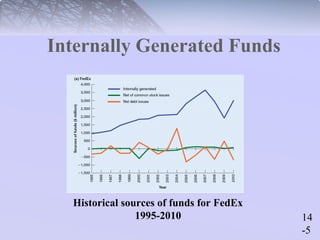

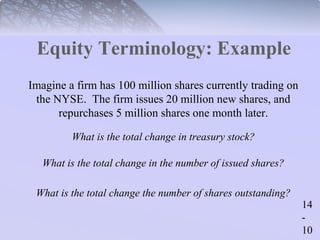

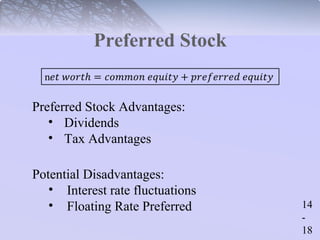

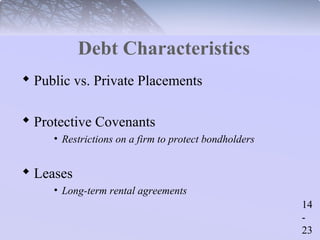

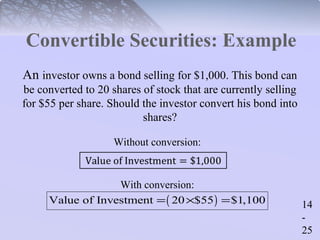

This document provides an overview of the different sources of corporate financing, including internally generated funds, equity issues, and debt issues. It defines key terms related to equity such as common stock, preferred stock, treasury stock, authorized shares, issued shares, and outstanding shares. It also discusses the characteristics of different types of debt such as secured vs. unsecured debt, callable bonds, and convertible securities. The document uses examples to illustrate equity terminology and scenarios involving debt conversions.