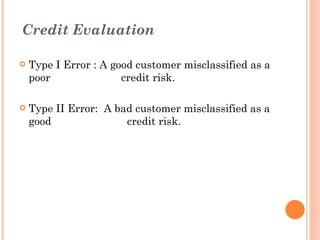

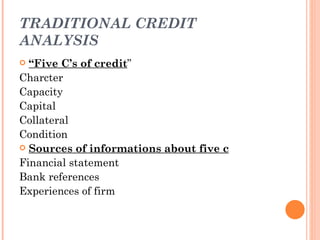

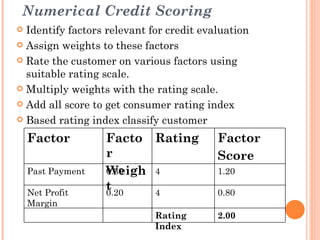

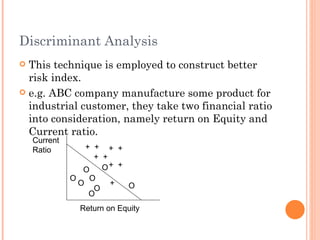

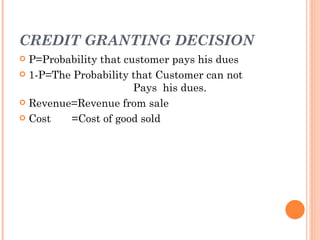

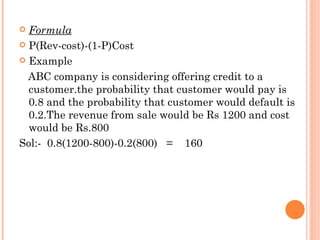

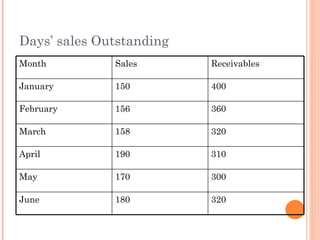

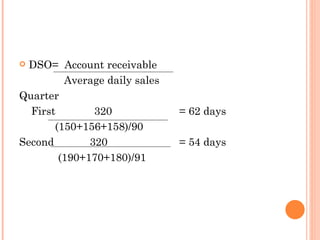

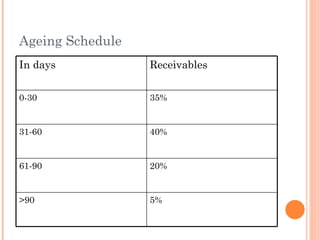

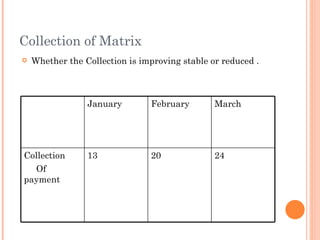

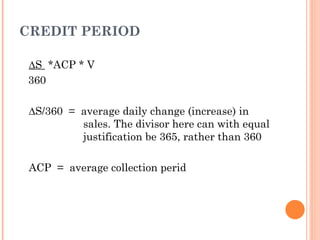

This document discusses credit management. It covers terms of payment like cash terms, open account, consignment, and letters of credit. It also discusses credit policy variables like credit standards, credit periods, cash discounts, and collection efforts. The document outlines methods for credit evaluation like traditional credit analysis, numerical credit scoring, and discriminant analysis. It then discusses making credit granting decisions using formulas that consider revenue, costs, and default probabilities. Finally, it covers controlling accounts receivable using days' sales outstanding and aging schedules.

![CREDIT STANDARDS

∆RI = [∆S (1 – V) - ∆S bn] (1 – t) -k ∆I

Where

∆RI = Change in residual income

∆S = increase in sales

V = ratio of variables costs to sales

bn = bad debt loss ratio on new sales

t = corporate tax rate

k = post tax cost of capital

∆t = increase in receivables investment.](https://image.slidesharecdn.com/creditmanagement-120328215750-phpapp01/85/Credit-management-6-320.jpg)

![CASH DISCOUNT

∆RI = [∆S (1 – V) - ∆DIS] (1 – t) + k∆I

Where

∆S = Increase in sales

V = ratio of variable cost to sales

k = cost of capital

∆I = savings in receivables investment

∆DIS = increase in discount cost](https://image.slidesharecdn.com/creditmanagement-120328215750-phpapp01/85/Credit-management-8-320.jpg)

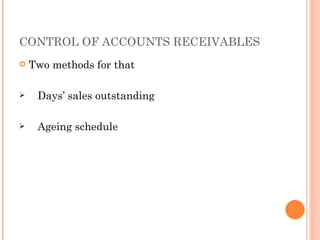

![COLLECTION EFFORT

∆RI = [∆S (1 – V) - ∆BD] (1 – t) + k∆I

Where

∆RI = Change in residual income

∆S = Increase in sales

V = ratio of variable cost to sales

∆BD = increase in bad debt cost

t = tax rate

k = cost of capital

∆I = savings in investment in receivables](https://image.slidesharecdn.com/creditmanagement-120328215750-phpapp01/85/Credit-management-9-320.jpg)