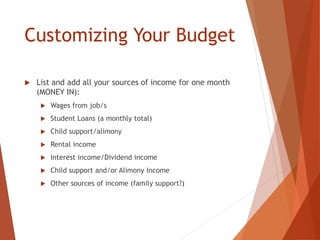

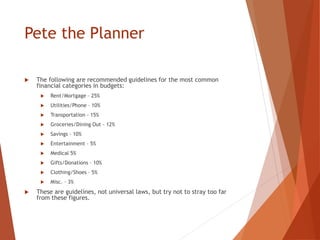

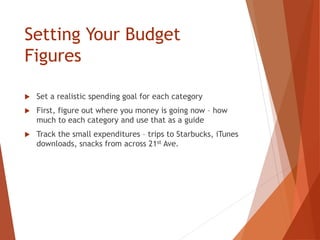

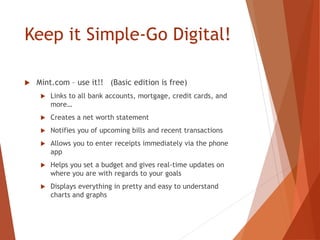

This document provides an overview of developing and maintaining a personal budget. It discusses identifying financial goals and values, basic budgeting principles, tools for creating a budget, and challenges to budgeting. Key steps include creating a net worth statement, setting short-term financial goals, customizing a budget by tracking income and expenses, and using digital tools like Mint.com to monitor progress. Maintaining a budget is presented as an important part of taking control of spending, saving, and avoiding debt.