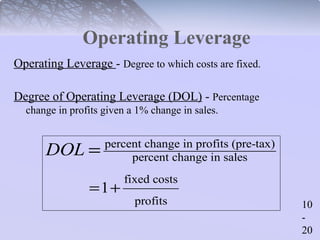

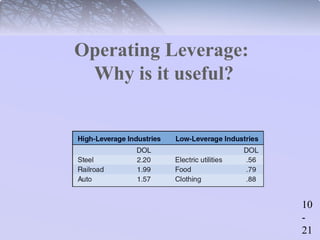

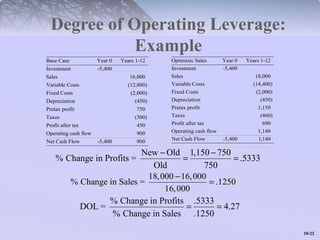

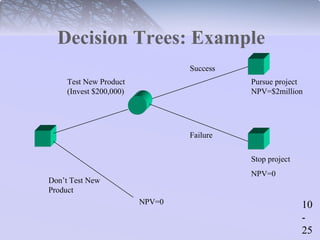

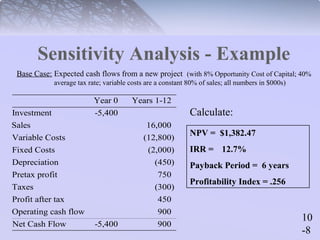

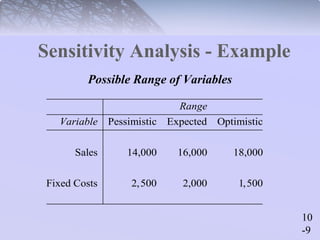

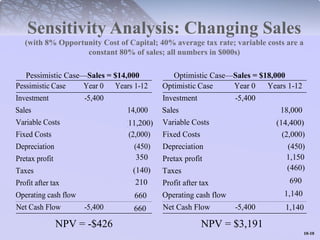

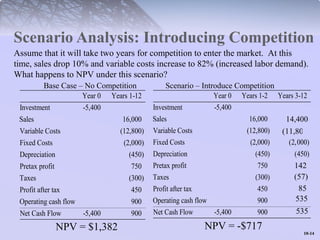

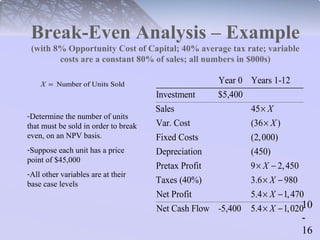

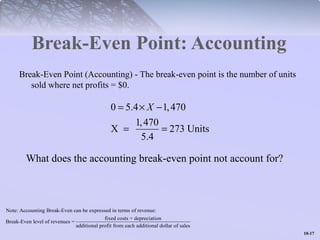

This document provides an overview of capital budgeting techniques for project analysis, including sensitivity analysis, scenario analysis, break-even analysis, operating leverage, and real options. It includes examples demonstrating how to perform sensitivity analysis by changing variables like sales and fixed costs, scenario analysis by introducing competition, and calculating break-even points and degree of operating leverage. The document emphasizes that these techniques help analyze the robustness of projects and value the flexibility provided by real options.

![10

-

18

Break-Even Point: Finance

NPV Break-Even Point (Finance):

How can we find the present value of future cash flows? As long as cash

flows are equal each year, we can use the Annuity Factor.

Step 1: PV (Cash Flows) = Annuity Factor Yearly Cash Flows

r t

r

where Annuity Factor = 1- (1 )

-

´

+

- + - ´ ´ -

1 (1 .08) 12 Example: PV(Cash Flows) = [5.4 1,020]

.08

X](https://image.slidesharecdn.com/chap010-140918114733-phpapp02/85/Chap010-18-320.jpg)

![1100--1199

Break-Even Analysis

Recall: the break-even point is the number of units sold where NPV = $0.

Step 2: PV (Cash Flows) = Initial Investment

- + - ´ ´ - =

1 (1 .08) 12 Example- [5.4 1,020] 5,400

.08

322units

X

X

=](https://image.slidesharecdn.com/chap010-140918114733-phpapp02/85/Chap010-19-320.jpg)