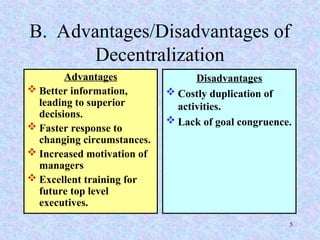

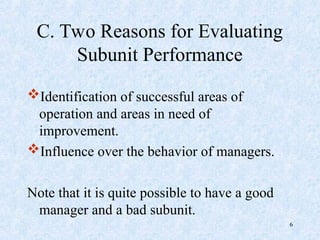

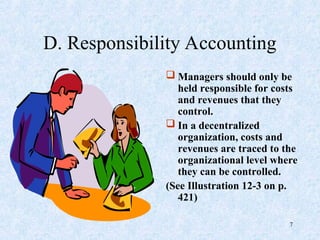

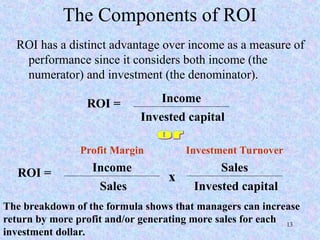

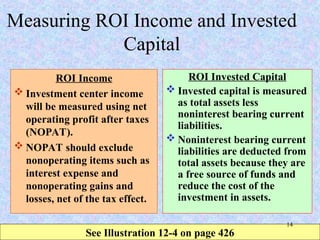

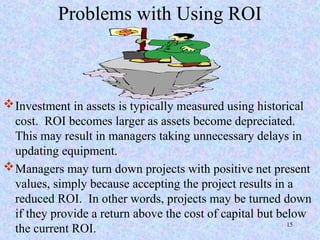

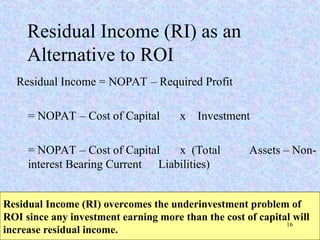

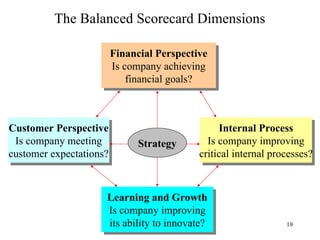

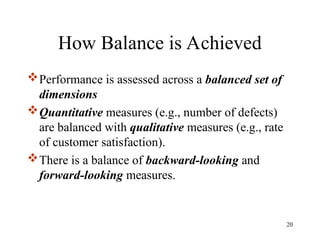

The document discusses decentralization in organizations, defining it as granting decision-making authority to subunit managers, along with its advantages and disadvantages. It outlines types of responsibility centers (cost, profit, investment), performance evaluation through return on investment (ROI) and residual income, and the balanced scorecard approach for assessing performance across various dimensions. Additionally, it covers the concept of transfer pricing and its implications, particularly in an international tax context.