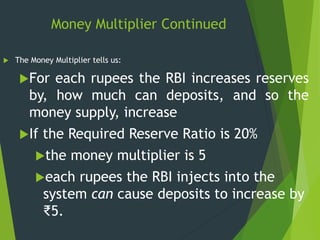

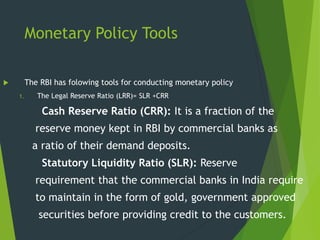

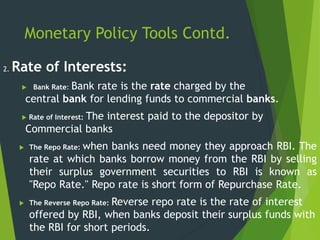

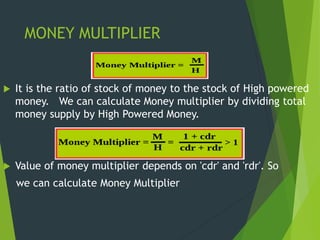

The document discusses the money multiplier concept in India. It explains that the money multiplier is the amount of money banks can generate from each rupee of required reserves, depending on the reserve ratio set by the RBI. A higher reserve ratio means a lower money multiplier and less money generated in the banking system. The document provides examples of how the money multiplier works and factors that affect its size. It also outlines the various monetary policy tools used by the RBI, including required reserve ratios, policy rates, and open market operations.