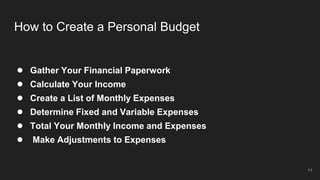

This document provides information about personal financial statements, budgeting, taxes, and savings. It discusses creating a personal balance sheet listing assets and liabilities to determine net worth. It also covers creating a personal budget that tracks income versus expenses and a cash flow statement showing cash inflows and outflows. Common budgeting methods like the 50/30/20 rule and envelope system are explained. The document also discusses investment management, different types of savings accounts and investments, direct and indirect taxes, and ways to reduce tax liability through deductions specified in the Indian Income Tax Act.