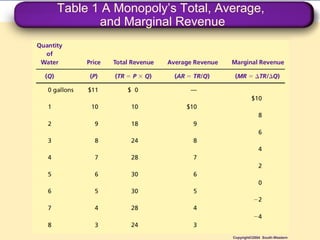

A monopoly is a sole seller of a product without close substitutes. It faces a downward-sloping demand curve and is a price maker. A monopoly's marginal revenue is below price. It maximizes profits by producing where marginal revenue equals marginal cost and charging a price above marginal cost. This leads to deadweight loss from producing a quantity below the efficient level. Policymakers address this through antitrust laws, regulation, or public ownership.