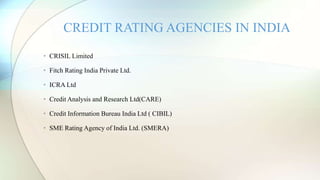

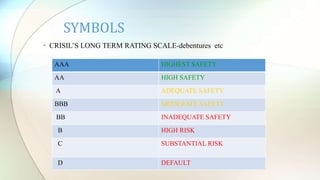

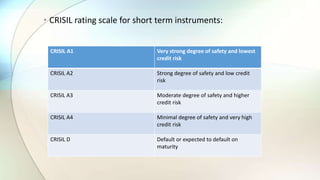

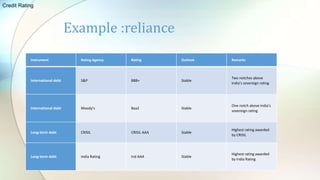

Credit rating evaluates the creditworthiness of debtors like businesses and governments, determined by agencies such as CRISIL and S&P. It provides an alphanumeric symbol representing the likelihood of debt repayment and plays a vital role in establishing risk-return relationships for investors and companies seeking funding. CRISIL, India's first credit rating agency established in 1987, offers insights that benefit both investors and issuing companies by enhancing market credibility and aiding investment decisions.