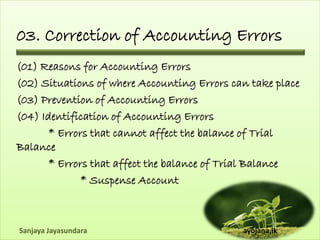

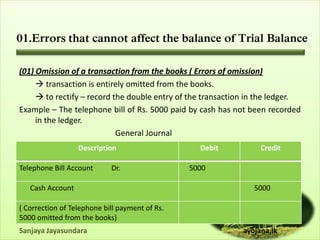

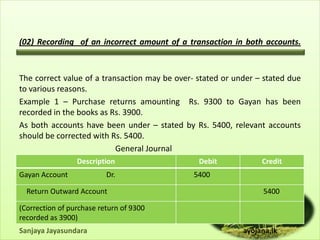

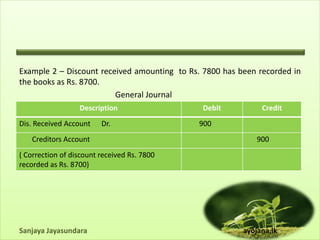

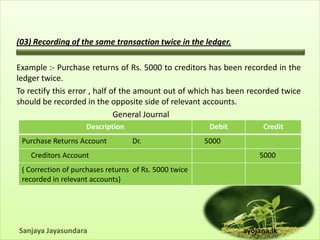

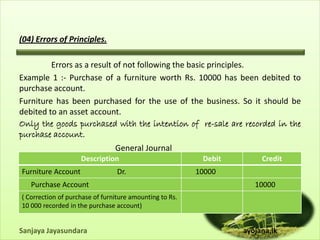

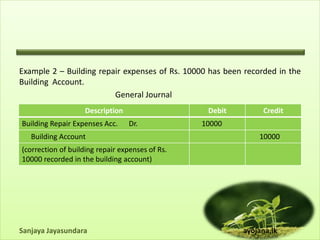

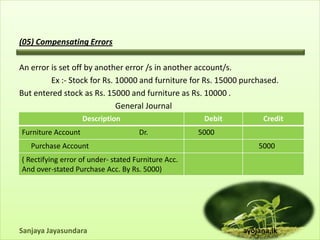

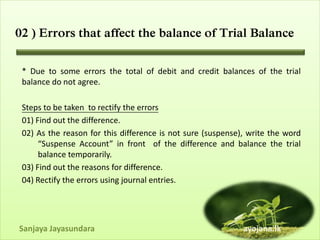

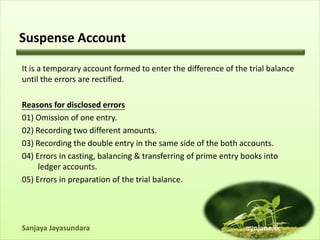

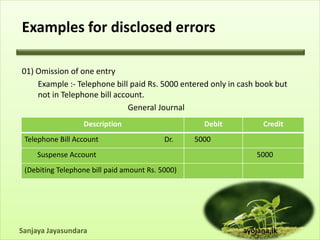

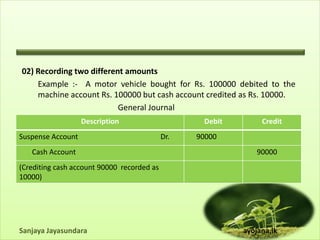

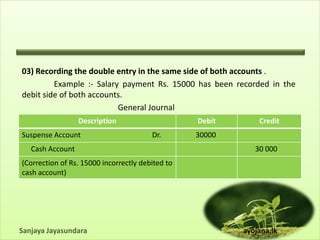

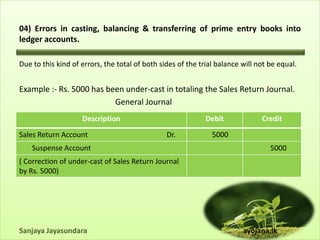

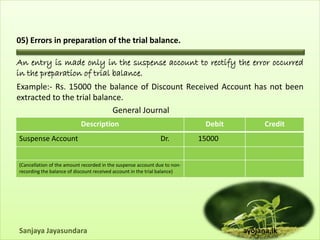

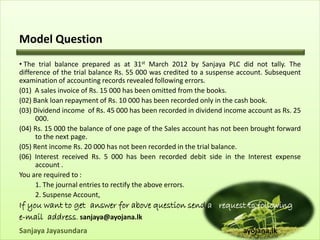

The document discusses the correction of accounting errors and outlines reasons, situations, prevention methods, and identification techniques for such errors. It categorizes errors into those that affect and do not affect the trial balance, while providing examples and journal entries for rectification. Additionally, it highlights the use of suspense accounts to temporarily balance discrepancies in trial balances until errors are resolved.