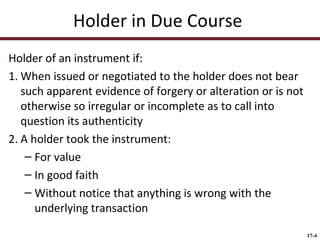

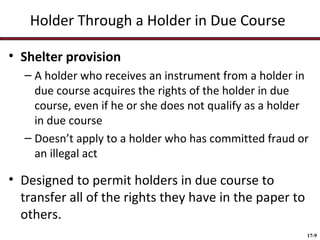

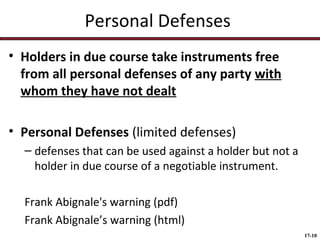

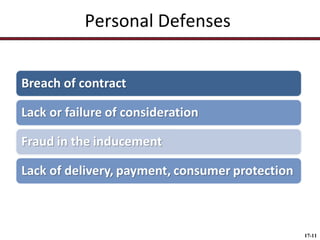

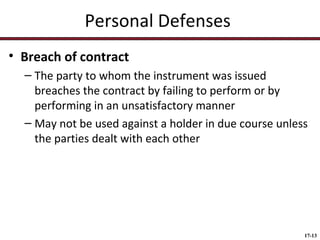

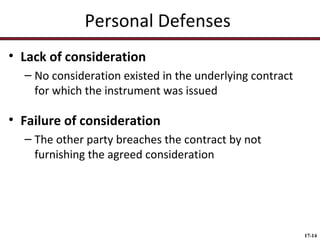

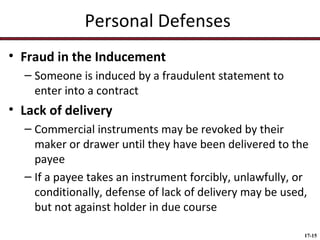

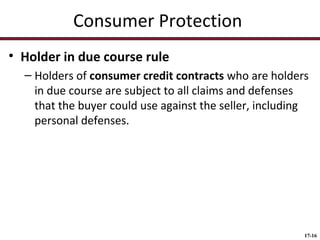

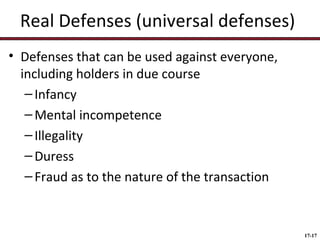

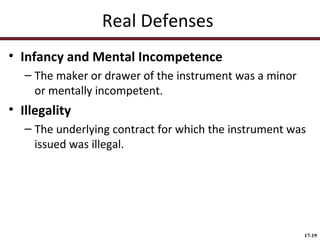

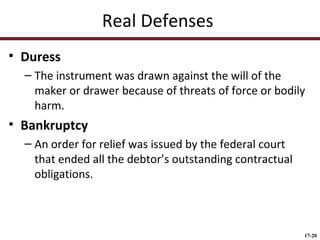

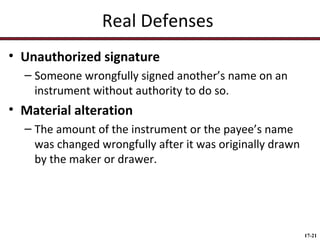

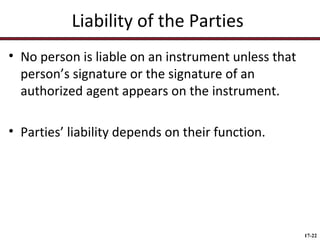

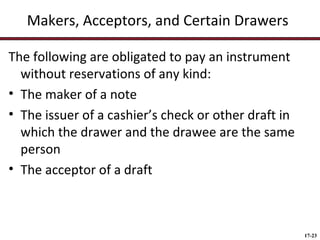

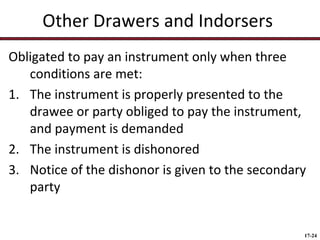

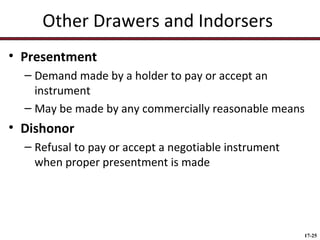

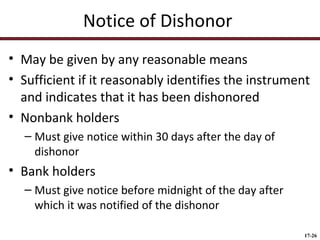

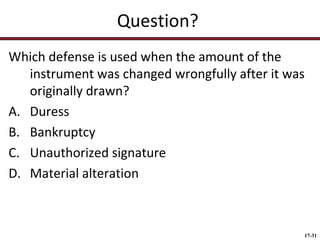

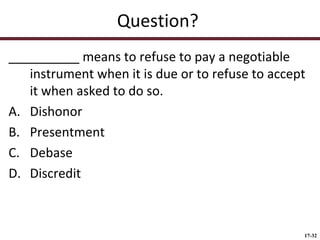

This document discusses key concepts related to holders in due course, defenses, and liabilities for negotiable instruments. It defines what makes someone a holder in due course and provides the protections this status grants. Personal defenses that cannot be used against a holder in due course are outlined. Real or universal defenses that can be used against any holder are also defined. The document explains primary and secondary liability for different parties involved in negotiable instruments.