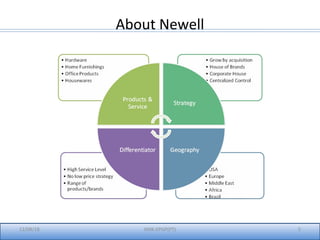

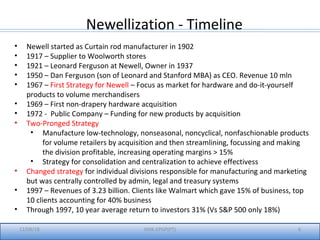

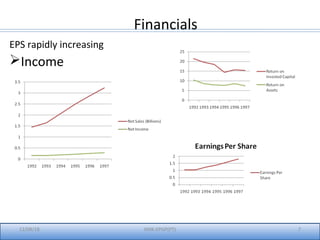

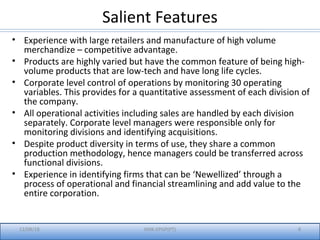

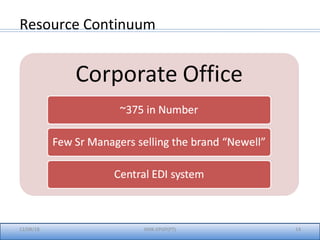

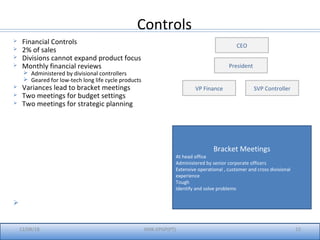

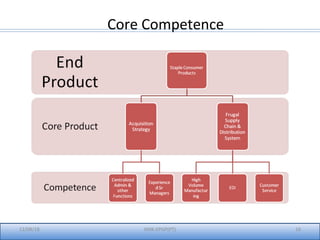

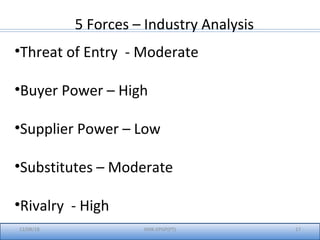

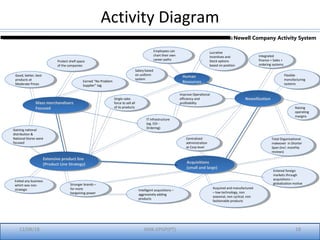

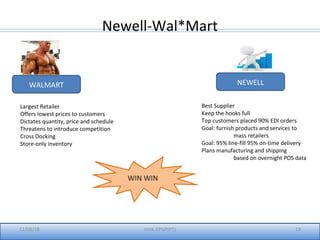

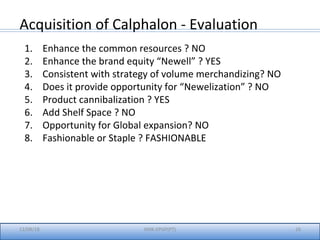

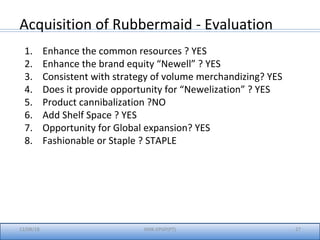

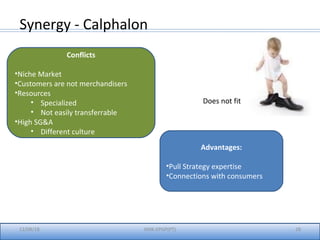

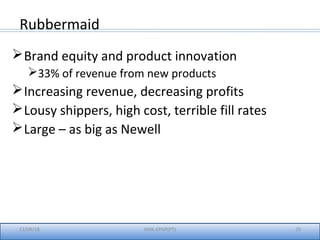

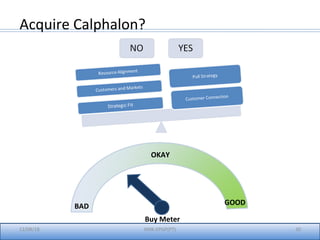

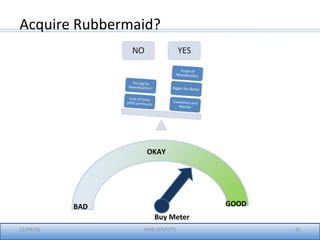

Newell's corporate strategy focuses on manufacturing and distributing a variety of low-tech, high-volume consumer products through acquisitions and consolidation aimed at large retailers. The company emphasized its competitive advantage through brand offerings, strong customer service, and centralized operational controls, while aiming for growth via a systematic acquisition process termed 'newellization.' Evaluations of potential acquisitions, such as Calphalon and Rubbermaid, highlight strategic alignments and financial considerations to maintain market leadership and operational efficiency.

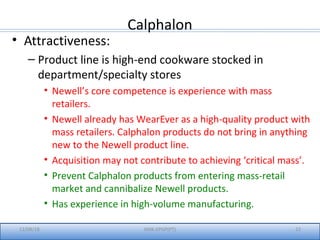

![About Newell

Manufacture Volume Merchandise and Distribute

to Volume Retailers

12/08/18 IIMK-EPGP(PT) 3

Strategy:

•Multi-product offerings

•Brand-name staple consumer products

•Excellent customer service

•[ Acquired companies to provide full line of products to fill

entire shelf space]

Top 10 customers accounted

For 40% of sales](https://image.slidesharecdn.com/newellajal-180812174359/85/Newell-ajal-3-320.jpg)