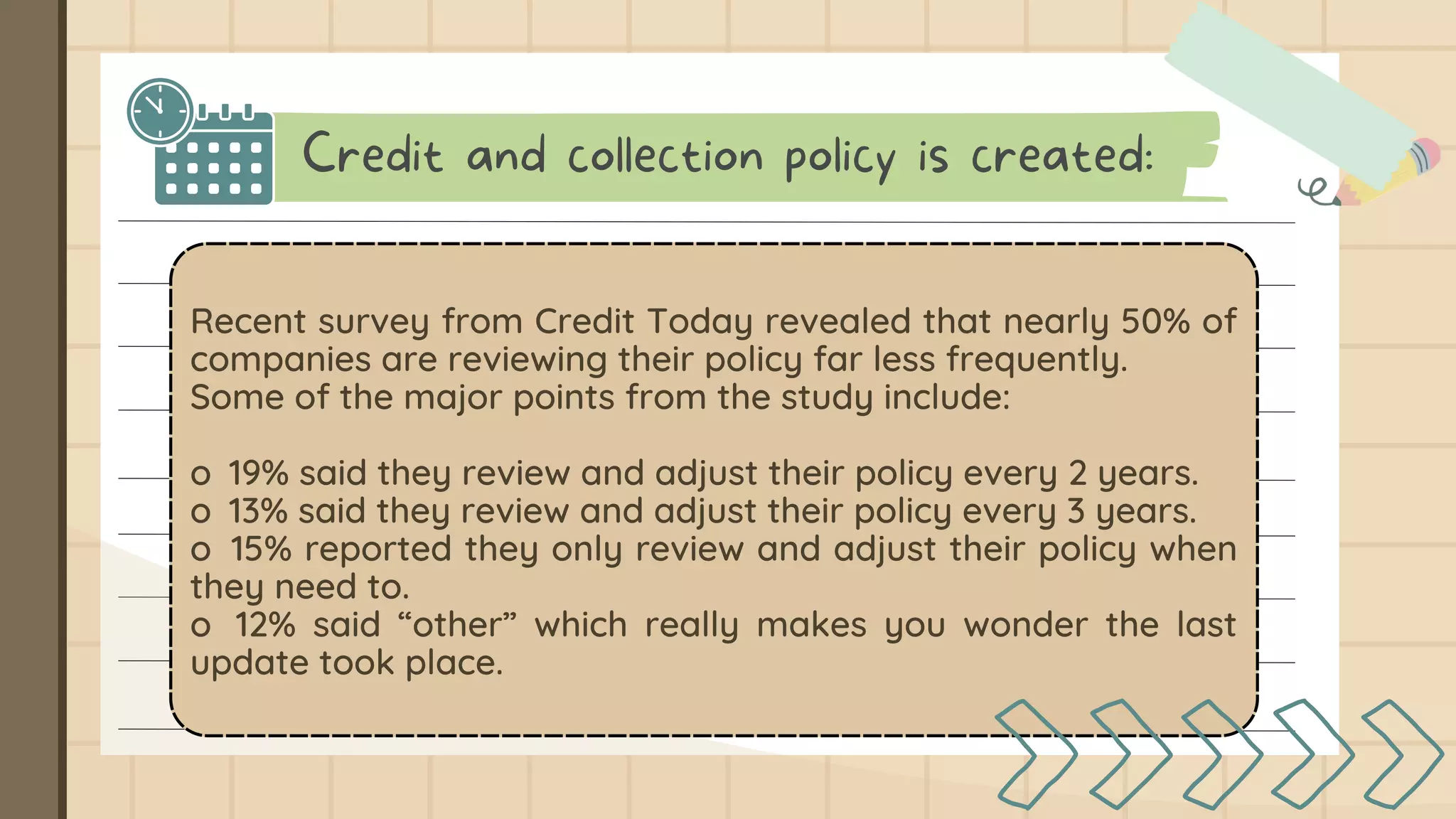

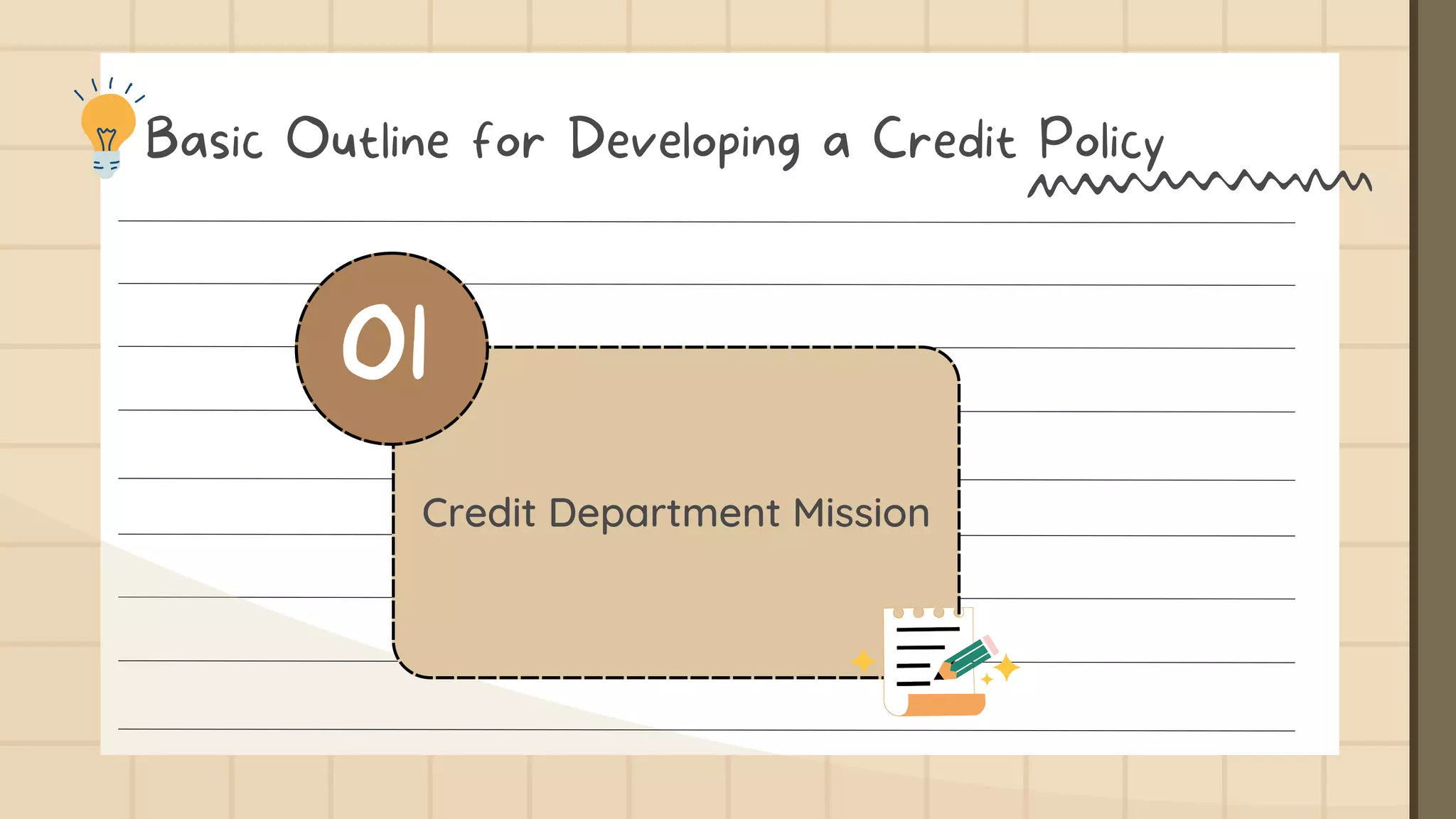

The document discusses credit and collection policies. It provides an overview of what a credit and collection policy is, who is responsible for creating it, and how to develop one. It notes that the policy should include guidelines for credit terms, customer qualification criteria, collection procedures, and steps for customer delinquency. It also discusses the importance of having a policy to ensure timely payment, minimize bad debt, protect customer relationships, and improve efficiency. The document then provides a sample outline for a credit policy, including sections on the credit department mission, goals, roles and responsibilities, procedures, and metrics for measuring results.

![Basic Outline for Developing a Credit Policy

01 Credit Department Mission Statement (sample text) :

• To support the financial goals of [company] and, specifically, to support

its sales efforts, while maintaining the highest quality of accounts

receivable within the corporation’s capacity for risk.

• To provide flexible mechanisms to sell to a broad range of customers

while ensuring that only prudent credit risks are taken and cash flow is

maintained.

• To maintain customer goodwill during the collection process. To keep

sales and senior management informed about emerging problems

including non-collectable accounts and order holds.](https://image.slidesharecdn.com/creditandcollectionpolicy-230703034734-845bb0b8/75/Credit-and-Collection-Policy-pdf-7-2048.jpg)