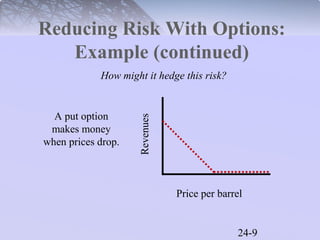

This document discusses various strategies that companies can use to manage and hedge risks, such as market risk, interest rate risk, and currency risk. It provides examples of how companies can use options, futures contracts, forwards contracts, and swaps to hedge against risks from fluctuations in prices, interest rates, and exchange rates. The key strategies discussed are increasing flexibility, purchasing insurance policies, and making investments in derivatives like options, futures, forwards and swaps to offset risks from changes in underlying prices, rates or currencies.