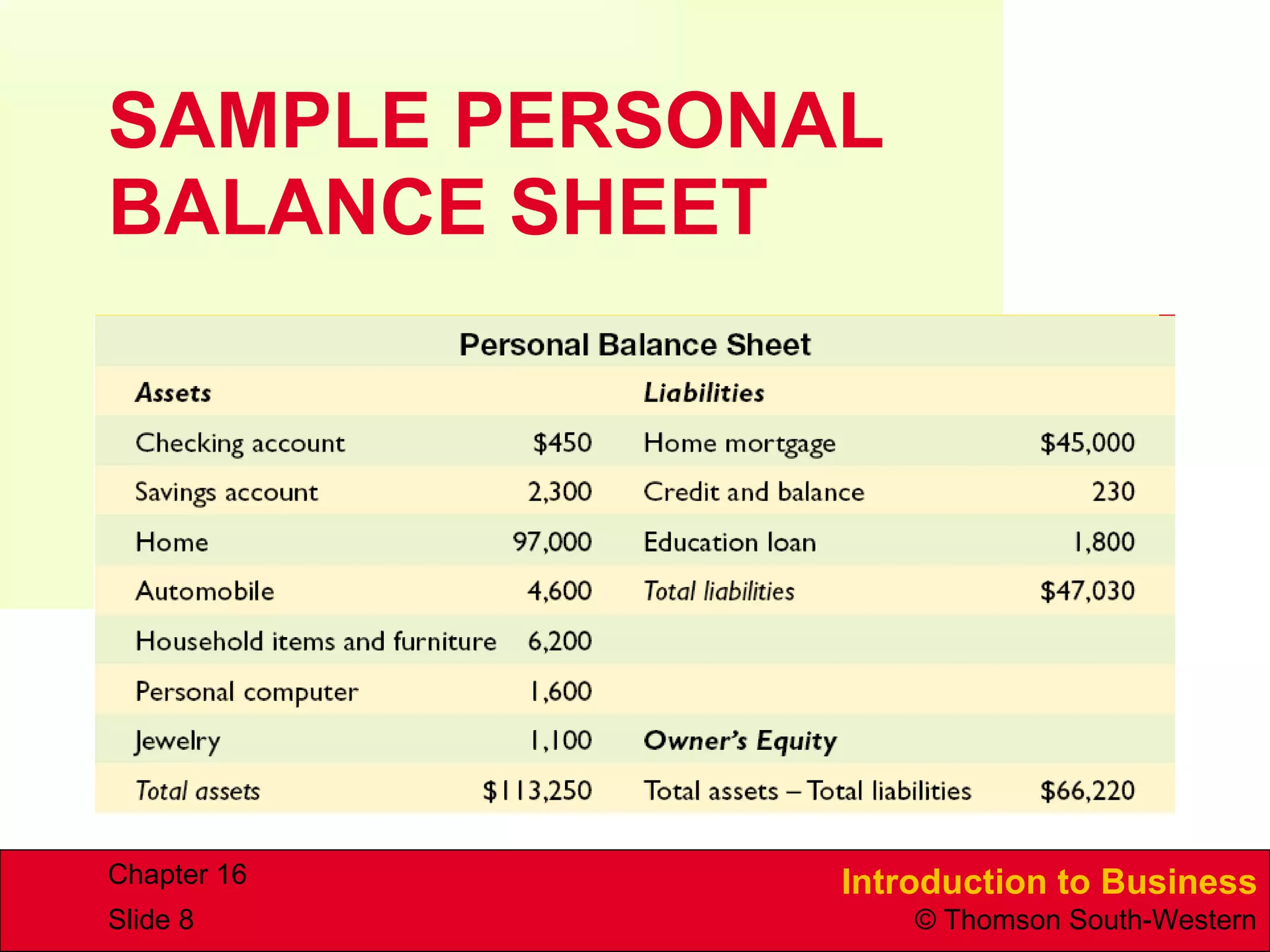

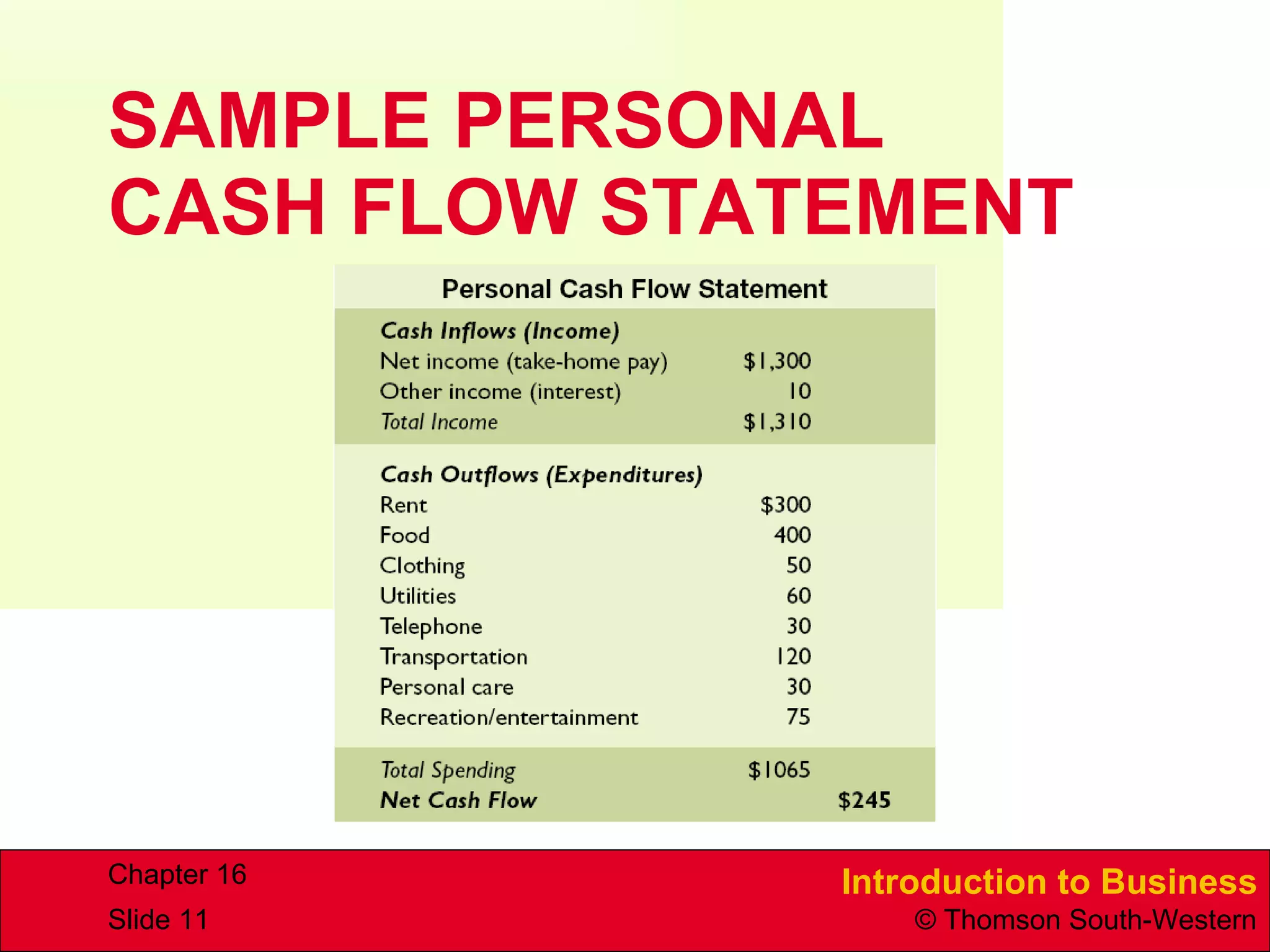

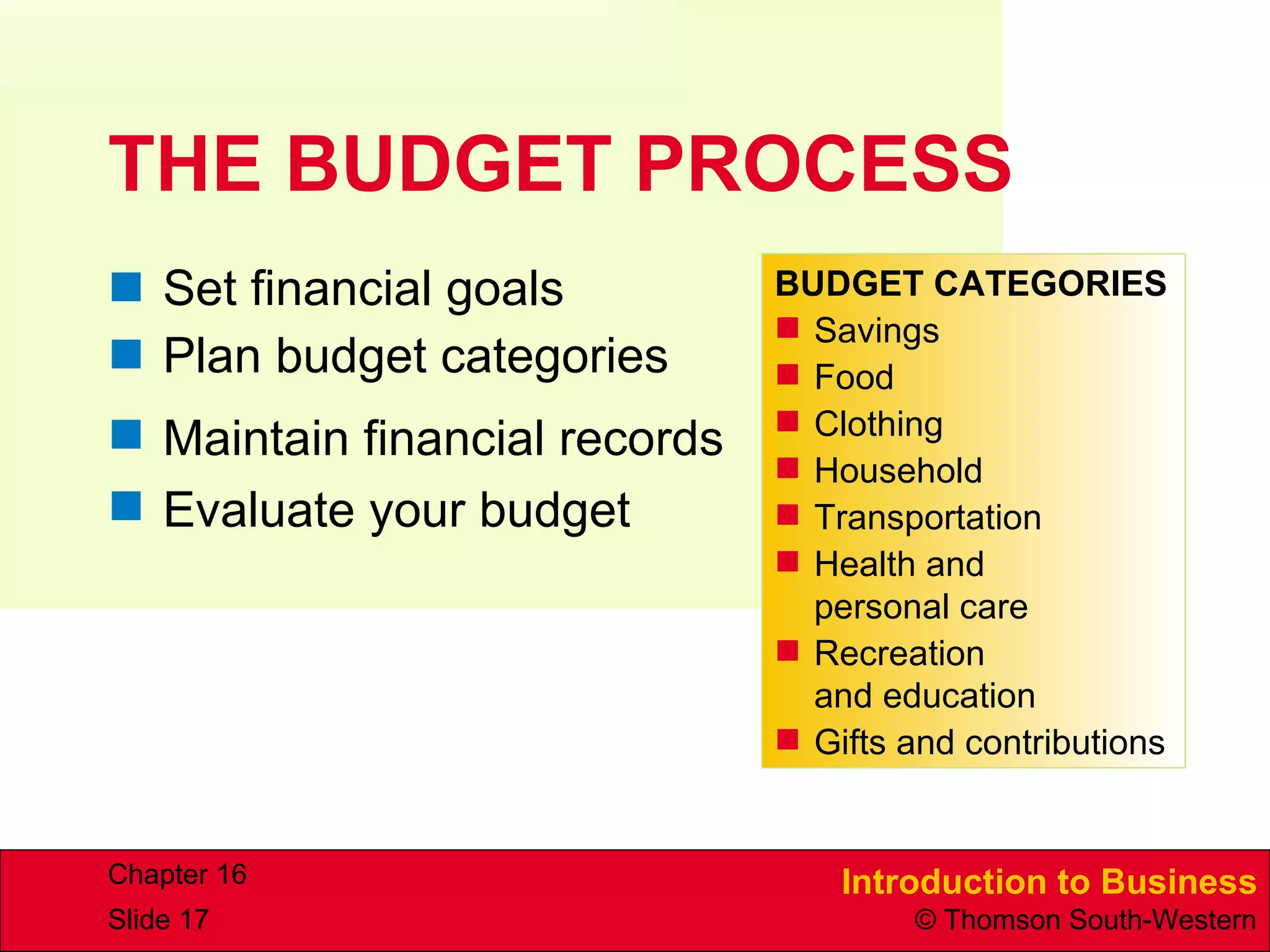

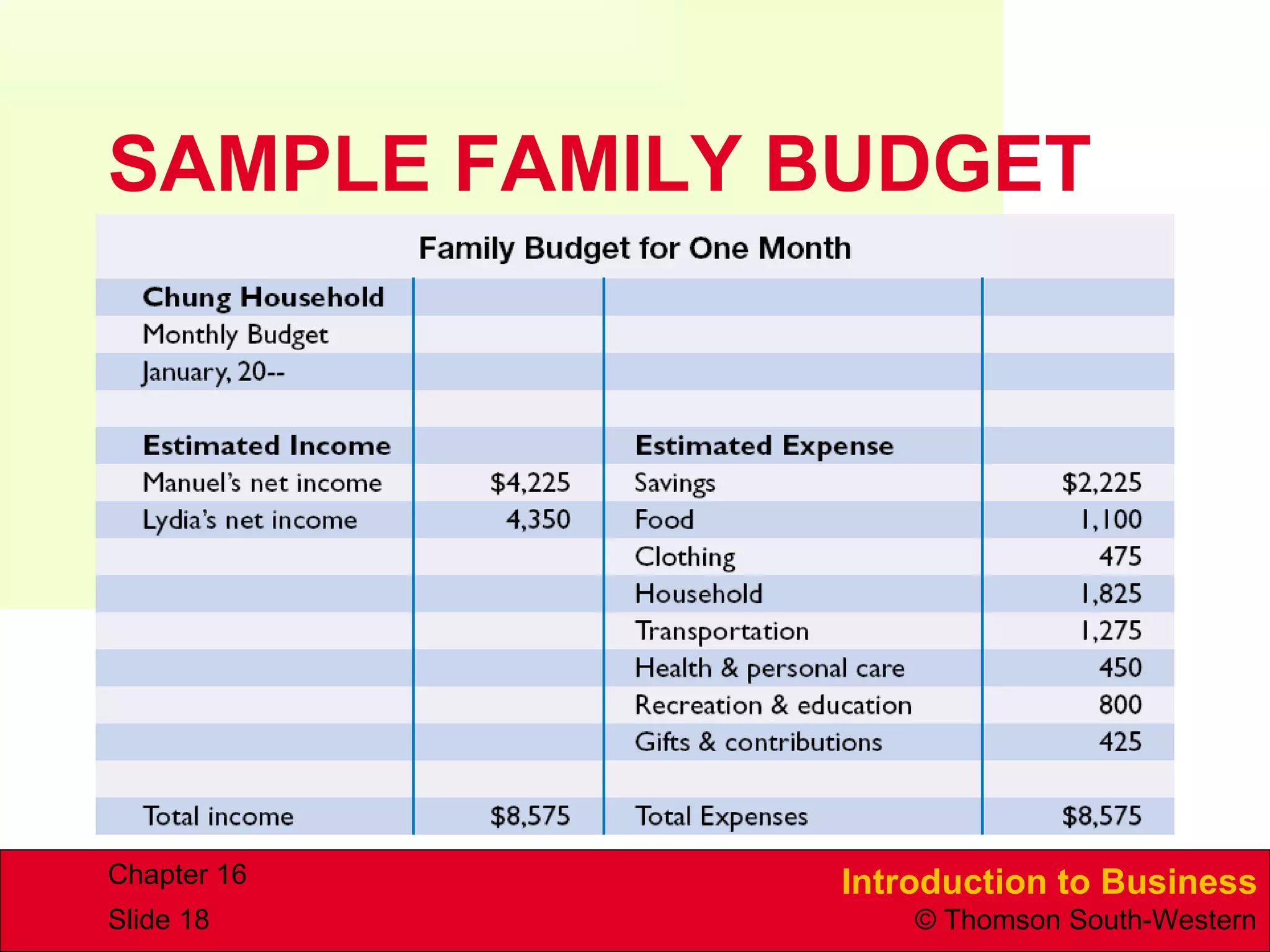

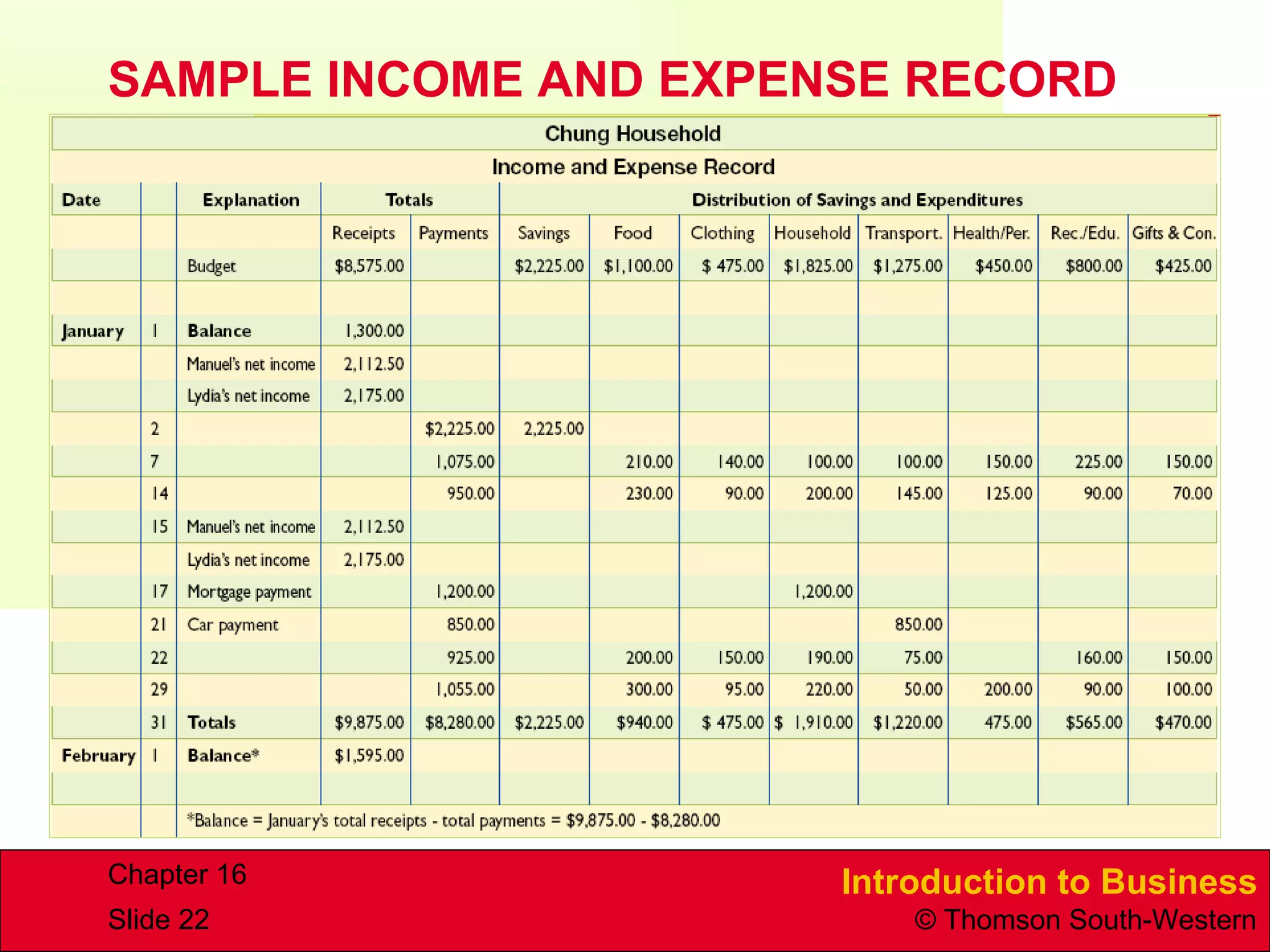

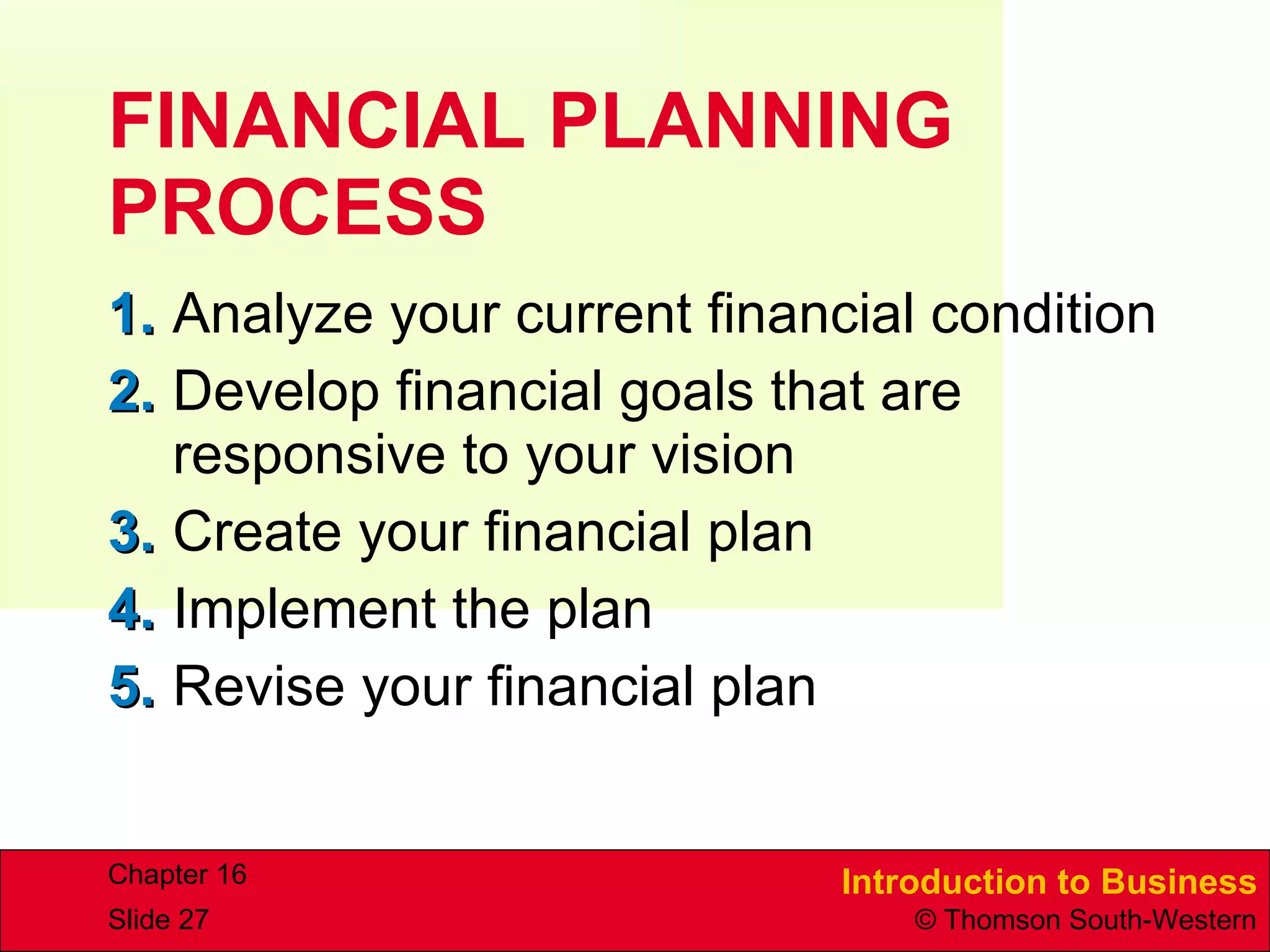

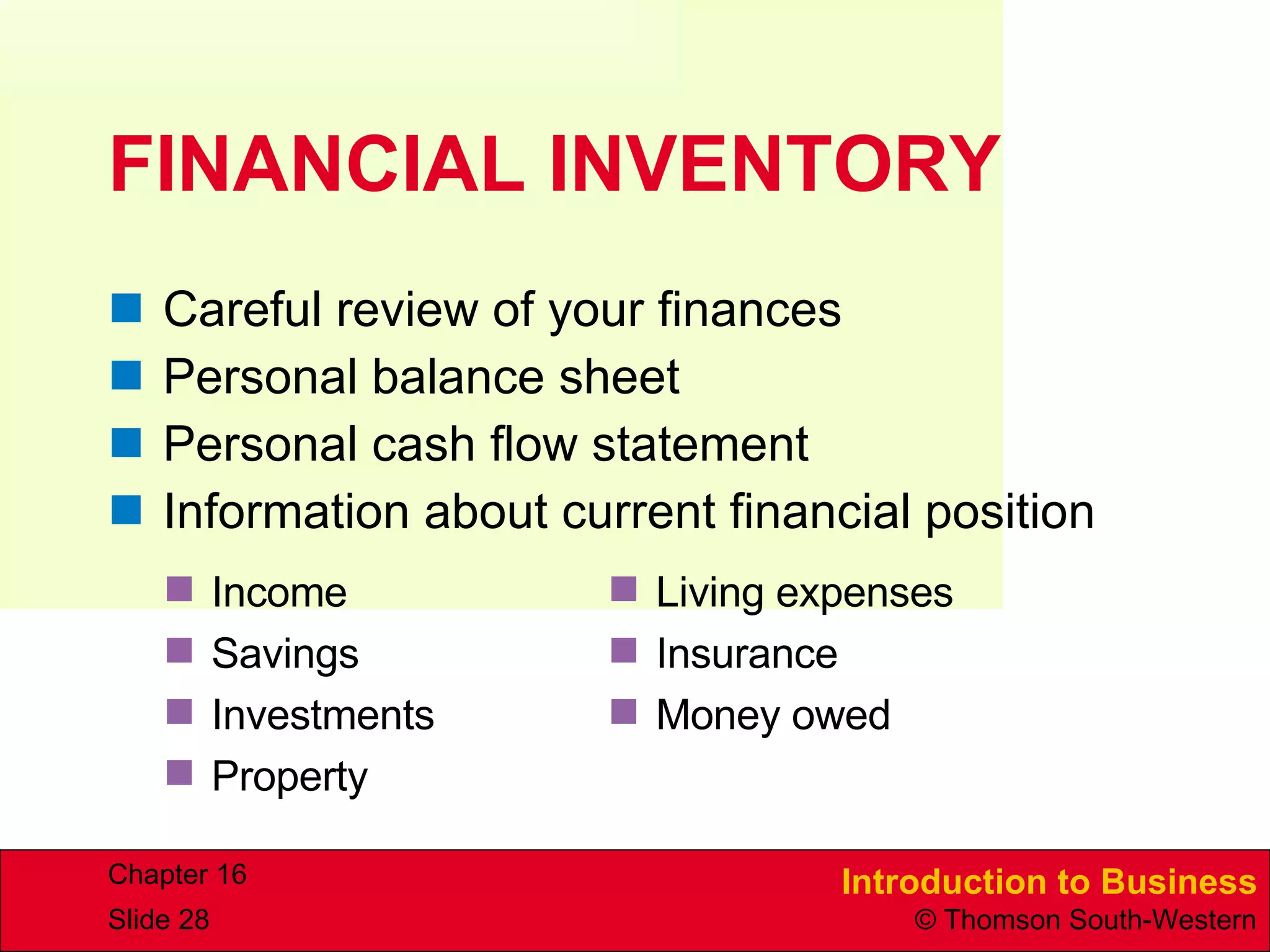

The document discusses personal money management and financial planning. It covers creating a personal balance sheet and cash flow statement to track assets, liabilities, and income/expenditures. It also discusses budgeting, including purposes of a budget, categories to include, and characteristics of effective budgets. Finally, it outlines the financial planning process, including developing goals, creating a plan, implementing it, and reviewing it over time.