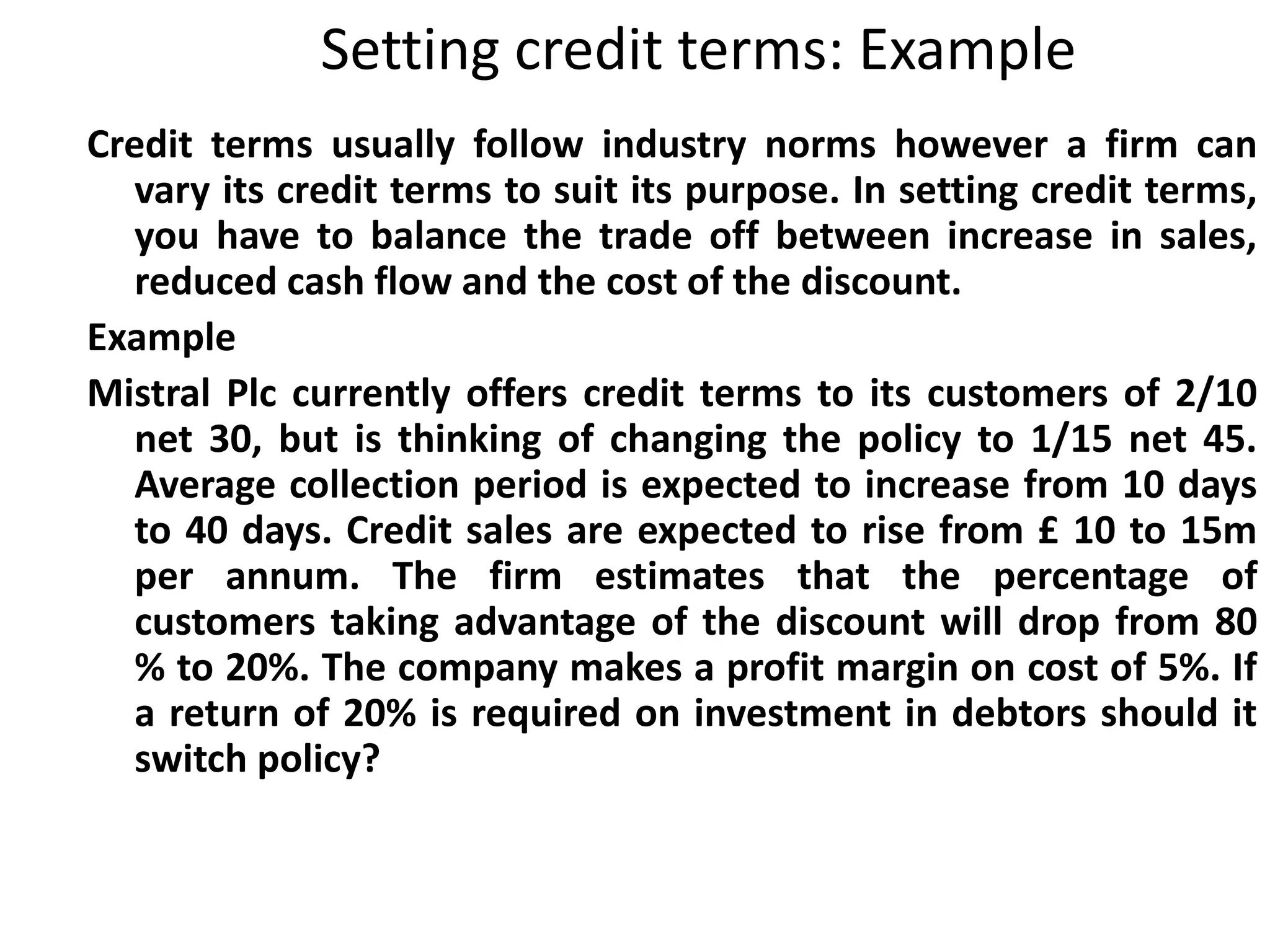

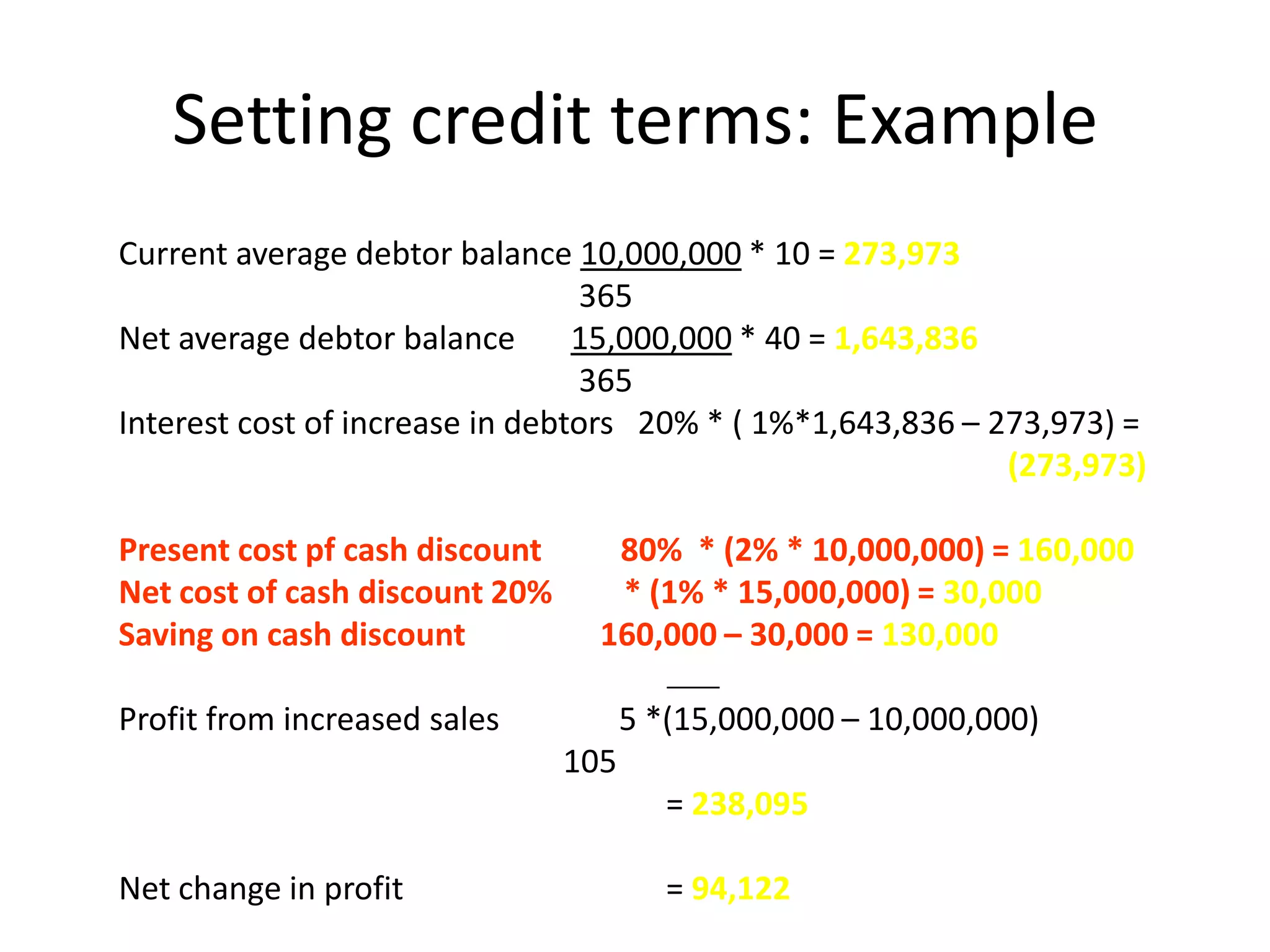

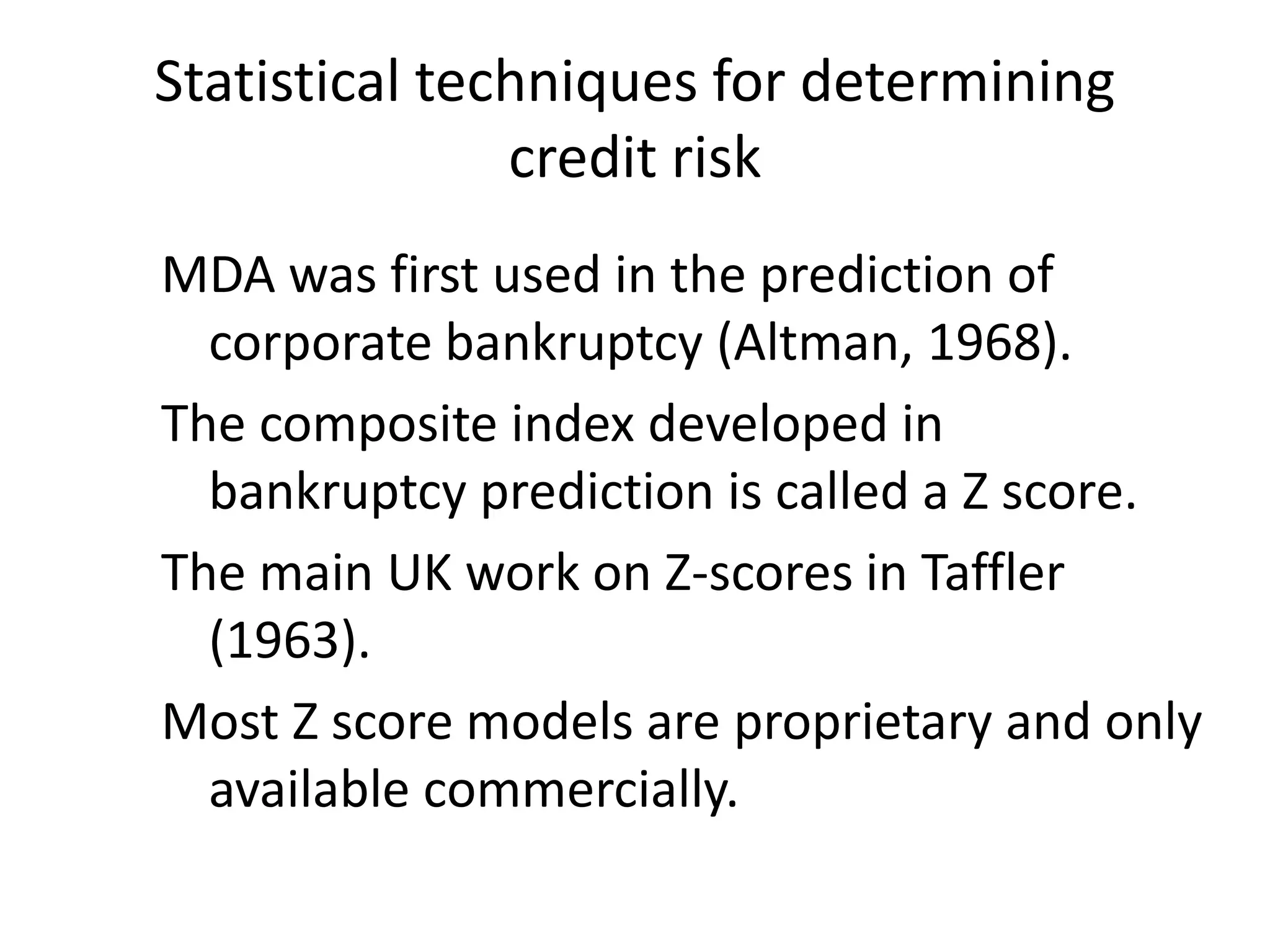

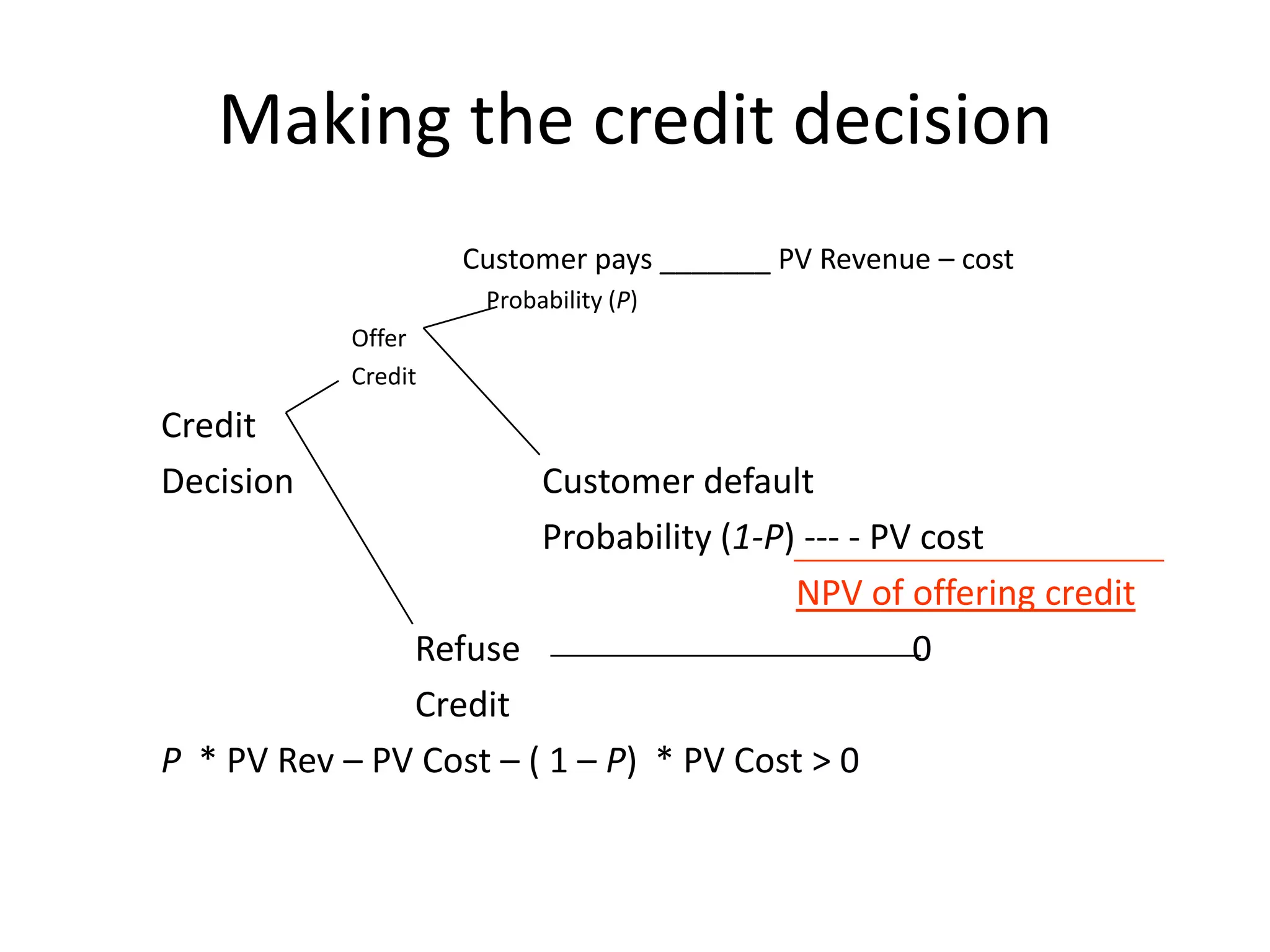

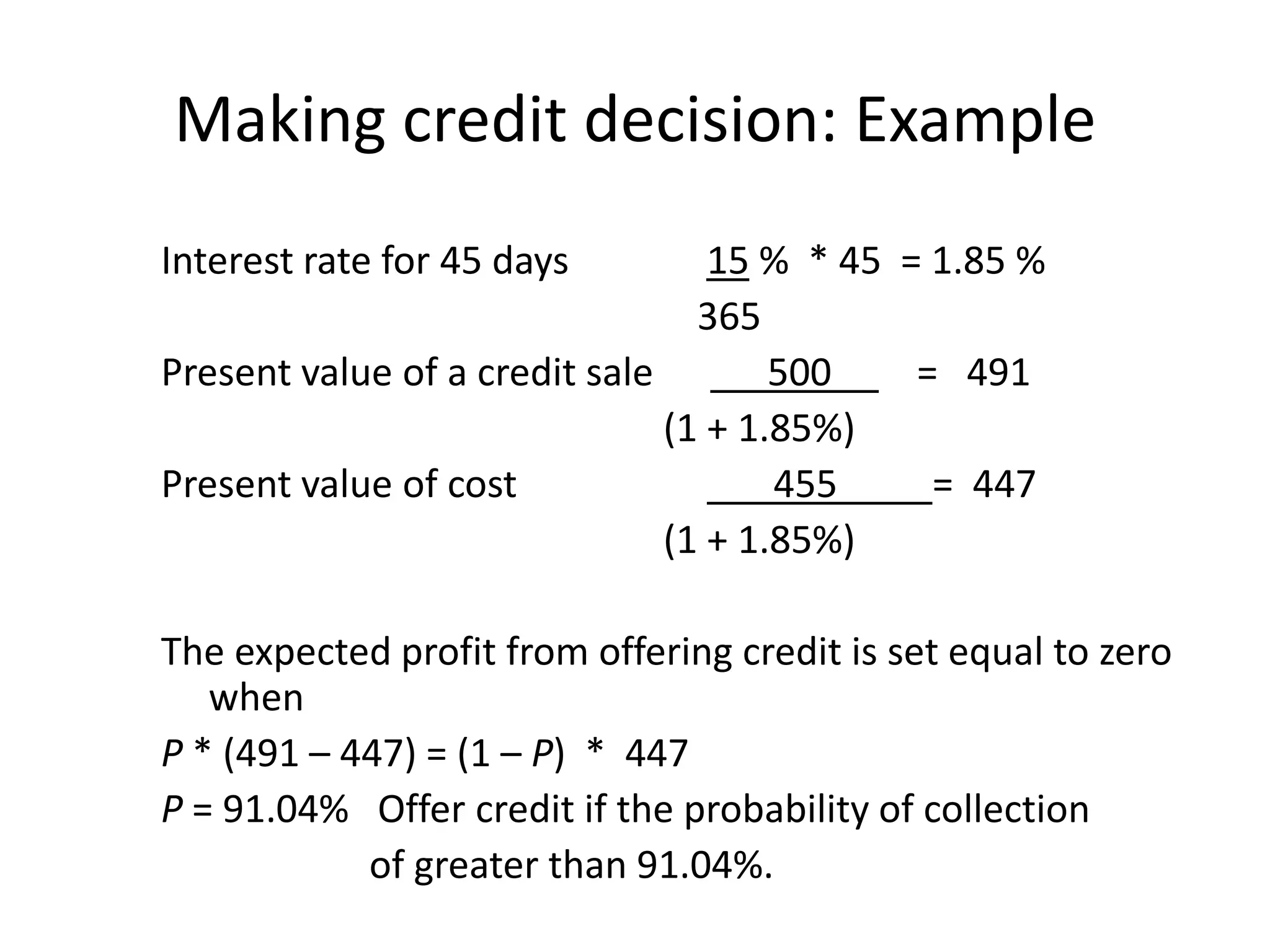

This document discusses managing credit and debt collection for businesses. It covers setting appropriate payment terms, analyzing credit risk, making credit decisions, and collection policies. Statistical techniques like credit scoring and multiple discriminant analysis can help determine customer credit risk. The key considerations for businesses include balancing increased sales from offering credit with costs of potential bad debts and reduced cash flow. Factoring is also presented as an option to speed up cash flow from sales.

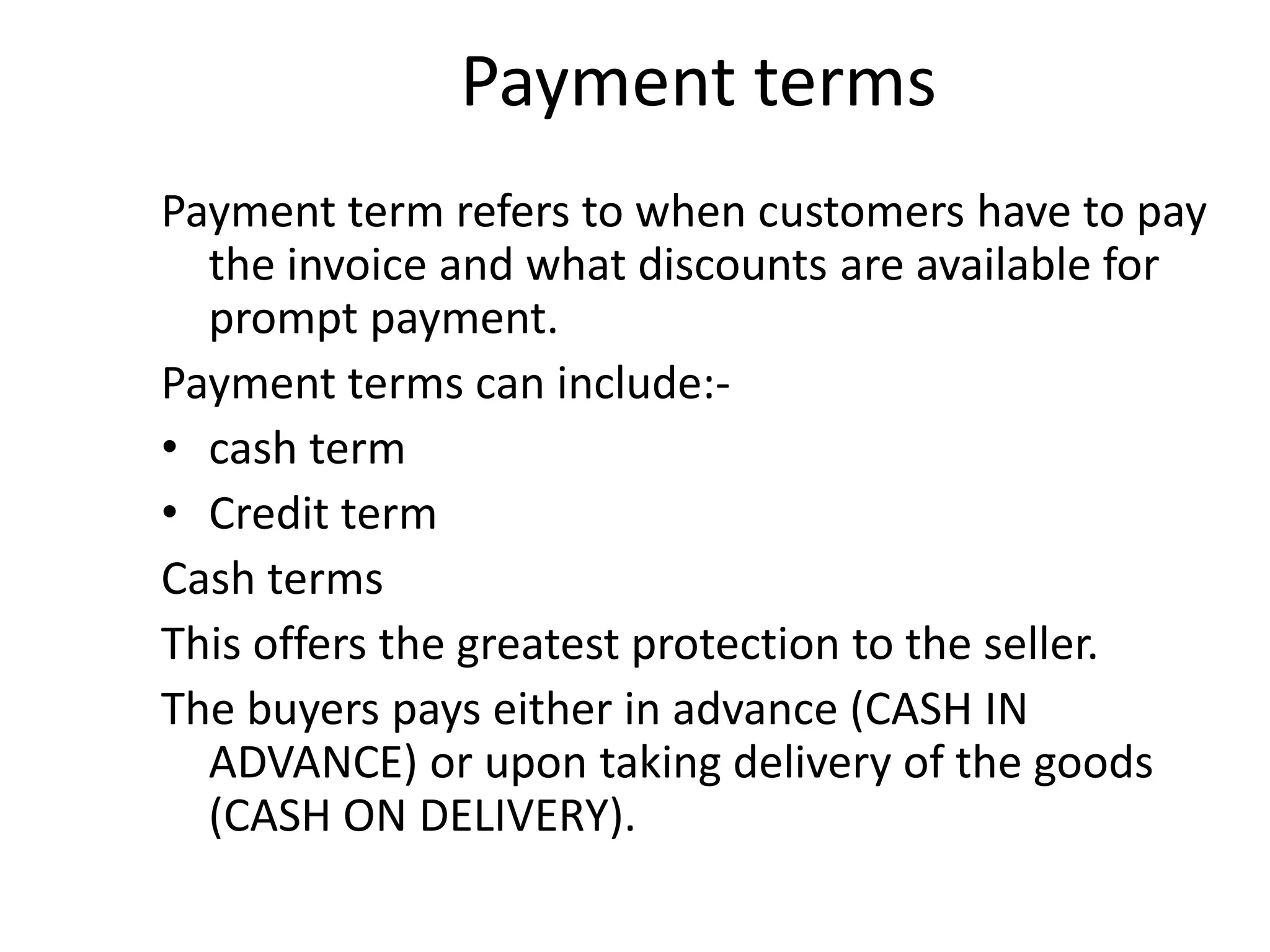

![Setting credit terms

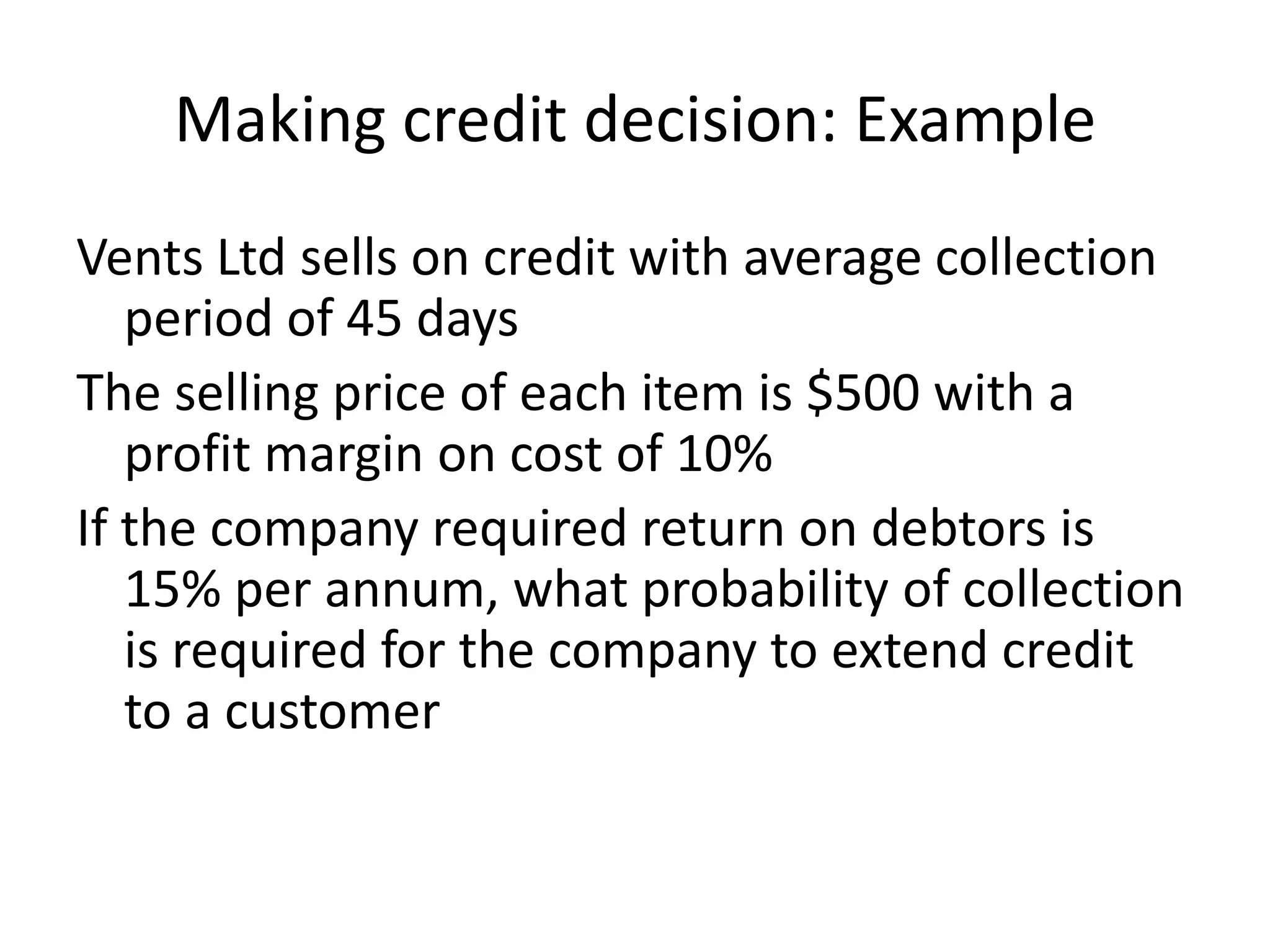

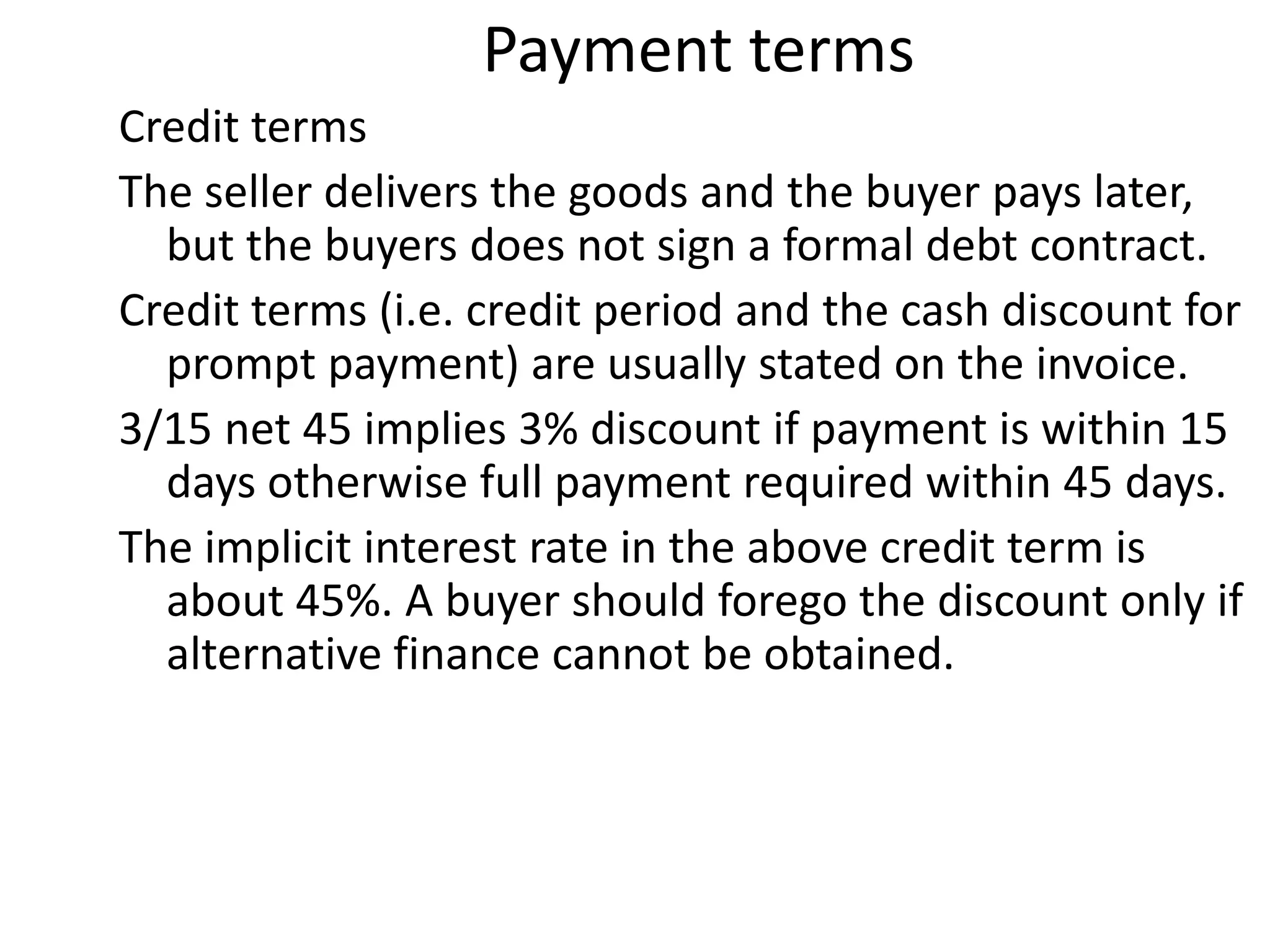

If a buyer is willing to borrow at this rate, then it is

highly likely that they are desperate for cash.

The interest rate implicit in the credit term is found

from the following formula:-

365

Interest rate = [ 1 + D ] N -1

100 – D

D is the cash discount percentage and N is the

number of days that payment can be delayed by

foregoing the discount.](https://image.slidesharecdn.com/managingdebtors-121227212938-phpapp01/75/Managing-debtors-5-2048.jpg)