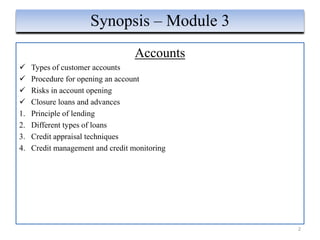

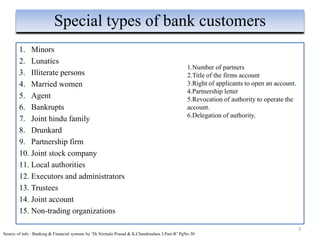

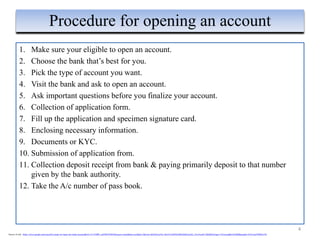

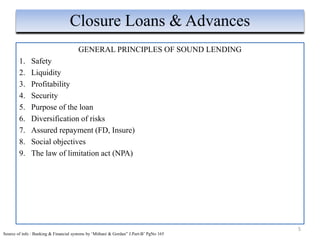

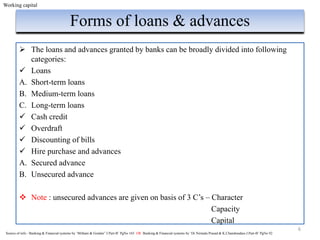

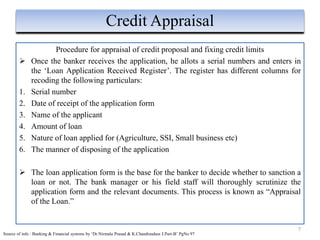

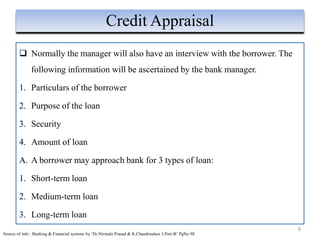

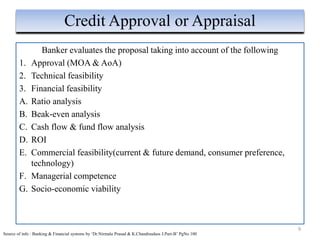

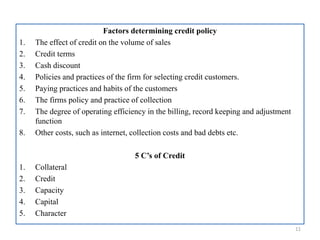

The document provides an overview of banking modules related to customer account types, account opening procedures, risks, and loan management. It details principles of lending, credit appraisal techniques, different loans, and the process of credit management. Various types of bank customers and specific requirements for opening accounts, as well as the factors influencing credit policy, are also discussed.