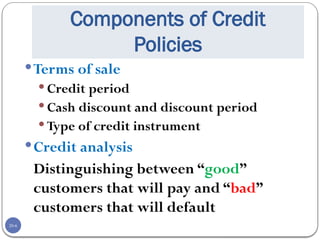

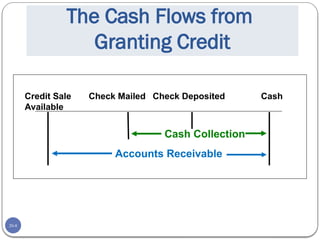

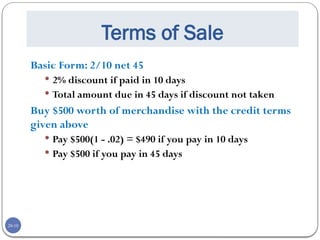

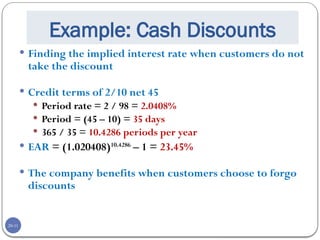

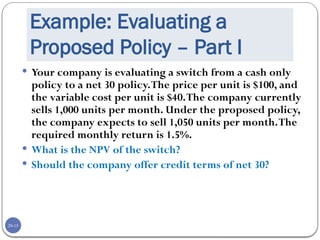

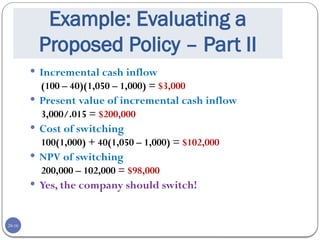

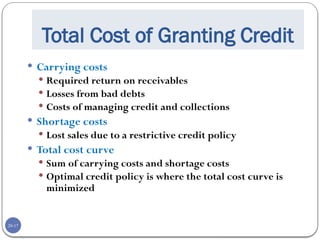

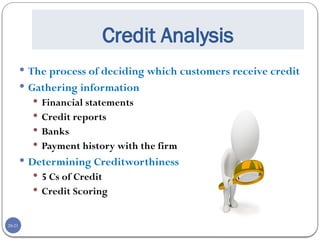

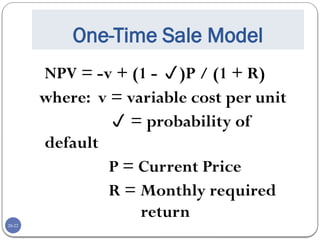

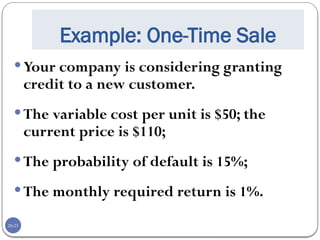

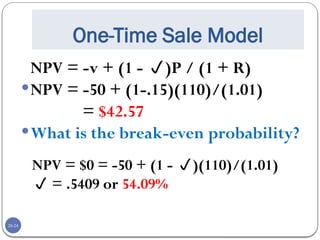

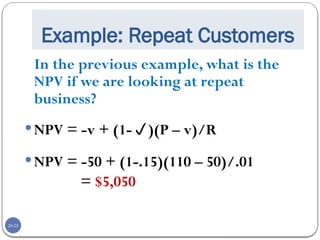

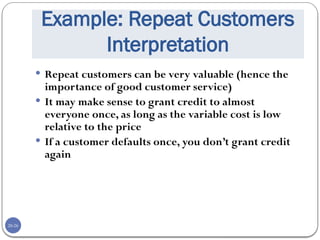

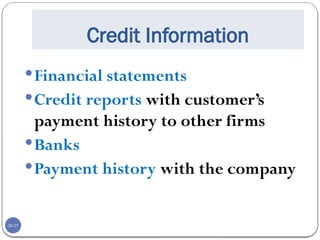

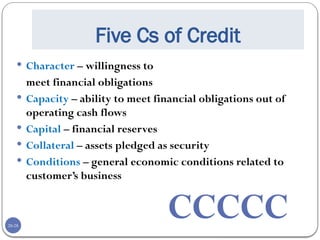

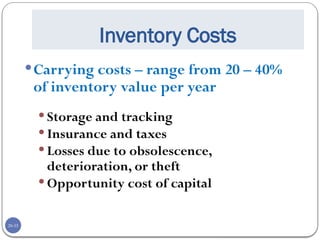

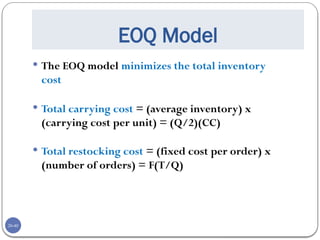

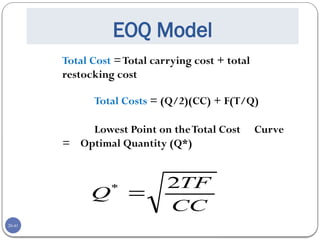

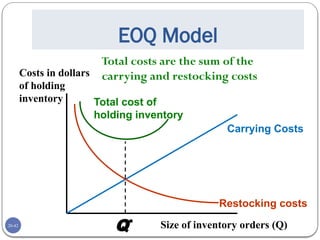

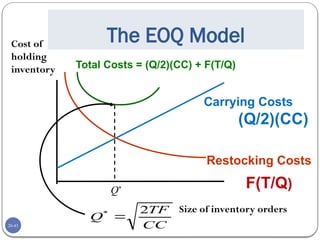

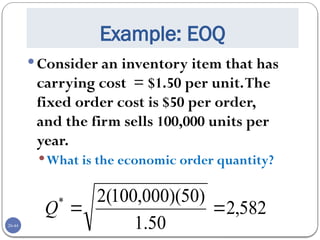

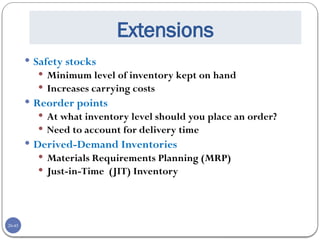

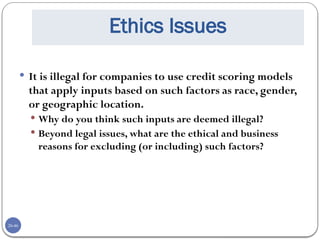

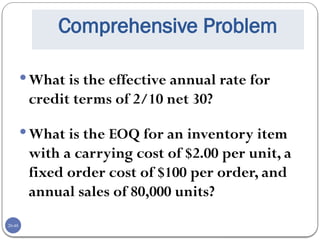

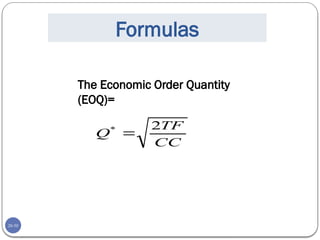

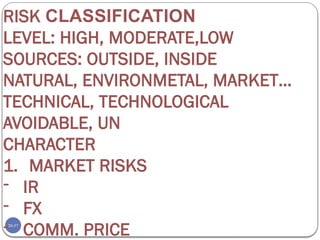

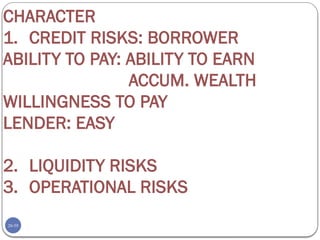

The document discusses credit and inventory management, highlighting key components such as credit policies, terms of sale, and collection efforts, along with the importance of analyzing credit risk and customer creditworthiness. It outlines costs associated with granting credit and strategies for optimizing inventory levels, including the Economic Order Quantity (EOQ) model. Additionally, it addresses the significance of ethical considerations in credit scoring practices.