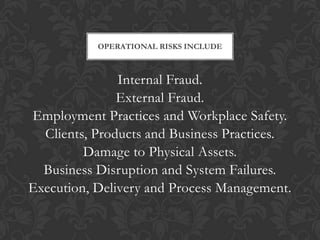

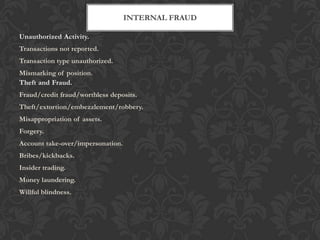

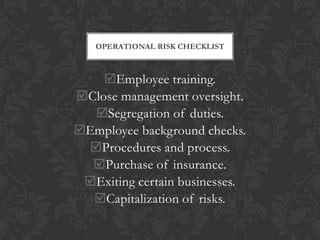

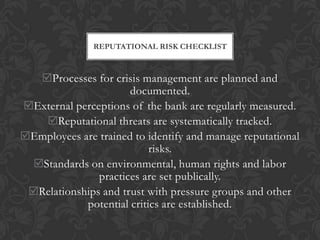

This document discusses risk management in e-banking. It defines e-banking and describes the main risks, including operational risk from failures and fraud, credit risk from counterparties, reputational risk from negative publicity, and legal risk from legal issues. It provides details on how to manage these risks, such as establishing proper processes, oversight, controls, and incident response plans to limit liability and ensure continuity of e-banking services.