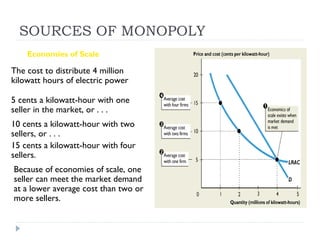

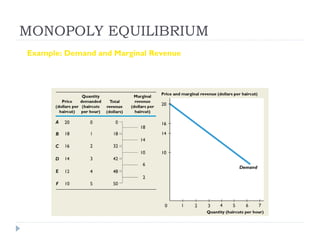

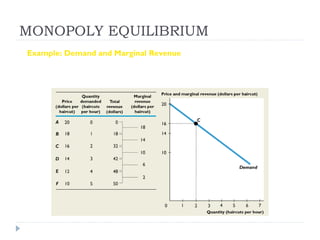

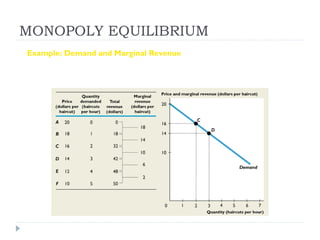

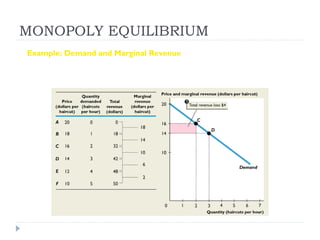

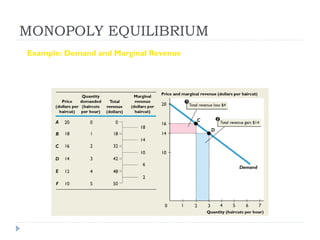

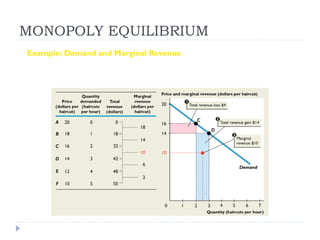

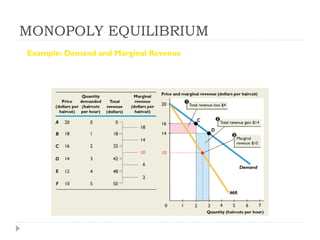

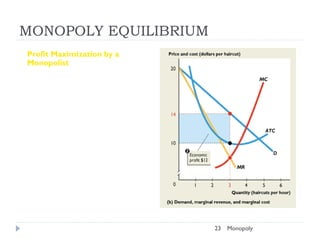

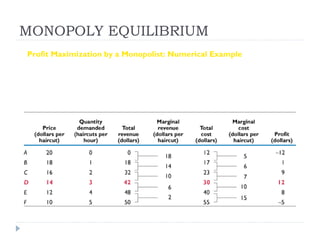

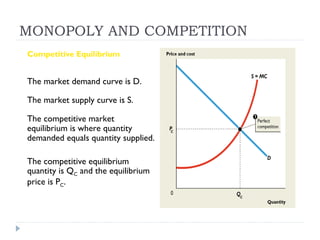

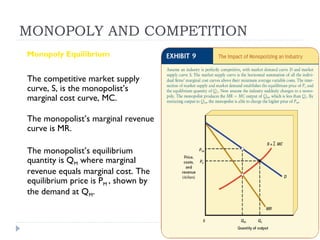

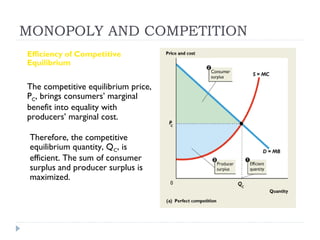

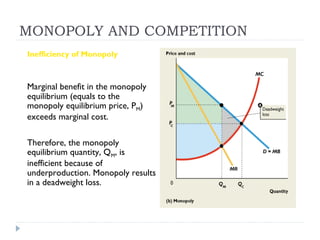

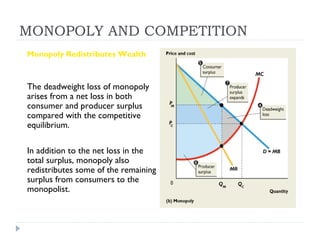

A monopoly is characterized by a single seller, a unique product with no close substitutes, and high barriers to entry that make it difficult for competitors to enter the market. A monopolist is a price maker that faces a downward sloping demand curve and sets price and quantity such that marginal revenue equals marginal cost to maximize profits. This results in the monopoly quantity being lower and price being higher than under perfect competition, creating inefficiencies like deadweight loss and redistributing wealth from consumers to the producer.