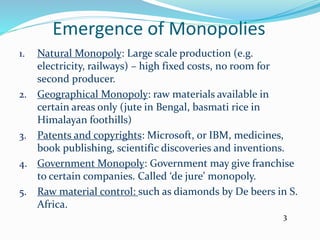

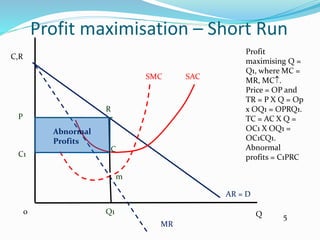

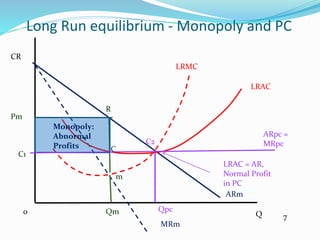

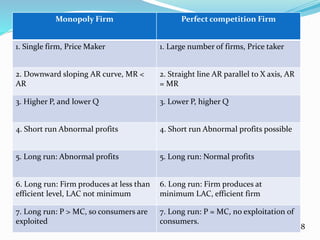

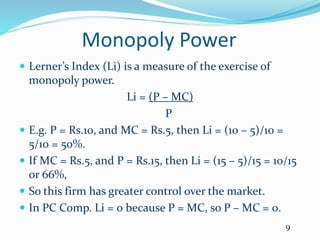

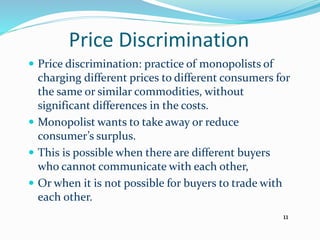

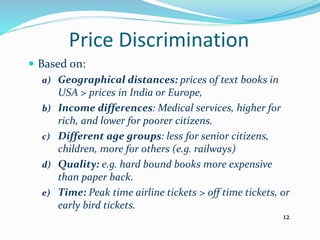

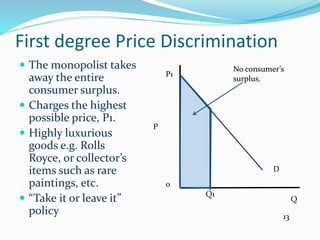

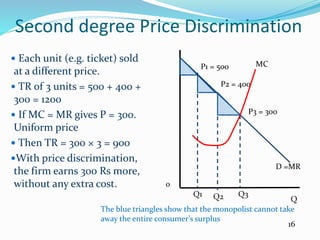

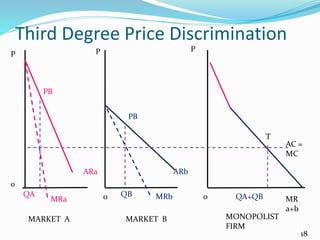

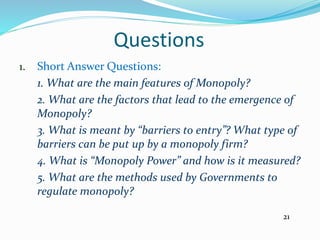

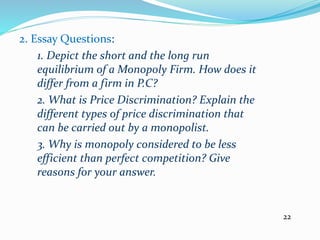

This document discusses the concept of monopoly and profit maximization by monopolistic firms. It covers the key features of monopoly markets including barriers to entry, downward sloping demand curves, and the ability of monopolies to be price makers. The document also examines how monopolies can engage in price discrimination by charging different prices to different consumer groups in order to maximize profits. Government policies aimed at regulating monopolies through anti-trust laws and taxes are also summarized.