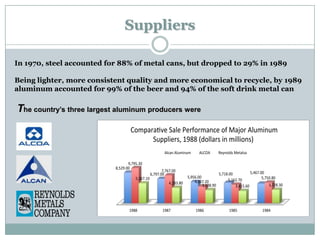

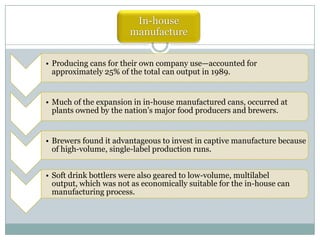

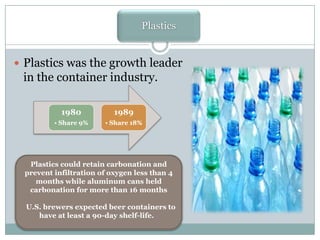

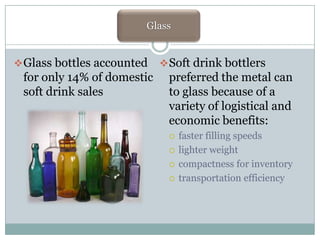

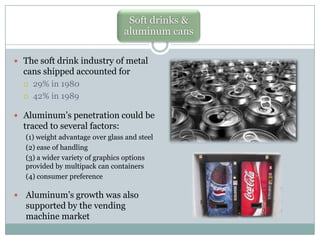

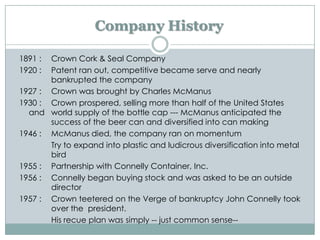

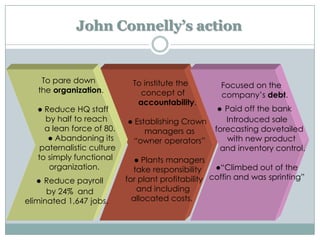

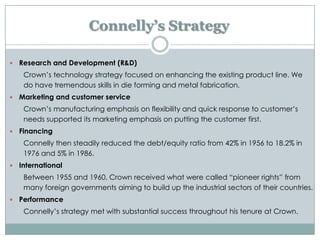

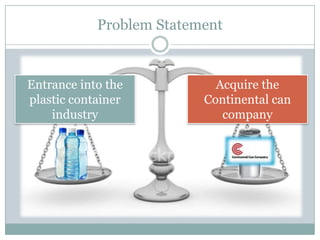

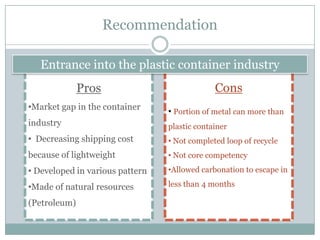

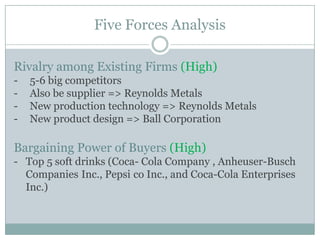

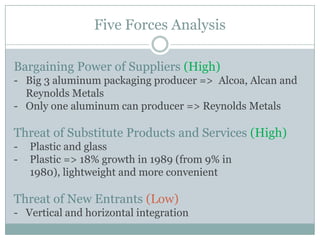

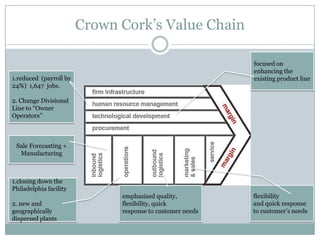

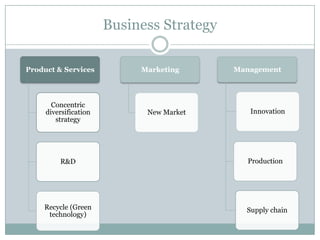

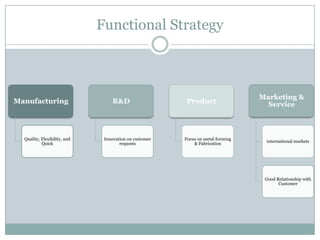

The document provides background information on Crown Cork & Seal in 1989. It discusses the metal container industry structure, trends towards in-house manufacturing, plastics, glass, and aluminum cans. It also profiles Crown Cork & Seal's history, challenges under new leadership, competitors, and recommendations for entering plastics and acquiring Continental Can. Analysis includes a SWOT analysis, 5 forces analysis, value chain analysis, and corporate, business, and functional strategies.