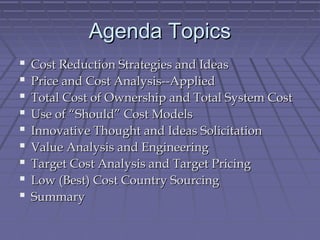

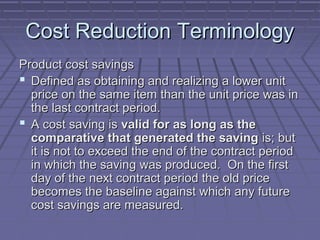

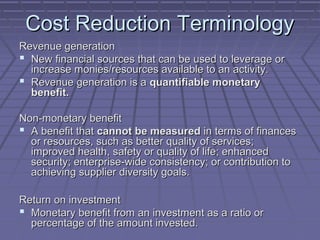

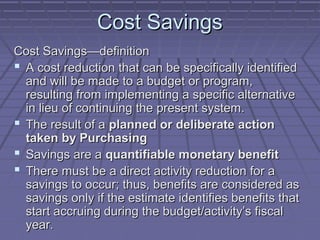

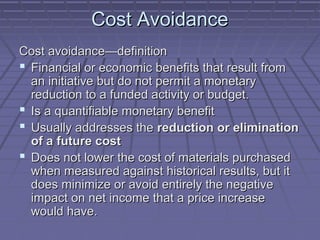

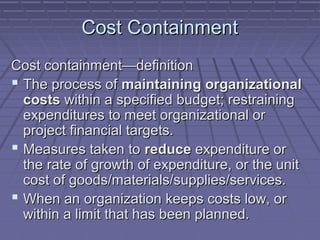

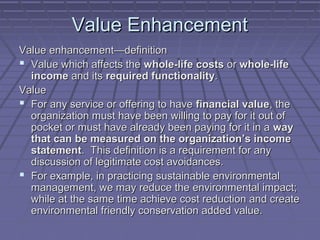

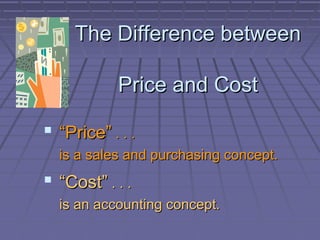

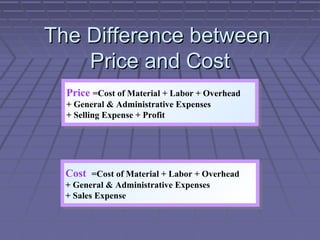

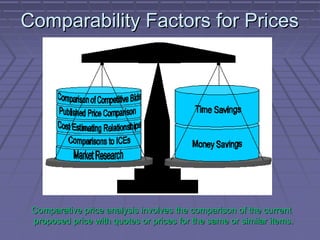

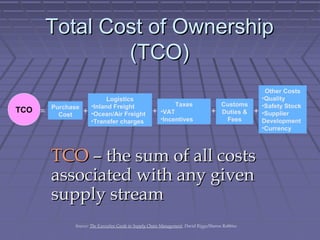

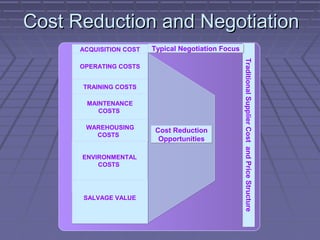

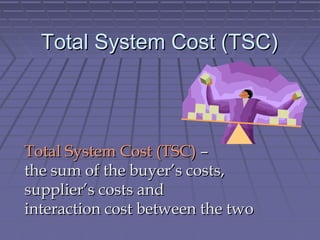

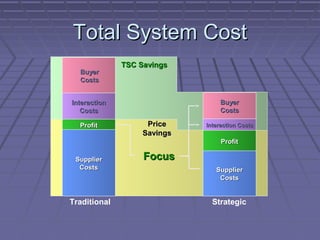

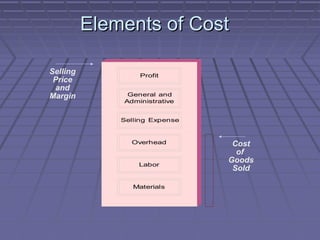

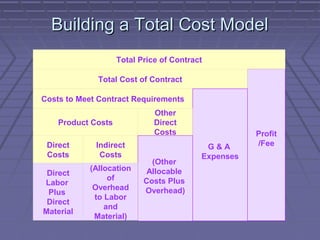

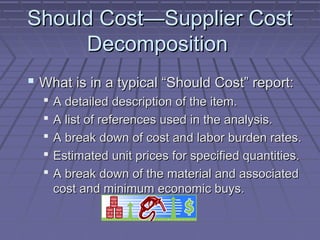

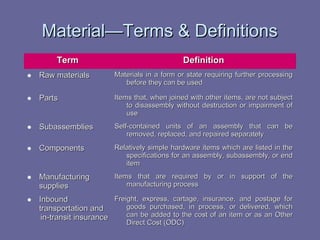

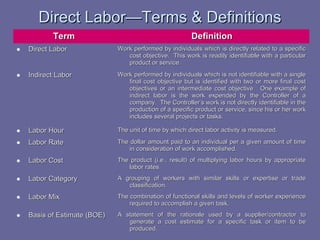

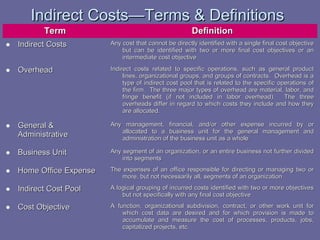

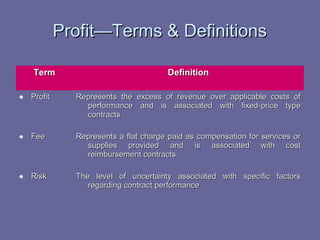

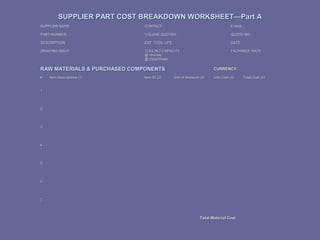

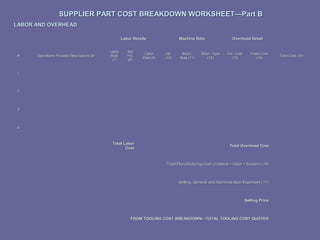

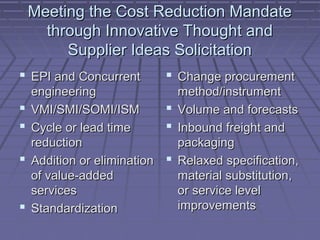

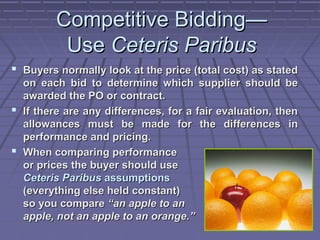

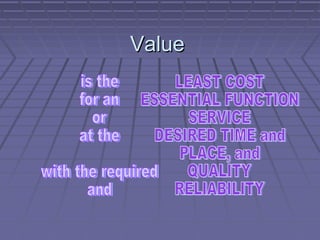

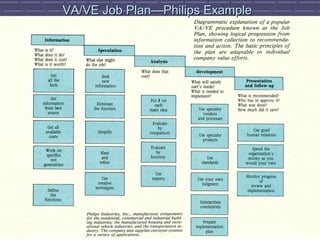

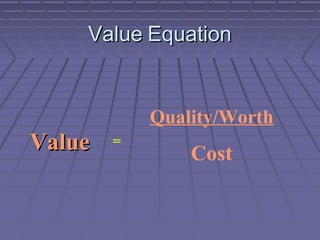

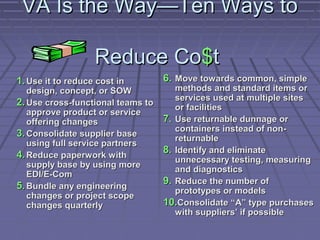

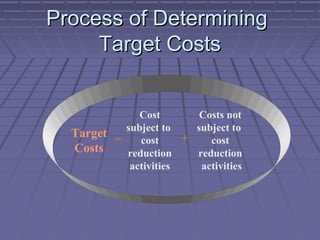

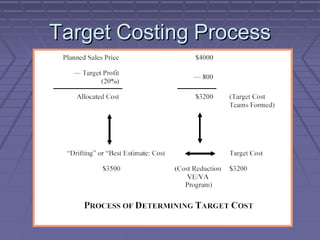

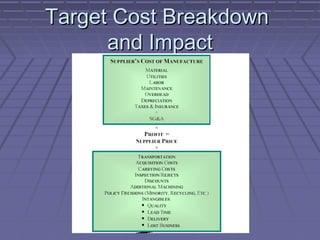

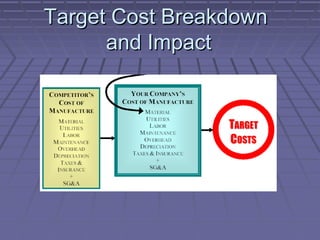

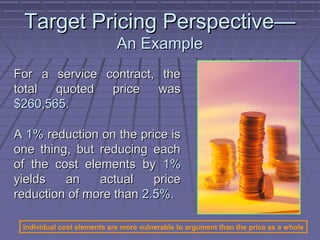

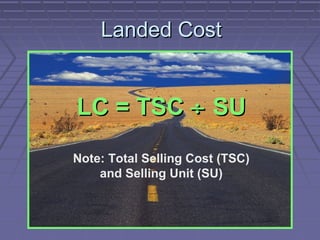

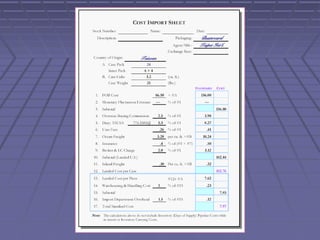

The document presents cost reduction strategies and techniques focused on improving financial efficiency in procurement processes. It defines key terms like cost savings, cost avoidance, and value enhancement, and discusses methodologies including total cost of ownership, should cost analysis, and value analysis. Additionally, it emphasizes the importance of collaboration and innovative approaches in cost reduction efforts.