Red clause letters of credit originated as a means of providing sellers financing for purchases or production of goods. They allowed sellers to receive advances from the issuing or confirming bank before shipment using the letter of credit as collateral. While once common, red clause credits are now rarely used, being largely replaced by other forms of financing. Recent cases discuss liability and remedies under these historical letters of credit, but they remain mostly a thing of the past, confined now to only occasional or niche uses.

![RELEVANCE?

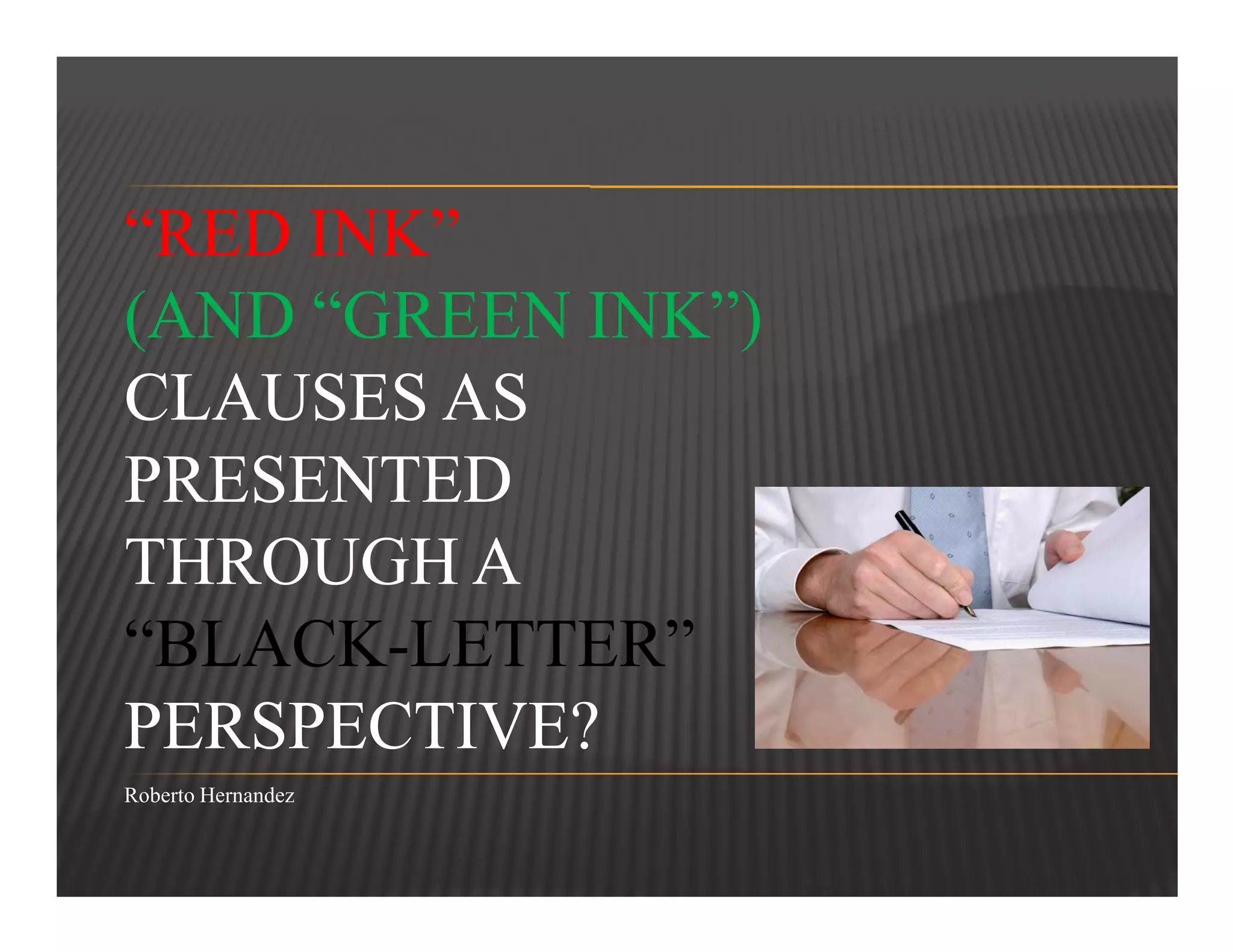

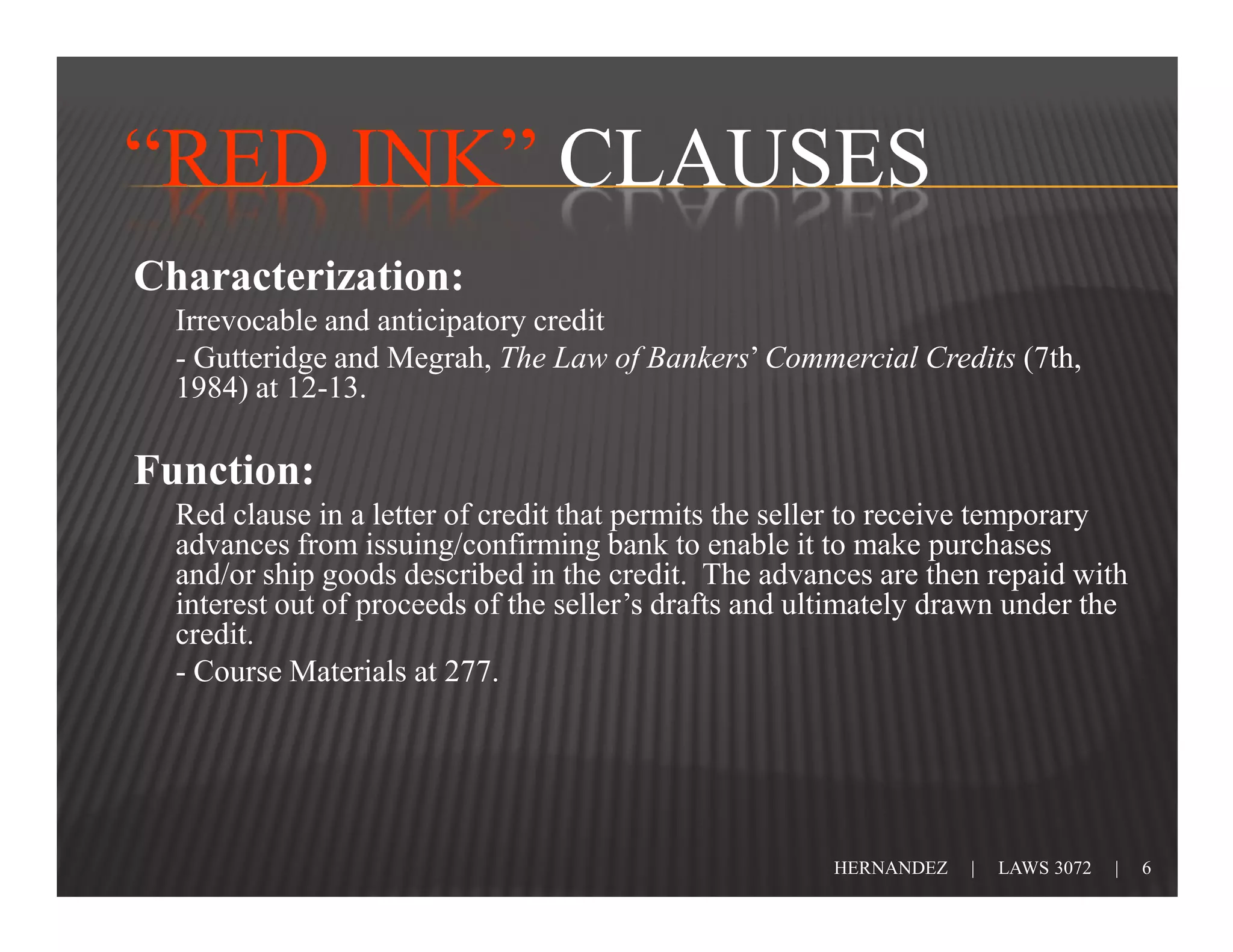

“Red ink clause credits are now largely historic…”

“A green ink clause credit is a variation of the ‘red ink’ clause… These credits are

now seldom if ever used.”

- Weaver at [15.1650].

“This type of credit [red ink clause] developed in Australasia especially in the wool

and fishing export industries… These now appear to be used only infrequently.”

- Burnett and Bath at 230.

“On the evidence relating to ‘Red Clause’ letter of credit, I am satisfied that they

are now rare, especially in the log trade.”

- Course Materials at 278.

“The red clause is today dying out.”

- Gutteridge and Megrah at 13.

HERNANDEZ | LAWS 3072 | 3](https://image.slidesharecdn.com/internationalcommercialtransactions2b-100315150333-phpapp02/75/Red-Clause-Letters-of-Credit-3-2048.jpg)

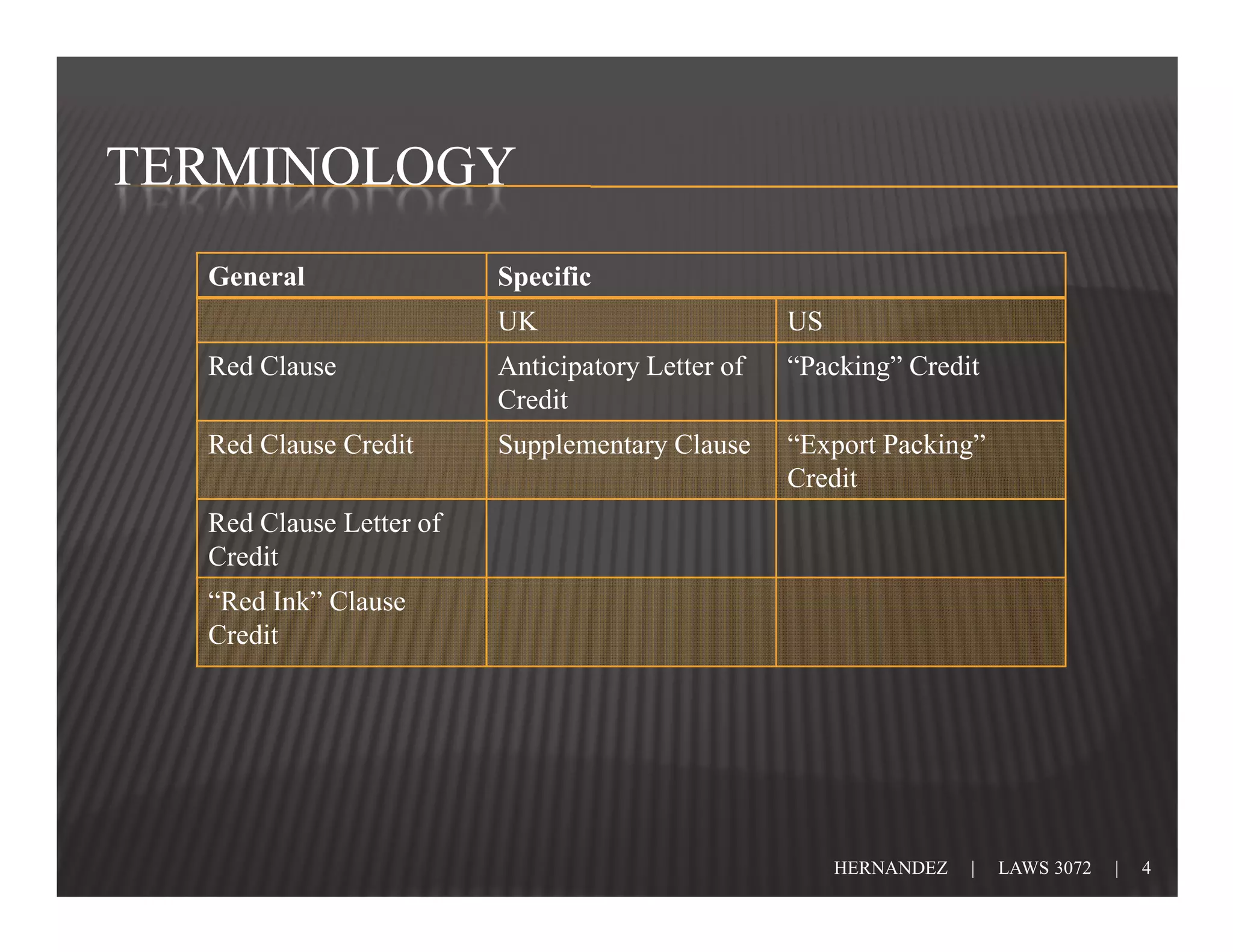

![“RED INK” CLAUSES

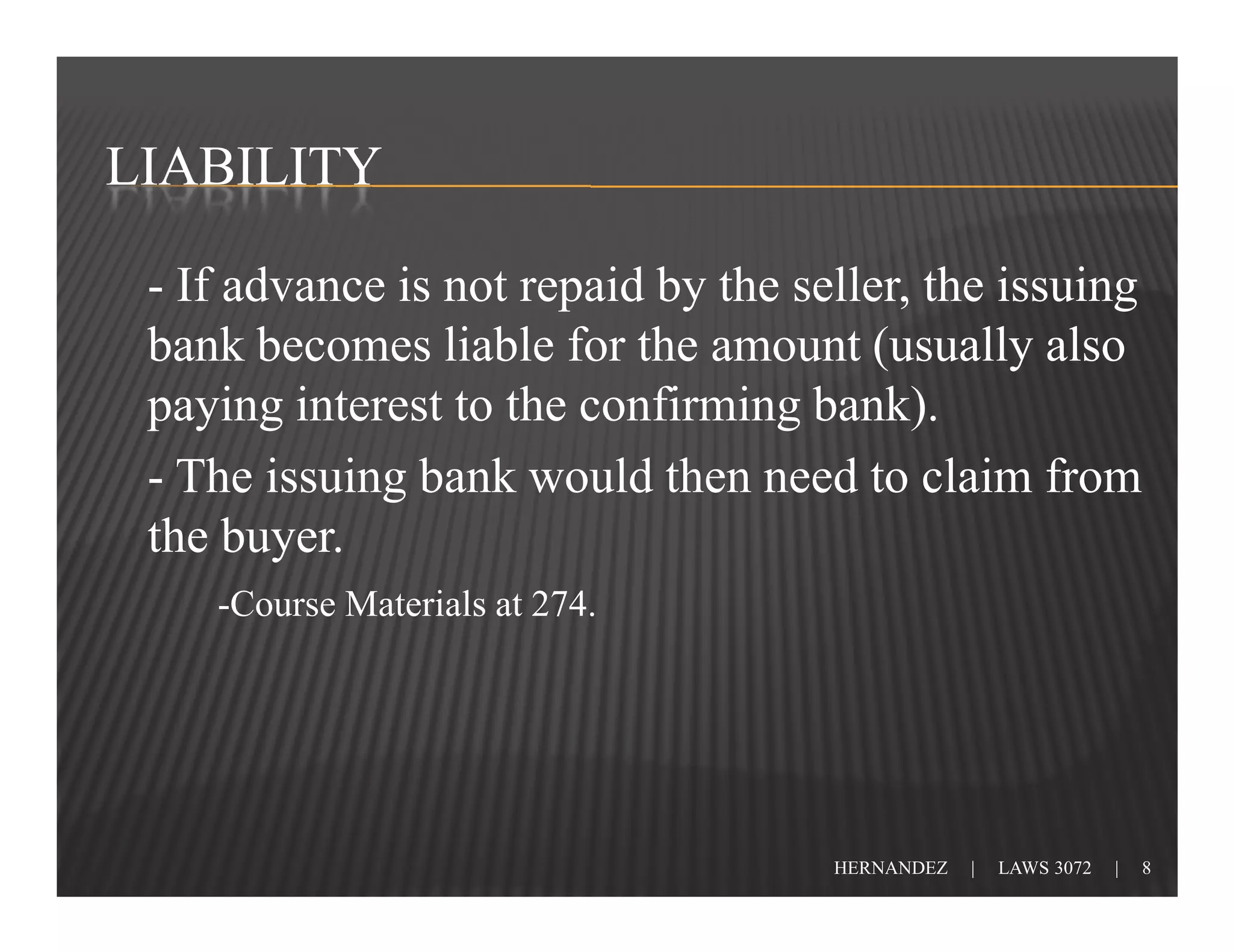

- E.g.

“Advances are available under this credit against the

beneficiaries’ simple receipt countersigned by Jonathan

Franklin or Hugh Gathorne-Hardy presented to ourselves

[- that of course is Barclays Bank.] Reimbursements will

be made by air mail to a bank of your choice as soon as the

receipt is received by us and in order. Each advance

clearly states which lots it refers to, the proceeds of each

negotiation will be applied in reduction [ - then I think

should be inserted the word ‘of’ - ] the relevant advance on

that lot, recourse of advance to be to beneficiary in the case

that goods have not been shipped by expiry of the credit.”

- Tukan Timber Ltd. v. Barclays Bank Plc. [1987] 1 Lloyd’s

Rep 171 at 173.

HERNANDEZ | LAWS 3072 | 9](https://image.slidesharecdn.com/internationalcommercialtransactions2b-100315150333-phpapp02/75/Red-Clause-Letters-of-Credit-9-2048.jpg)

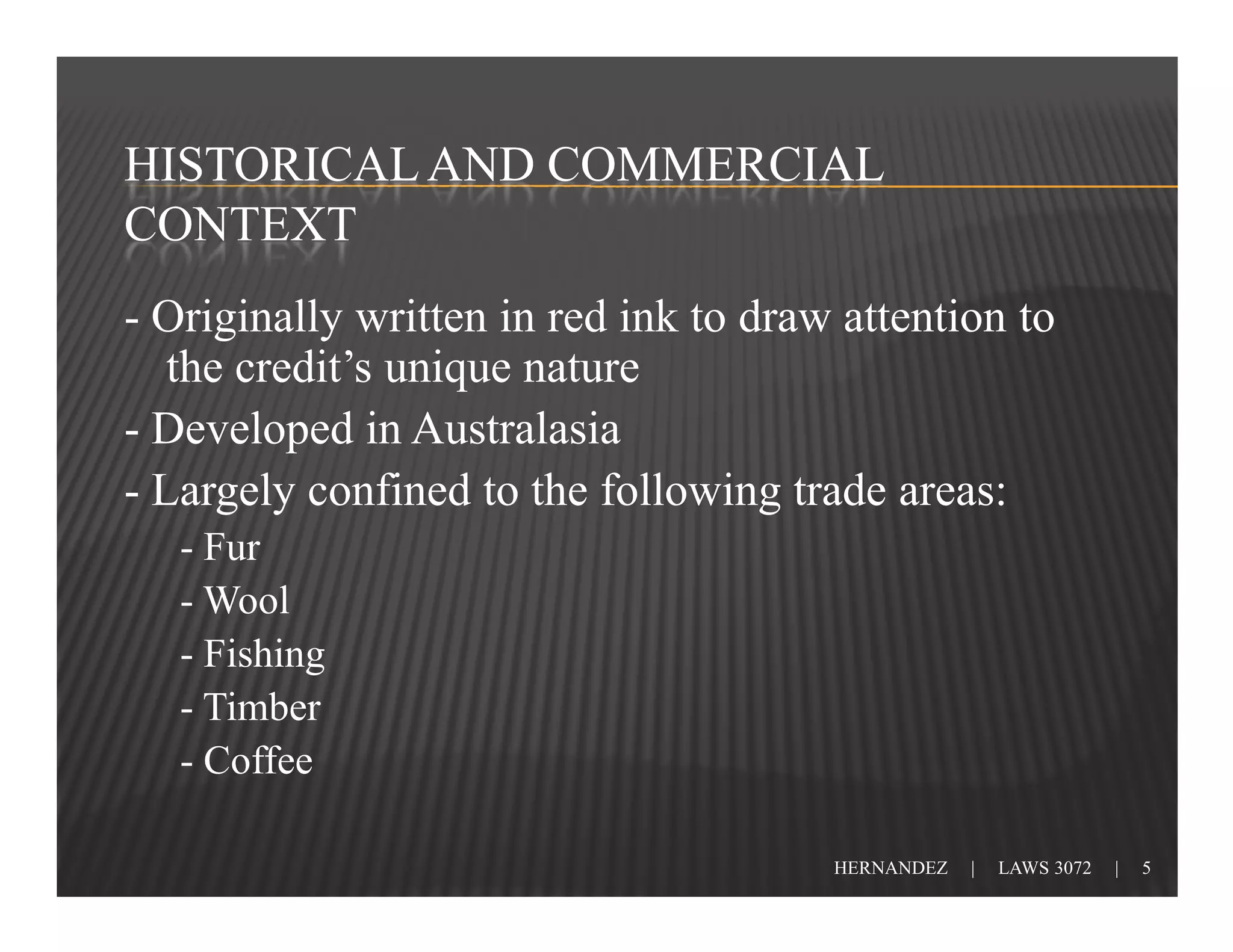

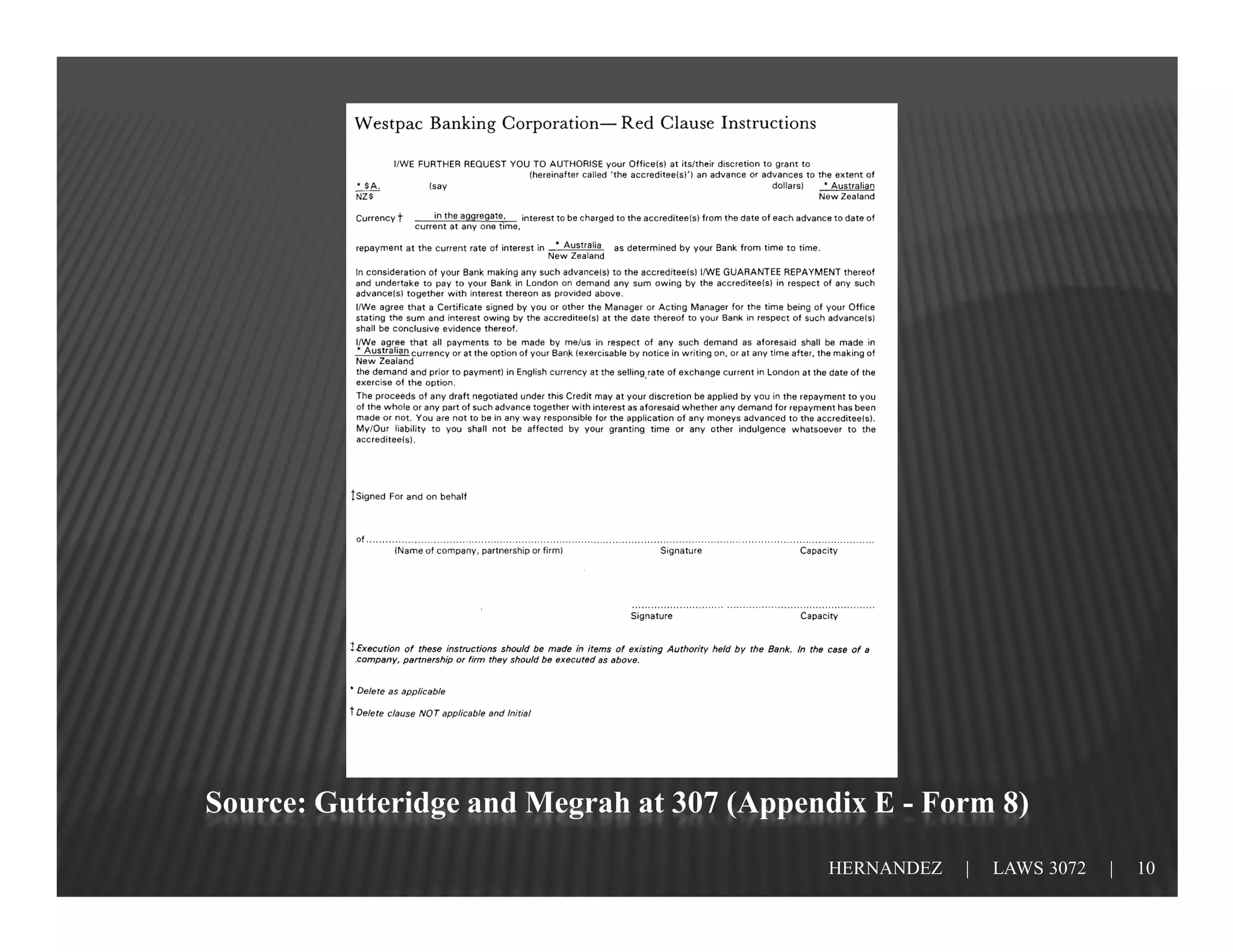

![“GREEN INK” CLAUSES

- Function:

I. Pre-shipment advances are made in the same

way as a red ink clause

II. BUT goods purchased are stored in the bank’s

name

III. Bank is then authorized to release goods to the

beneficiary to enable the beneficiary to ship them.

-Weaver at [15.1650].

HERNANDEZ | LAWS 3072 | 13](https://image.slidesharecdn.com/internationalcommercialtransactions2b-100315150333-phpapp02/75/Red-Clause-Letters-of-Credit-13-2048.jpg)