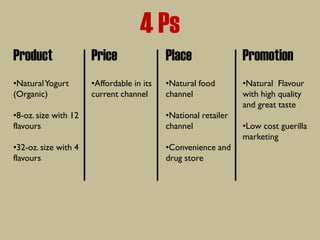

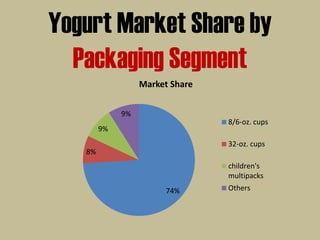

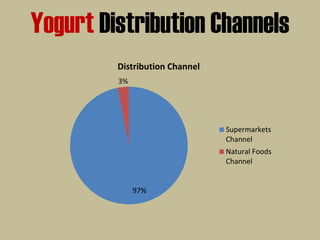

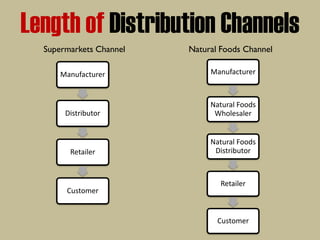

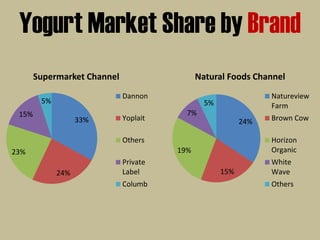

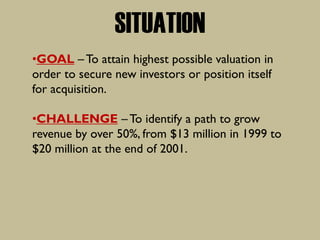

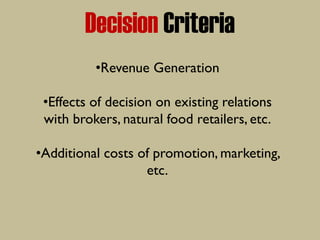

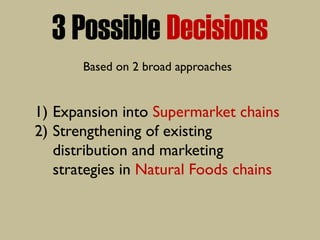

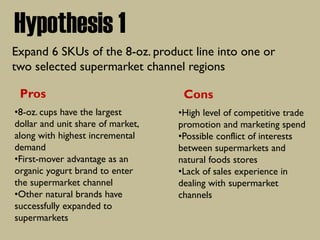

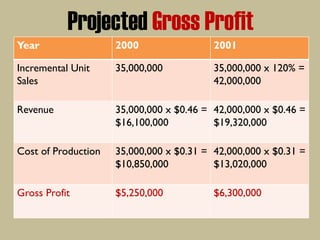

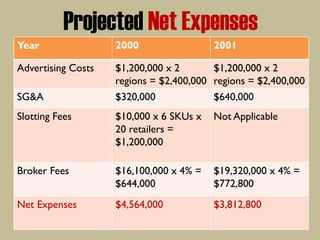

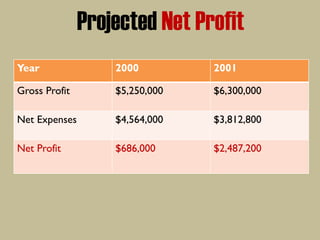

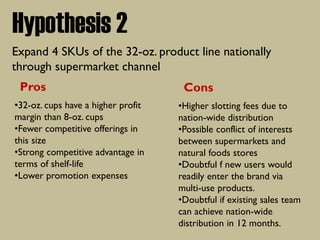

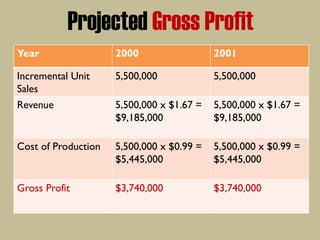

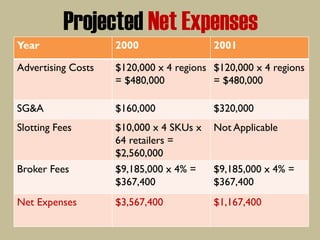

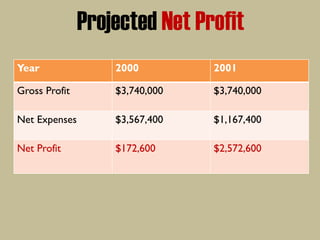

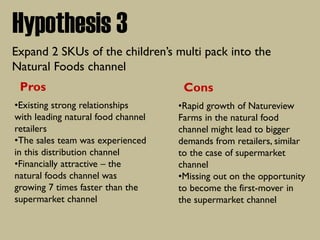

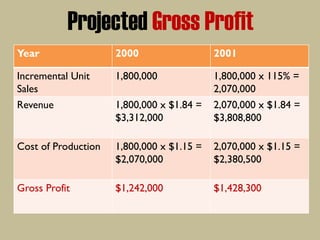

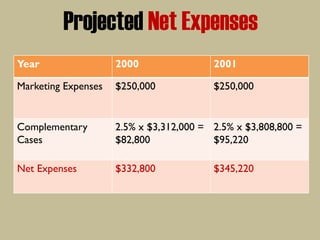

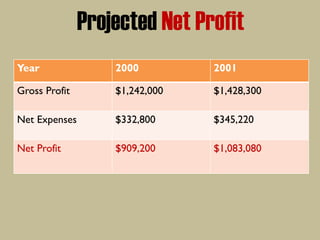

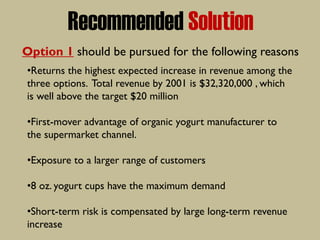

This case study analyzes a yogurt company, founded in 1989, that grew revenue from $100,000 to $13 million in a decade by leveraging natural ingredients and marketing strategies. It discusses three growth hypotheses focused on expanding product lines into supermarket channels and highlights their financial implications and market trends within the organic food spectrum. The recommended strategy emphasizes entering the supermarket channel with 8-ounce cups for maximum revenue potential due to high demand and first-mover advantage.