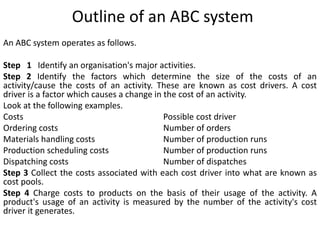

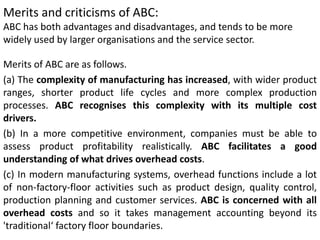

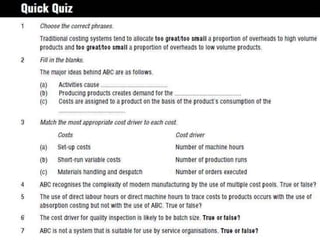

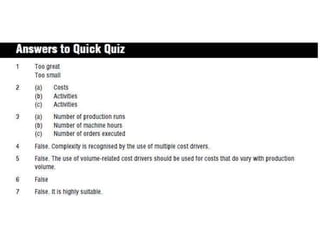

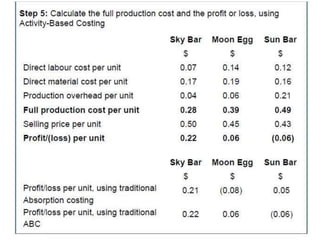

1) Activity-based costing (ABC) is a cost accounting method that allocates overhead costs to products and services based on their actual consumption of resources instead of traditional methods that use less accurate cost drivers.

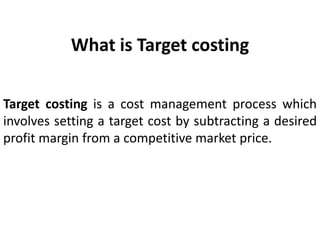

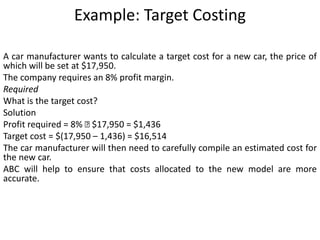

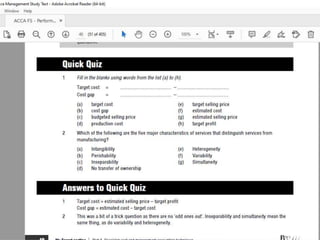

2) Target costing is a process that sets a target cost for a product by subtracting the desired profit margin from an estimated selling price and then works to reduce costs to meet the target.

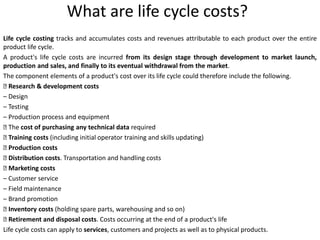

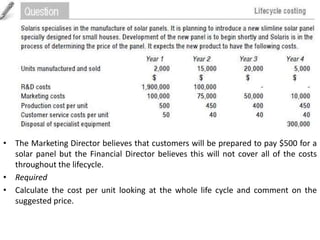

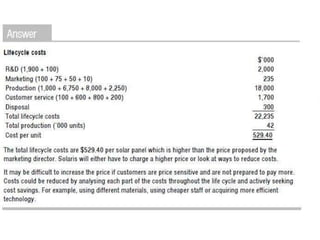

3) Life-cycle costing tracks and accumulates all costs associated with a product or service over its entire lifetime from design through disposal to determine total profitability.