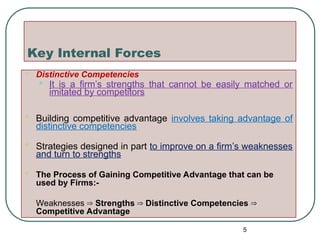

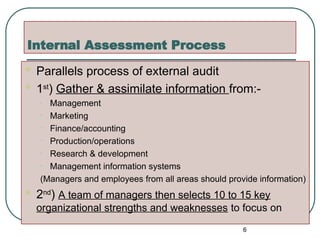

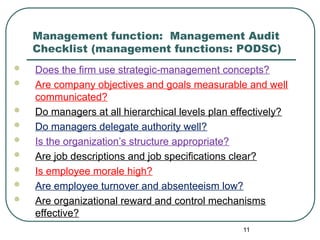

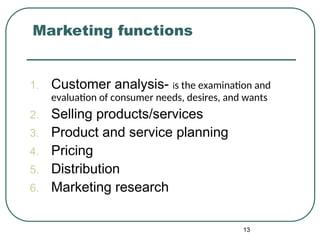

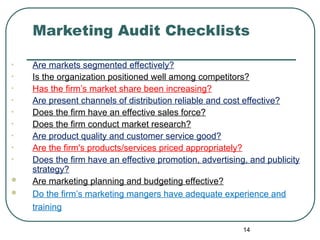

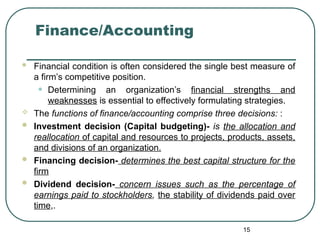

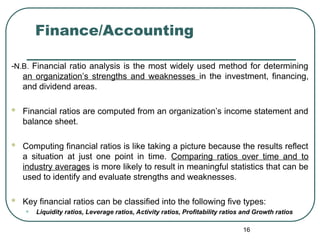

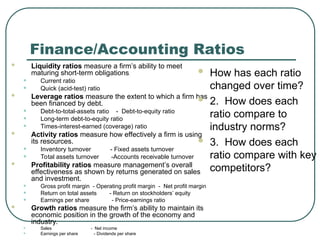

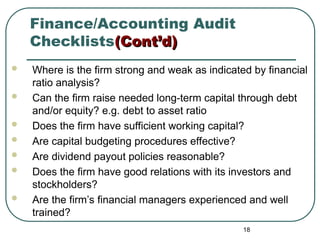

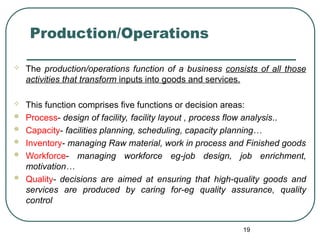

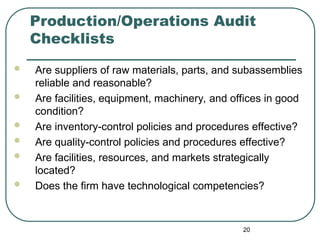

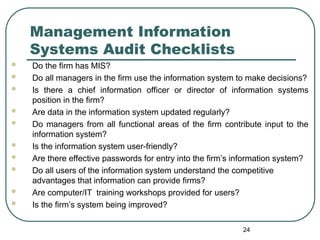

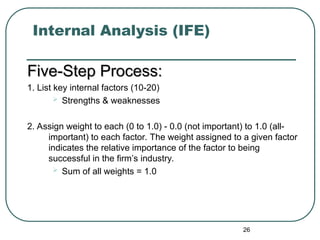

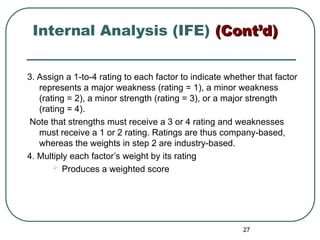

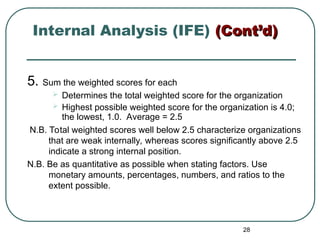

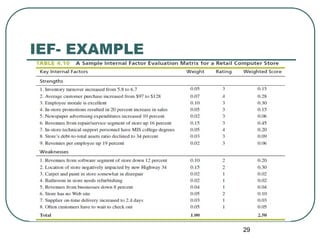

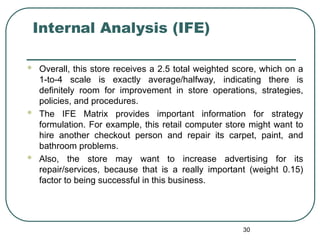

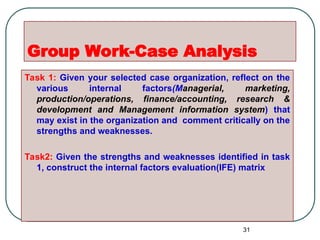

Chapter 4 of the document discusses the internal assessment process in organizations, emphasizing the importance of identifying strengths and weaknesses across various functional areas such as management, marketing, finance, and operations. It outlines the steps for conducting an internal audit, including gathering information, evaluating key factors, and utilizing the internal factor evaluation (IFE) matrix for strategic management. The chapter also highlights the interconnectedness of functional areas and the necessity of coordinated efforts to achieve competitive advantage.