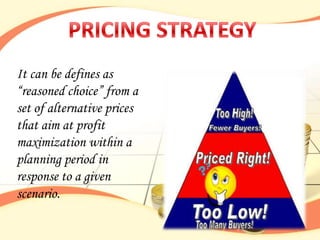

The document discusses factors that influence pricing decisions for marketing managers. It identifies internal factors like objectives, costs and external factors like competition and market demand. It describes different pricing strategies such as cost-based, demand-based and competition-based pricing. Specific strategies discussed include penetration pricing, image pricing, price bundling and premium pricing. The document provides guidelines on when to increase, decrease or sell below cost.