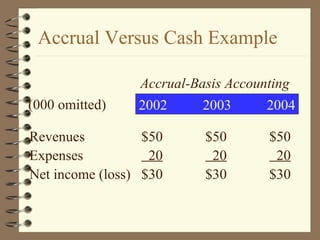

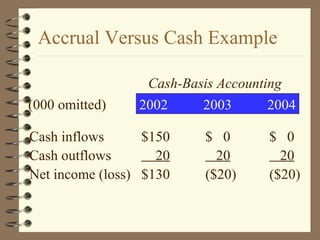

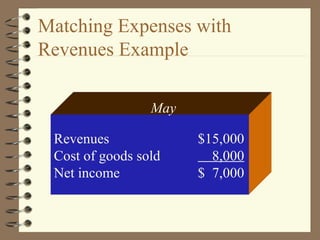

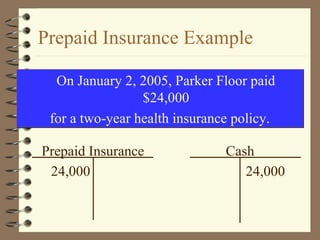

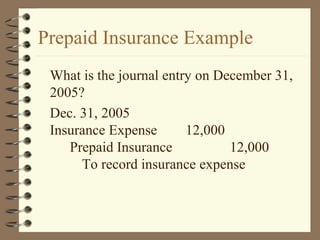

This document discusses accrual versus cash basis accounting and the adjusting process. It provides examples of adjusting entries for prepaid expenses, supplies, depreciation, accrued expenses, accrued revenues, and unearned revenues. The key points are:

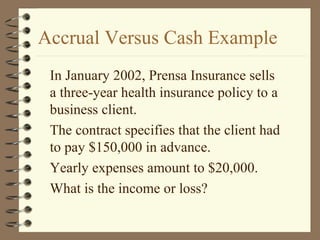

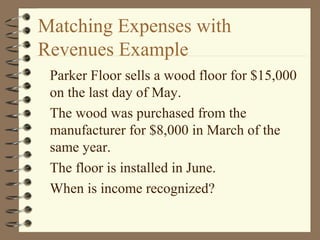

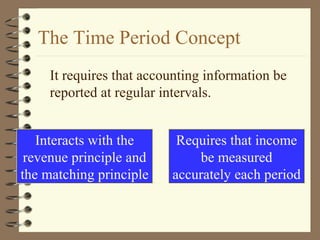

- Accrual basis accounting records revenues when earned and expenses when incurred, regardless of cash receipt/payment. Cash basis records when cash is paid/received.

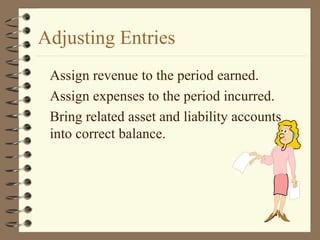

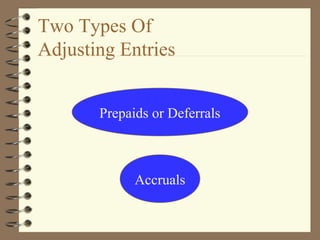

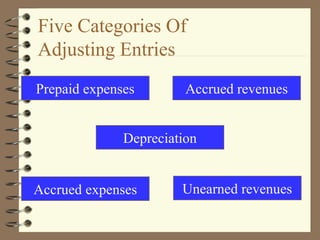

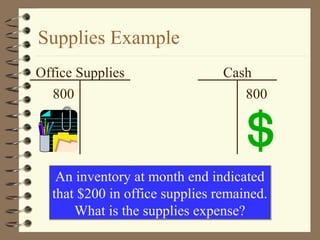

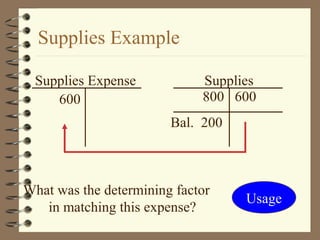

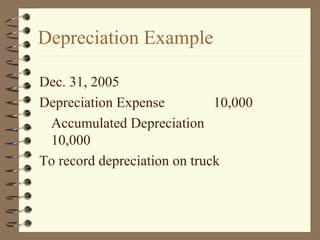

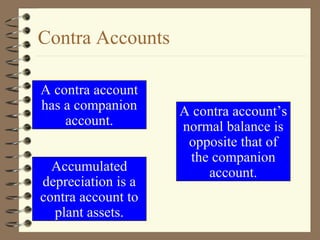

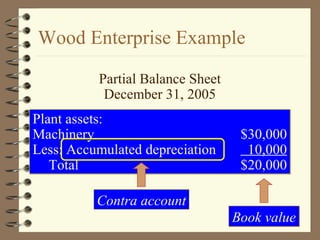

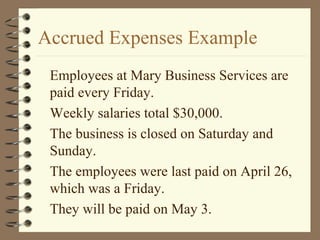

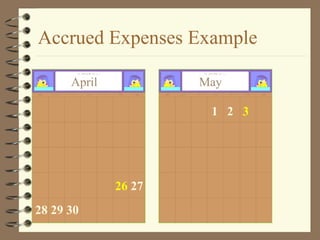

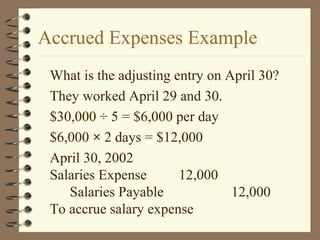

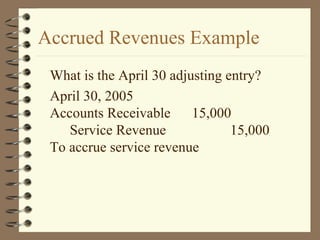

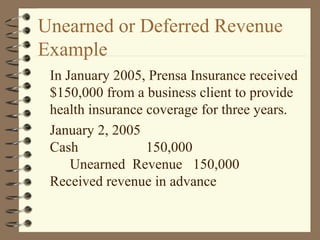

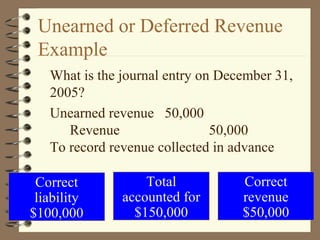

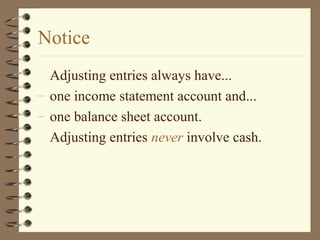

- Adjusting entries bring accounts to correct balances at financial statement dates by recognizing revenues/expenses in appropriate periods.

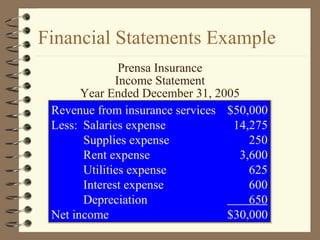

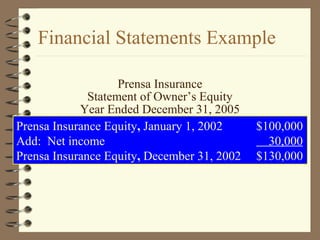

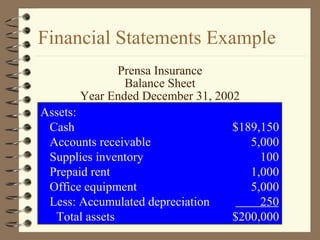

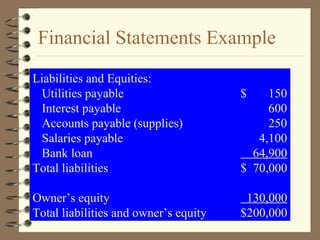

- An adjusted trial balance serves as the basis for the financial statements: income statement, statement of owner's equity, and balance sheet.