Recommended

PPTX

PPTX

PPTX

PPT

Joint Arrengement and public sector teaching

PDF

Chapter 1. accounting in action student

PPTX

PPT

Advanced I Ch V ppt..ppt best presentation

PPTX

ch02 The Recording Process.pptx

PPT

fraud, internal control.ppt

PPT

RTF

PPTX

PPTX

Auditing the expenditure cycle

PDF

Principle Accounting Warren Reeve Fees 22 edition

PPT

Chapter 1(accounting) kimmel kieso

PPTX

Accounting Information Systems - Chapt 7

PPTX

Fraud, Internal Control and Cash - Accounting Principles

PPTX

Accounting Information System - Accounting Principles

PPT

BAB 18-1 modul untuk mata kuliah akuntansi keuangan 2

PPTX

Chapter 13 Fundamental of Accounting Financial

PPTX

ch21 process costing managerial accounting

PDF

PPT

Ch 8 - Accounting for Receivables.ppt

PPTX

ch13_Current Liability.pptx

PPS

Bab 4 Income Statement and Related Information

PPT

Ch03 the matching concept and the adjusting process, intro accounting, 21st...

PPTX

Revenue Recognition - Intermediate Accounting

PPTX

Chapter two: The Recording Process (Financial Accounting)

PPTX

Wey_FinIFRS_5e_PPT_Ch03.pptxilhkljkjbjbbh

PPT

أبسط المعلومات المالية باللغة الانجليزية عرض محاسبية2.ppt

More Related Content

PPTX

PPTX

PPTX

PPT

Joint Arrengement and public sector teaching

PDF

Chapter 1. accounting in action student

PPTX

PPT

Advanced I Ch V ppt..ppt best presentation

PPTX

ch02 The Recording Process.pptx

What's hot

PPT

fraud, internal control.ppt

PPT

RTF

PPTX

PPTX

Auditing the expenditure cycle

PDF

Principle Accounting Warren Reeve Fees 22 edition

PPT

Chapter 1(accounting) kimmel kieso

PPTX

Accounting Information Systems - Chapt 7

PPTX

Fraud, Internal Control and Cash - Accounting Principles

PPTX

Accounting Information System - Accounting Principles

PPT

BAB 18-1 modul untuk mata kuliah akuntansi keuangan 2

PPTX

Chapter 13 Fundamental of Accounting Financial

PPTX

ch21 process costing managerial accounting

PDF

PPT

Ch 8 - Accounting for Receivables.ppt

PPTX

ch13_Current Liability.pptx

PPS

Bab 4 Income Statement and Related Information

PPT

Ch03 the matching concept and the adjusting process, intro accounting, 21st...

PPTX

Revenue Recognition - Intermediate Accounting

PPTX

Chapter two: The Recording Process (Financial Accounting)

Similar to Chapter 3 Slides - Part I-accountibg.pptx

PPTX

Wey_FinIFRS_5e_PPT_Ch03.pptxilhkljkjbjbbh

PPT

أبسط المعلومات المالية باللغة الانجليزية عرض محاسبية2.ppt

PPT

ch03 Introduction to accounting Conepts.ppt

PPTX

https://www.slideshare.net/upload?download_id=50789038&_gl=1*1psauer*_gcl_au*...

PPTX

very important notetaking presentation useful much.pptx

PPT

NSU EMB 501 Accounting Ch03

PPT

Financial_Accounting_chapter_03.ppt

PPT

Accounting 201 intro to accounting ch03.ppt

PPTX

accounting principles ch03- adjusting entries-1.pptx

PPT

PPTX

Lecture slides_Chapter 3 _ 4.pptx

PPT

rtrtrtrtrtrtrtrtrtrtrtrtrtrtrtrtrtrtr.ppt

PPTX

Adjusting the Accounts Adjusting Entries

PDF

PPTX

principles of accounting adjusting entries.pptx

PPTX

principles of accounting adjusting entriew.pptx

PPTX

This is the Week 3 Live Session.pptx without audio

PPT

Chapter three of drugs supply management

PPT

accounting adjusting entries chapter 3.ppt

DOCX

Accrual Accounting ConceptsKimmel ● Weygandt ● KiesoAccounti.docx

Recently uploaded

PDF

Chemical Hazards at Workplace – Types, Properties & Exposure Routes, CORE-EHS

PDF

(en/zhTW) Heterogeneous System Architecture: Design & Performance

PPTX

1.Module 4-Clamping of jigs and fixtures for manufacturing.pptx

PPTX

Theory to Practice of Unsaturated Soil Mechanics-1.pptx

PDF

Chad Ayach - An Accomplished Mechanical Engineer

PPT

Integer , Goal and Non linear Programming Model

PDF

Soil Compressibility (Elastic Settlement).pdf

PDF

NS unit wise unit wise 1 -5 so prepare,.

PPTX

operating_systems.pptx m,nm,nm,n,nm,n,nm,nikl

PDF

Infinite Sequence and Series: It Includes basic Sequence and Series

PPTX

A professional presentation on Cosmos Bank Heist

PDF

engineering management chapter 5 ppt presentation

PDF

Model QP 2025 scheme Q &A- Module 1 and 2.pdf

PPTX

ISO 13485.2016 Awareness's Training material

PPTX

Why TPM Succeeds in Some Plants and Struggles in Others | MaintWiz

PPTX

Unit 1_Importance of modelling(Object oriented concepts).pptx

PPTX

Presentation-WPS Office.pptx afgouvhyhgfccf

PPTX

ME3592 - Metrology and Measurements - Unit - 1 - Lecture Notes

PPT

Ceramic Matrix Composites Slide from Composite Materials

PPT

Cloud computing-1.ppt presentation preview

Chapter 3 Slides - Part I-accountibg.pptx 1. 2. Chapter Outline

Learning Objectives

LO 1 Explain the accrual basis of accounting and the reasons

for adjusting entries.

LO 2 Prepare adjusting entries for deferrals.

LO 3 Prepare adjusting entries for accruals.

LO 4 Describe the nature and purpose of an adjusted trial

balance.

2

Copyright ©2018 John Wiley & Sons, Inc.

3. 3

Copyright ©2018 John Wiley & Sons, Inc.

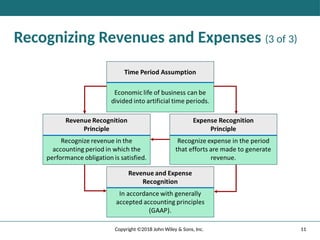

Accrual-Basis and Adjusting Entries

Accountants divide the economic life of a business into

artificial time periods (Time Period Assumption).

Generally a

• month,

• quarter, or

• year.

Alternative terminology

The time period assumption is also

called the periodicity assumption.

4. Fiscal and Calendar Years (1 of 5)

• Monthly and quarterly time periods are called interim

periods

• Most large companies must prepare both quarterly

and annual financial statements

• Fiscal Year = Accounting time period that is one year

in length

• Calendar Year = January 1 to December 31

4

Copyright ©2018 John Wiley & Sons, Inc.

5. 5

Copyright ©2018 John Wiley & Sons, Inc.

Fiscal and Calendar Years (2 of 5)

The time period assumption states that:

a. companies must wait until the calendar year is

completed to prepare financial statements.

b. companies use the fiscal year to report financial

information.

c. the economic life of a business can be divided into

artificial time periods.

d. companies record information in the time period in

which the events occur.

6. 6

Copyright ©2018 John Wiley & Sons, Inc.

Fiscal and Calendar Years (3 of 5)

The time period assumption states that:

a. companies must wait until the calendar year is

completed to prepare financial statements.

b. companies use the fiscal year to report financial

information.

c. Answer: the economic life of a business can be divided

into artificial time periods.

d. companies record information in the time period in

which the events occur.

7. 7

Copyright ©2018 John Wiley & Sons, Inc.

Accrual- versus Cash-Basis Accounting (1

of 2)

Accrual-Basis Accounting

• Transactions recorded in the periods in which the events

occur

• Companies recognize revenues when they perform

services (rather than when they receive cash)

• Expenses are recognized when incurred (rather than when

paid)

• In accordance with generally accepted accounting

principles (GAAP)

8. 8

Copyright ©2018 John Wiley & Sons, Inc.

Accrual- versus Cash-Basis Accounting (2

of 2)

Cash-Basis Accounting

• Revenues recognized when cash is received

• Expenses recognized when cash is paid

• Cash-basis accounting is not in accordance with generally

accepted accounting principles (GAAP)

9. 9

Copyright ©2018 John Wiley & Sons, Inc.

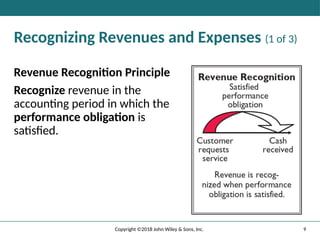

Recognizing Revenues and Expenses (1 of 3)

Revenue Recognition Principle

Recognize revenue in the

accounting period in which the

performance obligation is

satisfied.

10. 10

Copyright ©2018 John Wiley & Sons, Inc.

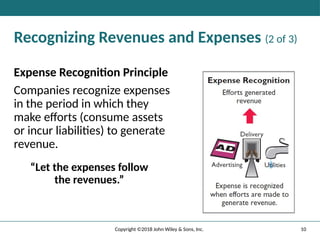

Recognizing Revenues and Expenses (2 of 3)

Expense Recognition Principle

Companies recognize expenses

in the period in which they

make efforts (consume assets

or incur liabilities) to generate

revenue.

“Let the expenses follow

the revenues.”

11. 12. 12

Copyright ©2018 John Wiley & Sons, Inc.

Fiscal and Calendar Years (4 of 5)

Which of the following statements about the accrual basis

of accounting is false?

a. Events that change a company’s financial statements are

recorded in the periods in which the events occur.

b. Revenue is recognized in the period in which services are

performed.

c. This basis is in accordance with generally accepted

accounting principles.

d. Revenue is recorded only when cash is received, and

expense is recorded only when cash is paid.

13. 13

Copyright ©2018 John Wiley & Sons, Inc.

Fiscal and Calendar Years (5 of 5)

Which of the following statements about the accrual basis

of accounting is false?

a. Events that change a company’s financial statements are

recorded in the periods in which the events occur.

b. Revenue is recognized in the period in which services are

performed.

c. This basis is in accordance with generally accepted

accounting principles.

d. Answer: Revenue is recorded only when cash is received,

and expense is recorded only when cash is paid.

14. The Need for Adjusting Entries (1 of 3)

Adjusting Entries

• Ensure that the revenue recognition and expense

recognition principles are followed.

• Necessary because the trial balance may not contain

up-to-date and complete data.

• Required every time a company prepares financial

statements.

• Will include one income statement account and one

balance sheet account.

14

Copyright ©2018 John Wiley & Sons, Inc.

15. 15

Copyright ©2018 John Wiley & Sons, Inc.

The Need for Adjusting Entries (2 of 3)

Adjusting entries are made to ensure that:

a. expenses are recognized in the period in which they are

incurred.

b. revenues are recorded in the period in which services are

performed.

c. balance sheet and income statement accounts have correct

balances at the end of an accounting period.

d. All the responses above are correct.

16. 16

Copyright ©2018 John Wiley & Sons, Inc.

The Need for Adjusting Entries (3 of 3)

Adjusting entries are made to ensure that:

a. expenses are recognized in the period in which they are

incurred.

b. revenues are recorded in the period in which services are

performed.

c. balance sheet and income statement accounts have correct

balances at the end of an accounting period.

d. Answer: All the responses above are correct.

17. 17

Copyright ©2018 John Wiley & Sons, Inc.

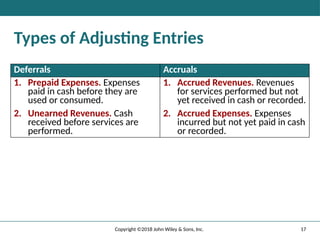

Types of Adjusting Entries

Deferrals Accruals

1. Prepaid Expenses. Expenses

paid in cash before they are

used or consumed.

2. Unearned Revenues. Cash

received before services are

performed.

1. Accrued Revenues. Revenues

for services performed but not

yet received in cash or recorded.

2. Accrued Expenses. Expenses

incurred but not yet paid in cash

or recorded.

18. 18

Copyright ©2018 John Wiley & Sons, Inc.

Do It! 1: Timing Concepts (1 of 2)

Below is a list of timing concepts in the

left column, with a description of the

concept in the right column. There are

more descriptions provided than

concepts. Match the description to the

concept

1. [blank] Accrual-basis accounting.

2. [blank] Calendar year.

3. [blank] Time period assumption.

4. [blank] Expense recognition principle.

(a) Monthly and quarterly time periods.

(b) Efforts (expenses) should be recognized in the

period in which a company uses assets or

incurs liabilities to generate results

(revenues).

(c) Accountants divide the economic life of a

business into artificial time periods.

(d) Companies record revenues when they

receive cash and record expenses when they

pay out cash.

(e) An accounting time period that starts on

January 1 and ends on December 31.

(f) Companies record transactions in the period in

which the events occur.

19. 19

Copyright ©2018 John Wiley & Sons, Inc.

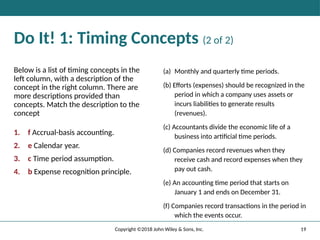

Do It! 1: Timing Concepts (2 of 2)

Below is a list of timing concepts in the

left column, with a description of the

concept in the right column. There are

more descriptions provided than

concepts. Match the description to the

concept

1. f Accrual-basis accounting.

2. e Calendar year.

3. c Time period assumption.

4. b Expense recognition principle.

(a) Monthly and quarterly time periods.

(b) Efforts (expenses) should be recognized in the

period in which a company uses assets or

incurs liabilities to generate results

(revenues).

(c) Accountants divide the economic life of a

business into artificial time periods.

(d) Companies record revenues when they

receive cash and record expenses when they

pay out cash.

(e) An accounting time period that starts on

January 1 and ends on December 31.

(f) Companies record transactions in the period in

which the events occur.

20. 20

Copyright ©2018 John Wiley & Sons, Inc.

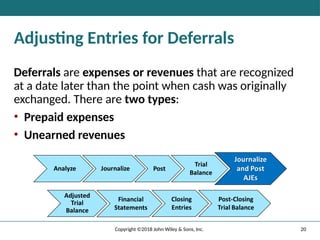

Adjusting Entries for Deferrals

Deferrals are expenses or revenues that are recognized

at a date later than the point when cash was originally

exchanged. There are two types:

• Prepaid expenses

• Unearned revenues

21. 21

Copyright ©2018 John Wiley & Sons, Inc.

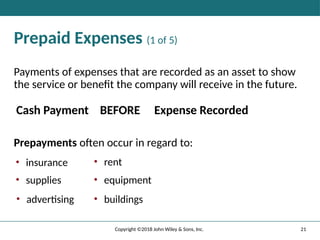

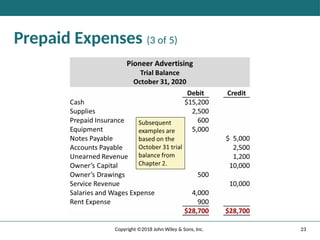

Prepaid Expenses (1 of 5)

Payments of expenses that are recorded as an asset to show

the service or benefit the company will receive in the future.

Cash Payment BEFORE Expense Recorded

Prepayments often occur in regard to:

• insurance

• supplies

• advertising

• rent

• equipment

• buildings

22. 22

Copyright ©2018 John Wiley & Sons, Inc.

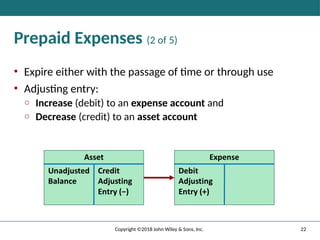

Prepaid Expenses (2 of 5)

• Expire either with the passage of time or through use

• Adjusting entry:

o Increase (debit) to an expense account and

o Decrease (credit) to an asset account

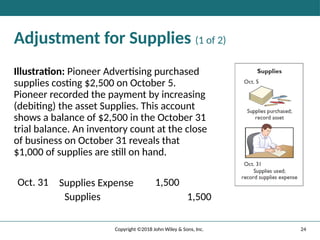

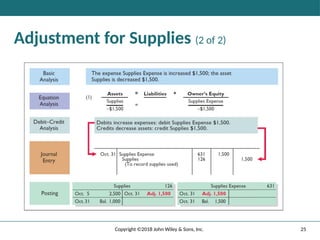

23. 24. 24

Copyright ©2018 John Wiley & Sons, Inc.

Adjustment for Supplies (1 of 2)

Illustration: Pioneer Advertising purchased

supplies costing $2,500 on October 5.

Pioneer recorded the payment by increasing

(debiting) the asset Supplies. This account

shows a balance of $2,500 in the October 31

trial balance. An inventory count at the close

of business on October 31 reveals that

$1,000 of supplies are still on hand.

Oct. 31 Supplies Expense 1,500

Supplies 1,500

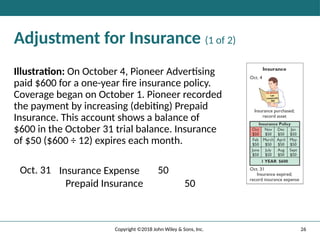

25. 26. 26

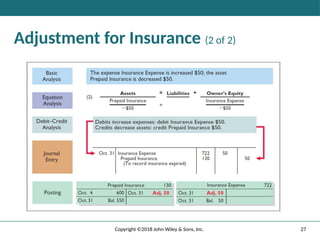

Copyright ©2018 John Wiley & Sons, Inc.

Adjustment for Insurance (1 of 2)

Illustration: On October 4, Pioneer Advertising

paid $600 for a one-year fire insurance policy.

Coverage began on October 1. Pioneer recorded

the payment by increasing (debiting) Prepaid

Insurance. This account shows a balance of

$600 in the October 31 trial balance. Insurance

of $50 ($600 ÷ 12) expires each month.

Oct. 31 Insurance Expense 50

Prepaid Insurance 50

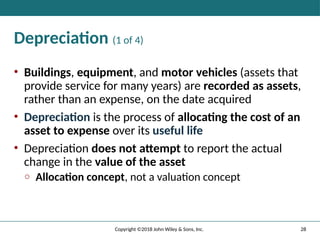

27. 28. 28

Copyright ©2018 John Wiley & Sons, Inc.

Depreciation (1 of 4)

• Buildings, equipment, and motor vehicles (assets that

provide service for many years) are recorded as assets,

rather than an expense, on the date acquired

• Depreciation is the process of allocating the cost of an

asset to expense over its useful life

• Depreciation does not attempt to report the actual

change in the value of the asset

o Allocation concept, not a valuation concept

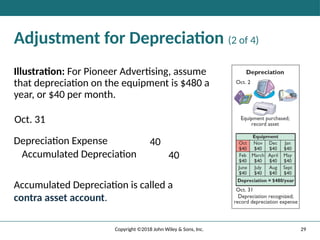

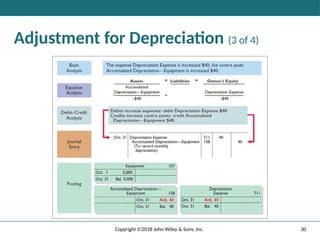

29. 29

Copyright ©2018 John Wiley & Sons, Inc.

Adjustment for Depreciation (2 of 4)

Illustration: For Pioneer Advertising, assume

that depreciation on the equipment is $480 a

year, or $40 per month.

Oct. 31

Depreciation Expense 40

Accumulated Depreciation 40

Accumulated Depreciation is called a

contra asset account.

30. 31. 31

Copyright ©2018 John Wiley & Sons, Inc.

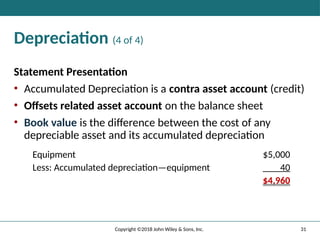

Depreciation (4 of 4)

Statement Presentation

• Accumulated Depreciation is a contra asset account (credit)

• Offsets related asset account on the balance sheet

• Book value is the difference between the cost of any

depreciable asset and its accumulated depreciation

Equipment $5,000

Less: Accumulated depreciation—equipment 40

$4,960

32. 32

Copyright ©2018 John Wiley & Sons, Inc.

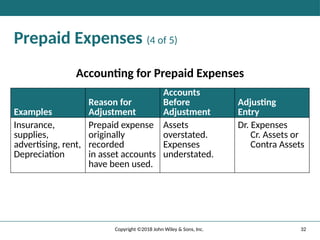

Prepaid Expenses (4 of 5)

Accounting for Prepaid Expenses

Examples

Reason for

Adjustment

Accounts

Before

Adjustment

Adjusting

Entry

Insurance,

supplies,

advertising, rent,

Depreciation

Prepaid expense

originally

recorded

in asset accounts

have been used.

Assets

overstated.

Expenses

understated.

Dr. Expenses

Cr. Assets or

Contra Assets

33. 33

Copyright ©2018 John Wiley & Sons, Inc.

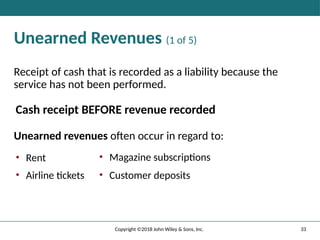

Unearned Revenues (1 of 5)

Receipt of cash that is recorded as a liability because the

service has not been performed.

Cash receipt BEFORE revenue recorded

Unearned revenues often occur in regard to:

• Rent

• Airline tickets

• Magazine subscriptions

• Customer deposits

34. 34

Copyright ©2018 John Wiley & Sons, Inc.

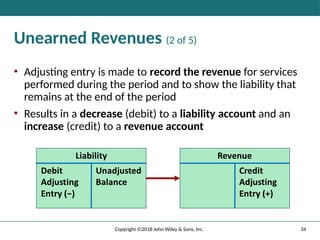

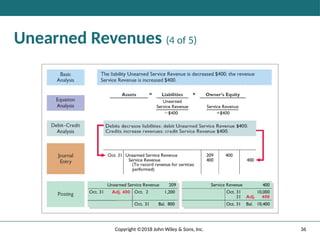

Unearned Revenues (2 of 5)

• Adjusting entry is made to record the revenue for services

performed during the period and to show the liability that

remains at the end of the period

• Results in a decrease (debit) to a liability account and an

increase (credit) to a revenue account

35. 35

Copyright ©2018 John Wiley & Sons, Inc.

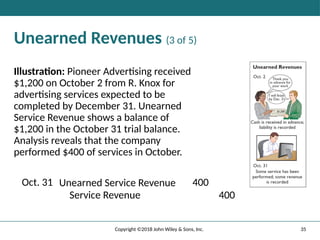

Unearned Revenues (3 of 5)

Illustration: Pioneer Advertising received

$1,200 on October 2 from R. Knox for

advertising services expected to be

completed by December 31. Unearned

Service Revenue shows a balance of

$1,200 in the October 31 trial balance.

Analysis reveals that the company

performed $400 of services in October.

Oct. 31 Unearned Service Revenue 400

Service Revenue 400

36. 37. 37

Copyright ©2018 John Wiley & Sons, Inc.

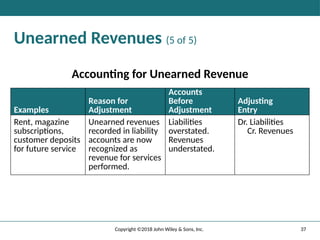

Unearned Revenues (5 of 5)

Accounting for Unearned Revenue

Examples

Reason for

Adjustment

Accounts

Before

Adjustment

Adjusting

Entry

Rent, magazine

subscriptions,

customer deposits

for future service

Unearned revenues

recorded in liability

accounts are now

recognized as

revenue for services

performed.

Liabilities

overstated.

Revenues

understated.

Dr. Liabilities

Cr. Revenues

38. 38

Copyright ©2018 John Wiley & Sons, Inc.

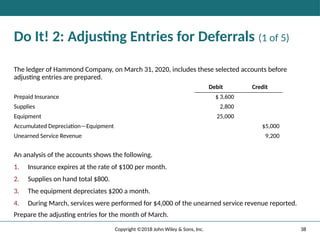

Do It! 2: Adjusting Entries for Deferrals (1 of 5)

The ledger of Hammond Company, on March 31, 2020, includes these selected accounts before

adjusting entries are prepared.

Debit Credit

Prepaid Insurance $ 3,600

Supplies 2,800

Equipment 25,000

Accumulated Depreciation—Equipment $5,000

Unearned Service Revenue 9,200

An analysis of the accounts shows the following.

1. Insurance expires at the rate of $100 per month.

2. Supplies on hand total $800.

3. The equipment depreciates $200 a month.

4. During March, services were performed for $4,000 of the unearned service revenue reported.

Prepare the adjusting entries for the month of March.

39. 39

Copyright ©2018 John Wiley & Sons, Inc.

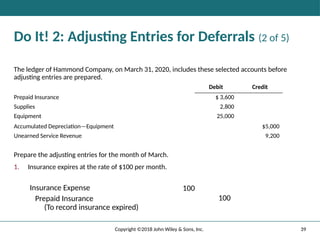

Do It! 2: Adjusting Entries for Deferrals (2 of 5)

The ledger of Hammond Company, on March 31, 2020, includes these selected accounts before

adjusting entries are prepared.

Debit Credit

Prepaid Insurance $ 3,600

Supplies 2,800

Equipment 25,000

Accumulated Depreciation—Equipment $5,000

Unearned Service Revenue 9,200

Prepare the adjusting entries for the month of March.

1. Insurance expires at the rate of $100 per month.

Insurance Expense 100

Prepaid Insurance

(To record insurance expired)

100

40. 40

Copyright ©2018 John Wiley & Sons, Inc.

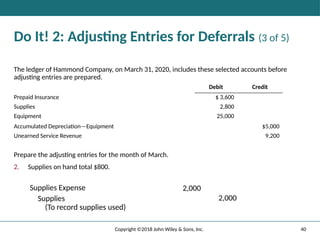

Do It! 2: Adjusting Entries for Deferrals (3 of 5)

The ledger of Hammond Company, on March 31, 2020, includes these selected accounts before

adjusting entries are prepared.

Debit Credit

Prepaid Insurance $ 3,600

Supplies 2,800

Equipment 25,000

Accumulated Depreciation—Equipment $5,000

Unearned Service Revenue 9,200

Prepare the adjusting entries for the month of March.

2. Supplies on hand total $800.

Supplies Expense 2,000

Supplies

(To record supplies used)

2,000

41. 41

Copyright ©2018 John Wiley & Sons, Inc.

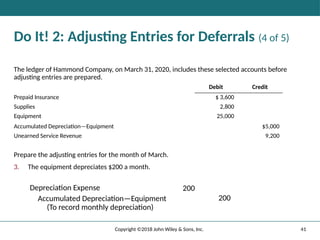

Do It! 2: Adjusting Entries for Deferrals (4 of 5)

The ledger of Hammond Company, on March 31, 2020, includes these selected accounts before

adjusting entries are prepared.

Debit Credit

Prepaid Insurance $ 3,600

Supplies 2,800

Equipment 25,000

Accumulated Depreciation—Equipment $5,000

Unearned Service Revenue 9,200

Prepare the adjusting entries for the month of March.

3. The equipment depreciates $200 a month.

Depreciation Expense 200

Accumulated Depreciation—Equipment

(To record monthly depreciation)

200

42. 42

Copyright ©2018 John Wiley & Sons, Inc.

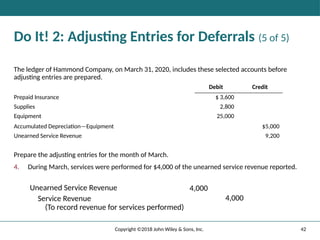

Do It! 2: Adjusting Entries for Deferrals (5 of 5)

The ledger of Hammond Company, on March 31, 2020, includes these selected accounts before

adjusting entries are prepared.

Debit Credit

Prepaid Insurance $ 3,600

Supplies 2,800

Equipment 25,000

Accumulated Depreciation—Equipment $5,000

Unearned Service Revenue 9,200

Prepare the adjusting entries for the month of March.

4. During March, services were performed for $4,000 of the unearned service revenue reported.

Unearned Service Revenue 4,000

Service Revenue

(To record revenue for services performed)

4,000

43. 43

Copyright ©2018 John Wiley & Sons, Inc.

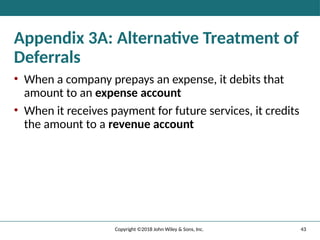

Appendix 3A: Alternative Treatment of

Deferrals

• When a company prepays an expense, it debits that

amount to an expense account

• When it receives payment for future services, it credits

the amount to a revenue account

44. 44

Copyright ©2018 John Wiley & Sons, Inc.

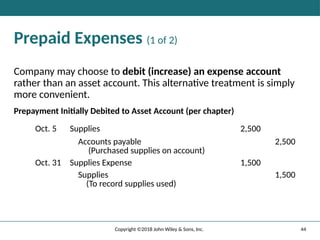

Prepaid Expenses (1 of 2)

Company may choose to debit (increase) an expense account

rather than an asset account. This alternative treatment is simply

more convenient.

Prepayment Initially Debited to Asset Account (per chapter)

Oct. 5 Supplies 2,500

Accounts payable

(Purchased supplies on account)

2,500

Oct. 31 Supplies Expense 1,500

Supplies

(To record supplies used)

1,500

45. 45

Copyright ©2018 John Wiley & Sons, Inc.

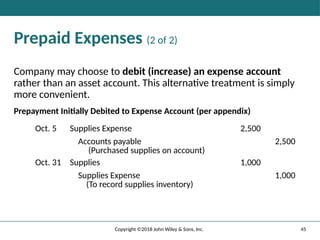

Prepaid Expenses (2 of 2)

Company may choose to debit (increase) an expense account

rather than an asset account. This alternative treatment is simply

more convenient.

Prepayment Initially Debited to Expense Account (per appendix)

Oct. 5 Supplies Expense 2,500

Accounts payable

(Purchased supplies on account)

2,500

Oct. 31 Supplies 1,000

Supplies Expense

(To record supplies inventory)

1,000

46. 46

Copyright ©2018 John Wiley & Sons, Inc.

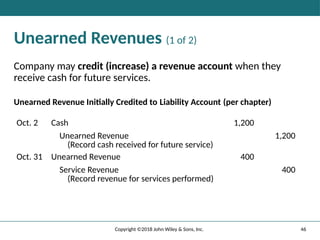

Unearned Revenues (1 of 2)

Company may credit (increase) a revenue account when they

receive cash for future services.

Unearned Revenue Initially Credited to Liability Account (per chapter)

Oct. 2 Cash 1,200

Unearned Revenue

(Record cash received for future service)

1,200

Oct. 31 Unearned Revenue 400

Service Revenue

(Record revenue for services performed)

400

47. 47

Copyright ©2018 John Wiley & Sons, Inc.

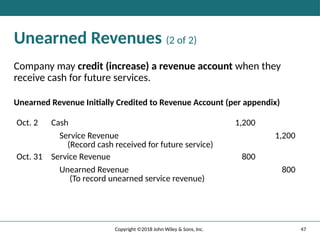

Unearned Revenues (2 of 2)

Company may credit (increase) a revenue account when they

receive cash for future services.

Unearned Revenue Initially Credited to Revenue Account (per appendix)

Oct. 2 Cash 1,200

Service Revenue

(Record cash received for future service)

1,200

Oct. 31 Service Revenue 800

Unearned Revenue

(To record unearned service revenue)

800

48. 48

Copyright ©2018 John Wiley & Sons, Inc.

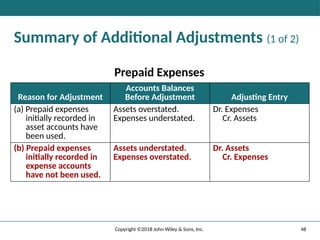

Summary of Additional Adjustments (1 of 2)

Prepaid Expenses

Reason for Adjustment

Accounts Balances

Before Adjustment Adjusting Entry

(a) Prepaid expenses

initially recorded in

asset accounts have

been used.

Assets overstated.

Expenses understated.

Dr. Expenses

Cr. Assets

(b) Prepaid expenses

initially recorded in

expense accounts

have not been used.

Assets understated.

Expenses overstated.

Dr. Assets

Cr. Expenses

49. 49

Copyright ©2018 John Wiley & Sons, Inc.

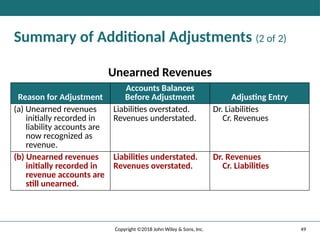

Summary of Additional Adjustments (2 of 2)

Unearned Revenues

Reason for Adjustment

Accounts Balances

Before Adjustment Adjusting Entry

(a) Unearned revenues

initially recorded in

liability accounts are

now recognized as

revenue.

Liabilities overstated.

Revenues understated.

Dr. Liabilities

Cr. Revenues

(b) Unearned revenues

initially recorded in

revenue accounts are

still unearned.

Liabilities understated.

Revenues overstated.

Dr. Revenues

Cr. Liabilities

50. 50

Copyright ©2018 John Wiley & Sons, Inc.

Copyright

Copyright © 2018 John Wiley & Sons, Inc.

All rights reserved. Reproduction or translation of this work beyond that permitted in

Section 117 of the 1976 United States Act without the express written permission of the

copyright owner is unlawful. Request for further information should be addressed to the

Permissions Department, John Wiley & Sons, Inc. The purchaser may make back-up copies

for his/her own use only and not for distribution or resale. The Publisher assumes no

responsibility for errors, omissions, or damages, caused by the use of these programs or

from the use of the information contained herein.

![18

Copyright ©2018 John Wiley & Sons, Inc.

Do It! 1: Timing Concepts (1 of 2)

Below is a list of timing concepts in the

left column, with a description of the

concept in the right column. There are

more descriptions provided than

concepts. Match the description to the

concept

1. [blank] Accrual-basis accounting.

2. [blank] Calendar year.

3. [blank] Time period assumption.

4. [blank] Expense recognition principle.

(a) Monthly and quarterly time periods.

(b) Efforts (expenses) should be recognized in the

period in which a company uses assets or

incurs liabilities to generate results

(revenues).

(c) Accountants divide the economic life of a

business into artificial time periods.

(d) Companies record revenues when they

receive cash and record expenses when they

pay out cash.

(e) An accounting time period that starts on

January 1 and ends on December 31.

(f) Companies record transactions in the period in

which the events occur.](https://image.slidesharecdn.com/chapter3slides-parti-250712161815-b85bfd48/85/Chapter-3-Slides-Part-I-accountibg-pptx-18-320.jpg)