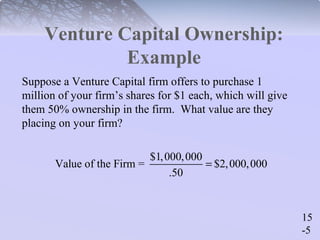

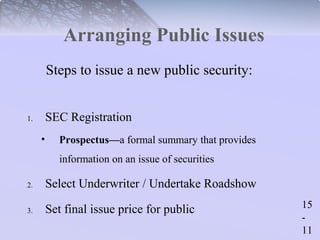

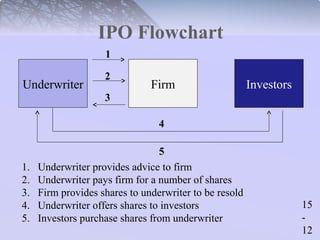

Young firms often require venture capital to finance growth. Venture capital provides entrepreneurs with financing to grow their firms and obtain staged financing. Firms issue securities like stocks to further finance their growth. When firms need more capital than private investors can provide, they can conduct an initial public offering (IPO) to sell stocks to the public for the first time. The issuance of securities through public offerings or private placements is a complex process that involves underwriters, registration with regulatory agencies, and costs for the company.