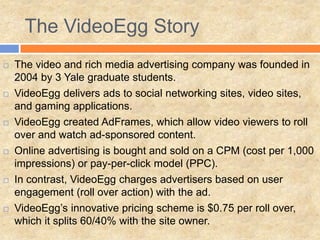

VideoEgg is an online video advertising company founded in 2004 by three Yale graduates. It delivers ads to social media, video, and gaming sites. VideoEgg created AdFrames that allow users to roll over ads to watch sponsored content. Unlike traditional CPM or CPC models, VideoEgg charges advertisers $0.75 per user roll over, splitting the fee with content sites. This innovative pricing scheme differs from standard online advertising models.