The document contains sample templates for comparative income statements, balance sheets, and explanations of their purpose. It also includes sample problems and solutions for preparing comparative statements. Specifically, it provides:

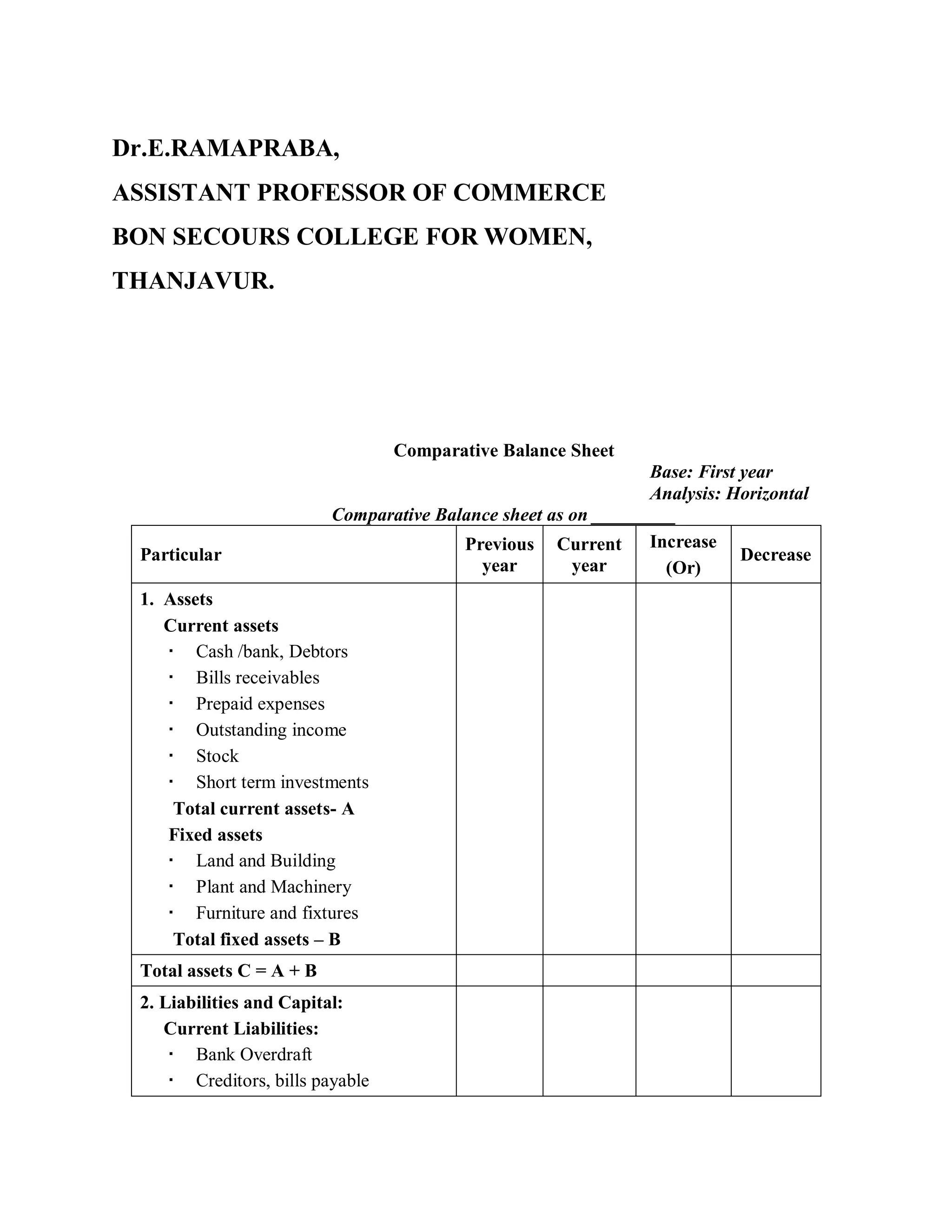

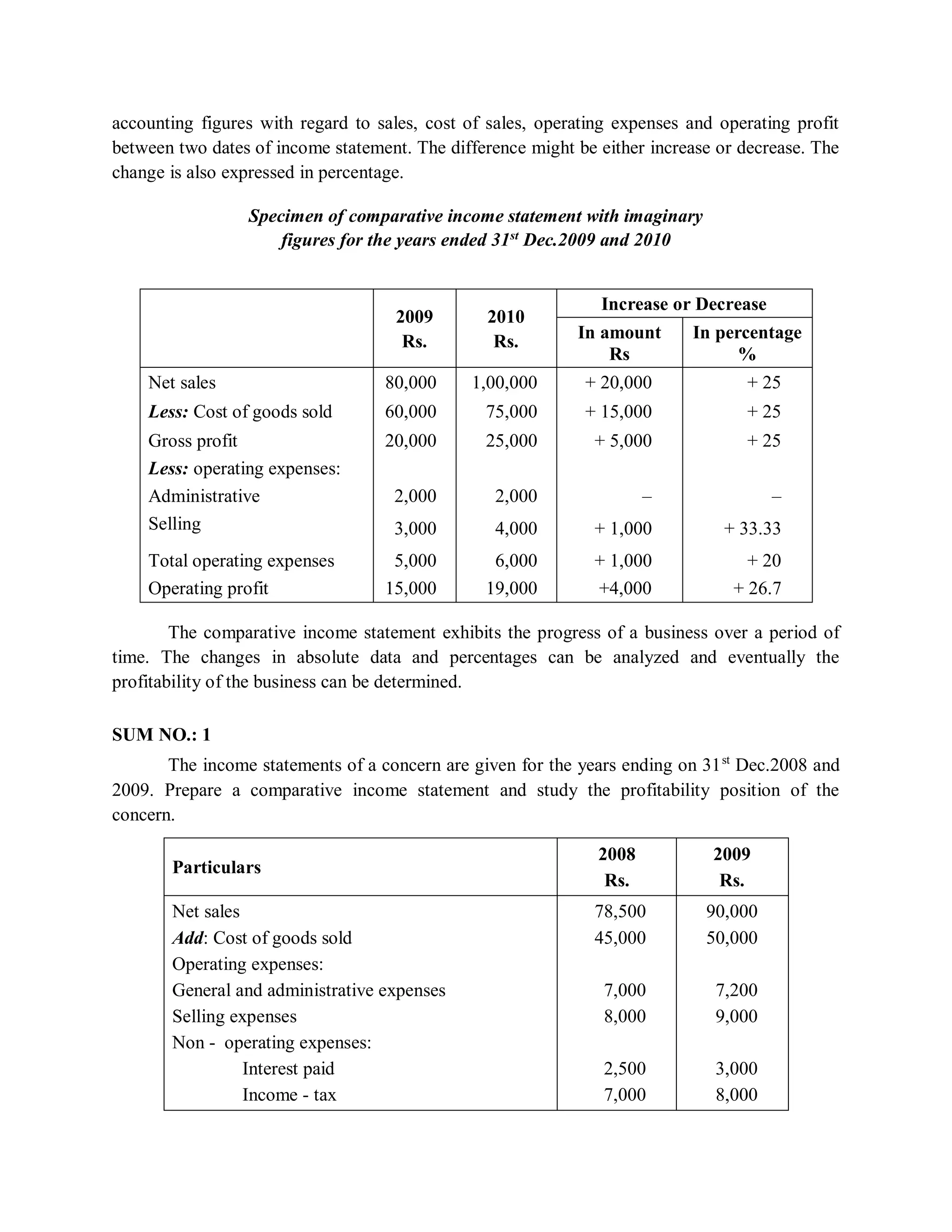

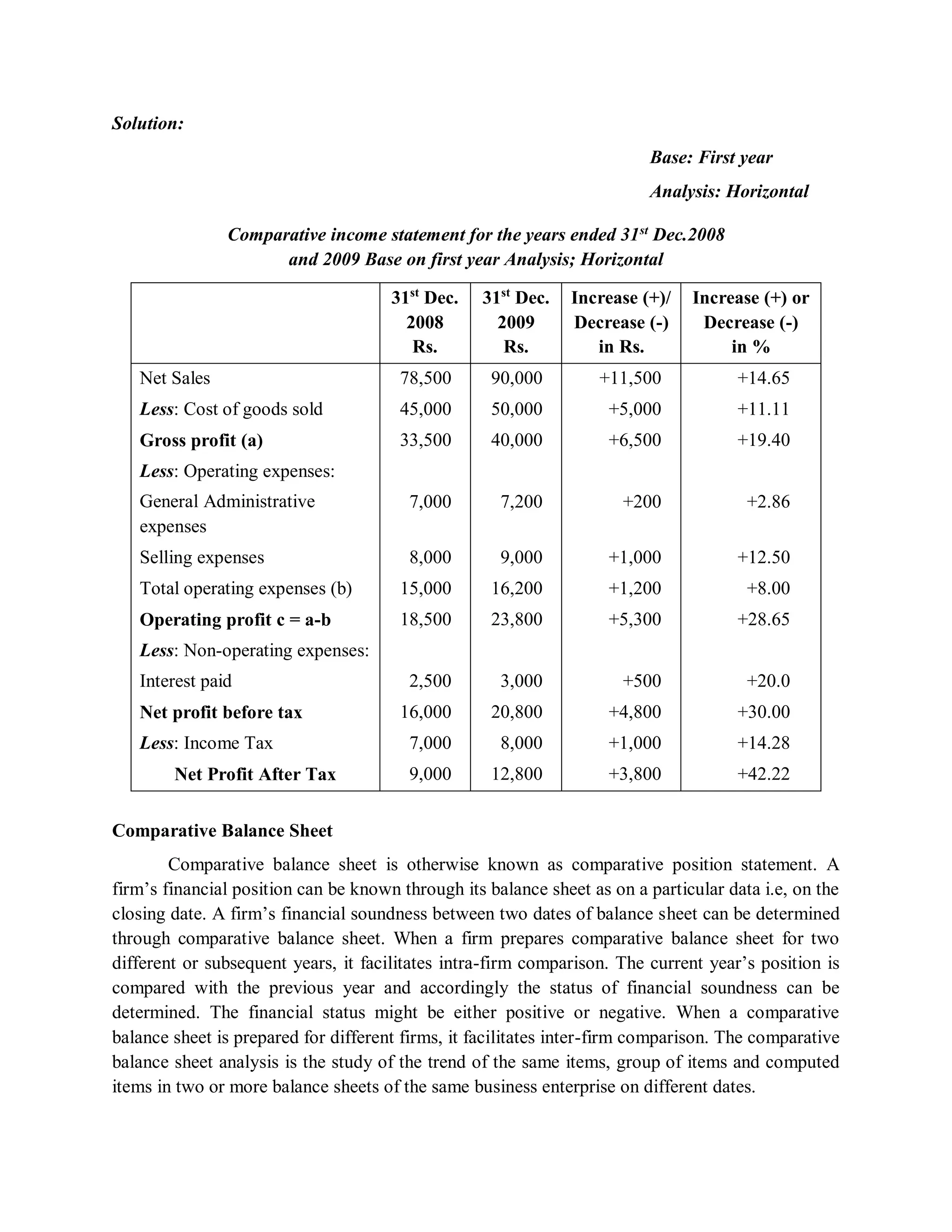

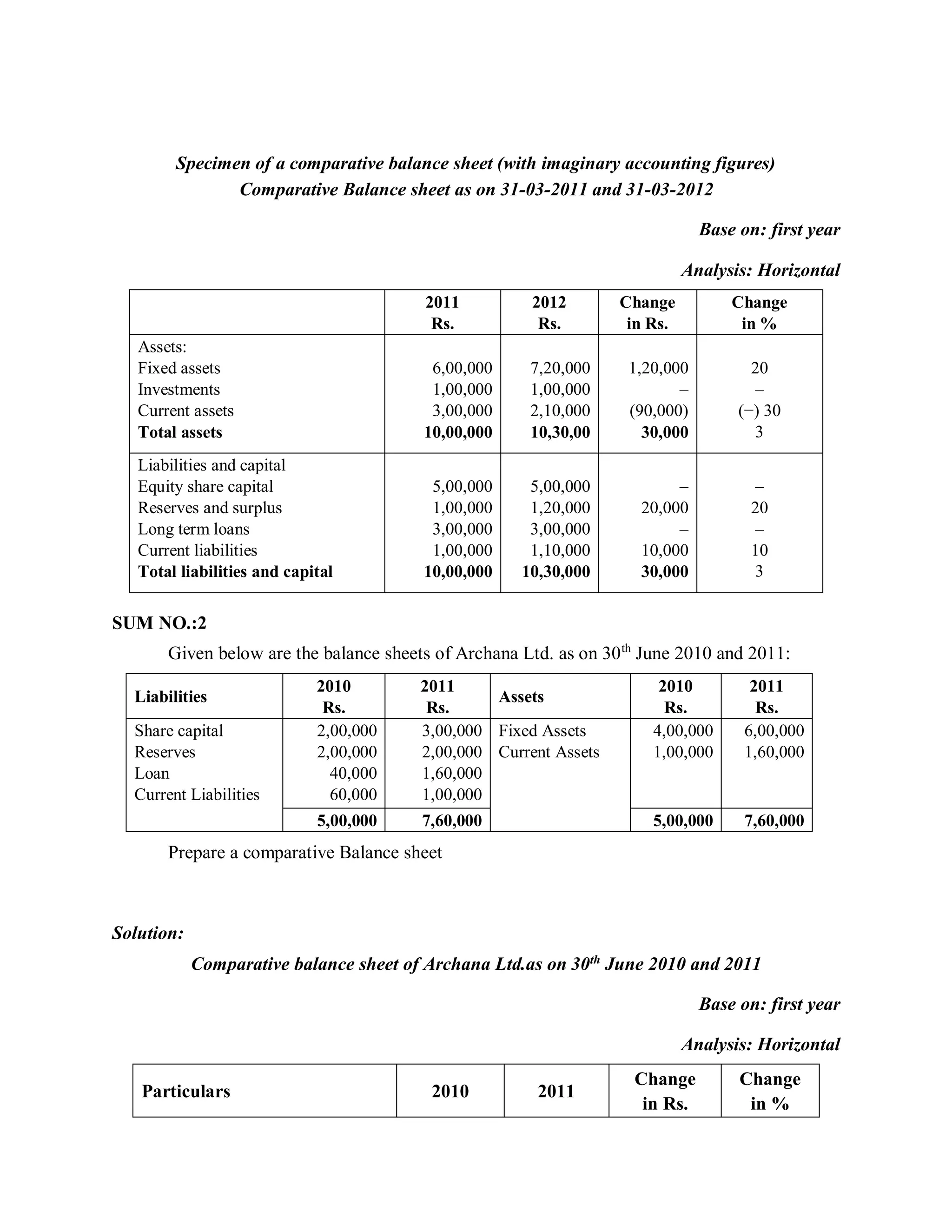

1) Sample comparative income statements and balance sheets showing accounting figures for two years and the increases/decreases.

2) Three sample problems solving for comparative income statements and balance sheets based on given financial data.

3) An interpretation of the comparative statements noting trends like increased costs reducing profits and long-term funds being used for additional working capital.