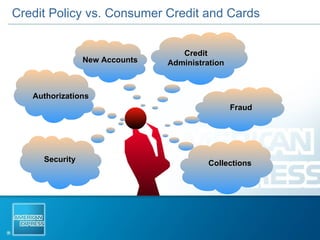

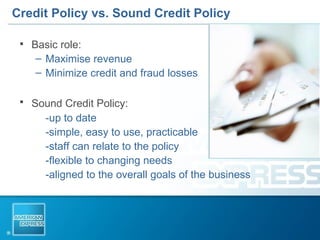

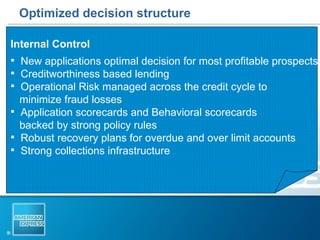

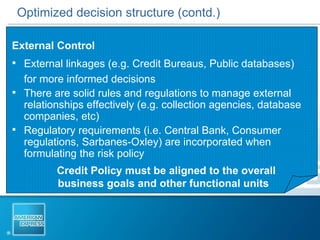

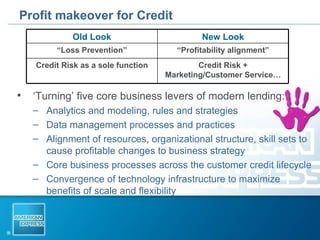

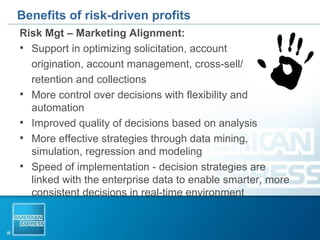

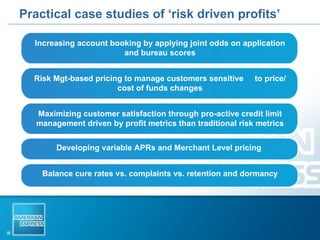

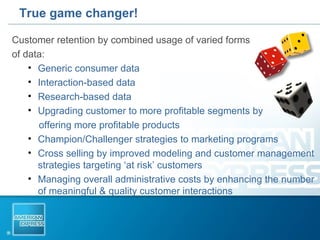

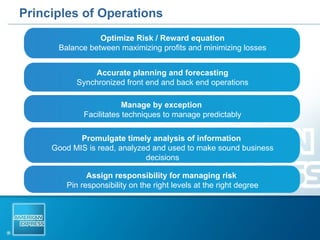

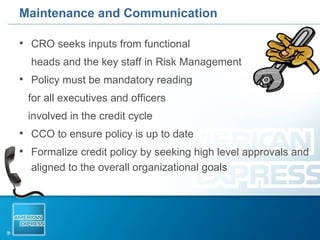

This document discusses effective credit policy management for consumer lending and credit cards. It outlines how sound credit policy that is integrated across business units can maximize profits while minimizing losses. Key points include aligning credit risk management with marketing, analytics and data-driven decision-making, dynamic pricing strategies, and focusing on customer retention through targeted programs. Regular review, communication and maintenance of the credit policy are also emphasized for optimal implementation.