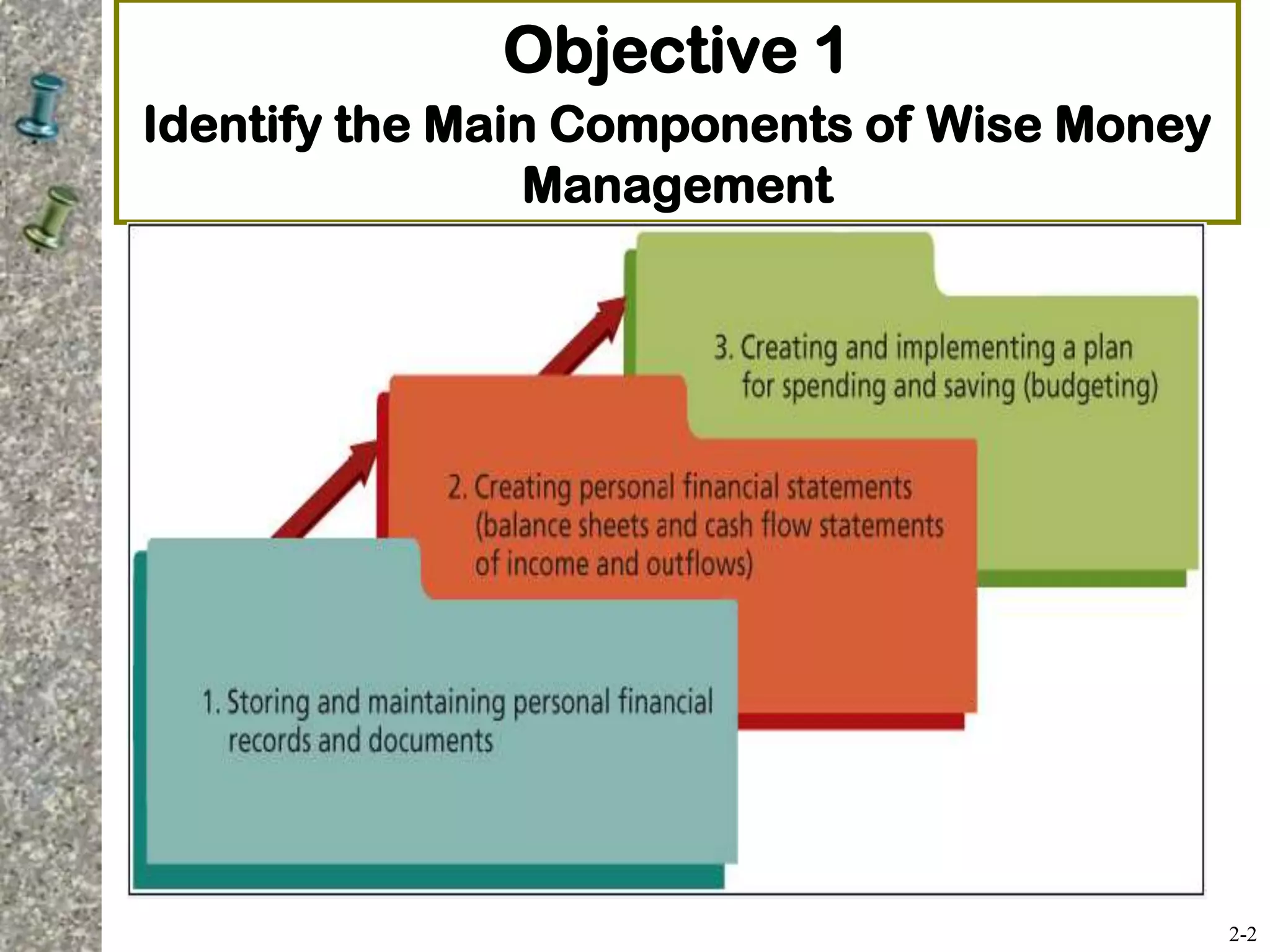

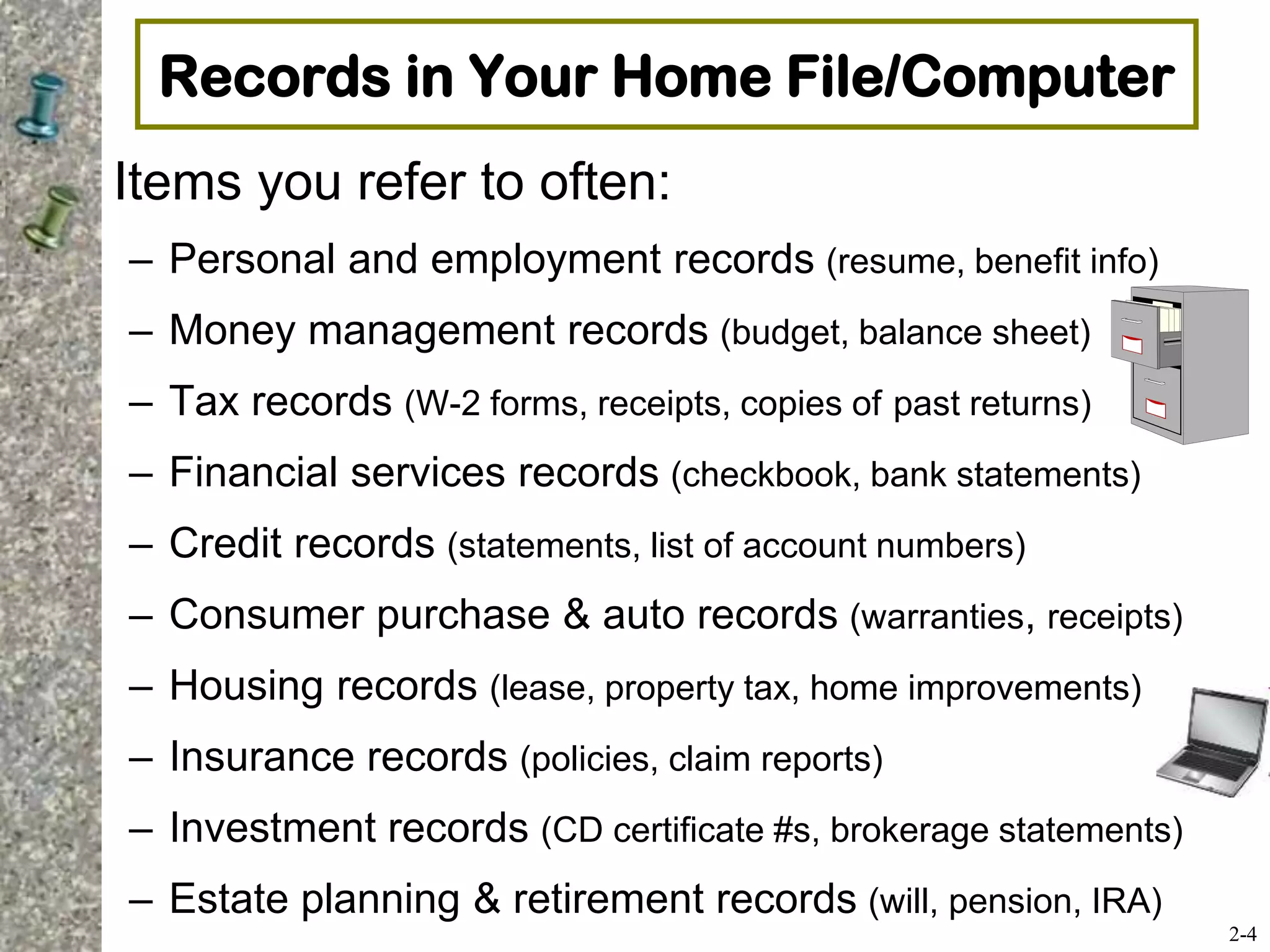

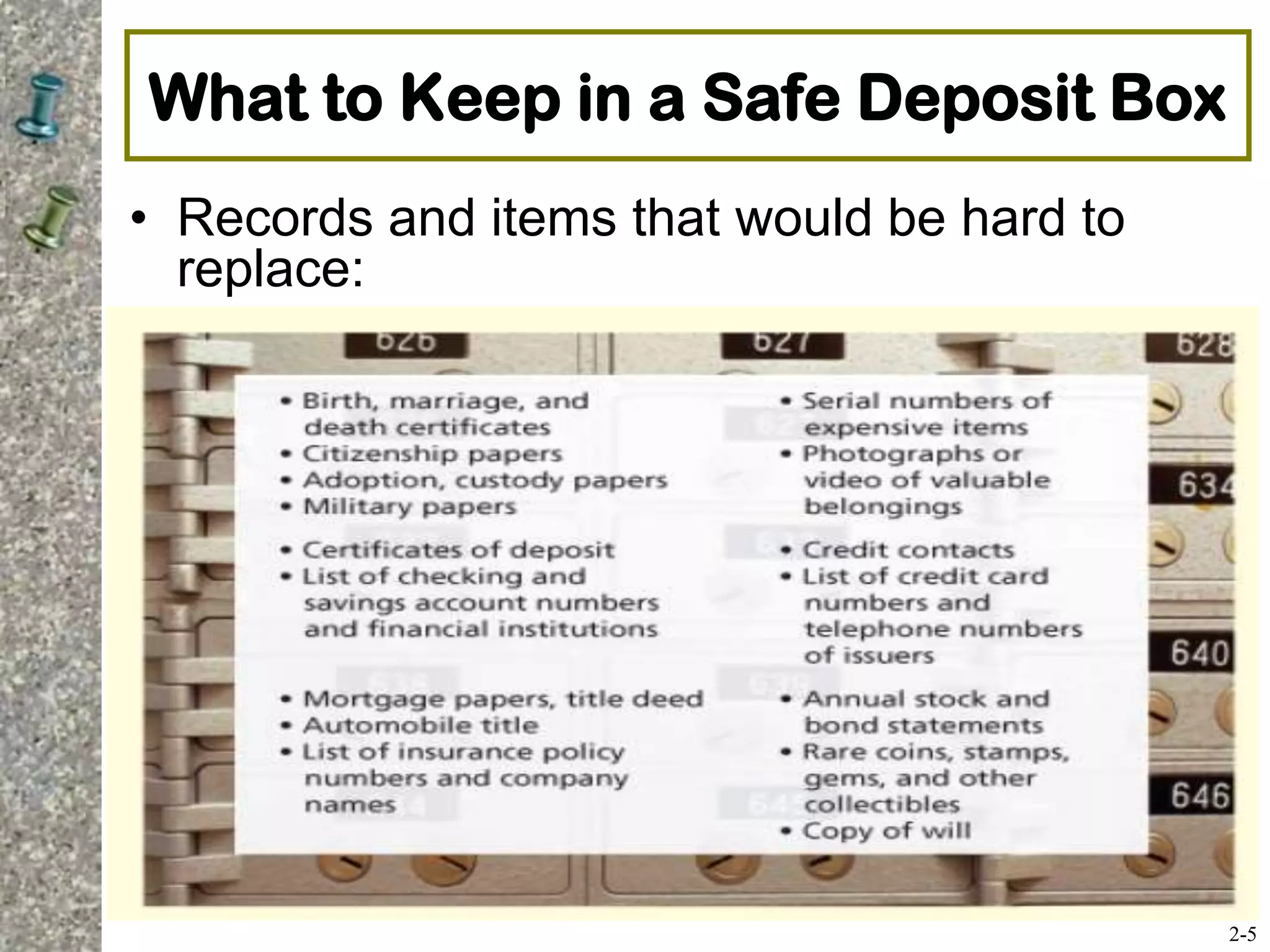

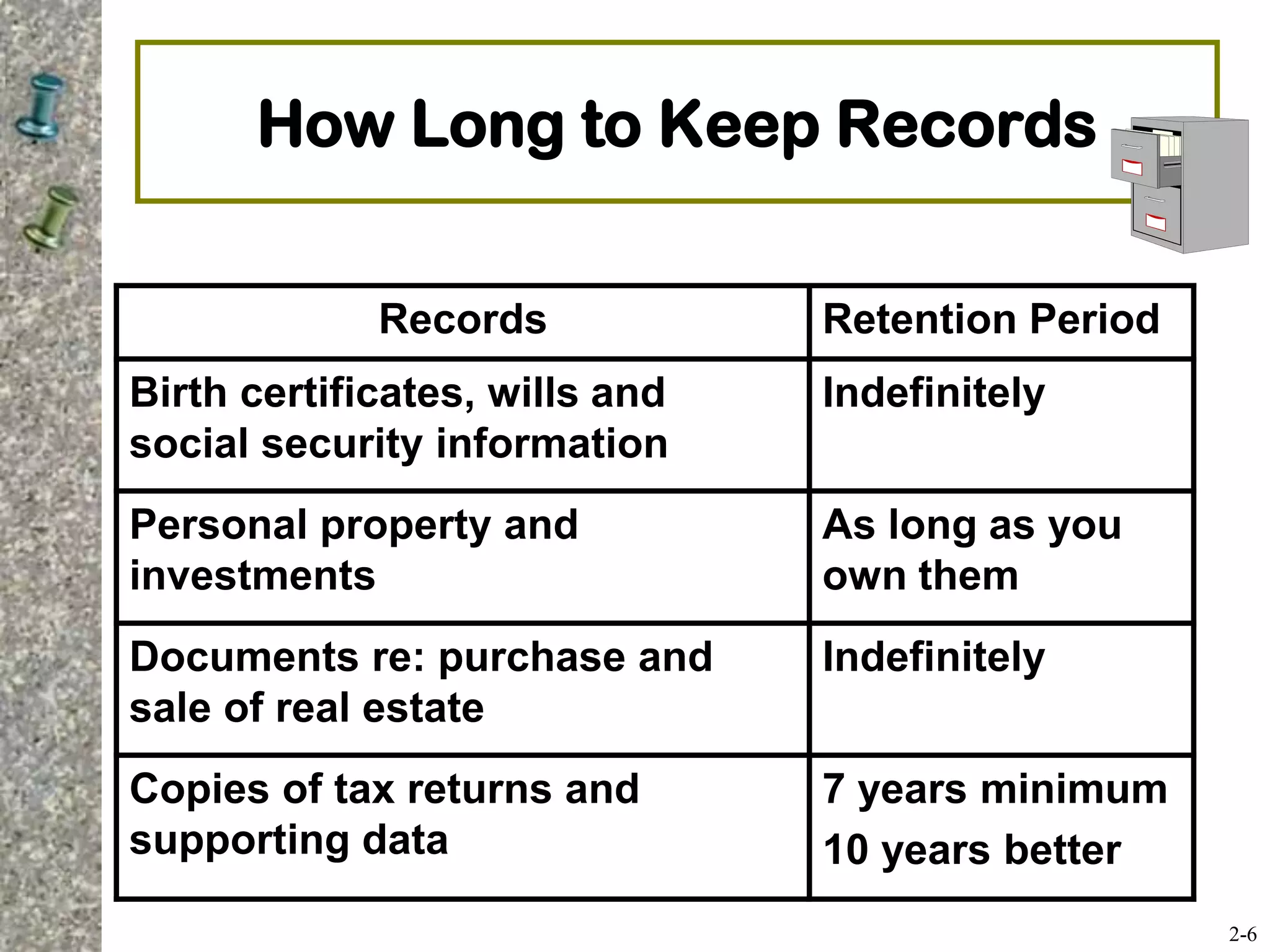

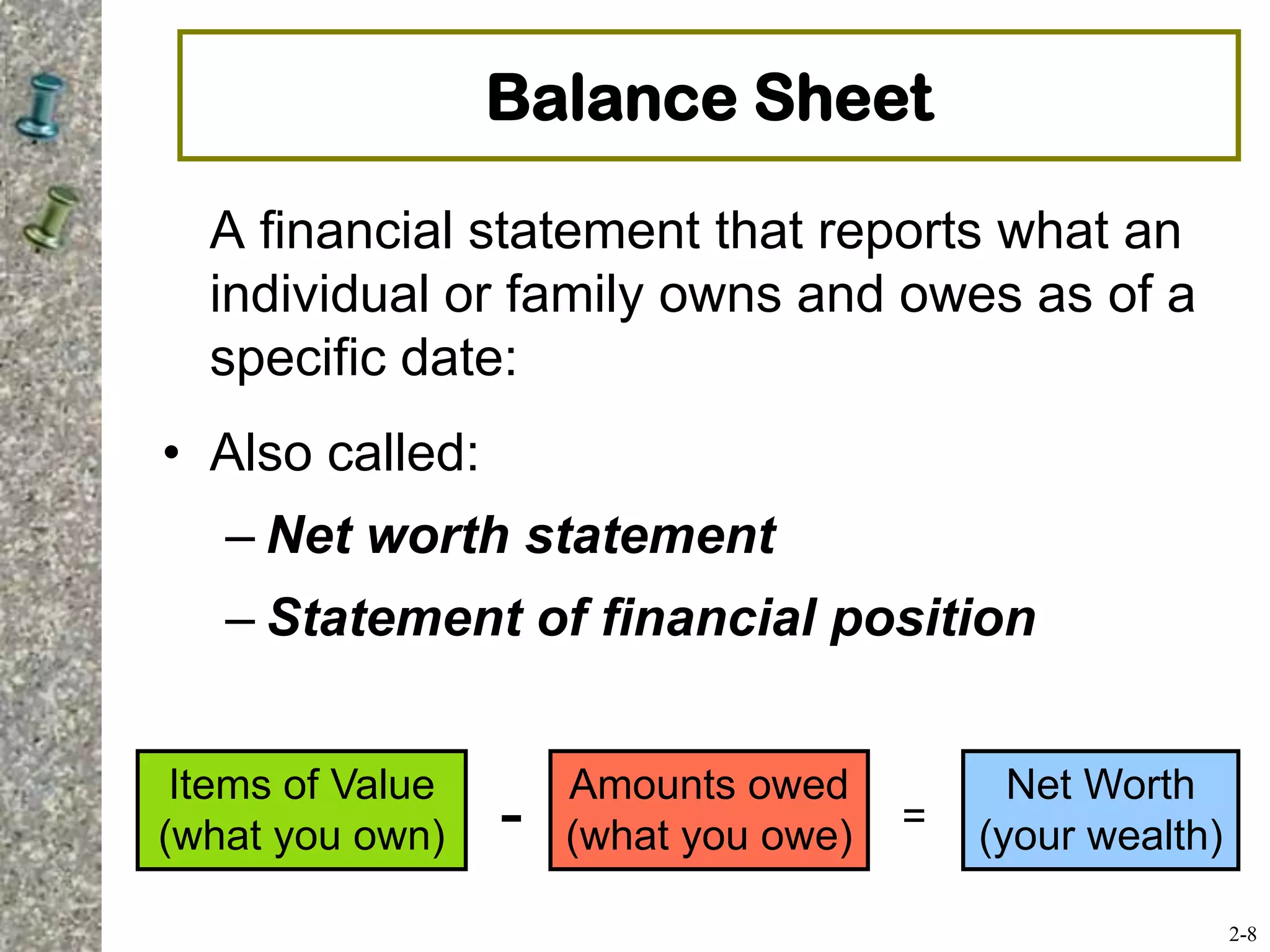

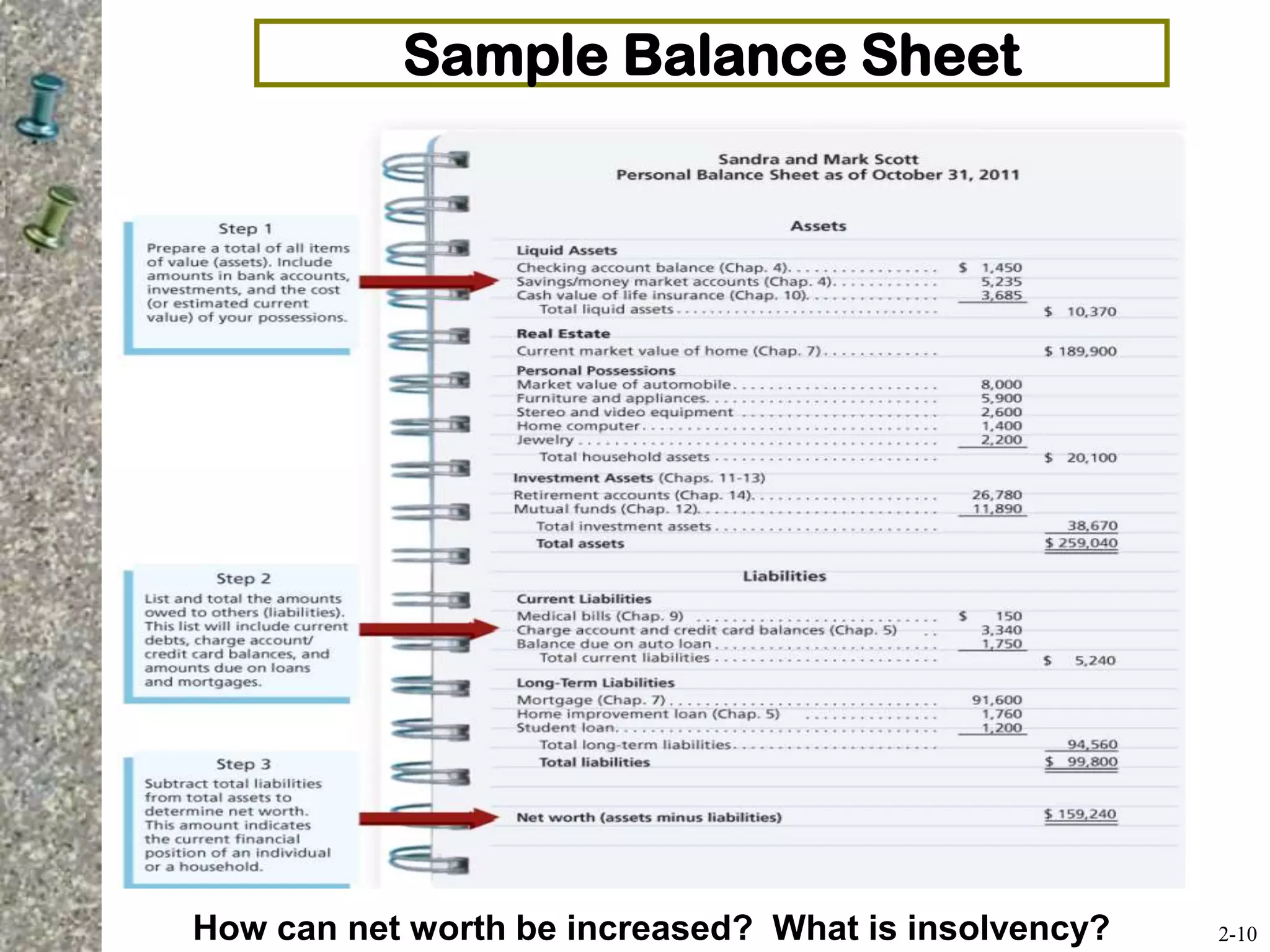

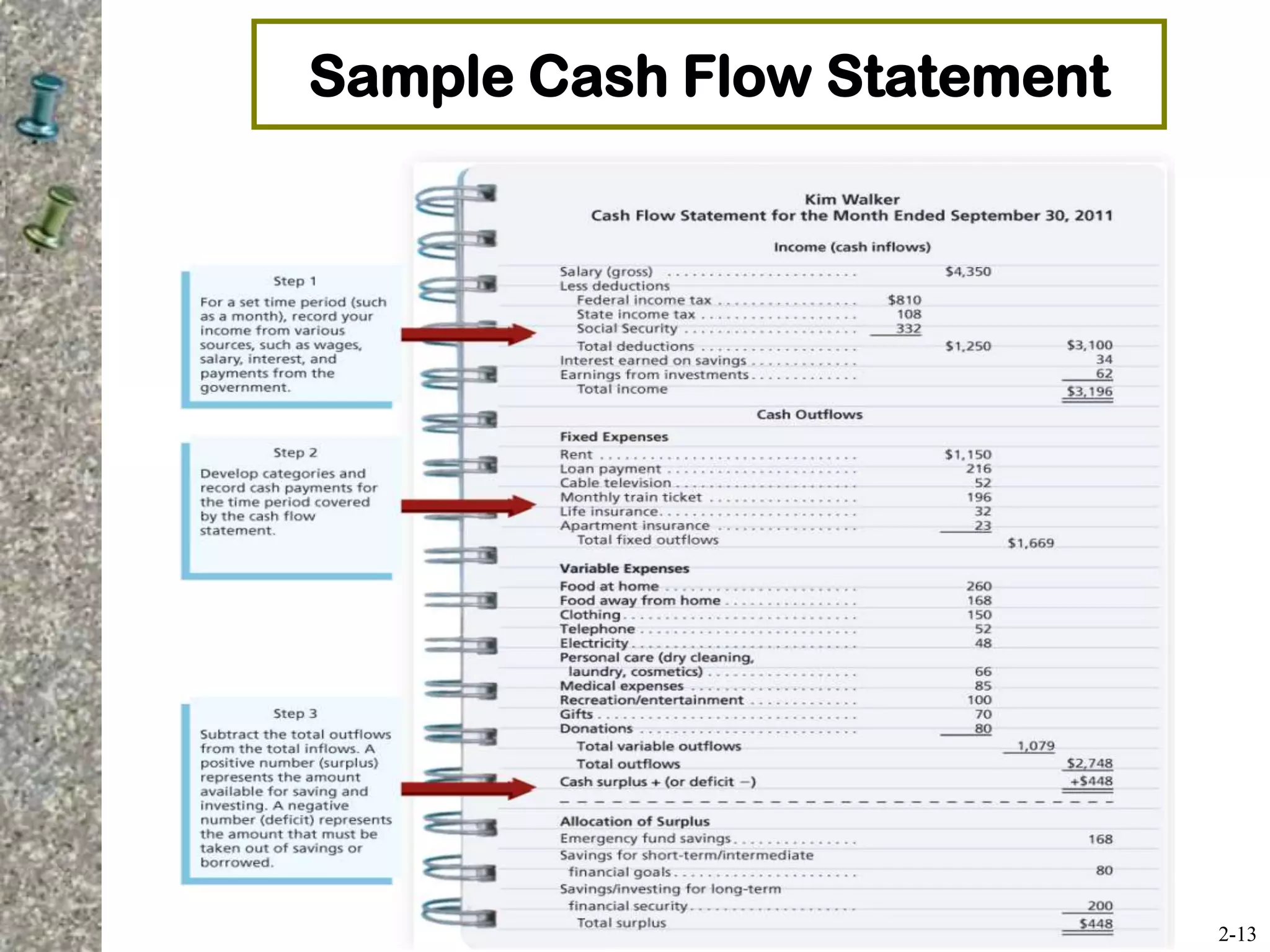

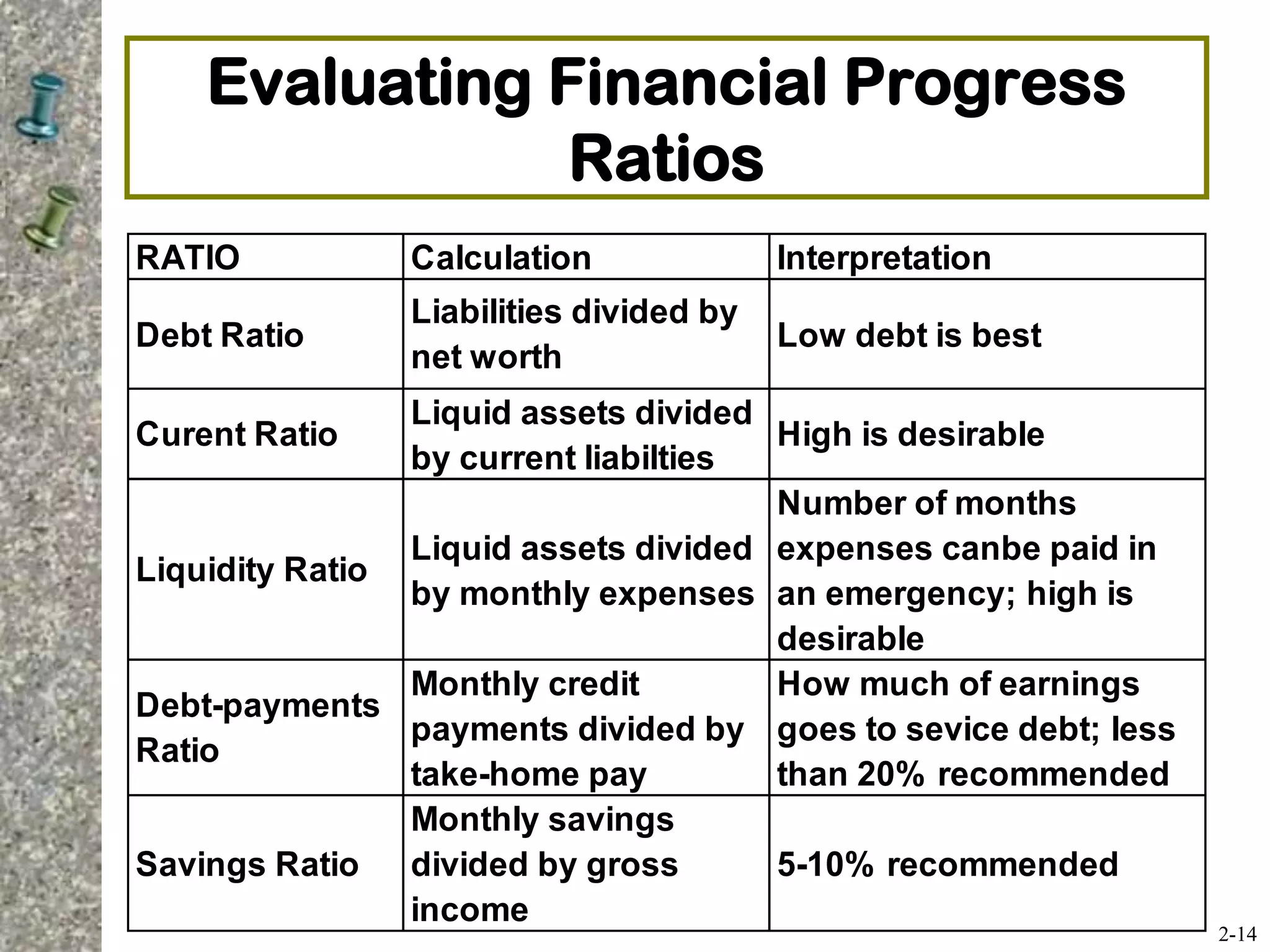

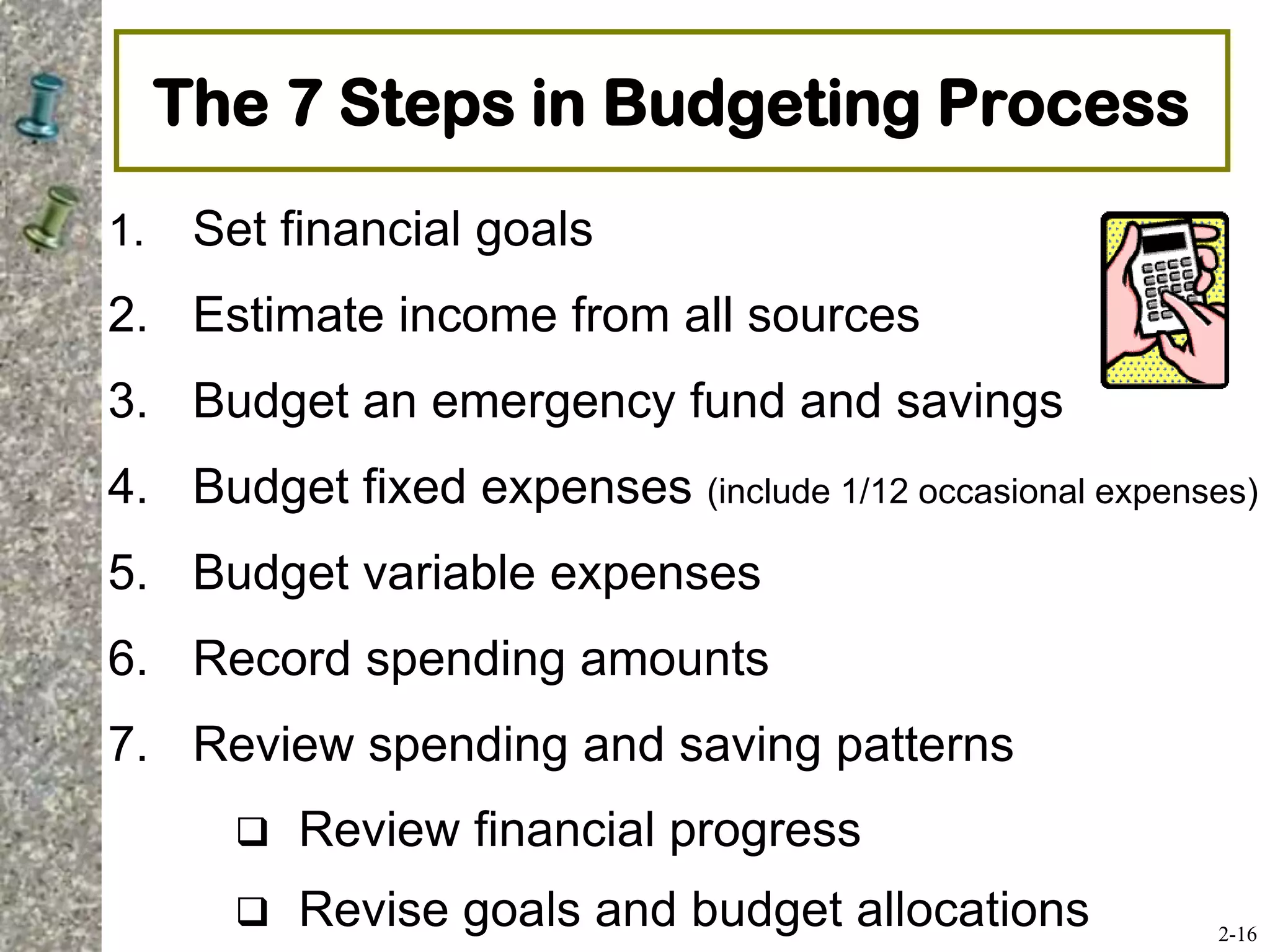

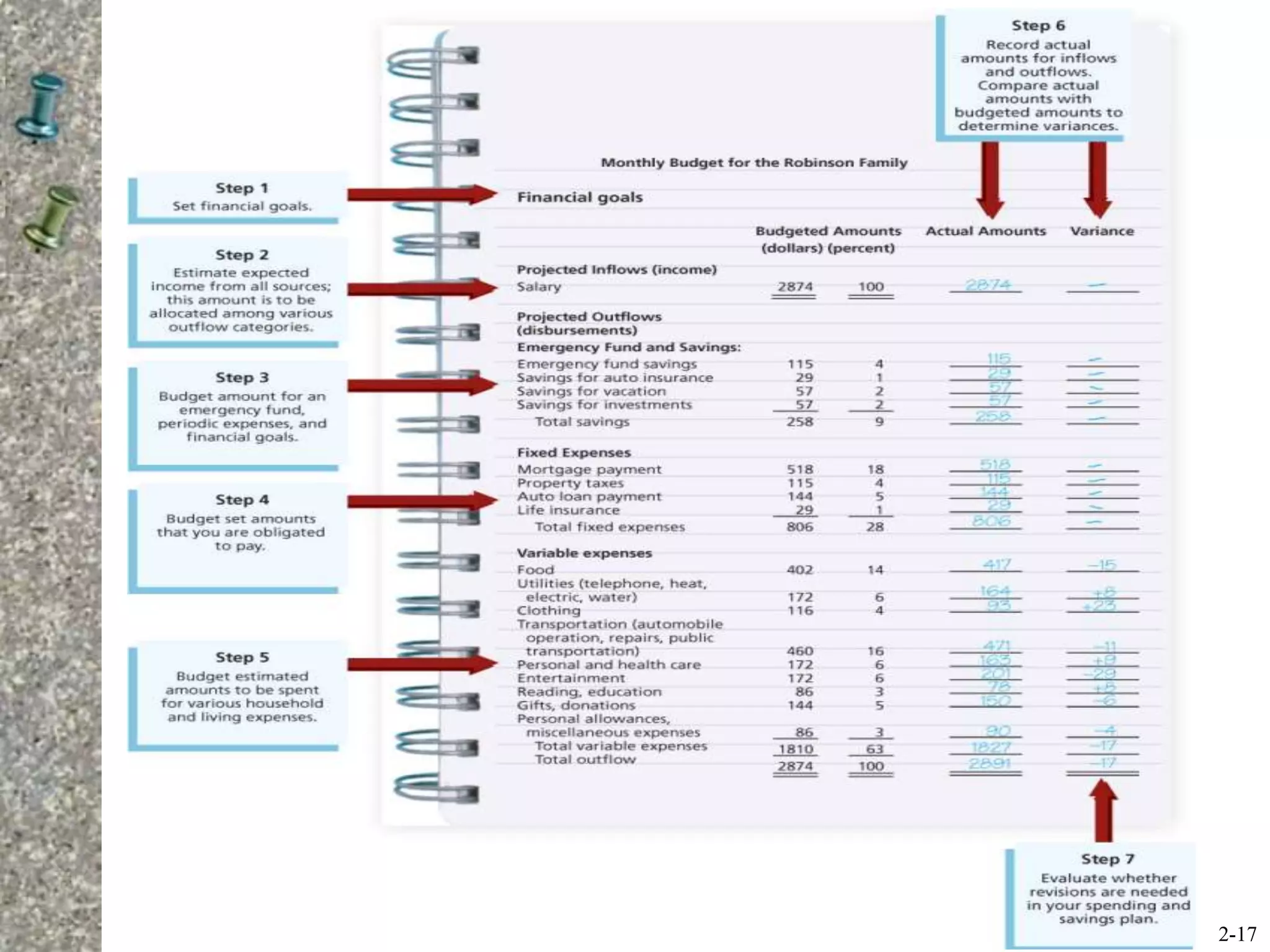

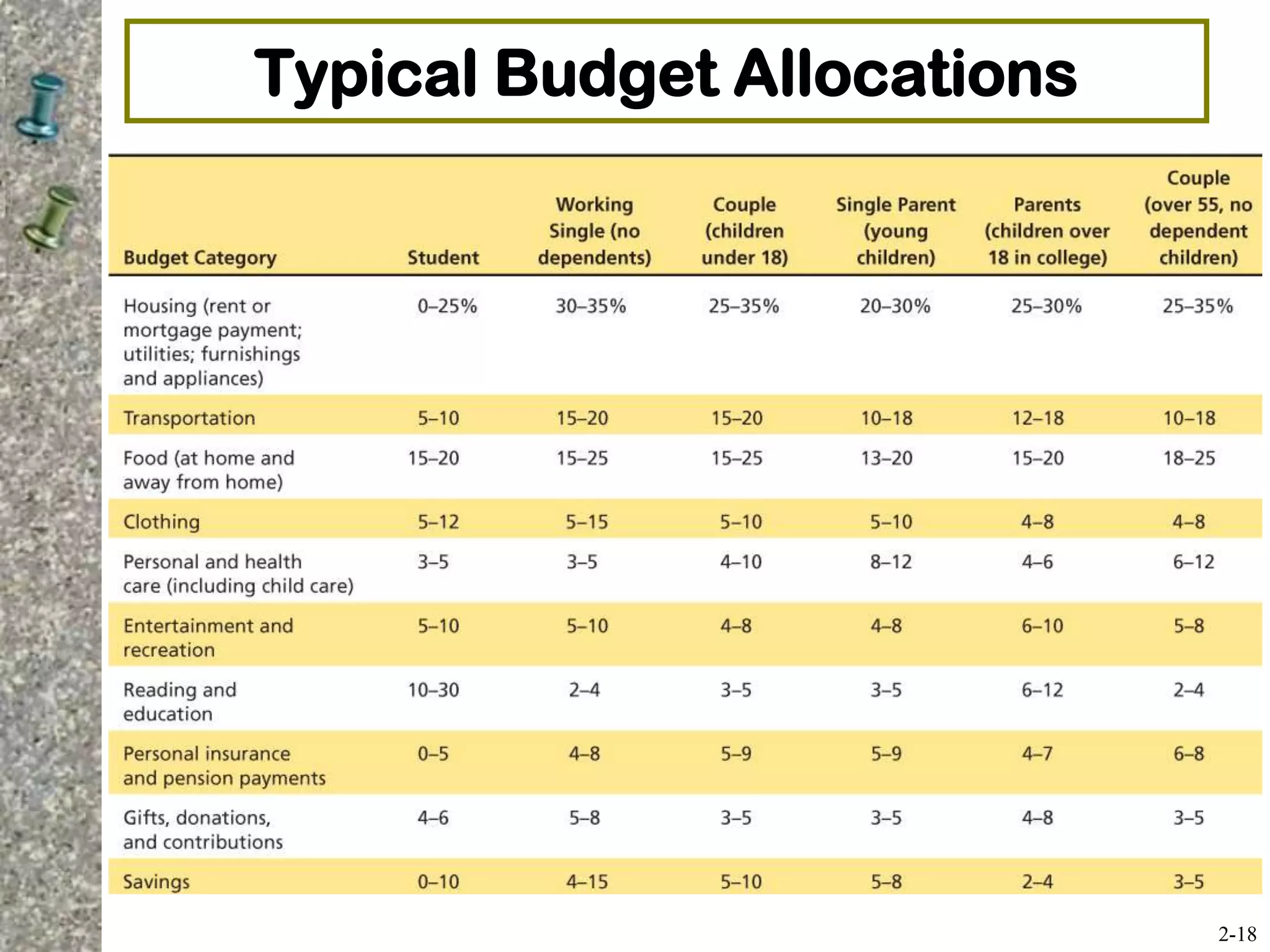

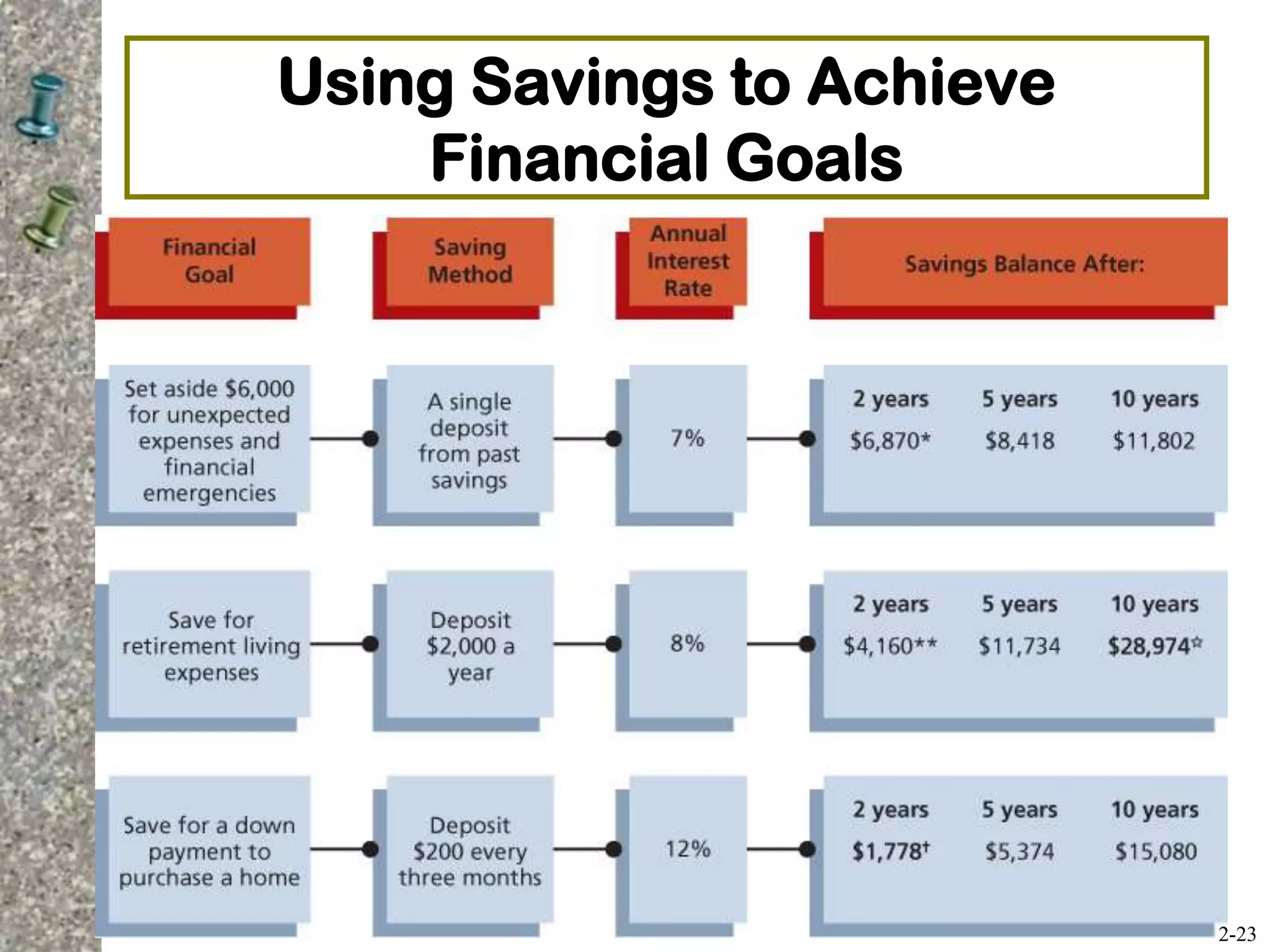

Money management involves daily financial activities to manage current resources and work towards long-term security. It is important to have an organized personal financial records system and develop a personal balance sheet, cash flow statement, and budget. These tools help track finances, measure progress towards goals, and plan spending and saving. Savings can be used to achieve goals by having savings inflows exceed outflows to increase net worth over time.