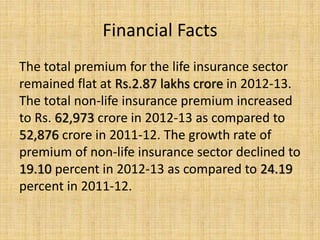

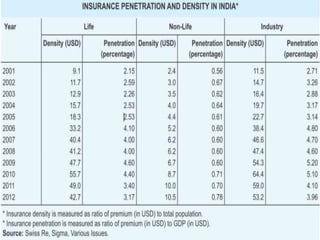

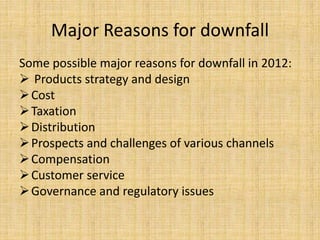

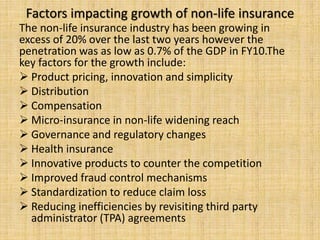

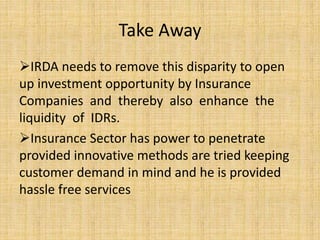

The Insurance Regulatory and Development Authority (IRDA) regulates and develops the insurance industry in India. It was established by an act of Parliament in 1999. IRDA's main functions include registering insurance companies, protecting policyholders' interests, promoting an orderly growth of the insurance sector, and regulating insurers' investments and financial practices. While the Indian insurance market has grown in recent years, greater penetration is still needed in rural areas through improved distribution channels, products, and customer service.