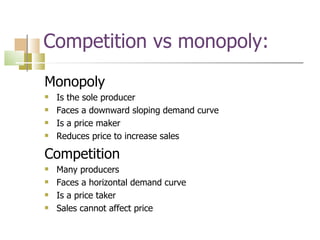

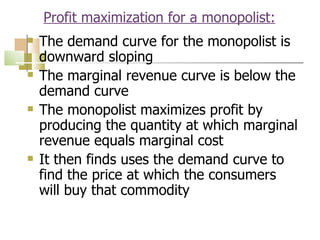

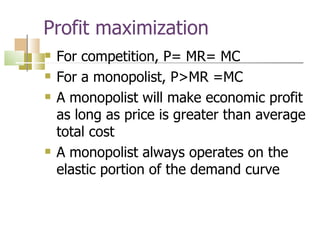

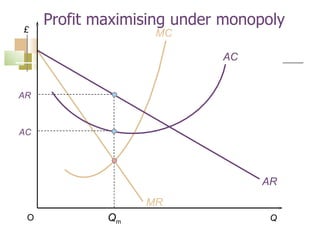

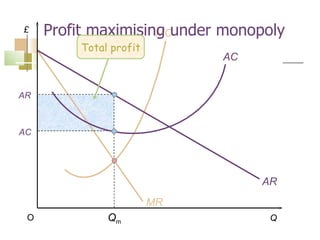

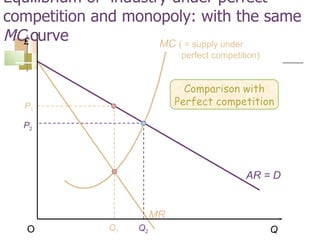

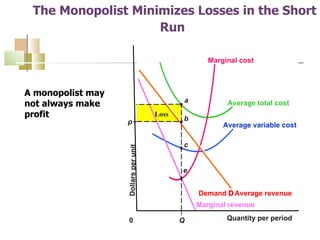

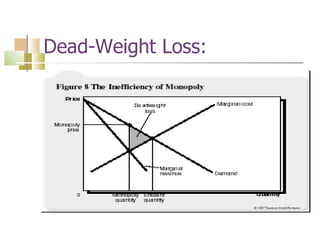

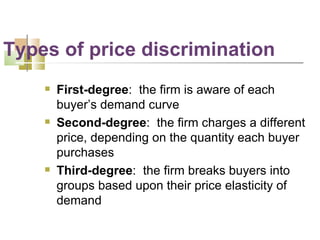

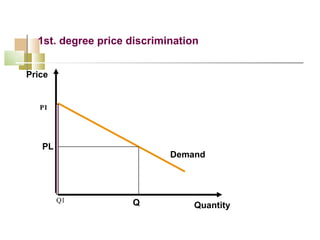

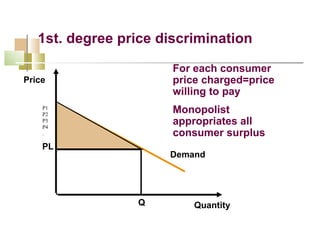

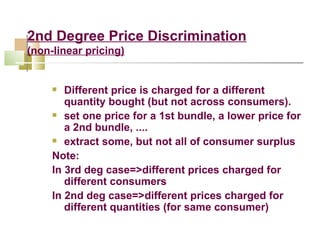

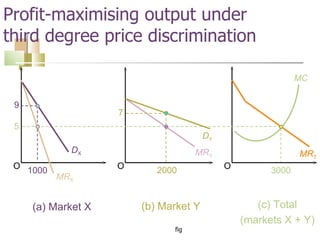

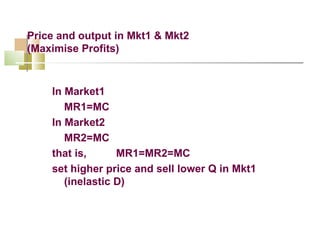

The document discusses key features and concepts related to monopolies, including how they arise and profit maximization strategies. It explains that monopolies have a single seller, no close substitutes, control price as a price maker, and may arise due to barriers to entry like legal restrictions or economies of scale. The document also covers natural monopolies, profit maximization under monopoly versus competition, equilibrium differences, short-run losses, monopoly supply curves, deadweight loss, and different degrees of price discrimination.