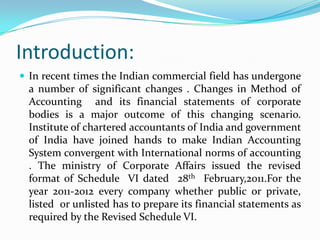

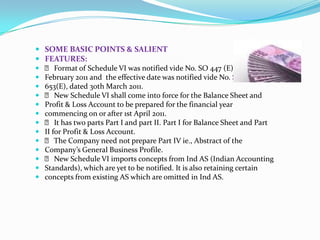

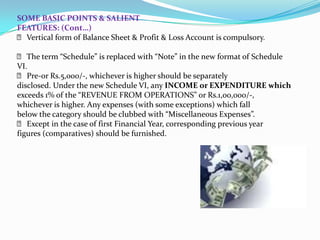

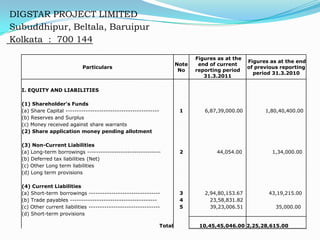

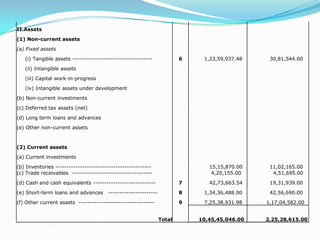

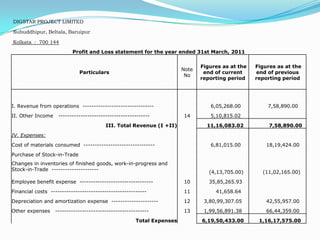

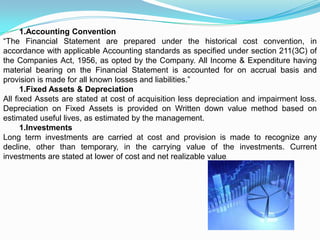

The document summarizes the key changes introduced in the revised Schedule VI format for preparation of financial statements in India. Some of the major changes include classification of assets and liabilities as current and non-current, compulsory vertical format for balance sheet and profit & loss account, replacement of term "schedule" with "note", and disclosure requirements for items exceeding 1% of revenue or Rs. 100,000. The document also provides details on general instructions, classification of tangible assets, investments, inventories, revenue and expenses in the financial statements.