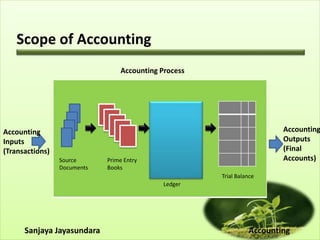

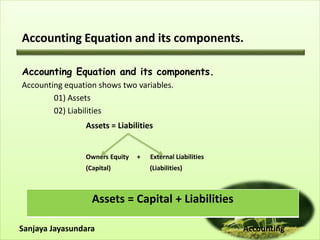

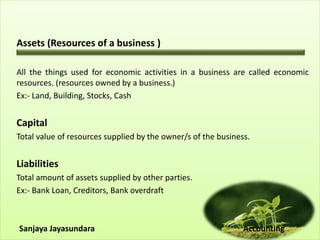

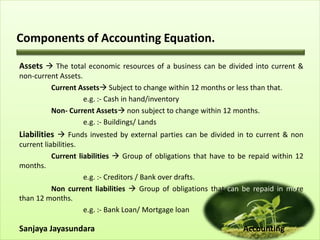

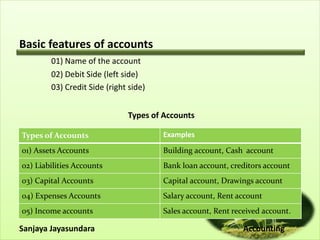

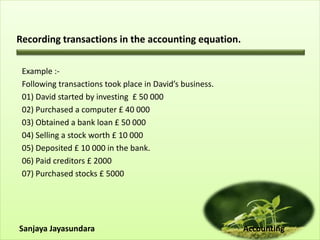

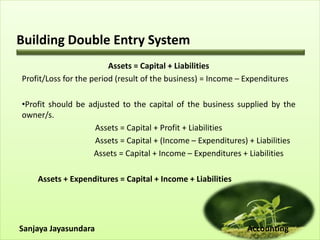

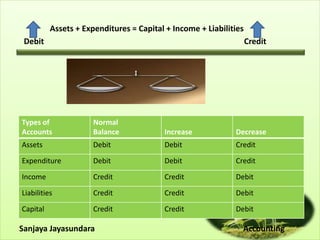

The document serves as an introduction to accounting, outlining its purpose as a language of business and its historical evolution. Key concepts include the accounting equation, the distinction between assets and liabilities, and the double-entry system. Various types of accounts and their roles in recording transactions are also discussed, emphasizing the importance of accounting information for informed business decisions.