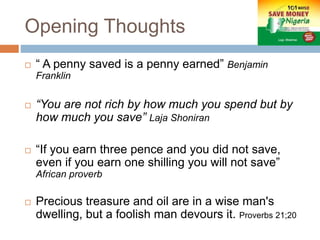

This document discusses the importance of financial literacy and savings. It begins by defining key concepts like money, savings, and investment. It then explains why saving is important, such as for emergencies, retirement, and opportunities. The document addresses common misconceptions about savings and outlines benefits like peace of mind, safety nets, and earning interest. Finally, it provides tips for saving regularly through deductions, reducing expenses, and consumption. The overall message is that financial literacy and savings are vital for security and achieving life goals.