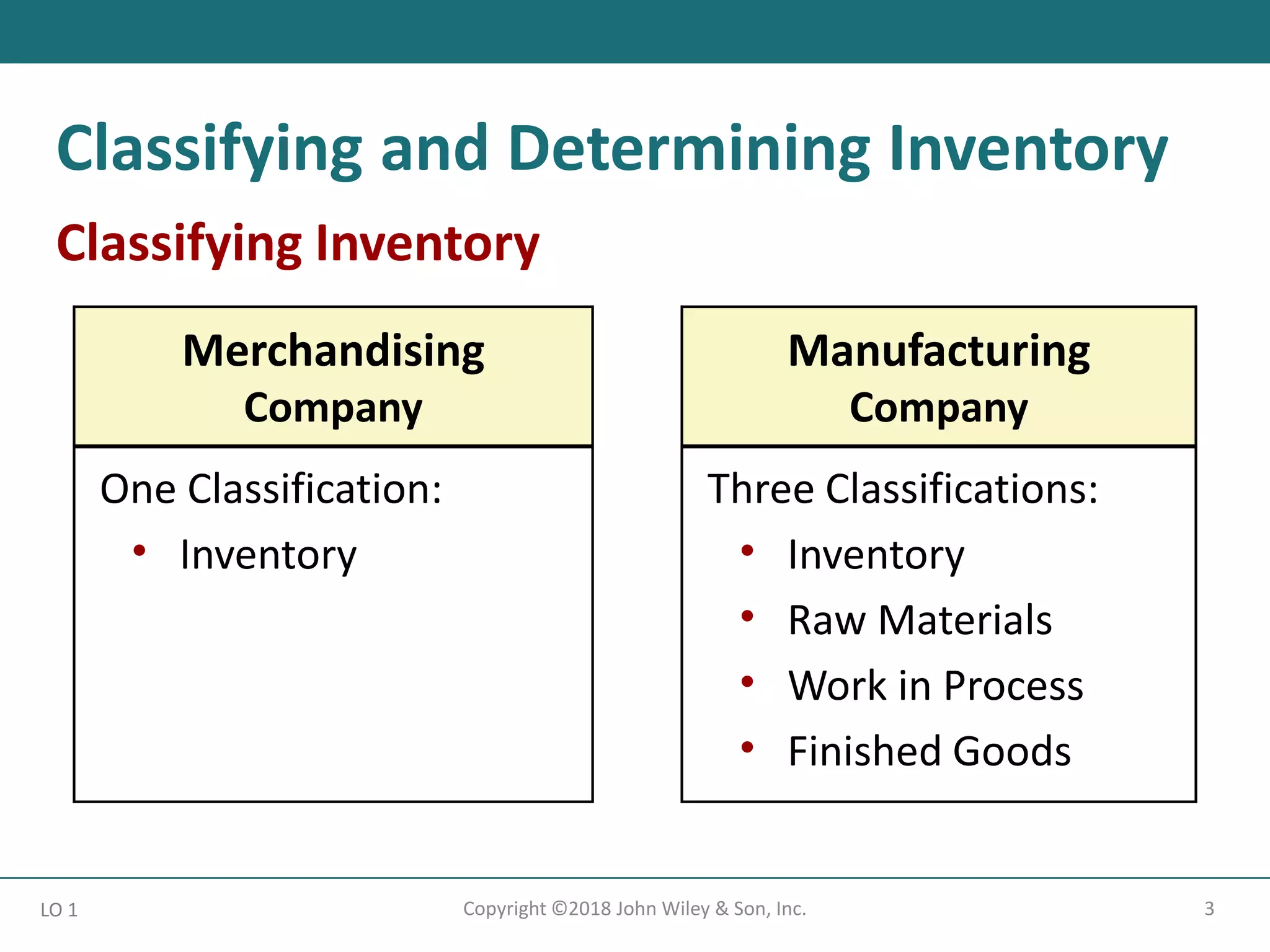

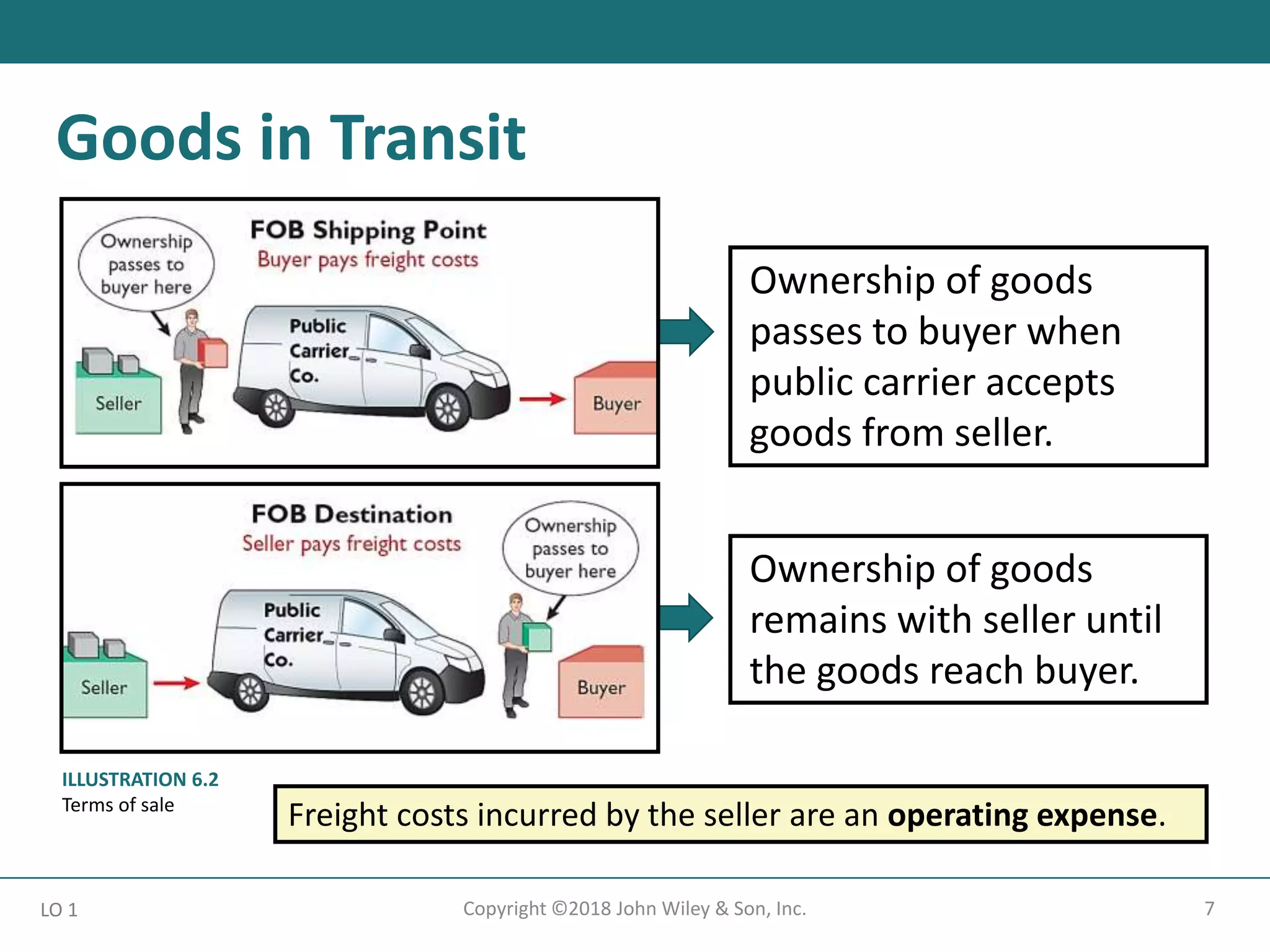

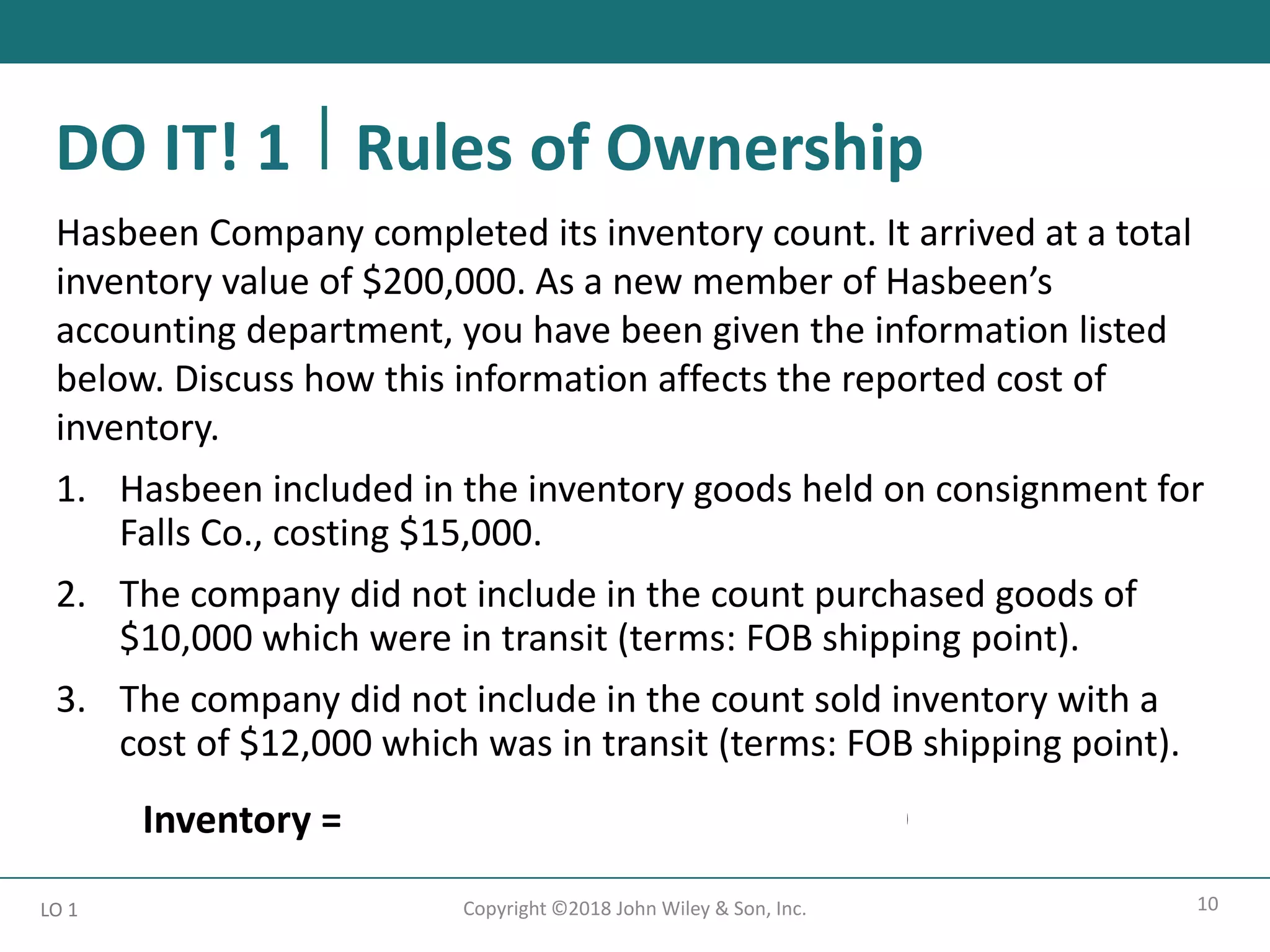

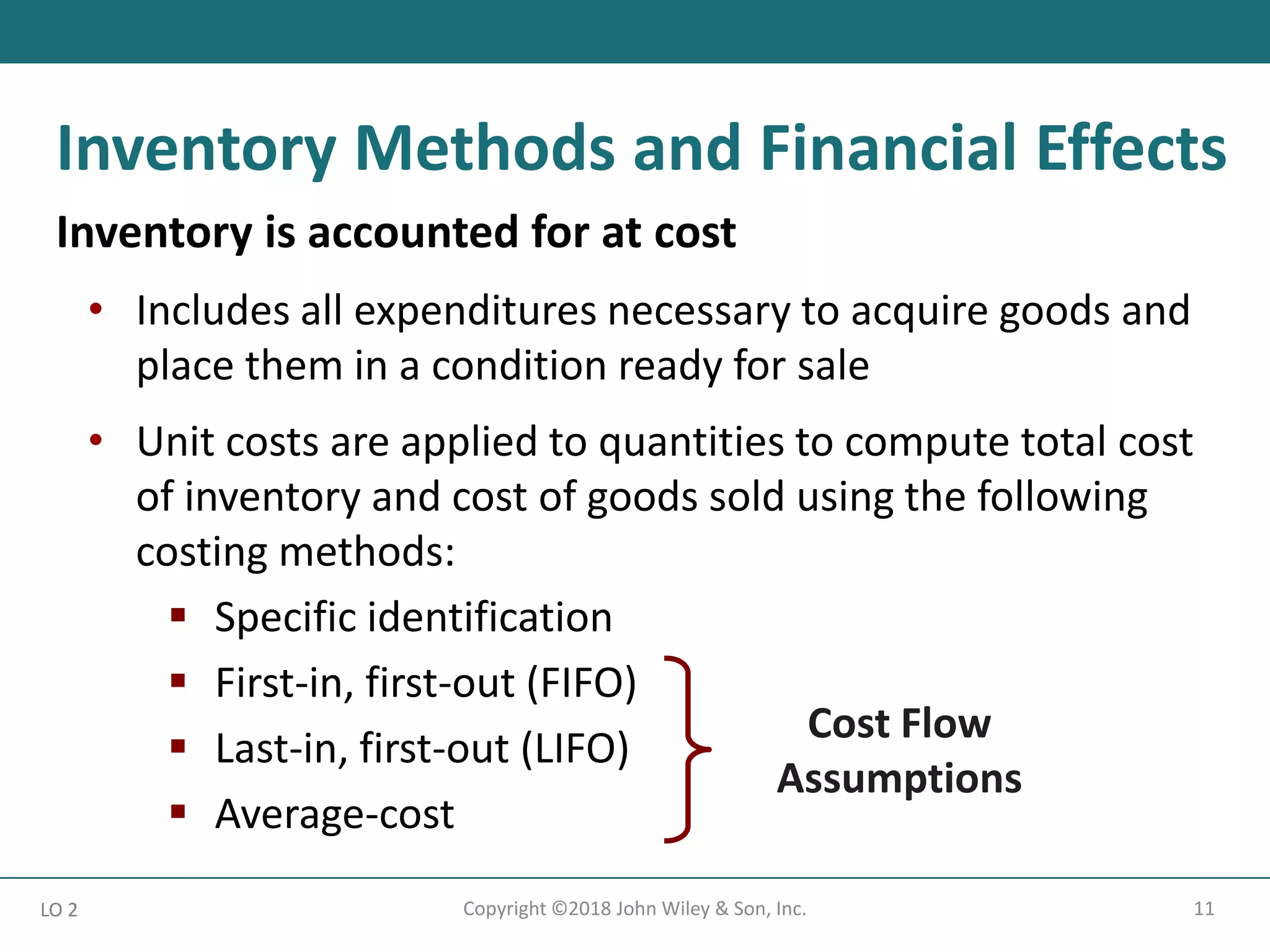

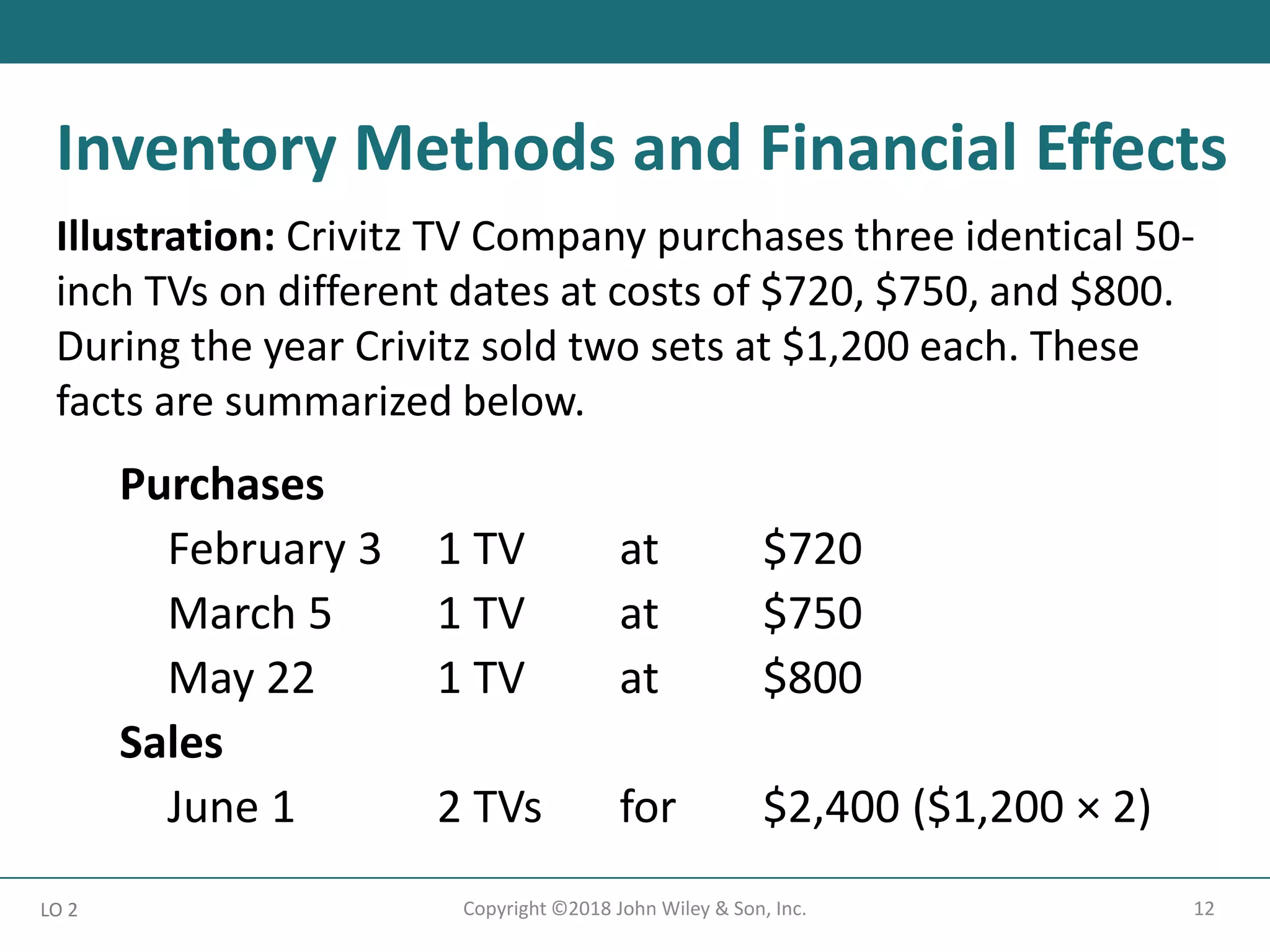

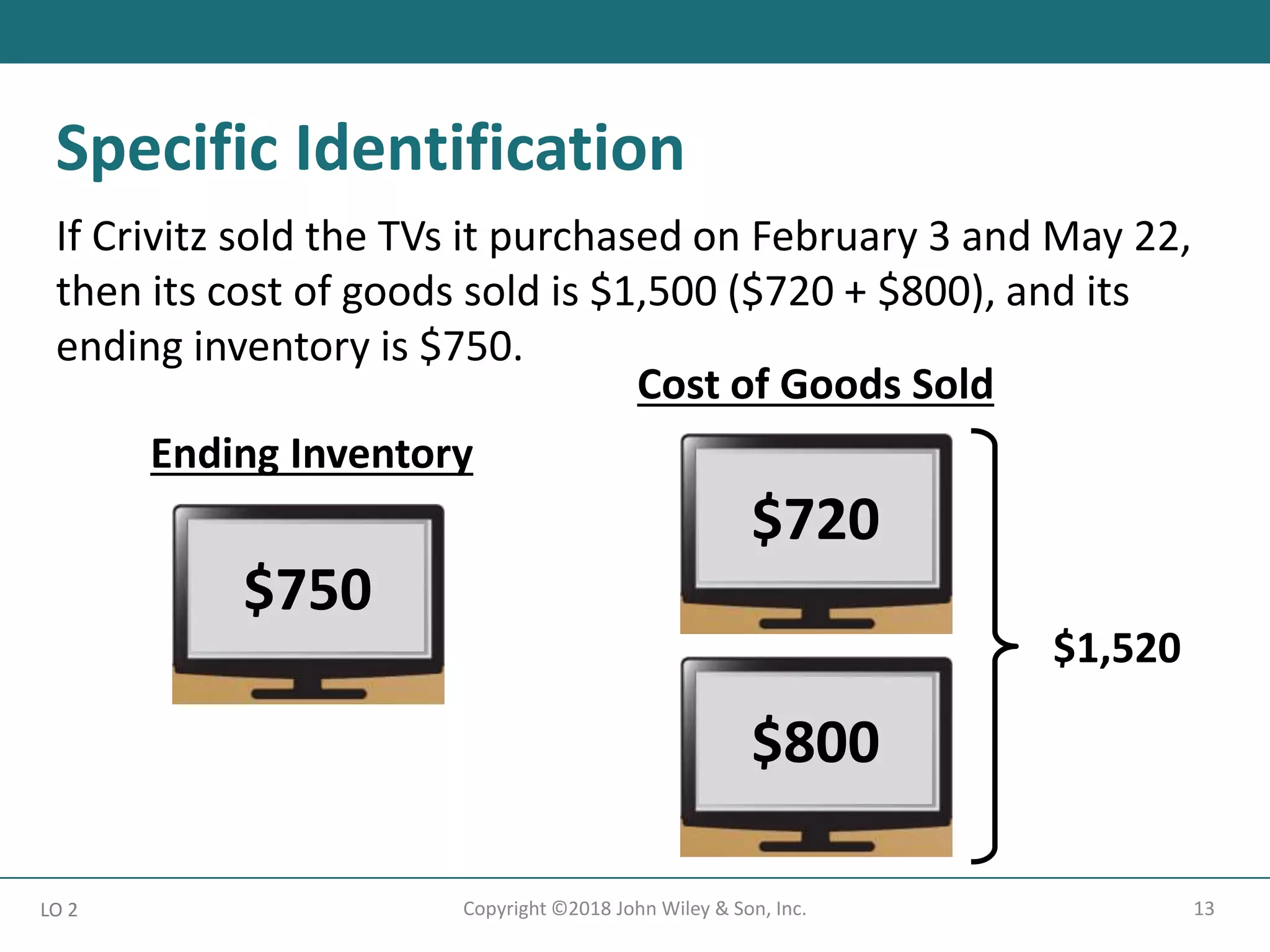

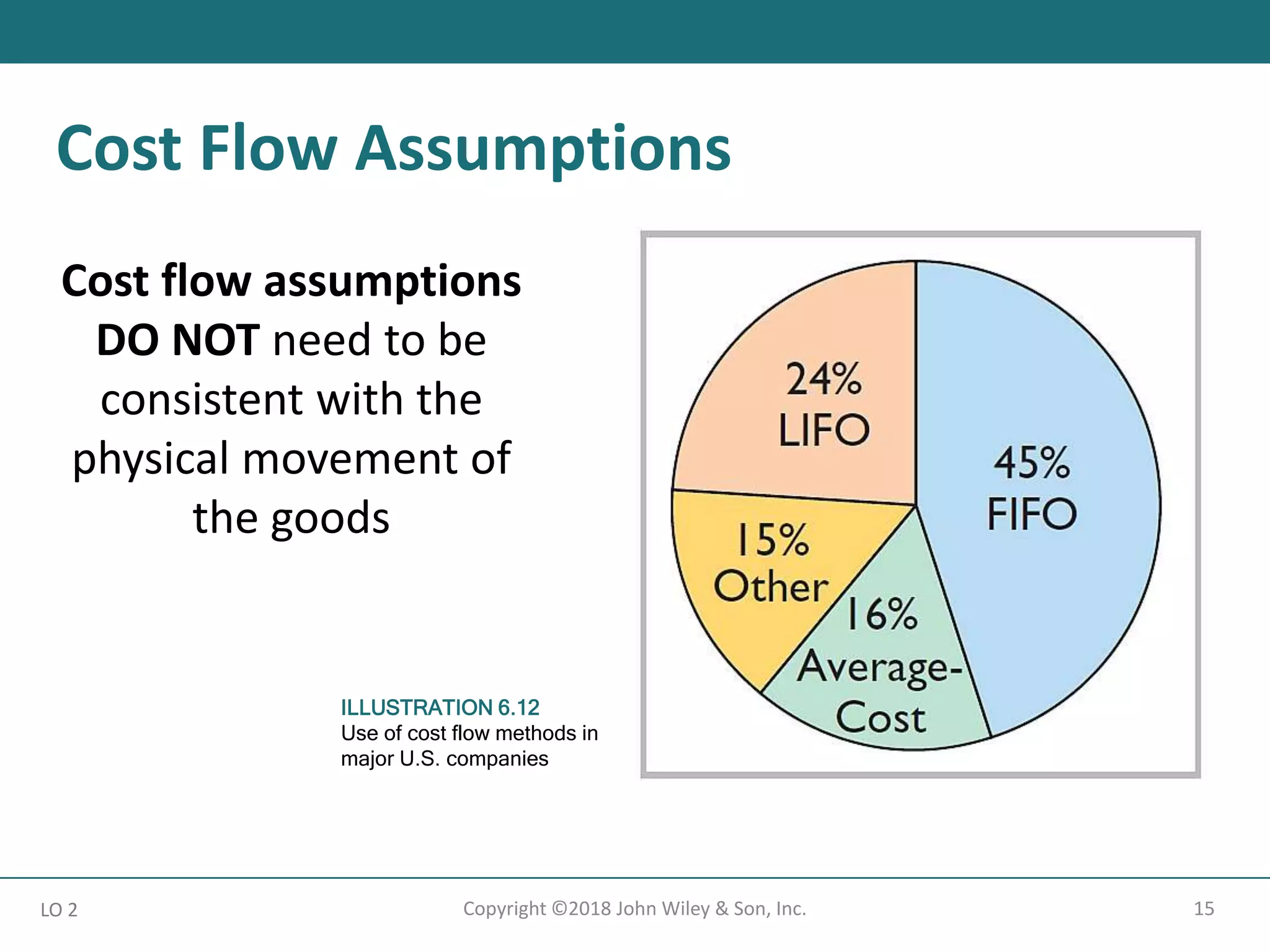

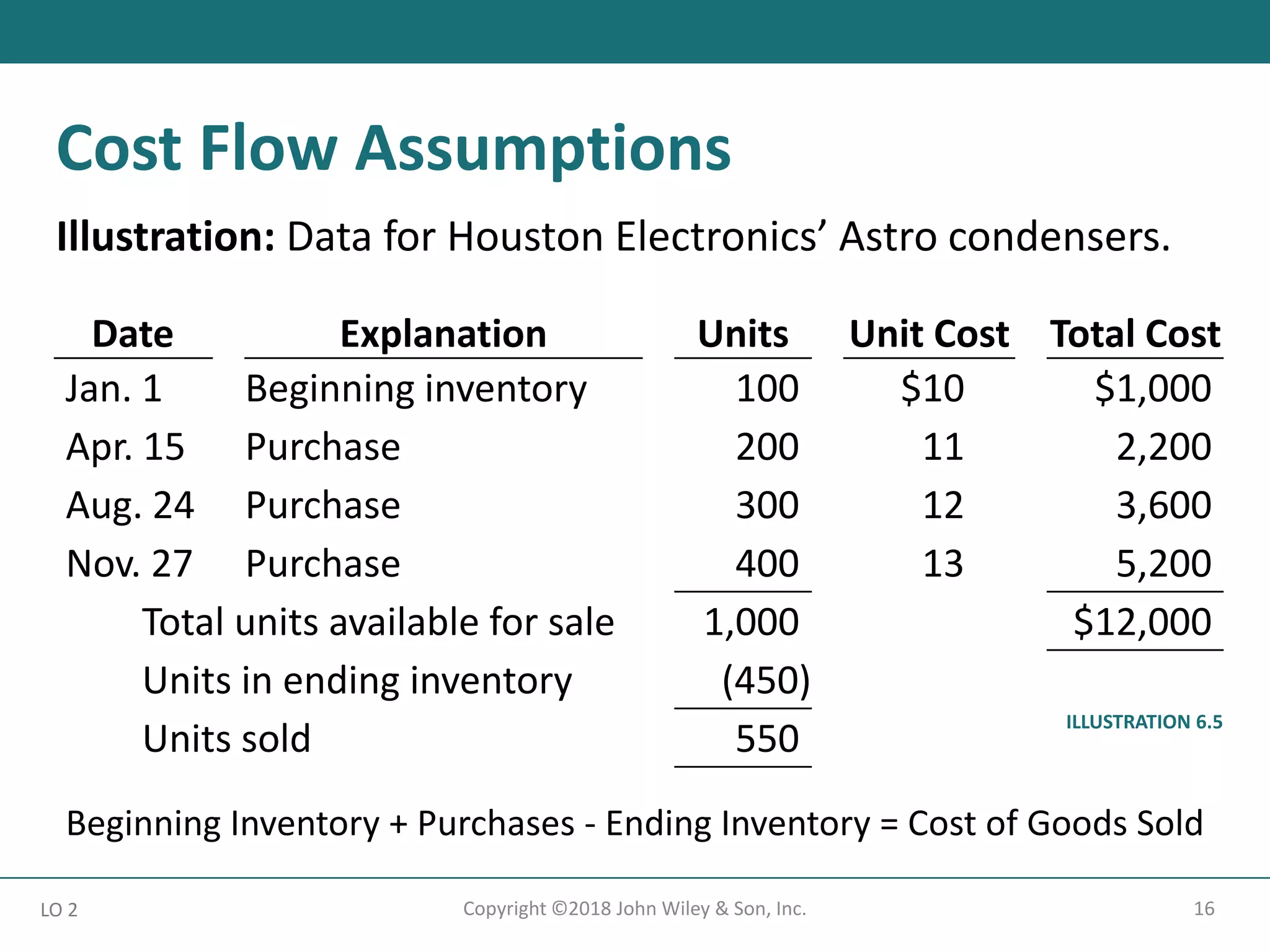

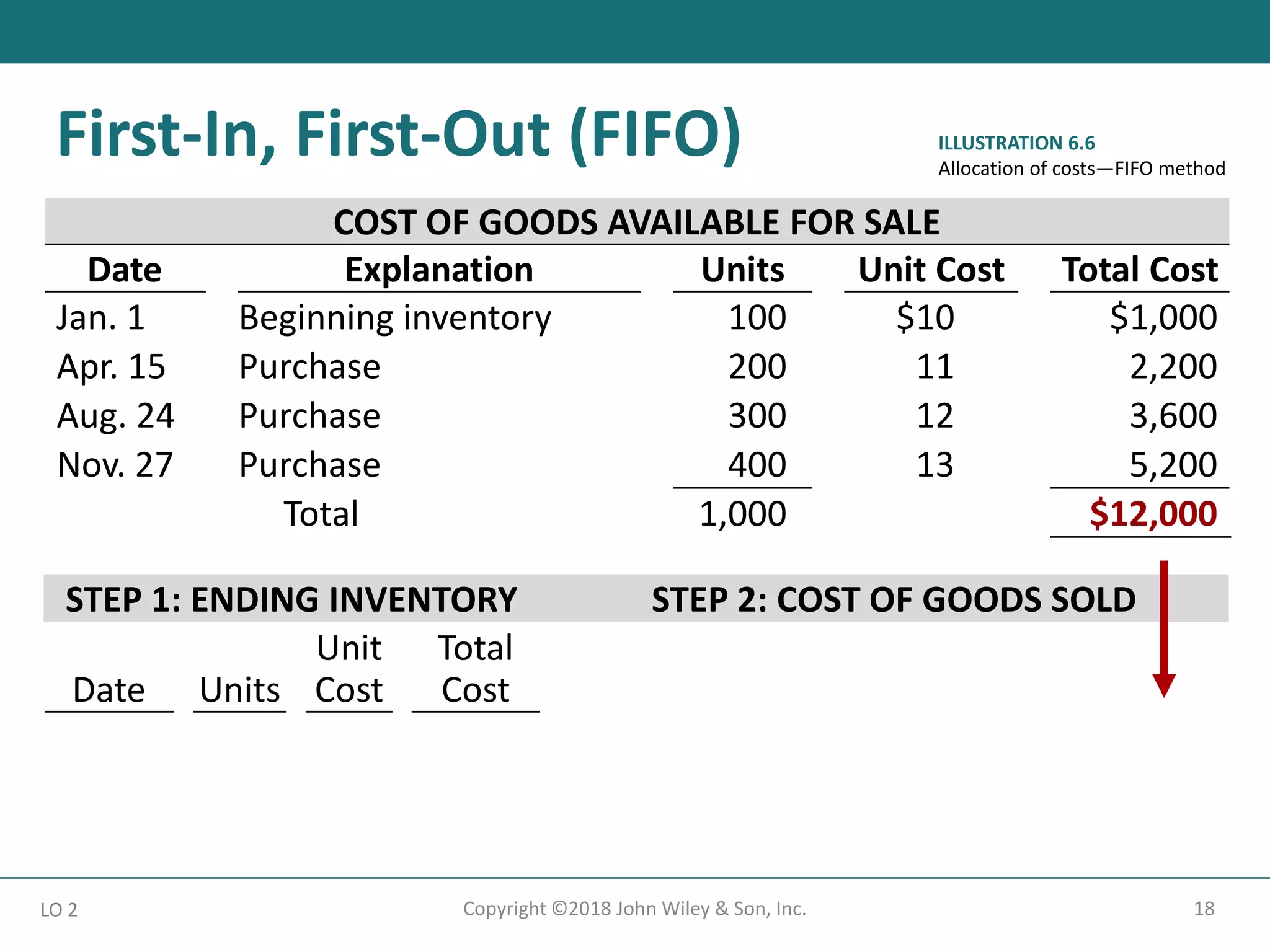

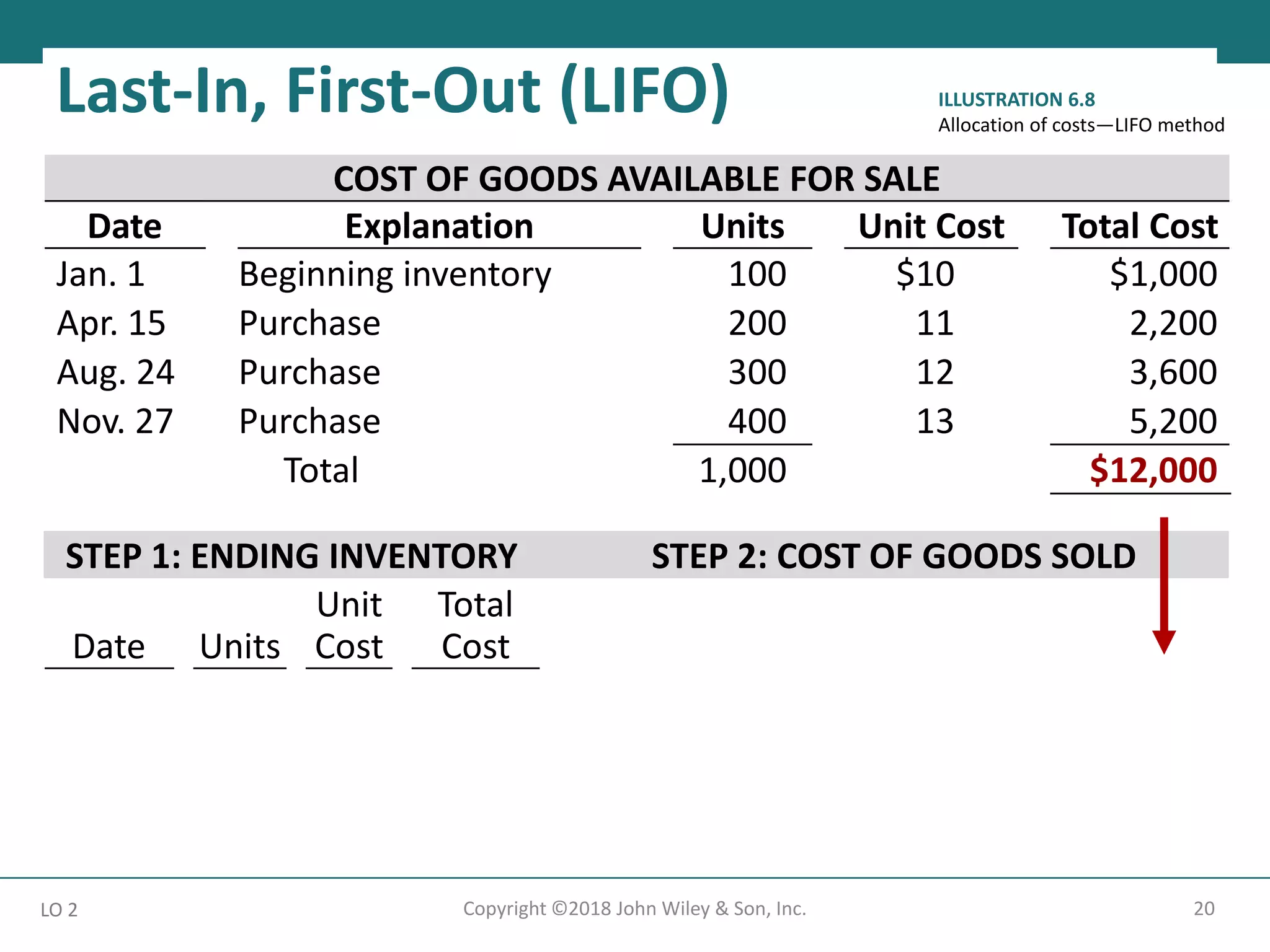

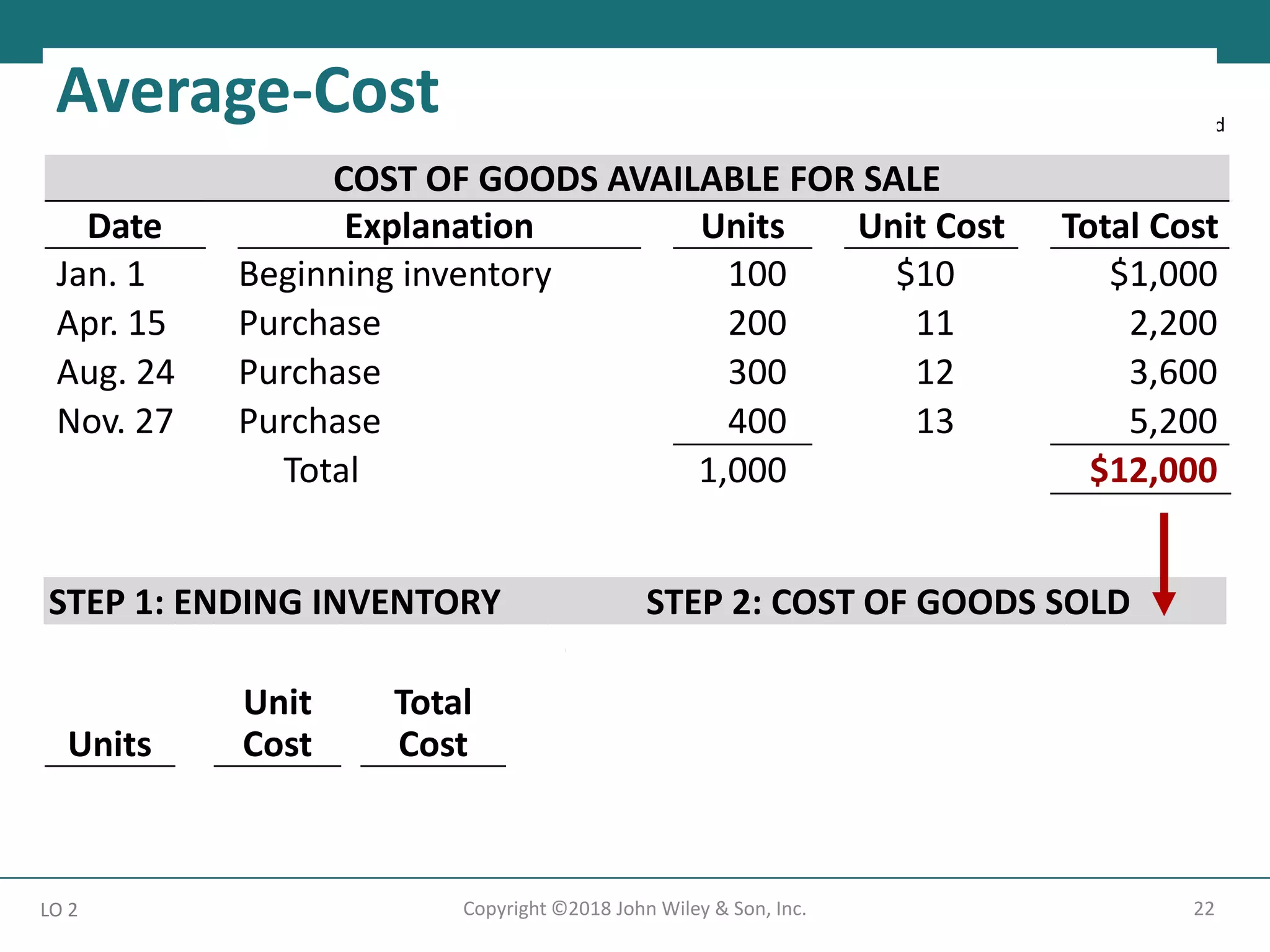

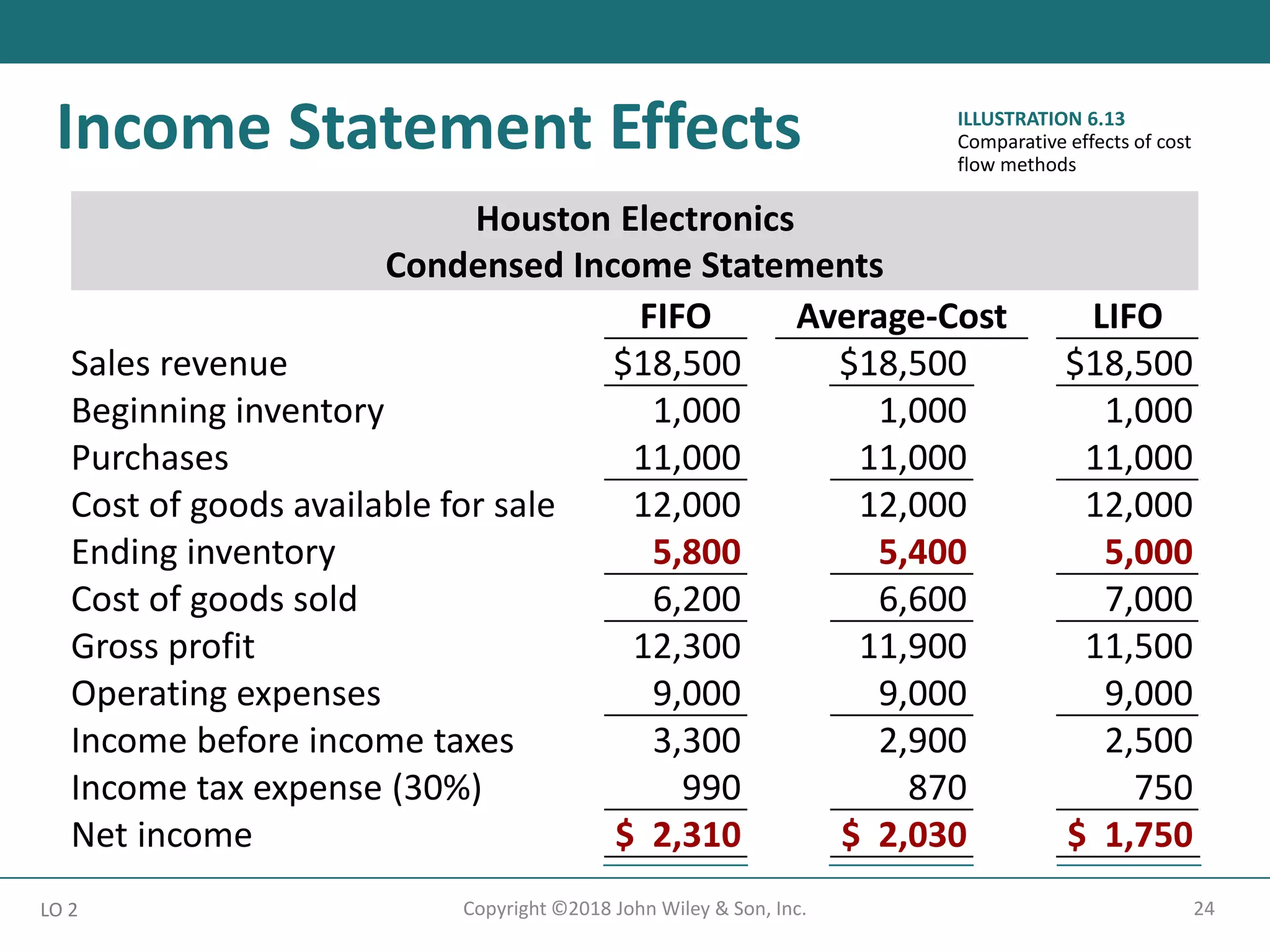

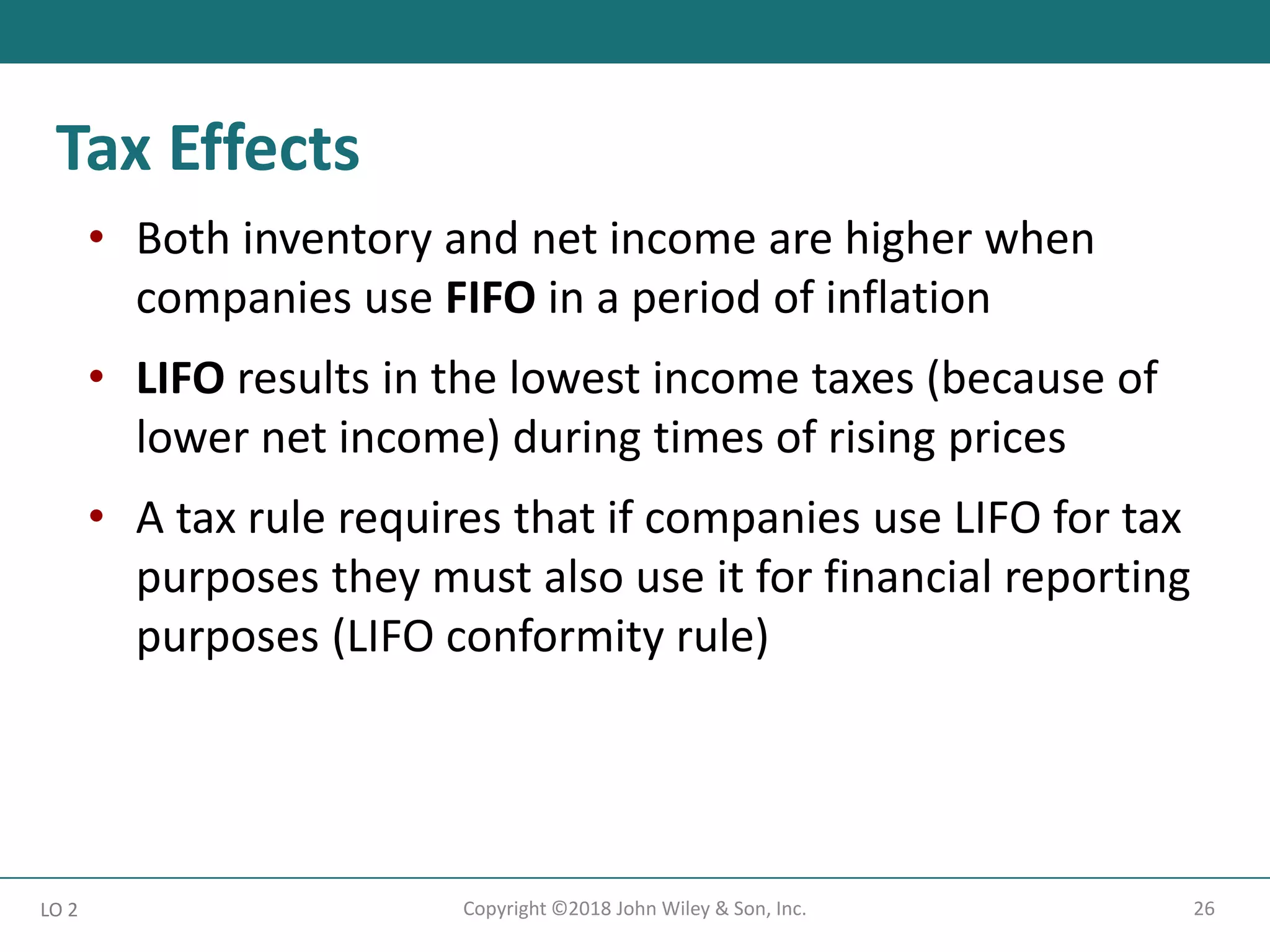

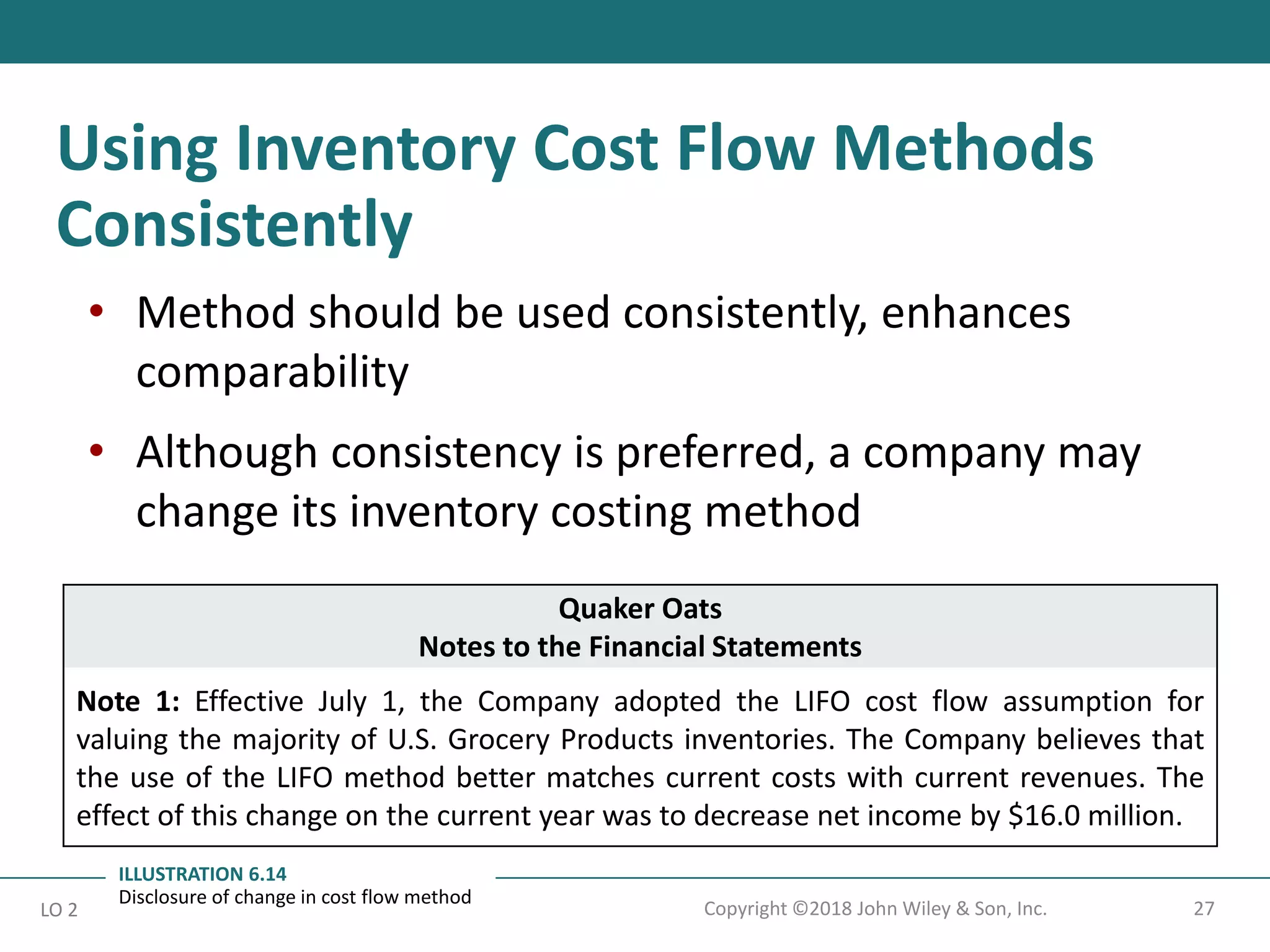

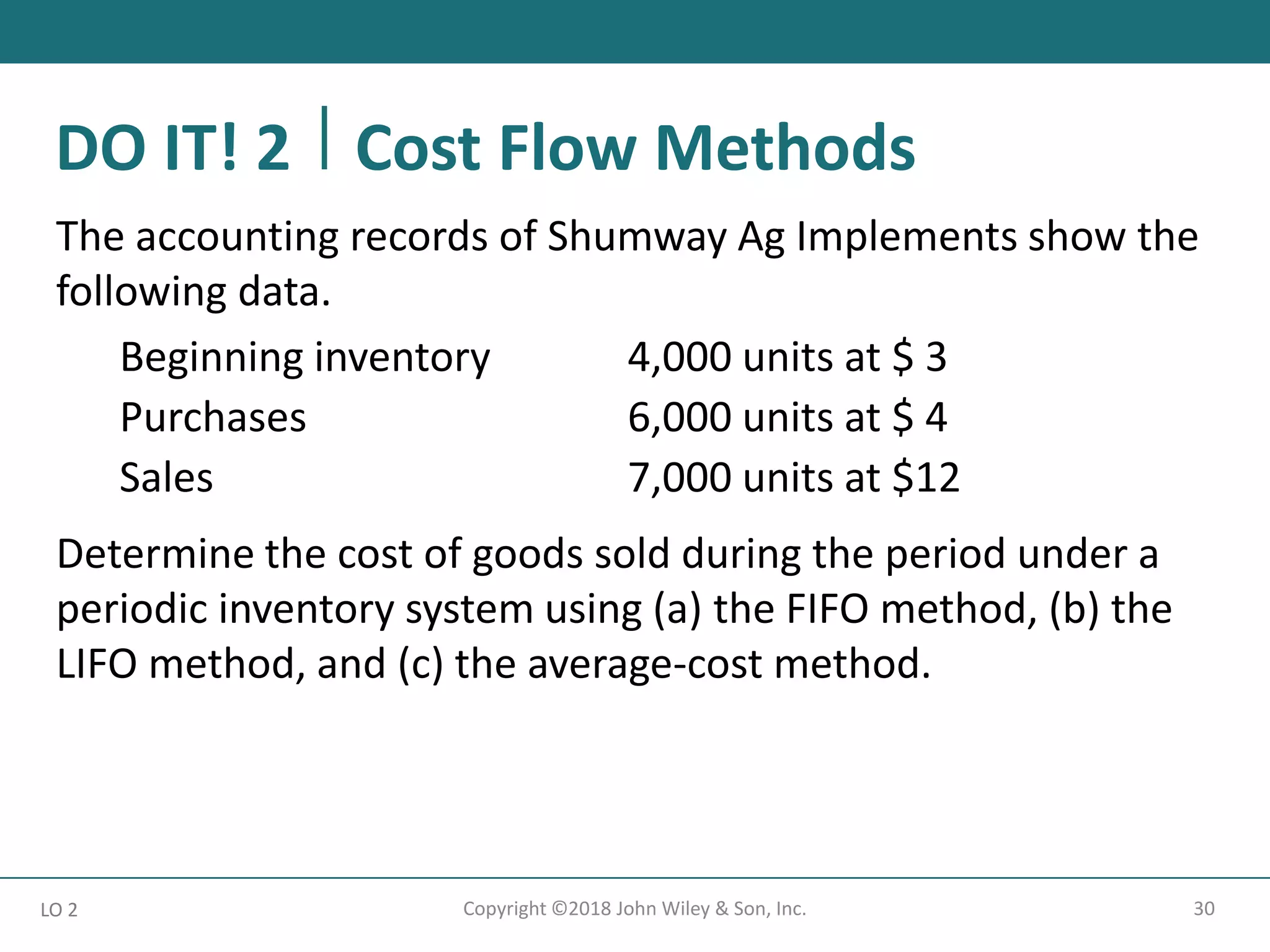

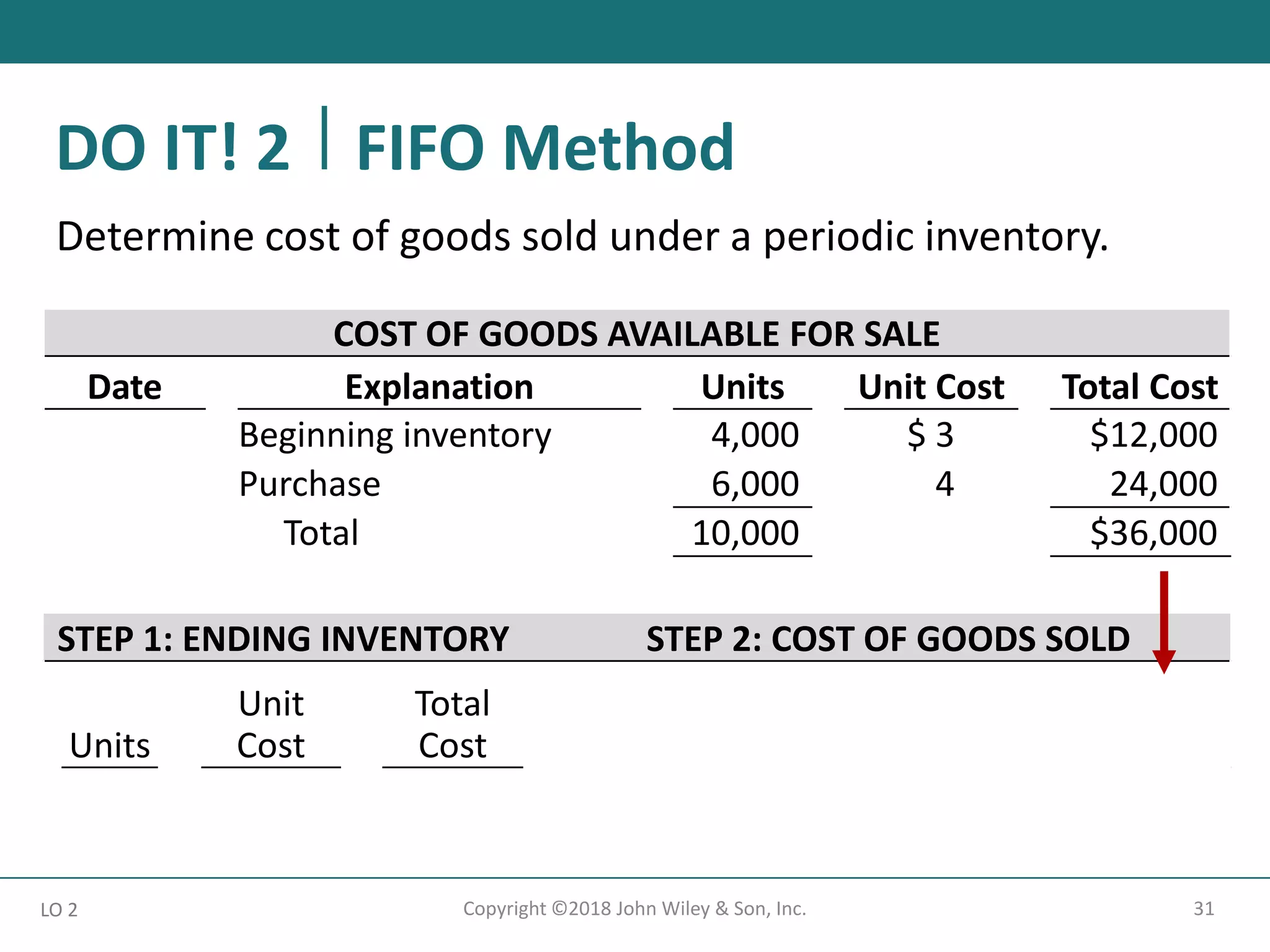

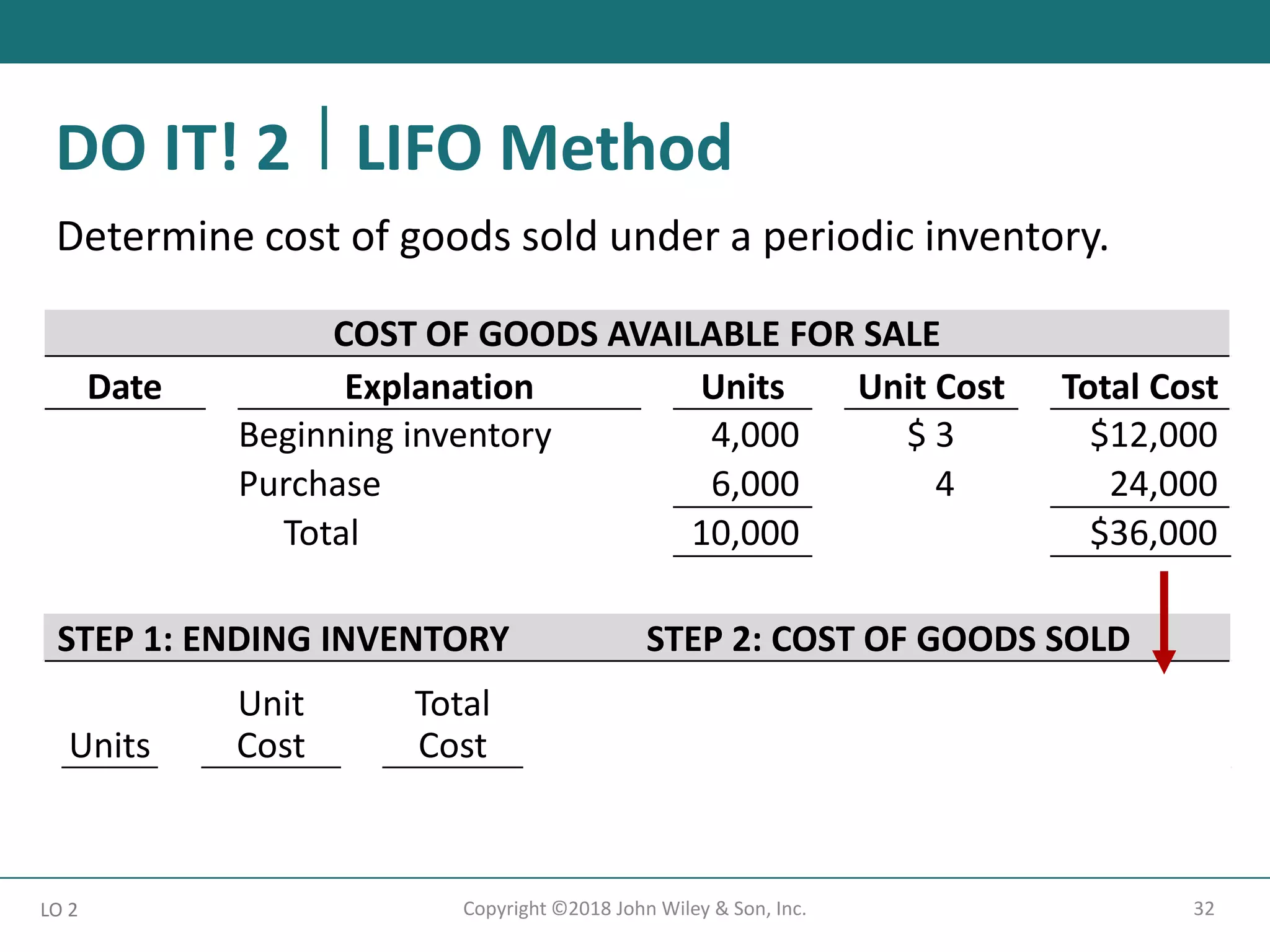

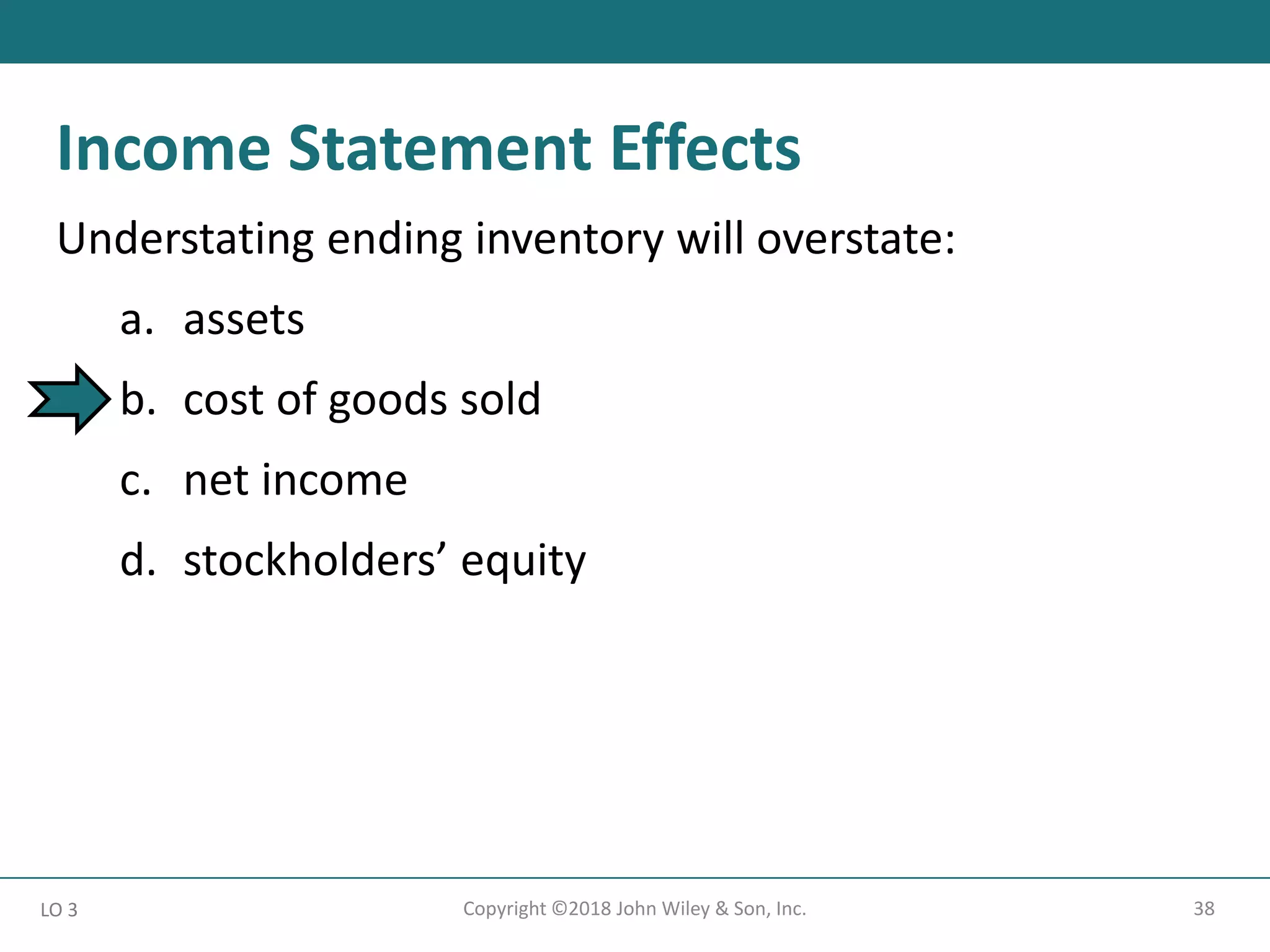

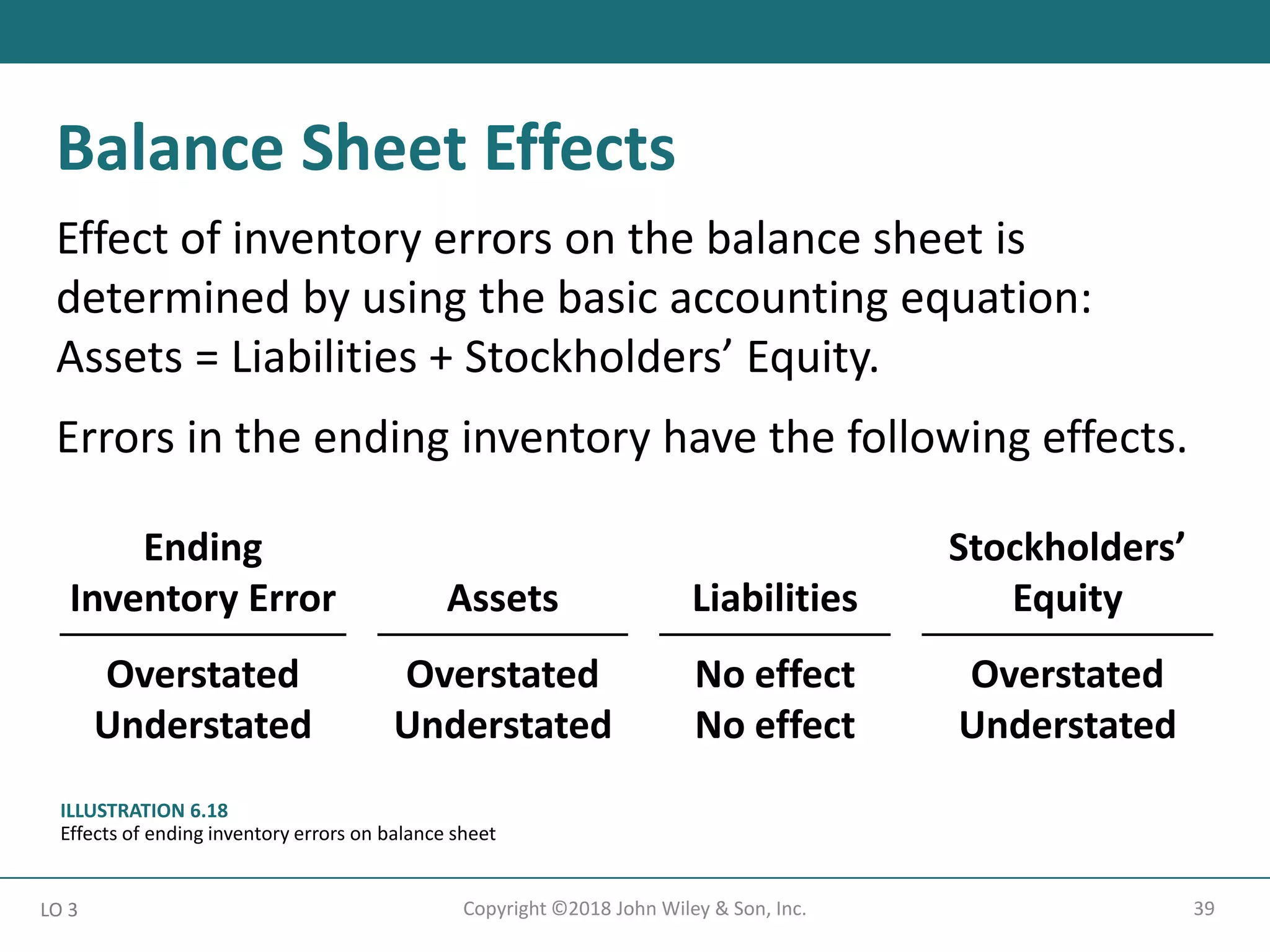

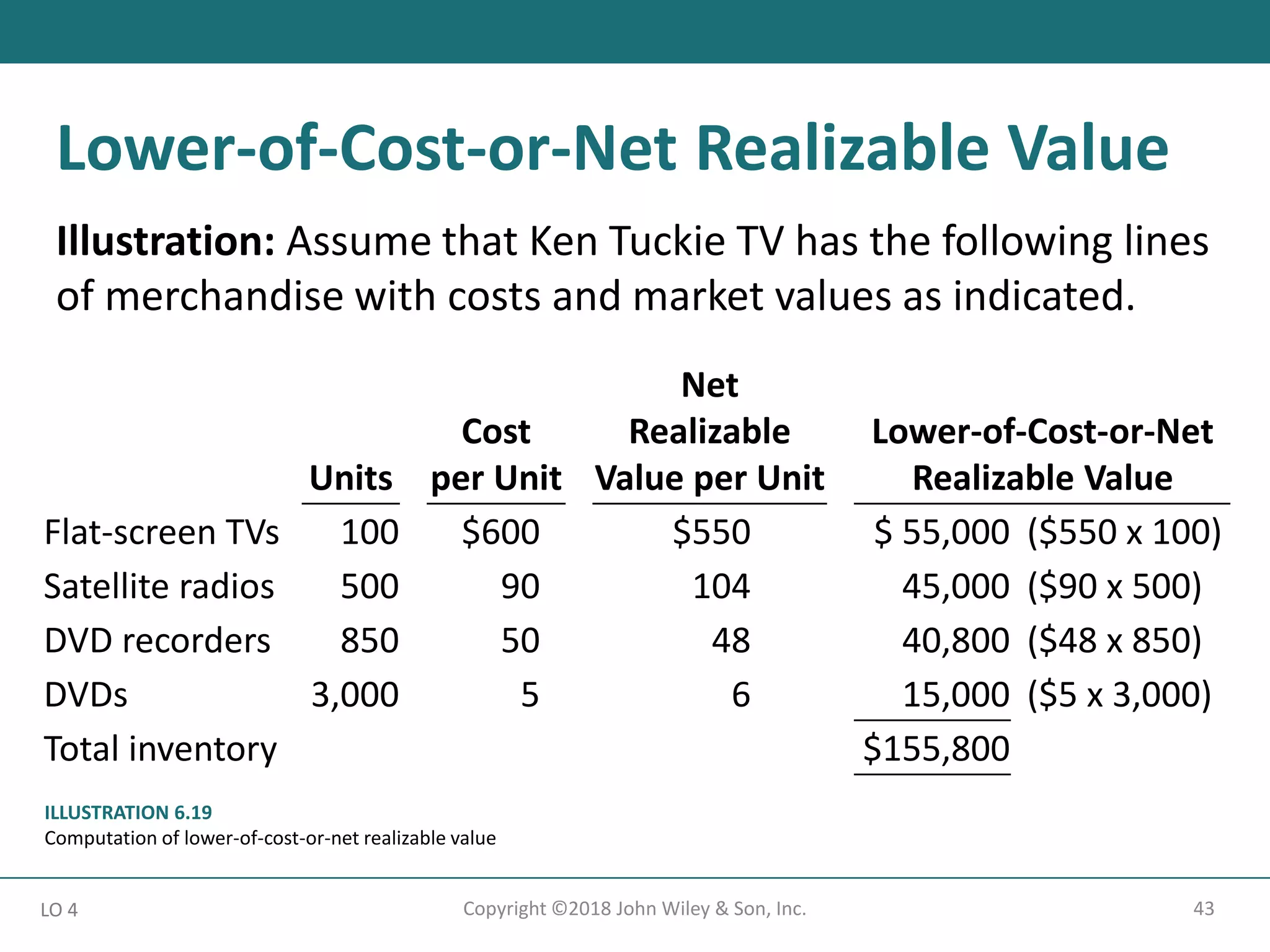

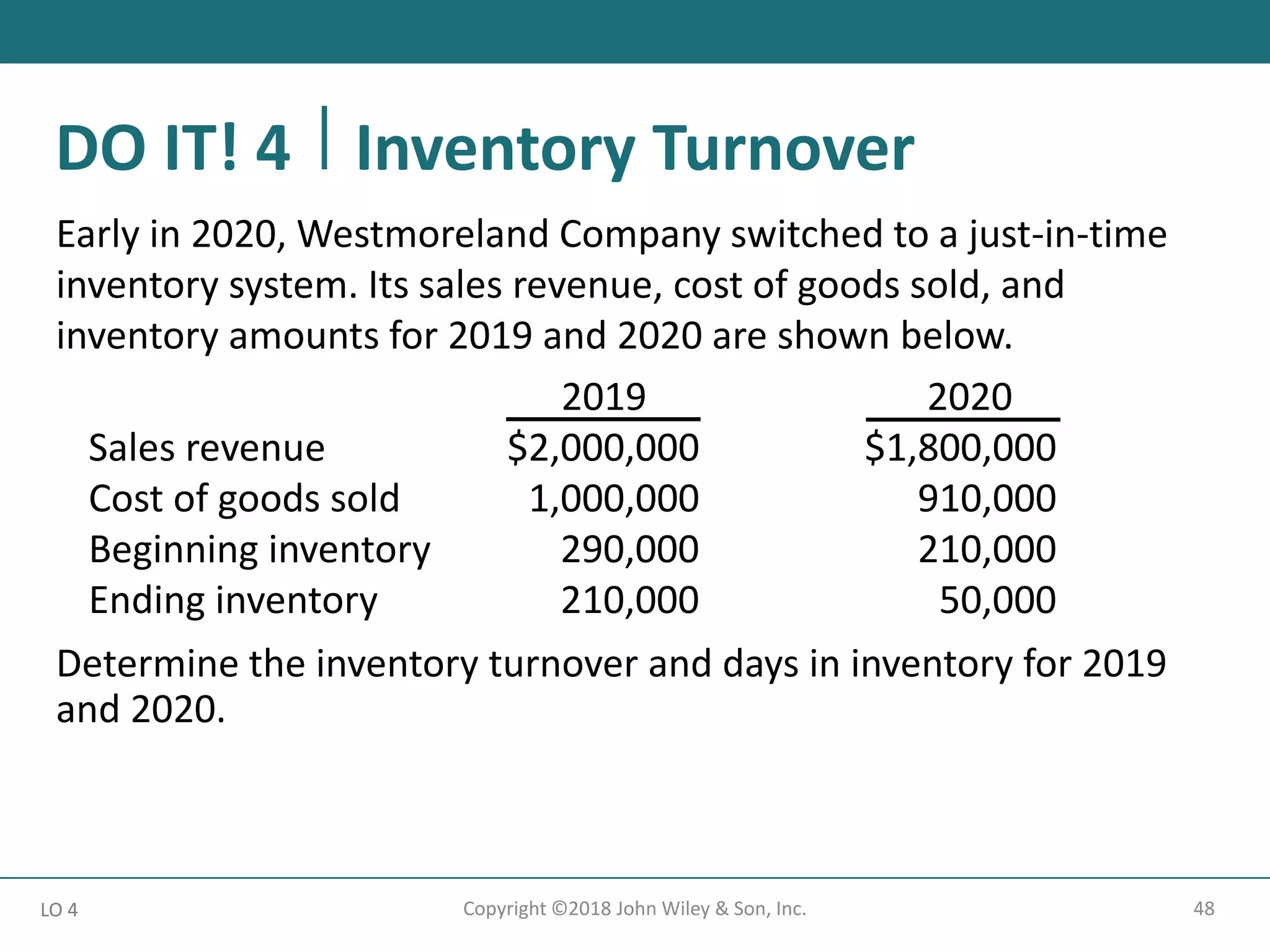

This document provides an outline and overview of key concepts from Chapter 6 of the textbook "Accounting Principles" related to inventories. It discusses how to classify inventory for merchandising vs manufacturing companies, determine inventory quantities through physical counts and rules of ownership, and apply different inventory cost flow methods (FIFO, LIFO, average cost). The effects of these cost flow methods on the financial statements are also examined through an example comparing the income statement impacts of each method.