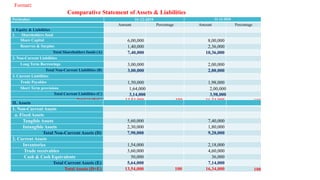

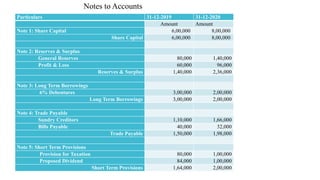

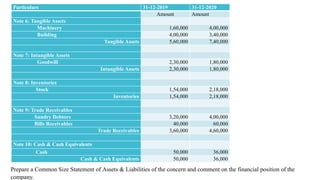

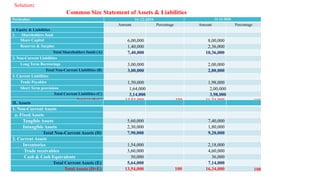

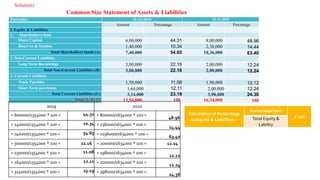

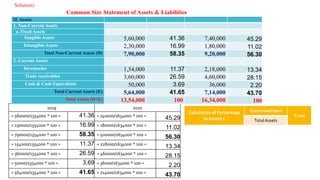

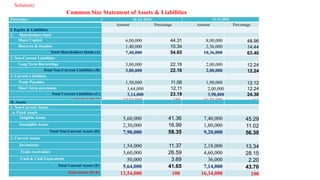

The document discusses management accounting principles, focusing on the analysis and interpretation of financial statements, particularly common size financial statements. It explains the methodology for preparing common size statements for both income and balance sheets, and provides worked examples demonstrating the calculation of percentages for different periods. The content aims to help users assess financial data in relation to total values, thus aiding in financial analysis and decision making.