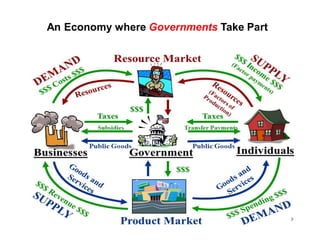

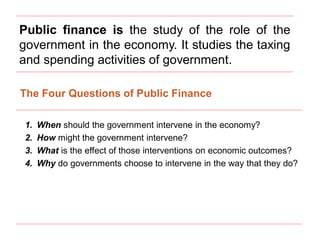

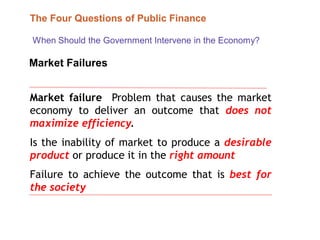

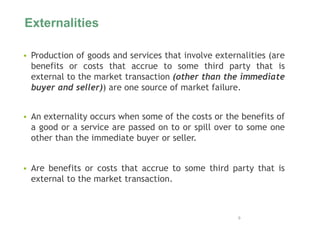

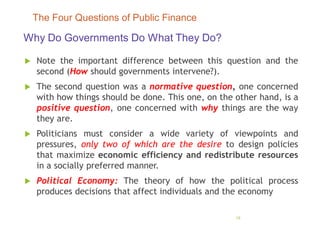

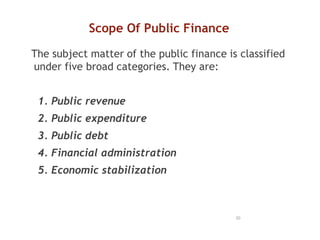

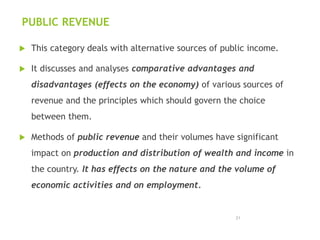

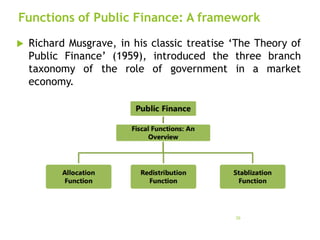

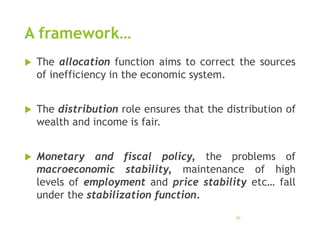

La financiación pública es el estudio del papel del gobierno en la economía, centrándose en la intervención gubernamental a través de la fiscalidad y el gasto. Se exploran las razones y efectos de esta intervención, incluyendo fallos del mercado, externalidades y la distribución de recursos en la sociedad. Las categorías clave de la financiación pública incluyen ingresos, gastos, deuda pública, administración financiera y estabilización económica.