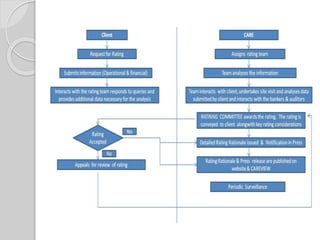

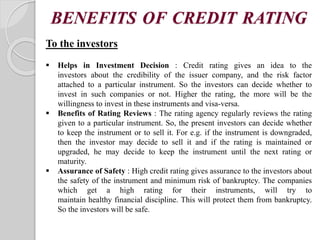

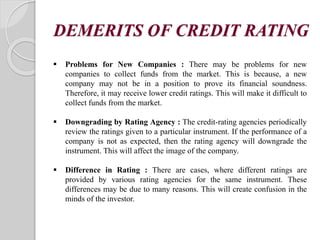

This document provides an overview of credit ratings. It begins by defining credit ratings as evaluations of a debtor's ability to pay back debt and likelihood of default. Credit ratings are determined by credit rating agencies who analyze both public and private information. The document then discusses the different types of ratings including sovereign, short-term, and corporate credit ratings. It explains the credit rating methodology and process. Finally, the benefits and drawbacks of credit ratings for both investors and companies are outlined. The major credit rating agencies operating in India are also listed.