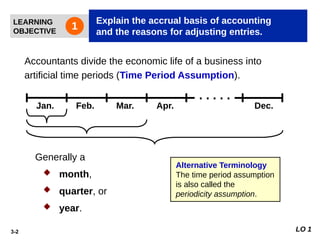

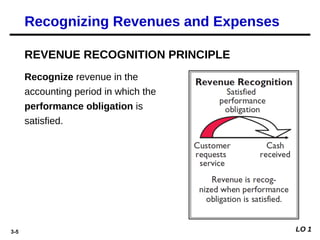

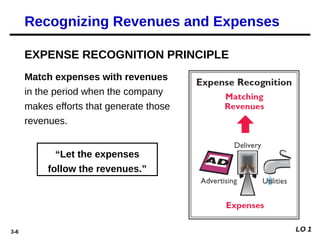

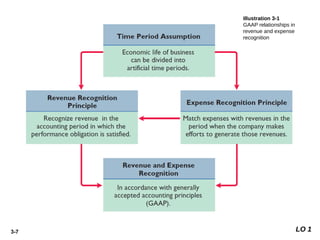

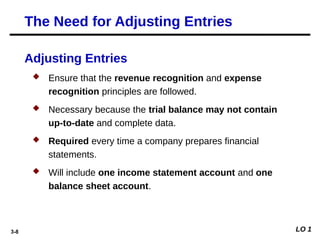

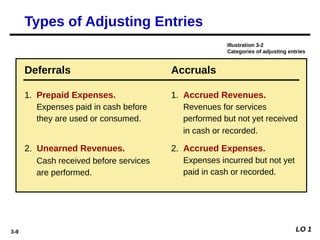

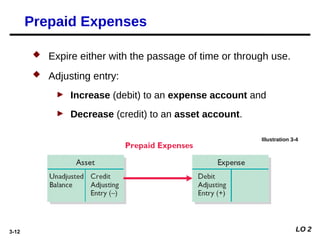

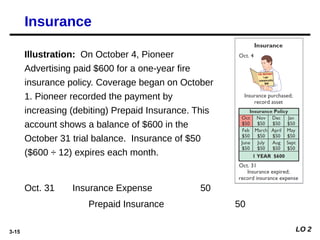

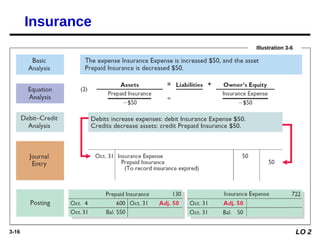

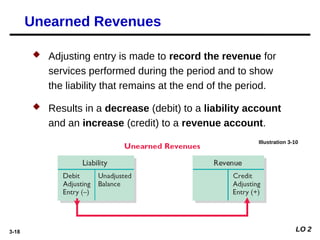

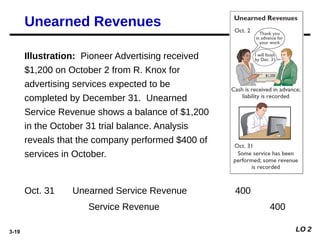

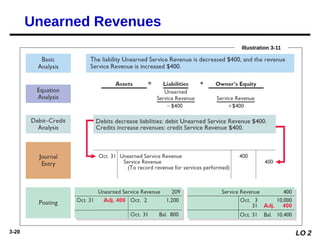

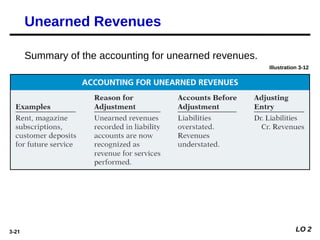

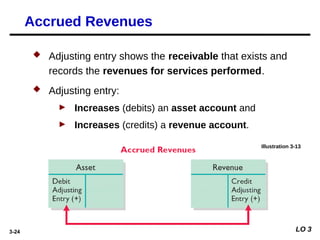

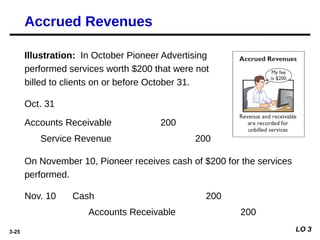

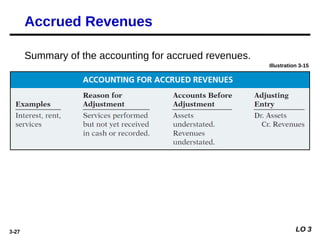

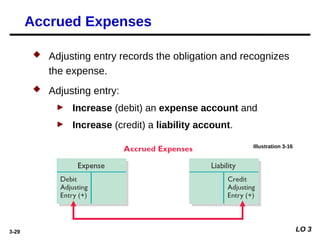

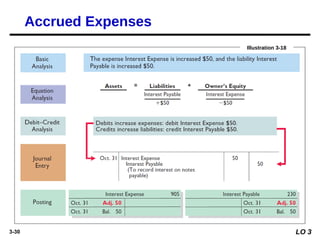

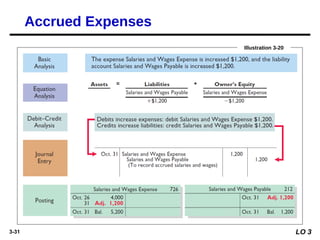

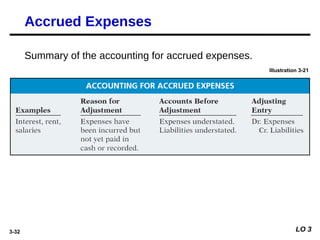

The document outlines the principles and processes of adjusting entries in accounting, emphasizing the accrual basis of accounting which recognizes revenues and expenses when they occur, rather than when cash is exchanged. It categorizes adjusting entries into deferrals (prepaid expenses and unearned revenues) and accruals (accrued revenues and expenses), and explains the necessary accounting adjustments to ensure accurate financial statements. The document also provides illustrative examples and describes the implementation of these principles to align financial reporting with Generally Accepted Accounting Principles (GAAP).