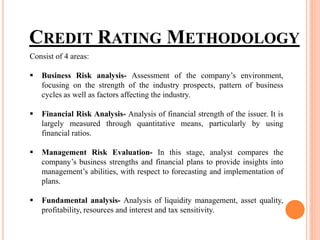

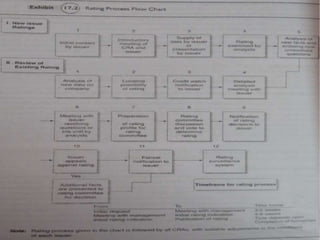

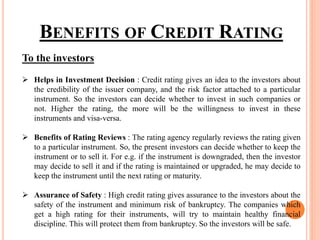

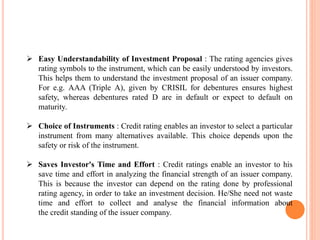

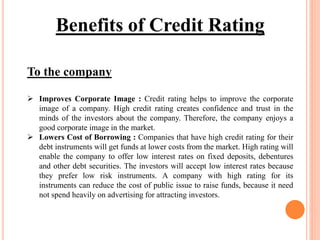

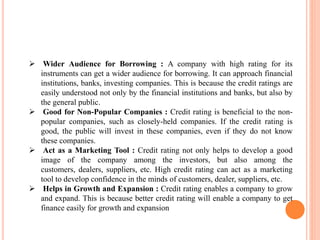

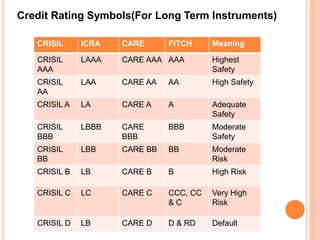

The document discusses credit ratings, which evaluate the creditworthiness of debtors like businesses and governments. Credit rating agencies determine ratings based on qualitative and quantitative analysis of financial information. Ratings are used by bond investors to assess the likelihood of default, and are indicated by symbols rather than mathematical formulas. A poor credit rating suggests a high risk of default. The document also outlines the benefits of credit ratings for both investors and companies.